Joint Stock Company Eco Baltia - Dom Maklerski BZ WBK SA

Joint Stock Company Eco Baltia - Dom Maklerski BZ WBK SA

Joint Stock Company Eco Baltia - Dom Maklerski BZ WBK SA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Joint</strong> <strong>Stock</strong> <strong>Company</strong> <strong>Eco</strong> <strong>Baltia</strong><br />

a joint stock company, having its registered office at Darza iela 2, Riga, Latvia and registered with the Commercial Register of the Republic<br />

of Latvia under number 40103446506<br />

Offering of up to 12,558,000 Shares, with a nominal value of LVL 1.00 each, and admission to trading on the Warsaw <strong>Stock</strong><br />

Exchange and the Riga <strong>Stock</strong> Exchange of up to 28,704,000 Shares of <strong>Joint</strong> <strong>Stock</strong> <strong>Company</strong> <strong>Eco</strong> <strong>Baltia</strong><br />

This document (the “Prospectus”) has been prepared for the purpose of (i) the offering (the “Offering”) of up to 12,558,000 bearer shares in<br />

the share capital, with a nominal value of LVL 1.00 each, in <strong>Joint</strong> <strong>Stock</strong> <strong>Company</strong> <strong>Eco</strong> <strong>Baltia</strong> (the “Issuer” or the “<strong>Company</strong>”), and (ii) the<br />

admission of up to 28,704,000 bearer shares of the Issuer (the “Shares”) to trading on the Warsaw <strong>Stock</strong> Exchange (Giełda Papierów<br />

Wartościowych w Warszawie S.A., the “WSE”) and the Riga <strong>Stock</strong> Exchange (NASDAQ OMX Riga, the “RSE”). The Issuer will be<br />

offering for subscription up to 6,279,000 newly issued Shares (the “New Shares”). Otrais Eko Fonds (the “Selling Shareholder”), the Issuer’s<br />

minority shareholder, will be offering up to 6,279,000 existing Shares (the “Sale Shares”). The New Shares to be issued by the Issuer and the<br />

Sale Shares offered by the Selling Shareholder are referred to, where the context permits, as the offer shares (the “Offer Shares”). The Issuer<br />

will only receive the net proceeds from the sale of the New Shares, whereas the Selling Shareholder will receive the net proceeds from the<br />

sale of its respective Sale Shares. The Offer Shares offered in this Offering constitute a minority interest in the Issuer. Prior to the completion<br />

of the Offering, the Selling Shareholder holds 28% of the issued share capital of the Issuer.<br />

The Offering consists of: (i) public offering to retail investors in Poland (the “Retail Investors”), (ii) public offering to institutional investors<br />

in Poland (the “Polish Institutional Investors”) and (iii) private placement to institutional investors in certain jurisdictions outside the United<br />

States and Poland in reliance on Regulation S under the U.S. Securities Act (the “International Investors”, and together with the Polish<br />

Institutional Investors, the “Institutional Investors”), in each case in accordance with applicable securities laws.<br />

The Offer Shares have not been and will not be registered under the United States Securities Act of 1933, as amended (the “US<br />

Securities Act”), or under any securities laws of any state or other jurisdiction of the United States. The Offer Shares are being<br />

offered and sold only outside the United States in offshore transactions in reliance on Regulation S under the US Securities Act<br />

(“Regulation S”) and may not be offered or sold within the United States or to, or for the account or benefit of, US persons (as<br />

defined in Regulation S) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of<br />

the US Securities Act (see "Selling Restrictions").<br />

The Offer Shares are being offered, as specified in this Prospectus, subject to cancellation or modification of the Offering and subject to<br />

certain other conditions.<br />

This Prospectus constitutes a prospectus for the purposes of Article 3 of European Union (EU) Directive 2003/71/EC (the “Prospectus<br />

Directive”) and has been prepared in accordance with the Financial Instrument Market Law of the Republic of Latvia, dated 20 November<br />

2003 (the “Latvian Financial Instrument Market Law”). The Latvian Financial and Capital Market Commission (Finanšu un kapitāla tirgus<br />

komisija, the “FKTK”) in its capacity as the competent authority in Latvia under the Latvian Financial Instrument Market Law, has approved<br />

this document as a prospectus. The Issuer has requested that the FKTK provide the competent authority in Poland, Polish Financial<br />

Supervision Authority (Komisja Nadzoru Finansowego, the “PF<strong>SA</strong>”) with a certificate of approval attesting that this Prospectus has been<br />

drawn up in accordance with the Prospectus Directive. The Issuer will be authorised to carry out the Offering to the public in Poland, once<br />

the FKTK has provided the PF<strong>SA</strong> with a certificate of approval of this Prospectus and after the Prospectus has been made available to the<br />

public together with a translation of the summary into the Polish language. See "Risk Factors" for a discussion of certain considerations<br />

to be taken into account when deciding whether to invest in the Offer Shares.<br />

Prior to the Offering, there was no public market for the Shares. Based on this Prospectus, the Issuer intends to apply for up to 28,704,000<br />

Shares, including the Offer Shares, to be admitted to listing and trading on the main market of the WSE and the main market (list) of the RSE<br />

(the “Admission”). The Issuer expects that trading in the Shares on the WSE and the RSE will commence in on or about 16 July 2012 (the<br />

“Listing Date”). Settlement of the Offering is expected to occur on or about 12 July 2012 (the “Settlement Date”). Prospective Retail and<br />

Institutional Investors may subscribe for or purchase the Offer Shares during a period which is expected to commence on or about 29 June<br />

2012 and is expected to end on or about 4 July 2012 (the “Subscription Period”). The final offer price per one Offer Share denominated in<br />

PLN (the "Offer Price"), the final number of the Offer Shares, and the final number of Offer Shares allocated to each tranche will be<br />

determined by the Issuer and the Selling Shareholder, acting jointly, upon recommendation of the Offering Broker after completion of bookbuilding<br />

process for Institutional Investors and prior to commencement of the subscription period in the retail and institutional tranche no<br />

later than on or about 29 June 2012 (by 9:00 am CET) and will, in accordance with Art. 17.7 and 21.4 of the Latvian Financial Instrument<br />

Market Law and Art. 54 of the Polish Public Offerings Act, be filed with the FKTK and PF<strong>SA</strong> and published on the websites of the Issuer<br />

(www.ecobaltia.lv) and the Offering Broker (www.dmbzwbk.pl), otherwise in accordance with applicable Latvian and Polish regulations.<br />

The Shares of the <strong>Company</strong> are bearer shares and are registered with the Latvian Central Depository (Latvijas Centrālais Depozitārijs, the<br />

