Comprehensive Annual Financial Report - Cobb County

Comprehensive Annual Financial Report - Cobb County

Comprehensive Annual Financial Report - Cobb County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COBB COUNTY, GEORGIA<br />

NOTES TO FINANCIAL STATEMENTS<br />

September 30, 2007<br />

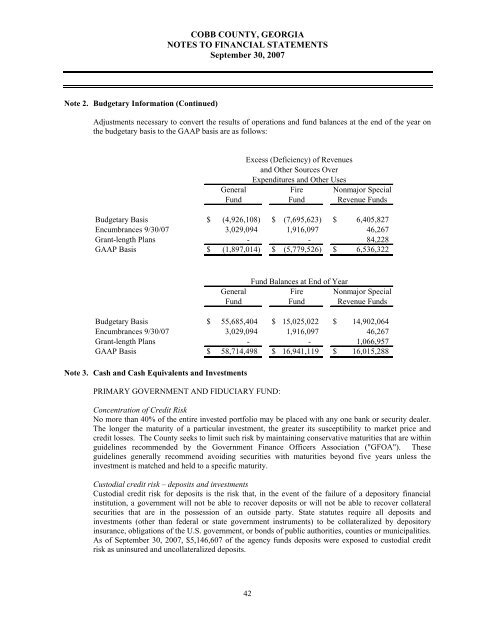

Note 2. Budgetary Information (Continued)<br />

Adjustments necessary to convert the results of operations and fund balances at the end of the year on<br />

the budgetary basis to the GAAP basis are as follows:<br />

Excess (Deficiency) of Revenues<br />

and Other Sources Over<br />

Expenditures and Other Uses<br />

General Fire Nonmajor Special<br />

Fund Fund Revenue Funds<br />

Budgetary Basis<br />

Encumbrances 9/30/07<br />

Grant-length Plans<br />

GAAP Basis<br />

$ (4,926,108) $ (7,695,623) $ 6,405,827<br />

3,029,094 1,916,097 46,267<br />

- - 84,228<br />

$ (1,897,014) $ (5,779,526) $ 6,536,322<br />

Fund Balances at End of Year<br />

General Fire Nonmajor Special<br />

Fund Fund Revenue Funds<br />

Budgetary Basis<br />

Encumbrances 9/30/07<br />

Grant-length Plans<br />

GAAP Basis<br />

$ 55,685,404 $ 15,025,022 $ 14,902,064<br />

3,029,094 1,916,097 46,267<br />

- - 1,066,957<br />

$ 58,714,498 $ 16,941,119 $ 16,015,288<br />

Note 3. Cash and Cash Equivalents and Investments<br />

PRIMARY GOVERNMENT AND FIDUCIARY FUND:<br />

Concentration of Credit Risk<br />

No more than 40% of the entire invested portfolio may be placed with any one bank or security dealer.<br />

The longer the maturity of a particular investment, the greater its susceptibility to market price and<br />

credit losses. The <strong>County</strong> seeks to limit such risk by maintaining conservative maturities that are within<br />

guidelines recommended by the Government Finance Officers Association ("GFOA"). These<br />

guidelines generally recommend avoiding securities with maturities beyond five years unless the<br />

investment is matched and held to a specific maturity.<br />

Custodial credit risk – deposits and investments<br />

Custodial credit risk for deposits is the risk that, in the event of the failure of a depository financial<br />

institution, a government will not be able to recover deposits or will not be able to recover collateral<br />

securities that are in the possession of an outside party. State statutes require all deposits and<br />

investments (other than federal or state government instruments) to be collateralized by depository<br />

insurance, obligations of the U.S. government, or bonds of public authorities, counties or municipalities.<br />

As of September 30, 2007, $5,146,607 of the agency funds deposits were exposed to custodial credit<br />

risk as uninsured and uncollateralized deposits.<br />

42