Corporate Banking

Corporate Banking

Corporate Banking

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Year ended<br />

31 December 2006 RUR’000<br />

Related party<br />

transactions<br />

Total category<br />

as per<br />

financial<br />

statements<br />

caption<br />

- other related parties 243,737 142,474<br />

Key management personnel compensation 258,046 43,116<br />

Year ended<br />

31 December 2005 RUR’000<br />

Related party<br />

transactions<br />

Total category<br />

as per<br />

financial<br />

statements<br />

caption<br />

- short-term employee benefits 243,737 6,167,565 142,474 5,356,324<br />

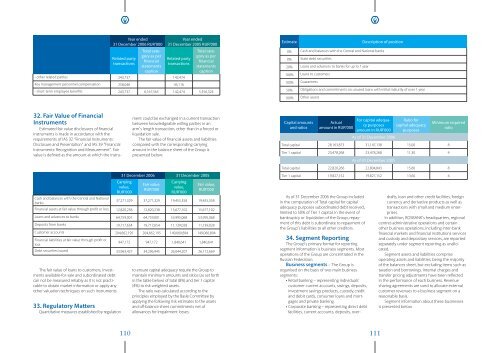

Estimate<br />

Description of position<br />

0% Cash and balances with the Central and National banks<br />

0% State debt securities<br />

20% Loans and advances to banks for up to 1 year<br />

100% Loans to customers<br />

100% Guarantees<br />

50% Obligations and commitments on unused loans with initial maturity of over 1 year<br />

100% Other assets<br />

32. Fair Value of Financial<br />

Instruments<br />

Estimated fair value disclosures of financial<br />

instruments is made in accordance with the<br />

requirements of IAS 32 “Financial Instruments:<br />

Disclosure and Presentation” and IAS 39 “Financial<br />

Instruments: Recognition and Measurement”. Fair<br />

value is defined as the amount at which the instru-<br />

ment could be exchanged in a current transaction<br />

between knowledgeable willing parties in an<br />

arm’s length transaction, other than in a forced or<br />

liquidation sale.<br />

The fair value of financial assets and liabilities<br />

compared with the corresponding carrying<br />

amount in the balance sheet of the Group is<br />

presented below:<br />

Capital amounts<br />

and ratios<br />

Actual<br />

amount in RUR’000<br />

For capital adequacy<br />

purposes<br />

amount in RUR’000<br />

As of 31 December 2006<br />

Ratio for<br />

capital adequacy<br />

purposes<br />

Minimum required<br />

ratio<br />

Total capital 28,163,873 31,147,138 15,00 8<br />

Tier 1 capital 23,478,268 23,478,268 11,30 4<br />

As of 31 December 2005<br />

Total capital 22,820,266 22,804,843 15,60 8<br />

Cash and balances with the Central and National<br />

banks<br />

31 December 2006 31 December 2005<br />

Carrying<br />

value,<br />

RUR’000<br />

Fair value,<br />

RUR’000<br />

Carrying<br />

value,<br />

RUR’000<br />

Fair value,<br />

RUR’000<br />

37,271,329 37,271,329 19,455,358 19,455,358<br />

Financial assets at fair value through profit or loss 12,820,238 12,820,238 15,677,102 15,677,102<br />

Loans and advances to banks 64,759,001 64,759,001 53,995,068 53,995,068<br />

Deposits from banks 19,717,654 19,717,654 11,139,028 11,139,028<br />

Customer accounts 204,662,195 204,662,195 149,060,894 149,060,894<br />

Financial liabilities at fair value through profit or<br />

loss<br />

947,172 947,172 1,840,641 1,840,641<br />

Debt securities issued 33,963,427 34,296,945 26,044,207 26,112,669<br />

The fair value of loans to customers, investments<br />

available-for-sale and subordinated debt<br />

can not be measured reliably as it is not practicable<br />

to obtain market information or apply any<br />

other valuation techniques on such instruments.<br />

33. Regulatory Matters<br />

Quantitative measures established by regulation<br />

to ensure capital adequacy require the Group to<br />

maintain minimum amounts and ratios (as set forth<br />

in the table below) of total (8%) and tier 1 capital<br />

(4%) to risk weighted assets.<br />

The ratio was calculated according to the<br />

principles employed by the Basle Committee by<br />

applying the following risk estimates to the assets<br />

and off-balance sheet commitments net of<br />

allowances for impairment losses:<br />

Tier 1 capital 19,827,152 19,827,152 13,60 4<br />

As of 31 December 2006 the Group included<br />

in the computation of Total capital for capital<br />

adequacy purposes subordinated debt received,<br />

limited to 50% of Tier 1 capital. In the event of<br />

bankruptcy or liquidation of the Group, repayment<br />

of this debt is subordinate to repayment of<br />

the Group’s liabilities to all other creditors.<br />

34. Segment Reporting<br />

The Group’s primary format for reporting<br />

segment information is business segments. Most<br />

operations of the Group are concentrated in the<br />

Russian Federation.<br />

Business segments – The Group is<br />

organised on the basis of two main business<br />

segments:<br />

• Retail banking – representing individuals’<br />

customer current accounts, savings, deposits,<br />

investment savings products, custody, credit<br />

and debit cards, consumer loans and mortgages<br />

and private banking.<br />

• <strong>Corporate</strong> banking – representing direct debt<br />

facilities, current accounts, deposits, overdrafts,<br />

loan and other credit facilities, foreign<br />

currency and derivative products as well as<br />

transactions with small and medium enterprises.<br />

In addition, ROSBANK’s headquarters, regional<br />

centres administrative operations and certain<br />

other business operations, including inter-bank<br />

financial markets and financial institutions services<br />

and custody and depositary services, are reported<br />

separately under segment reporting as unallocated.<br />

Segment assets and liabilities comprise<br />

operating assets and liabilities, being the majority<br />

of the balances sheet, but excluding items such as<br />

taxation and borrowings. Internal charges and<br />

transfer pricing adjustments have been reflected<br />

in the performance of each business. Revenue<br />

sharing agreements are used to allocate external<br />

customer revenues to a business segment on a<br />

reasonable basis.<br />

Segment information about these businesses<br />

is presented below.<br />

110 111