“LCD“) under ISIN code LV0000101350. The delivery of the Offer Shares will be made through the book-entry facilities by transferring<br />

them from the LCD to the Polish clearing and settlement institution – the National Depository for Securities (Krajowy Depozyt Papierów<br />

Wartościowych S.A., the “NDS”). Shareholders in the Issuer may hold the Shares through the NDS and/or LCD participants, such as<br />

investment firms and custodian banks operating in Poland and/or Latvia.<br />

Offer Price: To be determined in PLN and announced no later than on or about 29 June 2012<br />

BIC Securities SIA is the financial advisor (the “Financial Advisor”) and Bank Zachodni <strong>WBK</strong> S.A. is the capital advisor (the “Capital<br />

Advisor”) of the Issuer. AS SEB Enskilda is the sales agent (the “Sales Agent”). <strong>Dom</strong> <strong>Maklerski</strong> <strong>BZ</strong> <strong>WBK</strong> S.A. is the global co-ordinator<br />

and sole bookrunner (the “Global Coordinator”), and the offering broker in Poland for the purposes of the Offering and Admission of the<br />

Shares on the WSE (“Offering Broker”).<br />

Financial Advisor<br />

Capital Advisor<br />

Global Coordinator and Offering Broker<br />

Sales Agent<br />

The date of this Prospectus is 18 June 2012

TABLE OF CONTENTS<br />

SUMMARY 3<br />

PERSONS RESPONSIBLE 11<br />

RISK FACTORS 12<br />

EXCHANGE RATES 32<br />

USE OF PROCEEDS 33<br />

DIVIDENDS AND DIVIDEND POLICY 34<br />

CAPITALI<strong>SA</strong>TION AND INDEBTEDNESS 35<br />

SELECTED HISTORICAL FINANCIAL INFORMATION 37<br />

OPERATING AND FINANCIAL REVIEW 41<br />

PRO FORMA FINANCIAL INFORMATION 77<br />

INDUSTRY OVERVIEW 82<br />

REGULATORY INFORMATION 96<br />

GENERAL INFORMATION ON THE ISSUER 101<br />

GROUP STRUCTURE 103<br />

BUSINESS OVERVIEW 109<br />

MATERIAL CONTRACTS 131<br />

RELATED PARTY TRAN<strong>SA</strong>CTIONS 138<br />

MANAGEMENT AND CORPORATE GOVERNANCE 141<br />

SHAREHOLDERS 152<br />

DESCRIPTION OF THE SHARES AND CORPORATE RIGHTS AND OBLIGATIONS 155<br />

CERTAIN LATVIAN AND POLISH SECURITIES MARKET REGULATIONS AND PROCEDURES,<br />

THE WAR<strong>SA</strong>W STOCK EXCHANGE AND THE RIGA STOCK EXCHANGE 163<br />

THE OFFERING AND PLAN OF DISTRIBUTION 168<br />

PLACING 178<br />

SELLING RESTRICTIONS 180<br />

TAXATION 184<br />

INDEPENDENT AUDITORS 189<br />

ADDITIONAL INFORMATION 190<br />

FINANCIAL INFORMATION F-1<br />

ANNEX I DEFINED TERMS A-1<br />

2

SUMMARY<br />

The following constitutes the summary of the essential characteristics and risks associated with the Issuer, the<br />

Group and the Offer Shares. This summary is not exhaustive, does not contain all information of importance to<br />

prospective investors, is not a substitute for reading the entre Prospectus and must be read as an introduction to<br />

this Prospectus. Prospective investors should read this Prospectus thoroughly and completely, including the<br />

"Risk Factors", any supplements to this Prospectus required under applicable laws and the Consolidated<br />

Financial Statements, the Condensed Consolidated Interim Financial Statements, the Pro Forma Financial<br />

Information and other financial information and related notes, before making any decision with respect to<br />

investing in the Offer Shares. No civil liability will attach to the Issuer and other companies of the Group in<br />

respect of this summary (including the Summary Financial and Operating Information) or any translation<br />

thereof, unless it is misleading, inaccurate or inconsistent when read together with the other parts of this<br />

Prospectus. Where a claim relating to the information contained in this Prospectus is brought before a court in a<br />

Member State, the plaintiff may, under the national legislation of the Member State where the claim is brought,<br />

be required to bear the costs of translating this Prospectus before the legal proceedings are initiated.<br />

Summary of the Business<br />

The Group is the largest vertically integrated multi-service waste management group in the Baltics in terms of<br />

turnover, consisting of companies that operate in four different waste management segments, providing wide<br />

variety of services, starting from (i) organisation of waste recovery, (ii) waste collection, (iii) recyclables sorting<br />

and trading, and finally (iv) recycling. The Group is market leader in Latvia in organisation of waste recovery<br />

segment in terms of market share and turnover and the Group is one of the largest waste collectors in Latvia in<br />

terms of turnover and the leader in terms of geographical coverage. The Group collects waste in cities and<br />

surrounding regions of Riga, Liepaja, Talsi, Tukums, Jurmala and Sigulda. The Group also holds large market<br />

share in terms of volume in recyclables sorting and trading segment in the Baltics. Moreover, the Group has an<br />

unrivalled position in polyethylene terephthalate (“PET”) bottle and polyethylene (“PE”) recycling segments in<br />

the Baltics in terms of amount of recycled material and turnover. The Group has a long lasting cooperation with<br />

all key customers and municipalities.<br />

In the three months period ended 31 March 2012 the Group had consolidated revenue of LVL 6,969,000 and net<br />

profit of LVL 1,052,000. In the three months period ended 31 March 2012 55.5% of revenue was generated by<br />

waste recycling segment, 22.7% by waste collection segment, 14.6% by organisation of waste recovery segment<br />

and 7.2% by recyclables sorting and trading segment. In 2011 the Group recorded consolidated revenue of LVL<br />

26,595,000 and net profit of LVL 3,378,000. In 2011 54.5% of revenue was generated by waste recycling<br />

segment, 21.9% by waste collection segment, 15.9% by organisation of waste recovery segment and 7.7% by<br />

recyclables sorting and trading segment. For the avoidance of doubt it should be noted that the above mentioned<br />

financial results were derived from the Consolidated Financial Statements and the Condensed Consolidated<br />

Interim Financial Statements and are financial results of Eko Baltija Group and not of the Group as it is at the<br />

date of the Prospectus.<br />

Competitive Strengths and Advantages<br />

The Group believes that the competitive strengths and advantages of its business are as follows:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Highly competitive vertically integrated business model.<br />

