Corporate Banking

Corporate Banking

Corporate Banking

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

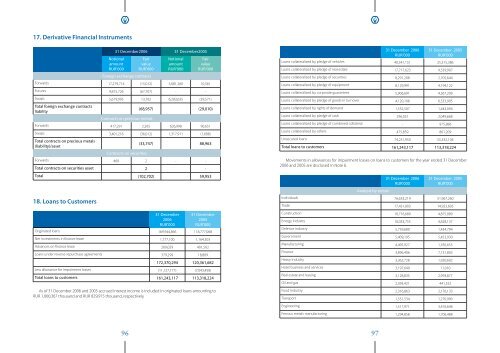

17. Derivative Financial Instruments<br />

31 December2006 31 December2005<br />

Notional<br />

amount<br />

RUR’000<br />

Fair<br />

value<br />

RUR’000<br />

Foreign exchange contracts<br />

Notional<br />

amount<br />

RUR’000<br />

Fair<br />

value<br />

RUR’000<br />

Forwards 17,279,714 (15,012) 5,681,260 10,561<br />

Futures 9,815,726 (67,707) - -<br />

Swaps 5,679,995 13,762 6,283,035 (39,571)<br />

Total foreign exchange contracts<br />

liability<br />

Contracts on precious metals<br />

(68,957) (29,010)<br />

Forwards 417,291 2,265 626,998 90,651<br />

Swaps 3,401,216 (36,012) 1,317,911 (1,688)<br />

Total contracts on precious metals<br />

(liability)/asset<br />

Contracts on securities<br />

(33,747) 88,963<br />

Forwards 460 2 - -<br />

Total contracts on securities asset 2 -<br />

31 December 2006<br />

RUR’000<br />

31 December 2005<br />

RUR’000<br />

Loans collateralized by pledge of vehicles 40,541,151 25,315,386<br />

Loans collateralized by pledge of real estate 17,717,623 9,539,907<br />

Loans collateralized by pledge of securities 8,291,208 2,705,644<br />

Loans collateralized by pledge of equipment 8,129,991 4,194,122<br />

Loans collateralized by corporate guarantees 5,906,691 4,367,209<br />

Loans collateralized by pledge of goods in turnover 4,120,106 6,533,995<br />

Loans collateralized by rights of demand 1,532,507 1,443,094<br />

Loans collateralized by pledge of cash 296,031 2,049,668<br />

Loans collateralized by pledge of combined collateral - 975,886<br />

Loans collateralized by others 475,859 861,209<br />

Unsecured loans 74,231,950 55,332,104<br />

Total loans to customers 161,243,117 113,318,224<br />

Movements in allowances for impairment losses on loans to customers for the year ended 31 December<br />

2006 and 2005 are disclosed in Note 6.<br />

Total (102,702) 59,953<br />

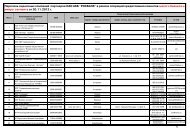

Analysis by sector:<br />

31 December 2006<br />

RUR’000<br />

31 December 2005<br />

RUR’000<br />

18. Loans to Customers<br />

31 December<br />

2006<br />

RUR’000<br />

31 December<br />

2005<br />

RUR’000<br />

Originated loans 169,944,866 118,777,068<br />

Net investments in finance lease 1,777,100 1,164,303<br />

Advances on finance lease 269,029 401,502<br />

Loans under reverse repurchase agreements 379,299 18,809<br />

172,370,294 120,361,682<br />

Less allowance for impairment losses (11,127,177) (7,043,458)<br />

Total loans to customers 161,243,117 113,318,224<br />

As of 31 December 2006 and 2005 accrued interest income is included in originated loans amounting to<br />

RUR 1,000,367 thousand and RUR 829,915 thousand, respectively.<br />

Individuals 76,633,219 51,967,260<br />

Trade 17,431,803 14,923,605<br />

Construction 10,716,689 4,875,089<br />

Energy industry 10,033,755 4,828,137<br />

Defence industry 5,739,680 1,434,794<br />

Government 5,409,195 5,453,930<br />

Manufacturing 4,495,927 1,185,655<br />

Finance 3,896,406 7,131,803<br />

Heavy industry 3,362,728 1,920,602<br />

Hotel business and services 3,197,649 11,010<br />

Real estate and leasing 3,128,835 2,993,877<br />

Oil and gas 2,393,421 441,552<br />

Food industry 2,316,863 2,176,133<br />

Transport 1,551,534 1,270,990<br />

Engineering 1,517,971 3,476,648<br />

Ferrous metals manufacturing 1,294,858 1,706,488<br />

96 97