<strong>Cobb</strong> <strong>County</strong>, Georgia Governmental Funds Statement of Revenues, Expenditures and Changes in Fund Balances For the Fiscal Year Ended September 30, 2007 2006 Other Total General Fire District SPLOST Governmental Governmental Fund Fund Fund Funds Funds Revenues: Taxes $ 206,236,101 $ 63,600,752 $ 134,143,700 $ 17,498,255 $ 421,478,808 Licenses and permits 21,755,826 1,650 - - 21,757,476 Intergovernmental 11,804,991 2,791,952 4,056,421 25,273,801 43,927,165 Charges for services 46,144,521 1,844,496 437,779 11,094,302 59,521,098 Fines and forfeits 16,218,879 - - 1,528,296 17,747,175 Interest earned 5,126,662 824,090 5,150,438 2,028,990 13,130,180 Miscellaneous 4,026,195 49,592 380,945 2,913,100 7,369,832 Total revenues $ 311,313,175 $ 69,112,532 $ 144,169,283 $ 60,336,744 $ 584,931,734 Expenditures: Current: General government $ 115,299,319 $ - $ - $ 18,358,592 $ 133,657,911 Public safety 114,546,936 62,675,294 6,803,951 15,276,921 199,303,102 Public works 19,158,905 - 50,832,306 19,486,661 89,477,872 Health and welfare 1,292,332 - - 6,120,975 7,413,307 Culture and recreation 32,132,425 - - 19,897,812 52,030,237 Housing and development 7,719,485 - - 7,430,972 15,150,457 Debt service: Principal retirement 161,443 - - 16,387,460 16,548,903 Interest and fiscal charges 1,458,797 596,145 - 4,922,220 6,977,162 Total expenditures $ 291,769,642 $ 63,271,439 $ 57,636,257 $ 107,881,613 $ 520,558,951 Excess (deficiency) of revenues over (under) other expenditures $ 19,543,533 $ 5,841,093 $ 86,533,026 $ (47,544,869) $ 64,372,783 Other financing sources (uses): Transfers in $ 18,425,101 $ 971,094 $ 1,334,009 $ 59,731,923 $ 80,462,127 Transfers out (40,140,251) (12,627,807) (18,113,016) (11,555,449) (82,436,523) Proceeds from sale of capital assets 274,603 36,094 - - 310,697 Bonds issued - - - 25,000,000 25,000,000 Premium on bonds issued - - - 926,933 926,933 Capital lease proceeds - - - 6,975,011 6,975,011 Total other financing sources (uses) $ (21,440,547) $ (11,620,619) $ (16,779,007) $ 81,078,418 $ 31,238,245 Net changes in fund balances $ (1,897,014) $ (5,779,526) $ 69,754,019 $ 33,533,549 $ 95,611,028 Fund balances at beginning of year 60,611,512 22,720,645 76,900,186 62,782,159 223,014,502 Fund balances at end of year $ 58,714,498 $ 16,941,119 $ 146,654,205 $ 96,315,708 $ 318,625,530 See accompanying notes to financial statements. 21

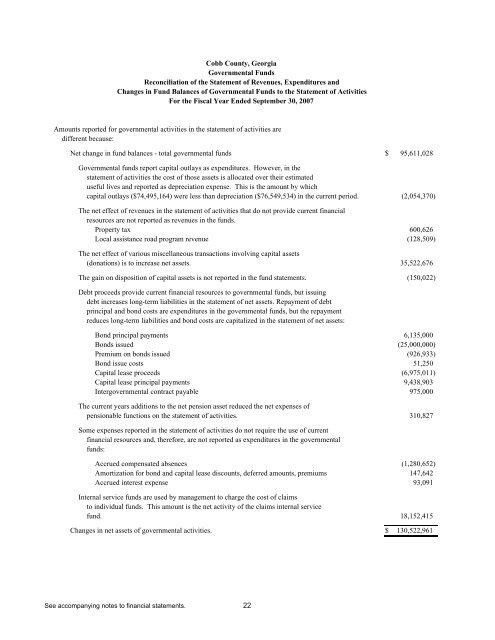

<strong>Cobb</strong> <strong>County</strong>, Georgia Governmental Funds Reconciliation of the Statement of Revenues, Expenditures and Changes in Fund Balances of Governmental Funds to the Statement of Activities For the Fiscal Year Ended September 30, 2007 Amounts reported for governmental activities in the statement of activities are different because: Net change in fund balances - total governmental funds $ 95,611,028 Governmental funds report capital outlays as expenditures. However, in the statement of activities the cost of those assets is allocated over their estimated useful lives and reported as depreciation expense. This is the amount by which capital outlays ($74,495,164) were less than depreciation ($76,549,534) in the current period. (2,054,370) The net effect of revenues in the statement of activities that do not provide current financial resources are not reported as revenues in the funds. Property tax 600,626 Local assistance road program revenue (128,509) The net effect of various miscellaneous transactions involving capital assets (donations) is to increase net assets. 35,522,676 The gain on disposition of capital assets is not reported in the fund statements. (150,022) Debt proceeds provide current financial resources to governmental funds, but issuing debt increases long-term liabilities in the statement of net assets. Repayment of debt principal and bond costs are expenditures in the governmental funds, but the repayment reduces long-term liabilities and bond costs are capitalized in the statement of net assets: Bond principal payments 6,135,000 Bonds issued (25,000,000) Premium on bonds issued (926,933) Bond issue costs 51,250 Capital lease proceeds (6,975,011) Capital lease principal payments 9,438,903 Intergovernmental contract payable 975,000 The current years additions to the net pension asset reduced the net expenses of pensionable functions on the statement of activities. 310,827 Some expenses reported in the statement of activities do not require the use of current financial resources and, therefore, are not reported as expenditures in the governmental funds: Accrued compensated absences (1,280,652) Amortization for bond and capital lease discounts, deferred amounts, premiums 147,642 Accrued interest expense 93,091 Internal service funds are used by management to charge the cost of claims to individual funds. This amount is the net activity of the claims internal service fund. 18,152,415 Changes in net assets of governmental activities. $ 130,522,961 See accompanying notes to financial statements. 22