Successful experience in accelerated growth.<br />

Diversified business model.<br />

Modern equipment and unique technologies.<br />

Market leadership.<br />

Highly competent growth oriented local management.<br />

Solid and consistent financial performance.<br />

3

Excellent ongoing collaboration with local authorities.<br />

Diversified client and supplier base.<br />

Positive public image.<br />

Business Strategy<br />

Being the leading waste management group in the Baltics by revenues, the Group believes that it can capitalise<br />

on significant market growth potential and the market’s fragmented structure, by identifying attractive<br />

consolidation opportunities and continuing its organic growth. The Group’s strategy rests on the following key<br />

pillars:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Investing into sorting of municipal solid waste by construction of the mechanical biological treatment<br />

plant.<br />

Introduction of new products in the recycling business line.<br />

Geographical expansion.<br />

Securing raw material base.<br />

Launching new cross-sector business projects.<br />

Introduction of one-stop-shop concept.<br />

Applying global trends, technologies and processes to local conditions.<br />

Actively seeking for the opportunities of financing from the EU.<br />

Use of Proceeds<br />

The net proceeds the Issuer receives from the issuance of the New Shares will be used primarily for fulfilling of<br />

the Group’s business plan which envisages the following capital investments:<br />

<br />

<br />

<br />

Construction of the first mechanical-biological treatment (MBT) plant in Latvia.<br />

Launch of food grade PET pellet production at PET Baltija production site with capacity of around<br />

11,500 tonnes of new products that are used in the food industry (material used in production of food<br />

packaging).<br />

Capacity expansion at Nordic Plast by installation of a second production line for production of<br />

polypropylene (“PP”) pellets with capacity of around 3,700 tonnes, thus doubling the current capacity.<br />

Summary of Risk Factors<br />

Risks Relating to the Group’s Business and Industry<br />

<br />

<br />

<br />

<br />

<br />

<br />

The Group operates in a highly regulated industry what limits its ability to adapt to changing economic<br />

conditions and any breaches of regulations may put at risk continuity of its operations.<br />

Changes in the regulatory environment may have an adverse effect on the Group’s operations.<br />

Amount of generated waste may fluctuate.<br />

The Group depends on licenses and permits that could be revoked, the Group may not be able to<br />

prolong them or the Group may not be able to obtain required licenses and permits.<br />

The Group is subject to regulations and liability under environmental laws.<br />

The Group’s operations are regulated by the municipalities.<br />

4

Agreements on providing the waste management services with municipalities may be terminated.<br />

Latvijas Zalais punkts may not be able to organise waste recovery system in the future.<br />

Increased competition could reduce the Group's revenue and profits and constrain the Group's growth.<br />

The Group’s revenues may decrease if the Group fails to win tenders for waste collection organised by<br />

the municipalities.<br />

Latvijas Zalais punkts may lose the right to use the “Green Dot” trademark.<br />

The tariffs for household waste management are subject to regulation by the authorities.<br />

Increase in operating costs and/or inability to pass on any increases in costs on Group’s customers<br />

could adversely affect the Group’s profits.<br />

The Group doesn’t conclude long-term agreements with its major customer.<br />

Disruptions in the Group’s production facilities may have a material adverse impact on the Group.<br />

Prices for the Group’s products are subject to fluctuations.<br />

Demand for certain services and products of the Group is subject to fluctuations.<br />

The Group has grown through acquisitions.<br />

Further expansion through acquisitions entails certain risks, which could have adverse consequences<br />

for the Group's business.<br />

The lease agreements concluded by the Group may be terminated or the Group may not be able to<br />

prolong them.<br />

A number of lease agreements have not been registered with the Land Register and in case of transfer<br />

of ownership to properties these leases may cease to be valid.<br />

Failure to register transfer of title to real properties as a result of merger of Tukuma Ainava into<br />

Kurzemes Ainava with the public registers and failure to register respective amendments to Nordea<br />

Financing Agreements and security agreements in the public registers may lead to event of default<br />

under Nordea Financing Agreements.<br />

Certain Group Companies are and in the future may be recognized as having dominant position on the<br />

market.<br />

The Group may be subject to claims for unpaid remuneration for fulfilment of duties of members of<br />

corporate bodies of certain Group Companies.<br />

Current and future assets of the Group Companies, certain amount of the Shares in the Issuer, as well<br />

as all the shares of the Group Companies are pledged.<br />

Certain of the Group’s credit facilities are subject to certain covenants and restrictions.<br />

The Group may not be able to obtain financing from the EU funds or the financing may be revoked.<br />

The Group’s ability to obtain debt financing may depend on the performance of its business and market<br />

conditions.<br />

The Group is exposed to currency exchange risk and interest rate risk.<br />

The Group is exposed to the credit risks of its customers and suppliers.<br />

The Group may not be able to grow or effectively manage its growth.<br />

The Group is dependent on its key personnel.<br />

The Group’s insurance coverage may be insufficient for any incurred losses.<br />

The Group may infringe third party IP rights.<br />

The tax office may determine that agreements executed by the Group Companies with each other and<br />

the related parties are not on arm-length basis and impose fines on the Group Companies.<br />

5

Historical financial statements of the Group may not be representative of its historic or future results<br />

and may not be comparable across periods, which may make it difficult to evaluate the Group’s results<br />

and future prospects.<br />

Risks Relating to Latvia<br />

<br />

<br />

<br />

<br />

<br />

Political and economic changes could negatively impact the Group.<br />

Pegged currency may have adverse impact on Latvian economy and therefore materially adversely<br />

influence the Group.<br />

Inflation risk may have material adverse impact on the Group.<br />

Unfavourable changes in taxes may have material adverse influence on the Group.<br />

Latvian judicial system is undergoing development.<br />

Risk Relating to the Issuer<br />

<br />

<br />

<br />

<br />

<br />

The Issuer is a holding company with no assets other than shares of its subsidiary.<br />

The rights of Latvian company shareholders differ from the rights of the shareholders of Polish listed<br />

companies.<br />

Judgments of Polish courts against the <strong>Company</strong> and the Group may be more difficult to enforce than if<br />

the company and its management were located in Poland.<br />

The Issuer has been, and will continue to be, influenced by three principal shareholders.<br />

The Issuer may have limited ability to attract financing through secondary offerings of Shares.<br />

Risks Relating to Shares, Listing and Trading on the WSE and the RSE<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The Offering may be delayed, suspended or cancelled.<br />

