Corporate Banking

Corporate Banking

Corporate Banking

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Personal Accounts<br />

and Plastic Cards<br />

In 2006, ROSBANK also focused on retail<br />

business line represented by personal accounts<br />

and plastic cards. The total number of retail<br />

customers who had chosen ROSBANK as their<br />

bank exceeded 5 million individuals, which<br />

represents 70% growth year on year. The Bank has<br />

opened accounts to 1.1 million clients, with<br />

almost 50% of them using ROSBANK plastic cards.<br />

The majority of personal accounts are opened<br />

under payroll payment options offered to employers.<br />

These projects reflect a high level of confidence<br />

in the Bank and offer the opportunity for<br />

selling the full range of banking services to new<br />

customers.<br />

In 2006, retail customers increased consumption<br />

of remote account management services<br />

through Internet-Bank and SMS-Bank products.<br />

ROSBANK is gradually expanding its range of<br />

remote services available through these two<br />

systems. At present, remote account management<br />

includes access to account statements, payment<br />

of bills, and transfers between accounts, as well as<br />

information support and a variety of related<br />

services.<br />

Money Transfers<br />

ROSBANK also offers traditional banking<br />

services, such as money transfers. Remittances can<br />

be made from an account in ROSBANK or in cash<br />

(without opening an account). Strategic partners<br />

of the Bank include MoneyGram and ALLURE<br />

money transfer systems.<br />

Retail Loans<br />

The retail loan portfolio grew 47.5% year on<br />

year to RUR 76.6 billion as of December 31, 2006<br />

(2005 – RUR 52.0 billion). In 2006, the Bank issued<br />

in total over 1.5 million loans.<br />

The retail loan portfolio is dominated by car<br />

loans (RUR 37.1 billion, 48.4% of total loans) and<br />

consumer loans (RUR 15.3 billion, 20% of total<br />

loans). The proportion of general purpose loans<br />

increased to 20.5%, or RUR 15.7 billion. The<br />

amount of mortgage loans exceeded RUR 5<br />

billion, growing 8.3 times year on year. The ratio of<br />

mortgage loans to total retail loans issued by the<br />

Bank increased from 1.2% in 2005 to 7% at the end<br />

of 2006.<br />

In 2006, the Bank focused on secured lending,<br />

mainly car and mortgage loans.<br />

Car Loans<br />

ROSBANK maintains its leadership in the car<br />

loan market: in 2006, its car loan portfolio increased<br />

by 54% to RUR 37 billion. In 2006, ROS-<br />

BANK extended 92,800 car loans worth RUR 28.3<br />

billion. At December 31, 2006, the total number of<br />

outstanding loans exceeded 167,800, or up 36%<br />

year on year.<br />

In 2006, ROSBANK focused on further development<br />

of its car loan products. Major developments<br />

include the launch of products with zero<br />

downpayment, discontinued the practice of<br />

mandatory life insurance for borrowers, the option<br />

to select the amount and dates of monthly<br />

payments offered to borrowers, and the extension<br />

of the maximum age limit for used cars purchsed<br />

with Bank loans. During the year, the Bank participated<br />

in joint campaigns with its car dealer<br />

partners (Avtomir, Elex-Polus, Incom-Auto) to offer<br />

the most attractive loan terms in various car<br />

market segments.<br />

Mortgage Loans<br />

The Bank is actively expanding its mortgage<br />

loan business and had a major breakthrough in<br />

this market in 2006. After the launch of regional<br />

mortgage programs, the mortgage loan portfolio<br />

of the Bank increased more than 8-fold to RUR 5.4<br />

billion. In 2006, loans to buy new homes being<br />

under construction contributed 53% of the total<br />

portfolio, while regular mortgages accounted for<br />

the remaining 47%. The currency structure of the<br />

loan book provides for 37% of loans in Rubles and<br />

63% in US Dollars.<br />

As of December 31, 2006, mortgage programs<br />

were offered in 66 major Russian cities. In 2006,<br />

regional branches contributed 40% of the total<br />

mortgage loans issued.<br />

In 2006, ROSBANK reduced interest rates for<br />

ruble-denominated loans issued under the<br />

mortgage lending program. Currently, the minimum<br />

interest rate offered by ROSBANK for<br />

traditional mortgage loans is 13% p.a. (down from<br />

15%). The amount of downpayment for such loans<br />

was cut down to 10% of the deal price.<br />

In 2006, the Bank launched several new<br />

programs, including the Home Loan (“Ipotechniy<br />

Lombard”) with downpayment financing provided<br />

by the Bank and secured by existing real estate<br />

property of a borrower, and an interregional<br />

program whereby a borrower can obtain a loan for<br />

the purchase of housing in a different city.<br />

In 2006, ROSBANK invested considerable effort<br />

to develop its mortgage loan business, extend the<br />

range of banking and related services and access<br />

new client groups. This work included a number<br />

of partnership agreements with major developers,<br />

insurance companies, and realtors.<br />

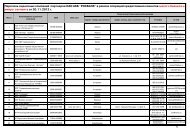

Retail Loans in 2006, RUR mln<br />

Car Loans in 2006, RUR mln<br />

Mortgage Loans in 2006, RUR mln<br />

51 967<br />

57 866<br />

65 405<br />

71 627 76 633<br />

24 091 27 490 32 258 35 385<br />

37 084<br />

647<br />

1 045<br />

2 141<br />

3 736<br />

5 361<br />

01.01.06 01.04.06 01.07.06 01.10.06 01.01.07<br />

01.01.06 01.04.06 01.07.06 01.10.06 01.01.07<br />

01.01.06 01.04.06 01.07.06 01.10.06 01.01.07<br />

28<br />

29