- Page 1 and 2: COBB COUNTY, GEORGIA Comprehensive

- Page 3 and 4: Metro Atlanta ACWORTH KENNESAW MARI

- Page 5 and 6: COBB COUNTY, GEORGIA COMPREHENSIVE

- Page 7 and 8: (THIS PAGE INTENTIONALLY LEFT BLANK

- Page 10 and 11: Cobb’s population has grown 11.8%

- Page 12 and 13: The Debt Service Fund reflects the

- Page 14: In developing and evaluating the Co

- Page 17 and 18: Helen Goreham Commissioner District

- Page 19 and 20: Financial Section The Financial Sec

- Page 21 and 22: The management's discussion and ana

- Page 23 and 24: COBB COUNTY GOVERNMENT Management

- Page 25 and 26: COBB COUNTY GOVERNMENT Management

- Page 27 and 28: COBB COUNTY GOVERNMENT Management

- Page 29 and 30: COBB COUNTY GOVERNMENT Management

- Page 31 and 32: COBB COUNTY GOVERNMENT Management

- Page 33 and 34: COBB COUNTY GOVERNMENT Management

- Page 35 and 36: COBB COUNTY GOVERNMENT Management

- Page 37 and 38: Basic Financial Statements

- Page 39 and 40: Cobb County, Georgia Statement of A

- Page 41: Cobb County, Georgia Governmental F

- Page 45 and 46: Cobb County, Georgia Fire District

- Page 47 and 48: Cobb County, Georgia Proprietary Fu

- Page 49 and 50: Cobb County, Georgia Proprietary Fu

- Page 51 and 52: Cobb County, Georgia Fiduciary Fund

- Page 53 and 54: (THIS PAGE INTENTIONALLY LEFT BLANK

- Page 55 and 56: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 57 and 58: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 59 and 60: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 61 and 62: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 63 and 64: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 65 and 66: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 67 and 68: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 69 and 70: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 71 and 72: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 73 and 74: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 75 and 76: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 77 and 78: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 79 and 80: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 81 and 82: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 83 and 84: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 85 and 86: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 87 and 88: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 89 and 90: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 91 and 92: COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 93 and 94:

COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 95 and 96:

COBB COUNTY, GEORGIA NOTES TO FINAN

- Page 97 and 98:

COBB COUNTY, GEORGIA EMPLOYEE RETIR

- Page 99 and 100:

COBB COUNTY, GEORGIA EMPLOYEE RETIR

- Page 101 and 102:

Nonmajor Funds

- Page 103 and 104:

COBB COUNTY, GEORGIA September 30,

- Page 105 and 106:

Cobb County, Georgia All Nonmajor G

- Page 107 and 108:

Cobb County, Georgia Nonmajor Gover

- Page 109 and 110:

Cobb County, Georgia Nonmajor Gover

- Page 111 and 112:

Cobb County, Georgia Nonmajor Gover

- Page 113 and 114:

Cobb County, Georgia Debt Service F

- Page 115 and 116:

Cobb County, Georgia Community Serv

- Page 117 and 118:

Cobb County, Georgia Hotel/Motel Ta

- Page 119 and 120:

Cobb County, Georgia Parking Deck F

- Page 121 and 122:

Cobb County, Georgia Nonmajor Busin

- Page 123 and 124:

Cobb County, Georgia Nonmajor Busin

- Page 125 and 126:

Cobb County, Georgia Nonmajor Busin

- Page 127 and 128:

Cobb County, Georgia Agency Funds C

- Page 129 and 130:

Cobb County, Georgia General Fund S

- Page 131 and 132:

Cobb County, Georgia General Fund S

- Page 133 and 134:

Cobb County, Georgia General Fund S

- Page 135 and 136:

Cobb County, Georgia General Fund S

- Page 137 and 138:

Statistical Section The Statistical

- Page 139 and 140:

Cobb County, Georgia Net Assets by

- Page 141 and 142:

Business-type activities: Miscellan

- Page 143 and 144:

Cobb County, Georgia Changes in Fun

- Page 145 and 146:

Residential Property Fiscal Year As

- Page 147 and 148:

Cobb County, Georgia Principal Prop

- Page 149 and 150:

Cobb County, Georgia Ratios of Gene

- Page 151 and 152:

Cobb County, Georgia Legal Debt Mar

- Page 153 and 154:

Water and Sewer Bonds: Direct Net R

- Page 155 and 156:

Cobb County, Georgia Demographic an

- Page 157 and 158:

Cobb County, Georgia Full-time Equi

- Page 159 and 160:

Fiscal Year Function/Program 2007 2

- Page 161 and 162:

Cobb County, Georgia Road Sales Tax

- Page 163 and 164:

0BMB Moore ^ CunLed^e, LLP Certifie

- Page 165 and 166:

0 :^a a C a Moore & CuLLed^e, LLP C

- Page 167 and 168:

Cobb County, Georgia Schedule of Fi

- Page 169 and 170:

Cobb County, Georgia Schedule of Ex

- Page 171 and 172:

Cobb County, Georgia Schedule of Ex

- Page 173 and 174:

Cobb County, Georgia Notes To Sched

- Page 175:

Finance Department 100 Cherokee St.