There has been no prior public trading market for the Shares.<br />

The price of the Shares may fluctuate significantly.<br />

Turmoil in emerging markets could cause the value of the Shares to suffer.<br />

The market value of the Shares may be adversely affected by future sales or issues of substantial<br />

amounts of Shares.<br />

Holders of the Offer Shares may not be able to exercise pre-emptive rights, and as a result may<br />

experience substantial dilution upon future issuances of Shares.<br />

The Issuer is established and organised under laws of Latvia while the Shares will be listed on a<br />

regulated market in Poland.<br />

There is no guarantee that the Issuer will pay dividends in the future.<br />

The Issuer may be unable to list the Shares on the WSE and/or the RSE, or the Issuer may be delisted<br />

from the WSE and/or the RSE.<br />

Trading in the Shares on the WSE and/or the RSE may be suspended.<br />

The Issuer may have a limited free float, which may have a negative effect on the liquidity,<br />

marketability or value of its Shares.<br />

The marketability of the Issuer’s Shares may decline and the market price of the Issuer’s Shares may<br />

fluctuate disproportionately in response to adverse developments that are unrelated to the Group’s<br />

operating performance and decline below the Offer Price.<br />

Dual listing of the Shares will result in differences in liquidity, settlement and clearing systems, trading<br />

currencies and transaction costs between the WSE and the RSE, which may hinder the transferability of<br />

the Shares between the WSE and the RSE.<br />

Tax treatment for non-Latvian investors in a Latvian company may vary.<br />

The Issuer has no experience in complying with requirements for publicly-listed companies.<br />

6

Summary of the Offering<br />

Issuer ................................................................ <strong>Joint</strong> <strong>Stock</strong> <strong>Company</strong> <strong>Eco</strong> <strong>Baltia</strong>, a joint stock company,<br />

incorporated under the laws of Latvia, having its registered<br />

office at Darza iela 2, Riga, LV-1007, Latvia, and registered<br />

under the corporate code 40103446506.<br />

Selling Shareholder ............................................. Limited partnership Otrais Eko Fonds, corporate code:<br />

40003837498, with registered office at Darza iela 2, Riga, LV-<br />

1007, Latvia.<br />

Principal Shareholders .......................................Ṃrs. Undine Bude, Mr. Viesturs Tamuzs and Mr. Maris<br />

Simanovics.<br />

Offering ................................................................ The Offering consists of: (i) public offering to retail investors in<br />

Poland (the "Retail Investors"), (ii) public offering to<br />

institutional investors in Poland (the “Polish Institutional<br />

Investors”), and (iii) private placement to institutional investors<br />

in certain jurisdictions outside the United States and Poland in<br />

reliance on Regulation S under the U.S. Securities Act (the<br />

“International Investors”, and together with the Polish<br />

Institutional Investors, the “Institutional Investors”), in each case<br />

in accordance with applicable securities laws.<br />

Offer Shares ........................................................Ụp to 12,558,000 bearer shares in the share capital of the Issuer.<br />

Consist of up to 6,279,000 bearer shares with a nominal value of<br />

LVL 1.00 each to be issued by the Issuer and up to 6,279,000<br />

existing bearer shares offered by the Selling Shareholder.<br />

New Shares..........................................................Ụp to 6,279,000 bearer shares with a nominal value of LVL 1.00<br />

each to be issued by the Issuer.<br />

Sale Shares..........................................................Ụp to 6,279,000 existing bearer shares offered by the Selling<br />

Shareholder.<br />

Book-building ...................................................... Before the commencement of subscription period, the bookbuilding<br />

process will be conducted, during which selected<br />

Institutional Investors, who have been invited by the Issuer and<br />

the Selling Shareholder through the Offering Broker will be able<br />

to make, in a manner agreed between them and the Offering<br />

Broker, declarations as to the total number of the Offer Shares<br />

they are willing to acquire and the price they are willing to pay<br />

for one Offer Share.<br />

Subscription Period........................................... The subscriptions by the Retail Investors and Institutional<br />

Investors will be accepted between on or about 29 June 2012 and<br />

on or about 4 July 2012 (inclusive).<br />

Maximum Price.................................................... The maximum price at which the Offer Price will be set, which<br />

will be announced no later than on or about 27 June 2012.<br />

Offer Price............................................................ The Offer Price at which the Offer Shares are being offered, the<br />

final number of the Offer Shares and the final number of Offer<br />

Shares allocated to each tranche will be determined by the Issuer<br />

and the Selling Shareholder, acting jointly, upon<br />

recommendation of the Offering Broker after completion of the<br />

book-building process and after taking into account other<br />

conditions. In particular, the following considerations will be<br />

taken into account: (i) the size and price sensitivity of demand<br />

indicated in the book-building process, (ii) the current and<br />

anticipated sentiment in the capital market in Poland, the<br />

European Union and globally and (iii) assessment by investors of<br />

<strong>Company</strong>’s business prospects, risk factors and other<br />

7

information contained in this Prospectus or available elsewhere.<br />

The Offer Price will not be higher than Maximum Price, will be<br />

identical for both New Shares and Sale Shares and for both<br />

Institutional and Retail Investors and will be set in PLN.<br />

The Issuer will announce the Offer Price prior to commencement<br />

of the Subscription Period. A pricing statement setting forth the<br />

Offer Price, the number of Offer Shares and the final number of<br />

Offer Shares allocated to each tranche will be filled with the<br />

FKTK and the PF<strong>SA</strong> and published no later than on or about 29<br />

June 2012 (09.00 a.m. CET) on the websites of the Issuer<br />

(www.ecobaltia.lv) and the Offering Broker<br />

(www.dmbzwbk.pl).<br />

Allotment ............................................................Ạllotment will take place on or about 5 July 2012, after closing<br />

of the Subscription Period.<br />

Settlement and Delivery of the Offer Shares....... The settlement of the Offering is expected to be made on or<br />

about 12 July 2012, after which delivery of the Offer Shares will<br />

follow. Delivery of the Offer Shares will be made in accordance<br />

with settlement instructions placed by the Investors upon<br />

subscription, through the facilities of the NDS, by registration of<br />

the Offer Shares on the Investors’ securities accounts indicated<br />

by such Investors. Delivery of the Offer Shares is expected to<br />

take place no longer than 14 days after the Settlement Date,<br />

barring unforeseen circumstances, by appropriate entry on the<br />

Investors’ securities accounts held through members of the NDS.<br />

The exact delivery dates will depend on timing of: (i)<br />

registration of capital increase of the <strong>Company</strong> with the<br />

Commercial Register, (ii) registration of the Shares of the Issuer<br />

(including the Offer Shares) with the LCD and (iii) registration<br />

of the Shares of the Issuer (including the Offer Shares) in the<br />

facilities of the NDS.<br />

Listing and Trading ............................................. The Issuer intends to apply for admission to listing and trading<br />

on the main market of the WSE and the main market (list) of the<br />

RSE of all the Issuer’s Shares, including the Offer Shares,<br />

immediately after the Settlement Date. The Issuer believes that<br />

trading on the WSE and the RSE will commence on or about 16<br />

July 2012, or as soon as possible thereafter, barring unforeseen<br />

circumstances.<br />

Form of Offer Shares and Deliver of the The Shares of the <strong>Company</strong> are bearer shares and are registered<br />

