How to interpret the Fund Fact Sheet report - Fi360

How to interpret the Fund Fact Sheet report - Fi360

How to interpret the Fund Fact Sheet report - Fi360

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

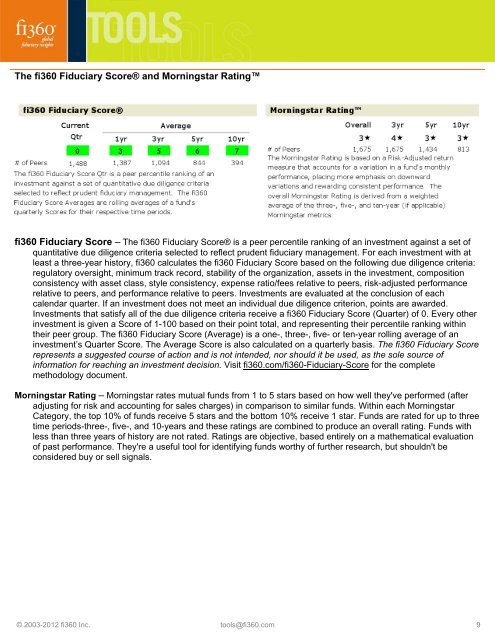

The fi360 Fiduciary Score® and Morningstar Rating<br />

fi360 Fiduciary Score – The fi360 Fiduciary Score® is a peer percentile ranking of an investment against a set of<br />

quantitative due diligence criteria selected <strong>to</strong> reflect prudent fiduciary management. For each investment with at<br />

least a three-year his<strong>to</strong>ry, fi360 calculates <strong>the</strong> fi360 Fiduciary Score based on <strong>the</strong> following due diligence criteria:<br />

regula<strong>to</strong>ry oversight, minimum track record, stability of <strong>the</strong> organization, assets in <strong>the</strong> investment, composition<br />

consistency with asset class, style consistency, expense ratio/fees relative <strong>to</strong> peers, risk-adjusted performance<br />

relative <strong>to</strong> peers, and performance relative <strong>to</strong> peers. Investments are evaluated at <strong>the</strong> conclusion of each<br />

calendar quarter. If an investment does not meet an individual due diligence criterion, points are awarded.<br />

Investments that satisfy all of <strong>the</strong> due diligence criteria receive a fi360 Fiduciary Score (Quarter) of 0. Every o<strong>the</strong>r<br />

investment is given a Score of 1-100 based on <strong>the</strong>ir point <strong>to</strong>tal, and representing <strong>the</strong>ir percentile ranking within<br />

<strong>the</strong>ir peer group. The fi360 Fiduciary Score (Average) is a one-, three-, five- or ten-year rolling average of an<br />

investment’s Quarter Score. The Average Score is also calculated on a quarterly basis. The fi360 Fiduciary Score<br />

represents a suggested course of action and is not intended, nor should it be used, as <strong>the</strong> sole source of<br />

information for reaching an investment decision. Visit fi360.com/fi360-Fiduciary-Score for <strong>the</strong> complete<br />

methodology document.<br />

Morningstar Rating – Morningstar rates mutual funds from 1 <strong>to</strong> 5 stars based on how well <strong>the</strong>y've performed (after<br />

adjusting for risk and accounting for sales charges) in comparison <strong>to</strong> similar funds. Within each Morningstar<br />

Category, <strong>the</strong> <strong>to</strong>p 10% of funds receive 5 stars and <strong>the</strong> bot<strong>to</strong>m 10% receive 1 star. <strong>Fund</strong>s are rated for up <strong>to</strong> three<br />

time periods-three-, five-, and 10-years and <strong>the</strong>se ratings are combined <strong>to</strong> produce an overall rating. <strong>Fund</strong>s with<br />

less than three years of his<strong>to</strong>ry are not rated. Ratings are objective, based entirely on a ma<strong>the</strong>matical evaluation<br />

of past performance. They're a useful <strong>to</strong>ol for identifying funds worthy of fur<strong>the</strong>r research, but shouldn't be<br />

considered buy or sell signals.<br />

© 2003-2012 fi360 Inc. <strong>to</strong>ols@fi360.com 9