Comprehensive Annual Financial Report - Cobb County

Comprehensive Annual Financial Report - Cobb County

Comprehensive Annual Financial Report - Cobb County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COBB COUNTY, GEORGIA<br />

NOTES TO FINANCIAL STATEMENTS<br />

September 30, 2007<br />

Note 8. Long-Term Debt (Continued)<br />

$16,730,000 series 1999 serial bonds, of which $3,240,000 was unrefunded and outstanding at<br />

September 30, 2007. These bonds are subject to mandatory redemption requirements beginning October<br />

1, 2011. The unrefunded term bonds come due October 1, 2014 at a fixed rate of 6.0 percent.<br />

The purpose of the 1999 issue was to finance the expansion of the <strong>Cobb</strong> Galleria Centre and the<br />

construction of a new parking deck. These bonds were partially advance refunded by the series 2005<br />

revenue refunding bonds.<br />

$2,120,000 series 2005 serial bonds, of which $2,105,000 was outstanding at September 30, 2007. The<br />

serial bonds are due in future annual installments of $20,000 to $990,000 through October 1, 2016, with<br />

interest at fixed rates from 3.0 to 4.0 percent.<br />

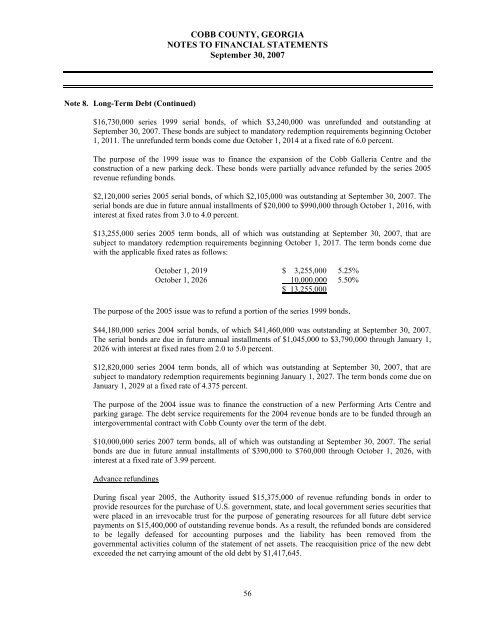

$13,255,000 series 2005 term bonds, all of which was outstanding at September 30, 2007, that are<br />

subject to mandatory redemption requirements beginning October 1, 2017. The term bonds come due<br />

with the applicable fixed rates as follows:<br />

October 1, 2019 $ 3,255,000 5.25%<br />

October 1, 2026 10,000,000 5.50%<br />

$ 13,255,000<br />

The purpose of the 2005 issue was to refund a portion of the series 1999 bonds.<br />

$44,180,000 series 2004 serial bonds, of which $41,460,000 was outstanding at September 30, 2007.<br />

The serial bonds are due in future annual installments of $1,045,000 to $3,790,000 through January 1,<br />

2026 with interest at fixed rates from 2.0 to 5.0 percent.<br />

$12,820,000 series 2004 term bonds, all of which was outstanding at September 30, 2007, that are<br />

subject to mandatory redemption requirements beginning January 1, 2027. The term bonds come due on<br />

January 1, 2029 at a fixed rate of 4.375 percent.<br />

The purpose of the 2004 issue was to finance the construction of a new Performing Arts Centre and<br />

parking garage. The debt service requirements for the 2004 revenue bonds are to be funded through an<br />

intergovernmental contract with <strong>Cobb</strong> <strong>County</strong> over the term of the debt.<br />

$10,000,000 series 2007 term bonds, all of which was outstanding at September 30, 2007. The serial<br />

bonds are due in future annual installments of $390,000 to $760,000 through October 1, 2026, with<br />

interest at a fixed rate of 3.99 percent.<br />

Advance refundings<br />

During fiscal year 2005, the Authority issued $15,375,000 of revenue refunding bonds in order to<br />

provide resources for the purchase of U.S. government, state, and local government series securities that<br />

were placed in an irrevocable trust for the purpose of generating resources for all future debt service<br />

payments on $15,400,000 of outstanding revenue bonds. As a result, the refunded bonds are considered<br />

to be legally defeased for accounting purposes and the liability has been removed from the<br />

governmental activities column of the statement of net assets. The reacquisition price of the new debt<br />

exceeded the net carrying amount of the old debt by $1,417,645.<br />

56