Offer Shares ......................................................... with the LCD. The delivery of the Offer Shares will be made<br />

through the book-entry facilities by transferring them from the<br />

LCD to the NDS. After the successful closing of the Offering,<br />

the Offer Shares will be held in book entry form in the NDS<br />

and/or the LCD. Shareholders in the Issuer may hold the Shares<br />

through the NDS and/or LCD participants, such as investment<br />

firms and custodian banks operating in Poland and/or Latvia.<br />

Shares outstanding before and after the The Issuer’s issued and outstanding share capital as of the date<br />

completion of the Offering................................ of this Prospectus is LVL 22,425,000, divided into 22,425,000<br />

Shares, each with a nominal value of LVL 1.00. The Issuer<br />

expects that up to 6,279,000 Shares will be issued and<br />

outstanding which Shares will comprise the Issuer’s share capital<br />

in the amount of LVL 6,279,000, assuming that all Offer Shares<br />

are subscribed for, allotted and issued. The Selling Shareholder<br />

is offering up to 6,279,000 Shares. Upon completion of the<br />

Offering no more than 28,704,000 Shares will be issued and<br />

outstanding, which Shares will comprise the Issuer’s share<br />

8

Securities code.................................................. ISIN code LV0000101350<br />

capital in the amount not exceeding LVL 28,704,000 (assuming<br />

that all of the Offer Shares have been issued).<br />

In case all the Offer Shares are subscribed or purchased and<br />

allotted, the Offer Shares will constitute up to 43.75% of the<br />

share capital of the Issuer and up to 43.75% of total votes at the<br />

General Meeting. Shares issued and outstanding as of the date of<br />

this Prospectus will be in bearer form.<br />

Dividends.............................................................Ạll Shares carry full dividend rights if and when the distribution<br />

of profit is declared.<br />

Voting Rights ....................................................... Each Share entitles its holder to one vote at the General Meeting.<br />

Lock-up ................................................................ Subject to certain exceptions, the Issuer, the Principal<br />

Shareholders the Selling Shareholder and ESOMTAX INVEST<br />

LIMITED (Cyprus) agreed that for a period of 12 months from<br />

the Settlement Date, they will not, without the prior written<br />

consent of the Offering Broker, propose or otherwise support an<br />

offering of any of the <strong>Company</strong>’s shares, announce any intention<br />

to offer new shares and/or to issue any securities convertible into<br />

<strong>Company</strong>’s shares or securities that in any other manner<br />

represent the right to acquire the <strong>Company</strong>’s shares, or conclude<br />

any transaction (including any transaction involving derivatives)<br />

of which the economic effect would be similar to the effect of<br />

selling the <strong>Company</strong>’s Shares.<br />

Financial Advisor ................................................ BIC Securities SIA<br />

Capital Advisor..................................................... Bank Zachodni <strong>WBK</strong> S.A.<br />

Global Coordinator and Offering Broker ..........Ḍom <strong>Maklerski</strong> <strong>BZ</strong> <strong>WBK</strong> S.A.<br />

Sales Agent..........................................................ẠS SEB Enskilda<br />

Managers.............................................................. The Financial Advisor, the Capital Advisor, the Offering Broker<br />

and the Sales Agent.<br />

Selling Restrictions .............................................. The Offer Shares may not be offered outside Poland in any<br />

manner that would constitute public offering or would otherwise<br />

require authorization under applicable local regulations. The<br />

Offer Shares have not been and will not be registered under the<br />

US Securities Act or with any securities regulatory authority of<br />

any state or any jurisdiction in the United States and subject to<br />

certain exceptions, may not be offered or sold within the United<br />

States or to, or for the account or benefit of, U.S. persons (as<br />

defined in the Regulation S) except in certain transactions<br />

exempt from the registration requirements of the US Securities<br />

Act. For information on further selling restrictions please see:<br />

"Selling Restrictions".<br />

9

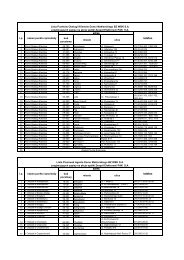

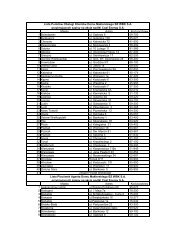

Summary financial and operating information<br />

The following tables set forth summary consolidated financial data on the level of Eko Baltija Group for the<br />

periods indicated, which have been extracted without material adjustments from the Consolidated Financial<br />

Statements and the Condensed Consolidated Interim Financial Statements.<br />

The information below should be read in conjunction with the Consolidated Financial Statements and the<br />

Condensed Consolidated Interim Financial Statements, including the notes thereto and included elsewhere in<br />

this Prospectus and with the information included in “Operating and Financial Review” section of the<br />

Prospectus.<br />

Comprehensive Income Information<br />

For three months ended<br />

31 March For the year ended 31 December<br />

2012 2011 2011 2010 2009<br />

(LVL in thousands)<br />

Net sales 6,969 6,315 26,595 21,088 13,851<br />

Cost of sales (4,979) (4,320) (19,354) (15,079) (10,174)<br />

Gross profit 1,990 1,995 7,241 6,009 3,677<br />

Operating profit/(loss) 1,206 1,200 3,981 2,325 (144)<br />

Profit before corporate income tax 1,154 1,142 3,722 2,039 (352)<br />

Income taxes (102) (63) (344) (245) (163)<br />

Current year profit/ (loss) and comprehensive<br />

1,052 1,079 3,378 1,794 (515)<br />

income<br />

Source: Consolidated Financial Statements and Condensed Consolidated Interim Financial Statements<br />

Financial Position Information<br />

ASSETS<br />

As of 31 March<br />

As of 31 December<br />

2012 2011 2010 2009<br />

(LVL in thousands)<br />

Total non-current assets 10,960 10,900 11,586 12,934<br />

Total current assets 8,016 7,566 5,781 4,665<br />

Total assets 18,976 18,466 17,367 17,599<br />

EQUITY AND LIABILITIES<br />

Total equity 7,171 6,119 7,989 6,198<br />

Total liabilities 11,805 12,347 9,378 11,401<br />

Total equity and liabilities 18,976 18,466 17,367 17,599<br />

Source: Consolidated Financial Statements and Condensed Consolidated Interim Financial Statements<br />

