PrimeResi Quarterly No.1 - preview pages

The handbook of the luxury property industry

The handbook of the luxury property industry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

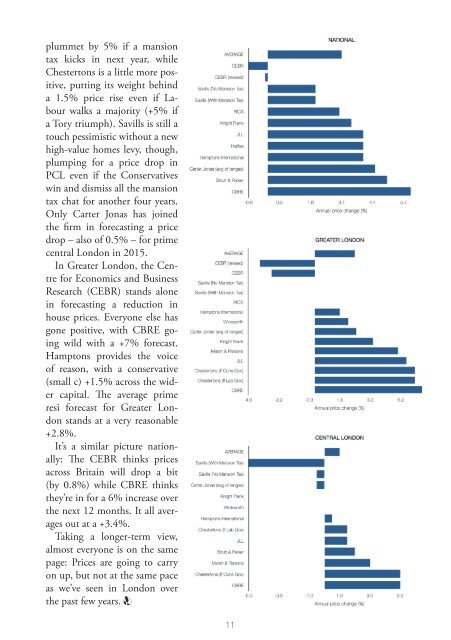

plummet by 5% if a mansion<br />

tax kicks in next year, while<br />

Chestertons is a little more positive,<br />

putting its weight behind<br />

a 1.5% price rise even if Labour<br />

walks a majority (+5% if<br />

a Tory triumph). Savills is still a<br />

touch pessimistic without a new<br />

high-value homes levy, though,<br />

plumping for a price drop in<br />

PCL even if the Conservatives<br />

win and dismiss all the mansion<br />

tax chat for another four years.<br />

Only Carter Jonas has joined<br />

the firm in forecasting a price<br />

drop – also of 0.5% – for prime<br />

central London in 2015.<br />

In Greater London, the Centre<br />

for Economics and Business<br />

Research (CEBR) stands alone<br />

in forecasting a reduction in<br />

house prices. Everyone else has<br />

gone positive, with CBRE going<br />

wild with a +7% forecast.<br />

Hamptons provides the voice<br />

of reason, with a conservative<br />

(small c) +1.5% across the wider<br />

capital. The average prime<br />

resi forecast for Greater London<br />

stands at a very reasonable<br />

+2.8%.<br />

It’s a similar picture nationally:<br />

The CEBR thinks prices<br />

across Britain will drop a bit<br />

(by 0.8%) while CBRE thinks<br />

they’re in for a 6% increase over<br />

the next 12 months. It all averages<br />

out at a +3.4%.<br />

Taking a longer-term view,<br />

almost everyone is on the same<br />

page: Prices are going to carry<br />

on up, but not at the same pace<br />

as we’ve seen in London over<br />

the past few years. Q<br />

11