Corporate Banking

Corporate Banking

Corporate Banking

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Services for Small<br />

and Medium Enterprises<br />

The number of loans issued to SME<br />

customers increased by 257%.<br />

the strong demand from SME customers operating<br />

in the Central Region – that share increased to<br />

18% from 12% in 2005.<br />

In 2007, ROSBANK plans a comprehensive<br />

upgrade of its SME product line, to increase the<br />

maximum loan amount to RUR 26 million (USD<br />

1 million) and segregate loan products into several<br />

segments: micro-loans, small business loans and<br />

medium business loans. The product range will<br />

also be expanded to include special offers<br />

targeting specific customer groups under partnership<br />

programs.<br />

With these innovations, ROSBANK will be able<br />

to offer competitive SME products and services<br />

targeting various customer groups in line with<br />

modern business requirements.<br />

The current favorable domestic macroeconomic<br />

situation combined with the on-going<br />

improvement of the product range will support<br />

the growth of the SME banking segment in line<br />

with the general growth of small and medium<br />

businesses in Russia.<br />

According to RBC ratings, in 2006, the SME<br />

lending market grew 40–50% to RUR 1.6 trillion<br />

(USD 60 billion). However, even this unprecedented<br />

growth was insufficient to bring the share of<br />

SME in the bank loan market to levels typical for<br />

developed economies.<br />

In 2006, ROSBANK focused on active development<br />

of its SME lending business, gradually<br />

expanding its market share in this segment.<br />

Products offered by the Bank generate considerable<br />

customer demand, and thereby the Bank<br />

easily outperformed its 2006 targets. The number<br />

of loans issued to SME customers increased by<br />

257% (from 1,400 to 5,000 loans). The strong<br />

demand for Bank products and services from SME<br />

clients is explained by the availability of an<br />

extensive branch network, which provides access<br />

to banking services within maximum proximity to<br />

business locations, while the Bank’s products are<br />

broad enough to meet all client requirements.<br />

In 2006, the Bank initiated major reforms of its<br />

SME business. These initiatives were positively<br />

met by customers and included the increase in<br />

the minimum loan amount to RUR 15 million (USD<br />

500 thousand). The maximum loan tenor was<br />

extended to 60 months. The Bank also cancelled<br />

the loan application commission.<br />

In addition, the Bank significantly expanded<br />

the range of its SME products and introduced two<br />

new programs – loans to SME owners and individual<br />

entrepreneurs, as well as overdrafts for SME<br />

and individual entrepreneurs. Both programs were<br />

launched in mid-2006 and are being actively<br />

developed by the Bank. As of December 31, 2006,<br />

the outstanding loan balance under the first<br />

program was close to RUR 171 million, under the<br />

second program – RUR 37 million. Both programs<br />

are characterized by high asset quality, with a default<br />

ratio of less than 0.03%.<br />

In addition to loans, the Bank actively promoted<br />

deposit and cash management products<br />

targeting the SME segment. In 2006, the number<br />

of customers using the Bank’s deposit products<br />

grew 48% to 3,700 clients, while the aggregate<br />

amount of customer deposits increased by 81.6%<br />

to RUR 84.7 billion. Current account balances<br />

increased by 48% to RUR 4.3 billion, with average<br />

account balances rising 81.6%. This trend reflects<br />

the growing confidence of SME clients in the Bank.<br />

The strong demand for SME loans and the<br />

expansion of the product line boosted the Bank’s<br />

2006 revenue from SME operations to RUR 1.2<br />

billion, or up 243% compared to 2005 revenue<br />

(RUR 353.5 million). The SME loan portfolio tripled<br />

by the end of 2006 to RUR 5.5 billion, while the<br />

share of overdue loans remained low at 1.3%,<br />

indicating the good credit standing of the Bank’s<br />

SME customers.<br />

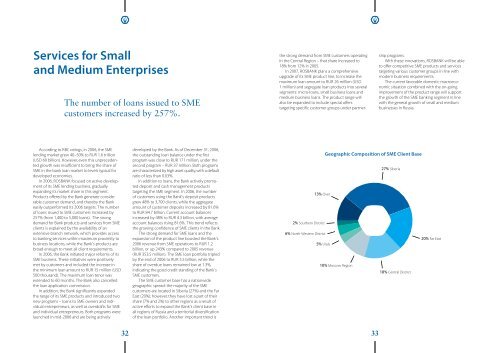

The SME customer base has a nationwide<br />

geographic spread: the majority of the SME<br />

customers are located in Siberia (27%) and the Far<br />

East (20%); however, they have lost a part of their<br />

share (7% and 2%) to other regions as a result of<br />

active efforts to expand the Bank’s client base in<br />

all regions of Russia and a territorial diversification<br />

of the loan portfolio. Another important trend is<br />

Geographic Composition of SME Client Base<br />

27% Siberia<br />

13% Over<br />

2% Southern District<br />

6% North-Western District<br />

20% Far East<br />

5% Urals<br />

10% Мoscow Region<br />

18% Central District<br />

32<br />

33