Cash Flows Information<br />

For three months<br />

ended 31 March<br />

For the year ended 31<br />

December<br />

2012 2011 2011 2010 2009<br />

(LVL in thousands)<br />

Net cash from operating activities 1,541 1,678 4,989 2,694 936<br />

Net cash used in investing activities (910) (563) (7,764) (918) (42)<br />

Net cash used in financing activities (810) (1,011) 2,885 (1,730) (100)<br />

Profit or loss from currency fluctuations - - (3) - (3)<br />

Net increase in cash and cash equivalents (179) 104 107 46 791<br />

Source: Consolidated Financial Statements and Condensed Consolidated Interim Financial Statements<br />

10

PERSONS RESPONSIBLE<br />

The Issuer and the Selling Shareholder (in case of the Selling Shareholder, only with respect to information<br />

relating to the Selling Shareholder and the Sale Shares offered by the Selling Shareholder) accept responsibility<br />

for the information contained in this Prospectus. To the best of the knowledge and belief of the Issuer and the<br />

Selling Shareholder (with respect to the above indicated information), which have taken all reasonable care to<br />

ensure that such is the case, the information contained in this Prospectus is in accordance with the facts and<br />

contains no omission likely to affect its import.<br />

Neither the delivery of this Prospectus nor any sale made hereby at any time after the date hereof should, under<br />

any circumstances, create any implication that there has been no change in the affairs of the Issuer or any of its<br />

subsidiaries or the Issuer and its subsidiaries taken as a whole (the “<strong>Eco</strong> <strong>Baltia</strong> Group”, the “Group”) since the<br />

date hereof or that the information contained herein is correct as of any date subsequent to the earlier of the date<br />

hereof or any date specified with respect to such information.<br />

Neither the Managers nor the legal advisers to the Issuer accept any responsibility whatsoever for the contents of<br />

this Prospectus, or for its transaction, or for any other statement made or purported to be made by any of them or<br />

on their behalf in connection with the Issuer or the Offering. The Managers and the legal advisers to the Issuer<br />

accordingly disclaim all and any liability whether arising in tort or contract which they might otherwise have in<br />

respect of this Prospectus or any such statement. No representation or warranty, express or implied, is made by<br />

the Managers as to the accuracy or completeness of the information set forth herein and nothing contained in this<br />

Prospectus is, or should be relied upon as a promise or representation, whether as to the past or the future.<br />

11

RISK FACTORS<br />

Prospective investors in the Offer Shares should carefully consider the following risks and uncertainties, as well<br />

as other information contained in this Prospectus before deciding to invest in any of the Offer Shares. The<br />

Issuer’s business, financial condition and results of operations have been, and could be, materially adversely<br />

affected by the following risks. If any of the following risks actually occurs, the value and trading price of the<br />

Shares could decline and investors could lose all or part of their investment. Described below are the risks and<br />

uncertainties the Issuer believes are material, but these risks and uncertainties may not be the only ones faced by<br />

the Issuer or the Group Companies. Additional risks and uncertainties, including those that the Issuer is not<br />

currently aware of or deems immaterial, may also result in decreased revenues, increased expenses or other<br />

events that could result in a decline in the value of the Shares.<br />

Risks Relating to the Group’s Business and Industry<br />

The Group operates in a highly regulated industry what limits its ability to adapt to changing economic<br />

conditions and any breaches of regulations may put at risk continuity of its operations.<br />

The Group’s main area of business operations is waste management (including: organisation of waste recovery,<br />

waste collection, recyclables sorting and trading, and recycling) in Latvia. In Latvia, as in many other countries,<br />

companies operating in waste management industry are subject to various regulations. Each of the segments of<br />

the business has different regulations. The Group is subject to constant supervision by the state authorities and<br />

continuous reporting obligations. The Group’s business depends on the continuing validity of a number of<br />

licenses granted to the Group Companies and the Group Companies’ compliance with the terms of such licenses,<br />

permits etc. Breaches of regulations by the Group, negative publicity concerning the Group or the waste<br />

management sector and/or fines or criminal prosecutions resulting from violation of regulations may result in<br />

imposition of fines or withdraw of licenses necessary to carry on the operations, what may have material adverse<br />

impact on the Group’s operations, prospects and financial results. See: “Regulatory Information” for more<br />

information on regulations relating to waste management industry.<br />

Changes in the regulatory environment may have an adverse effect on the Group’s operations.<br />

The Group operates in the waste management industry, which is regulated and therefore there are substantial<br />

uncertainties embedded in operations in this industry. The legal framework in Latvia could change in<br />

unpredictable way. Furthermore, some steps may be undertaken on the European Union level or may result from<br />

judgments of the European Court of Justice. New laws may be unfavourable to the operations of the Group or<br />

may require necessary adjustments to the operations. The Group Companies may be unable to implement new<br />

regulations in the prescribed period or to do it at all. Consequently, the Group’s operations may have to be<br />

changed, causing inability to use common solutions or implement the Group’s strategy. Moreover, the<br />

collaboration with the state and municipal authorities are very important to the business of the Group.<br />

All of factors mentioned above, especially adverse changes in the laws or their interpretation and/or deterioration<br />

of collaboration with the state and municipal authorities may have a material adverse effect on the business of<br />

the Group or create obstacles to further expansion.<br />

Amount of generated waste may fluctuate.<br />

Amount of generated waste is subject to fluctuations that cannot be predicted. The level of generated waste<br />

depends on, among others, stage of economic growth, macroeconomic situation, disposable income of the<br />

population and the structure of the population. Latvian population is decreasing as a result of migrations and low<br />

birth rate. Moreover, generation of different types of waste depends on many specific factors, e.g. generation of<br />

construction waste depends on, inter alia, availability of crediting and market conditions for construction<br />

business, and amount of disposed PET bottles depends on, among others, the weather conditions and<br />

consumption of beverages. As a consequence the generation of waste in general or different types of waste may<br />

be volatile in the next years. Adverse fluctuations in the amount of generated waste may have material adverse<br />

impact on the Group’s operations, prospects and financial results.<br />

12

The Group depends on licenses and permits that could be revoked, the Group may not be able to prolong them<br />

or the Group may not be able to obtain required licenses and permits.<br />

The business operations and activities undertaken by the Group Companies are subject to regulatory<br />

requirements imposed by law, including requirements to obtain certain licenses and permits. Such licenses and<br />

permits may be revoked due to, inter alia, incompliance to its terms. Usually, licenses and permits are granted on<br />

the defined period of time and after expiry of their term they should be prolonged. The Group may not be able to<br />

prolong its licenses and permits. Moreover, as the Group’s business and operations are expanding, the Group<br />

may require obtaining additional licenses and permits. The Group cannot assure that it will be able to obtain such<br />

additional licenses and permits.<br />

As of the date of the Prospectus, the Group has all required licenses and permits, although it cannot assure that in<br />

the future any of the events described above would not appear. If any of those factors appear, it may have<br />

material adverse impact on the Group’s operations, prospects and financial results.<br />

The Group is subject to regulations and liability under environmental laws.<br />

While operating in waste management business in Latvia the Group is subject to certain regulation and liability<br />

under environmental laws. Certain Group Companies, including Eko Riga, Eko Kurzeme, Jurmalas ATU, Jumis,<br />

Kurzemes Ainava, Eko Reverss, PET Baltija and Nordic Plast, are subject to the so-called strict liability, i.e. in<br />

case of environmental damage or imminent threat of damage to environment would emerge, they could be liable<br />

for environmental damage or imminent threat of damage irrespective of their fault. Any such environmental<br />

damage or imminent threat of damage could lead to penalties and fines imposed by the authorities, as well as<br />

claims raised by third parties. Although, the Group holds a third party liability insurance, which covers sudden<br />

and unforeseen damages to the environment, it cannot assure that the insurance coverage is sufficient for any<br />

incurred damages, penalties, fines and claims from third parties (see risk factor: “The Group’s insurance<br />

coverage may be insufficient for any incurred losses”). If any of those factors appear, it may have material<br />

adverse impact on the Group’s operations, prospects and financial results.<br />

The Group’s operations are regulated by the municipalities.<br />

The Group’s operations in the field of waste collection are subject to municipal regulation and supervision (for<br />

more information please see: “Regulatory Information - Environmental and other Licenses and Permits”).<br />

Adverse legislative changes in any of the municipalities where the Group operates may have adverse effect on<br />

the business of the Group or create obstacles to further growth. Any possible amendments to the enforced<br />

legislation, the frequency of adoption of such amendments, resolutions passed by municipalities, which provide<br />

additional obligations for service providers, and the results of controls carried out by various inspectorates and<br />

municipal authorities are additional risk factors in the field of waste collection.<br />

All of factors mentioned above, especially unfavourable changes in the municipal regulations may have a<br />

material adverse effect on the business of the Group or create obstacles to further expansion of the Group.<br />

Agreements on providing the waste management services with municipalities may be terminated.<br />

The Group Companies operating in the waste collection segment has concluded number of agreements with the<br />

municipalities on providing the waste management services (e.g. collection, transportation and disposal of<br />

household waste). Following the conclusion of number of these contracts, the applicable Latvian law changed<br />

the system of granting of rights to collect and transport household waste in the territories of municipalities.<br />

Currently, municipalities are entitled to grant such rights to contractors only by undergoing a public procurement<br />

procedure. According to the transitional provisions of the Waste Management Law, the contracts concluded for a<br />

definite period of time prior to 26 July 2005 without undergoing public procurement procedure, will be<br />

terminated on the date determined in the contract, and similar contracts concluded indefinitely and contracts<br />

entered into or extended after 26 July 2005 without applying public procurement procedure will be terminated no<br />

later than on 1 July 2013. The aforementioned transitional provisions authorising the municipalities to continue<br />

the validity of the contracts concluded for definite period of time by the end date determined in the contract is<br />

currently being examined in the Constitutional Court.<br />

Certain Group Companies, including Eko Kurzeme, Jumis, Jurmalas ATU and Kurzemes Ainava, prior to 26<br />

July 2005 concluded contracts with municipalities on granting rights to provide waste management services<br />

without determining their validity or entered into or extended such contracts after 26 July 2005 without applying<br />

13

the public procurement procedure. In accordance with applicable regulations such contracts have to be<br />

terminated no later than by 1 July 2013 and the municipality should select a municipal waste manager in<br />

accordance with the procedures specified in the regulatory enactments regulating public procurement or publicprivate<br />

partnership. When the waste manager has been selected, municipal authorities should conclude waste<br />

management contracts with the selected entity and should terminate the former waste management contracts no<br />

later than one month after the new contract of the municipality with the selected waste manager comes into<br />

force. For more information please see: “Material Contracts – Waste Management Agreements”.<br />

The Group Companies, including Eko Riga and Eko Kurzeme, prior to 26 July 2005 concluded long-term<br />

agreements with municipalities for a definite period of time without undergoing public procurement procedure<br />

(for more information please see: Material Contracts – Waste Management Agreements”). In accordance with<br />

transitional provisions those agreements should end on the date determined therein. However, there could be no<br />

assurance that the transitional provisions would not be change (e.g. due to the ruling of the Constitutional Court)<br />

and the agreements would not be terminated prior to their term.<br />

Termination of the agreements concluded by the Group Companies with municipalities prior to their term may<br />

have material adverse impact on the Group’s operations, prospects and financial results.<br />

Latvijas Zalais punkts may not be able to organise waste recovery system in the future.<br />

Latvijas Zalais punkts (“LZP”) has right to establish and implement waste recovery system of: (i) waste harmful<br />

to the environment, (ii) waste electric and electronic equipment, and (iii) packaging waste and disposable<br />

tableware and accessories, based on orders No 430, 431 and 428 issued on 29 December 2010 by the Ministry of<br />

Environment Protection and Regional Development of Latvia. The orders were issued on the grounds of the<br />

plans for implementation of waste recovery systems for above mentioned types of waste for period 2011-2013<br />

prepared by LZP and accepted by the Ministry of Environment Protection and Regional Development of Latvia.<br />

The orders grant rights to NRT payers, who have signed the agreement with LZP on participation in the waste<br />

recovery system to apply exemption from NRT for a period indicated in the orders, i.e. until 31 December 2013.<br />

Granted rights are conditional on validity of an agreement entered into between LZP and Latvian Environmental<br />

Protection Fund Administration. On 30 December 2010 LZP concluded three agreements with the Latvian<br />

Environmental Protection Fund Administration regarding implementation of waste recovery system of: (i) waste<br />

harmful to the environment, (ii) waste electric and electronic equipment, and (iii) packaging waste and<br />

disposable tableware and accessories. Each agreement is concluded for defined period starting from 1 January<br />

2011 till 31 December 2013.<br />

Prior to expiration of the term of validity of plans for implementation of waste recovery systems for above<br />

mentioned types of waste, a new waste recovery plans may be coordinated with competent authorities and the<br />

term may be extended for additional 3 years (the number of such extensions is currently not limited). Although,<br />

there could be no assurance that such new waste recovery plans for next periods would be coordinated with<br />

competent authorities, that the Ministry of Environment Protection and Regional Development of Latvia would<br />

issue required orders allowing LZP to establish and implement waste recovery systems of certain types of waste,<br />

and that LZP would conclude agreements with the Latvian Environmental Protection Fund Administration<br />

regarding implementation of waste recovery systems of certain types of waste.<br />

If LZP failed to extend the terms of validity of its waste recovery systems, it would not be allowed to organise<br />

waste recovery system. As a consequence, LZP would not be able to undertake its core business activities, which<br />

may have material adverse impact on the Group’s business model, strategy, operations, prospects and financial<br />

results.<br />

Increased competition could reduce the Group's revenue and profits and constrain the Group's growth.<br />

The Group faces competition from other waste management companies in Latvia and in the Baltics. Due to the<br />

specificity of its business model and carried operations the Group has to compete with both local and<br />

international waste management companies, which are present in different segments of waste management<br />

industry. There can be no assurance that the Group will be able to compete effectively against current and future<br />

competitors, in particular those with greater financial or operational resources than the Group. Although the<br />

Group believes that there are certain barriers to entry in its key markets, any new entrants to or other changes in<br />

the competitive environment may result in price reductions, reduced margins or loss of market share, any of<br />

which could materially adversely affect the Group’s profit margins. Current and potential competitors may<br />

increase their advertising expenditures and promotional activities and/or engage in irrational or predatory pricing<br />

14

ehaviour in an effort to gain market share. There can be no assurance that current or potential competitors will<br />

not provide services or products comparable or superior to those provided by the Group, adapt more quickly to<br />

the evolving industry trends, changing market requirements and legal framework, or price at level below those of<br />

the Group’s competing services and products, any of which could result in the Group losing its market share.<br />

There can be no assurance that competition from new or existing competitors who operates in the waste<br />

management industry in Latvia and in the Baltics will not have a material adverse effect on the Group’s<br />

operating results. In addition, there can be no assurance that any future development or investment by the Group<br />

will not be matched or surpassed by its competitors. The inability of the Group to compete effectively could have<br />

a material adverse effect on the Group’s business, prospects, results of operations, financial condition or the<br />

price of the Shares.<br />

The Group’s revenues may decrease if the Group fails to win tenders for waste collection organised by the<br />

municipalities.<br />

As of the date of the Prospectus municipalities in Latvia are entitled to grant rights to provide the household<br />

waste management services within the territory of municipality only by undergoing a public procurement<br />

procedure. Therefore, after expiry or termination of currently valid agreements between the Group Companies<br />

and municipalities, the only way to conclude such agreement will be participation in the public procurement<br />

procedure, e.g. in the public tenders. Due to competition in the waste management sector, the Group Companies<br />

may not be able to win tenders organised by the municipalities which in turn may have material adverse impact<br />

on the Group’s operations, prospects and financial results.<br />

Latvijas Zalais punkts may lose the right to use the “Green Dot” trademark.<br />

Latvijas Zalais punkts is a shareholder of Packaging Recovery Organization Europe (PRO Europe), which<br />

unifies “Green Dot” systems from 33 European and North American countries. Recently, amendments to the<br />

statutes of PRO Europe were proposed to impose the obligation to meet certain conditions to become a<br />

shareholder of PRO Europe and to keep the shares of the Packaging Recovery Organization Europe. One of<br />

discussed criteria was that a shareholder should not be controlled by the government or any waste management<br />

companies or recyclers. Should one or more criteria not be met, the shareholders should have one year to make<br />

the necessary adjustments in order to meet the criteria. After expiry of that term without making those necessary<br />

adjustments, the status of the shareholder should be reassessed by the general assembly of PRO Europe which<br />

will have the power to decide on expulsion of the shareholder from PRO Europe. Ultimately with the expulsion<br />

from PRO Europe, the former shareholder will lose the right to use “Green Dot” trademark.<br />

Amended statutes of Packaging Recovery Organization Europe were not adopted at the shareholders meeting of<br />

PRO Europe held on 20 April 2012. However, it is possible that PRO Europe and its shareholders will return to<br />

discussing issue in the future and such amendments in the statutes of PRO Europe will be accepted. Due to the<br />

fact that LZP is part of the Group, which also indirectly owns companies engaged in a waste management, LZP<br />

may be forced to dispose shares of PRO Europe and ultimately LZP may lose the sub-license to use the “Green<br />

Dot” trademark.<br />

Consequences of such event may have material adverse effect on the Group’s business operations. LZP may be<br />

forced to undertake rebranding and may not offer its customers the legal right to use “Green Dot” trademark as<br />

part of the Group’s services, what may have negative influence on the Group’s market position.<br />

Furthermore, LZP has registered national trademark LZP (“Latvia’s Green Dot”) and uses it as a corporate logo,<br />

disregarding the prohibition included in Article 2 of the Principal Licensing Agreement of 27 August 2003,<br />

concluded with the Packaging Recovery Organisation Europe, which forbids registration of the trademarks<br />

identical or similar to Green Dot trademark and using Green Dot trademark for business activities other than<br />

indication for financial participation in system of collection and recycling of packaging and packaging waste in<br />

Latvia. The registration of national trademark LZP or use of Green Dot trademark other than in relation to<br />

participation in packaging and packaging waste recovery system in Latvia may trigger termination of the<br />

Principal Licensing Agreement and loss of rights of LZP to use and sub-license of this trademark in relation to<br />

activities related to packaging and packaging waste in Latvia.<br />

Consequences of termination of the Principal Licensing Agreement may have material adverse effect on the<br />

Group’s business operations. Furthermore, LZP may lose the rights to use and sub-license its trademark in<br />

relation to activities related to packaging and packaging waste in Latvia.<br />

15

All these factors may have material adverse impact on the Group’s operations, prospects and financial results.<br />

The tariffs for household waste management are subject to regulation by the authorities.<br />

The tariffs of household waste management are subject to regulation by the authorities. Pursuant to the Waste<br />

Management Law, during the transition period (i.e. until municipalities have entered into a contracts on<br />

household waste management with waste management companies selected in accordance with the public<br />

procurement procedures), the fees for household waste management should comply with the last tariff approved<br />

by the Latvian Public Utilities Commission (the “LPUC”) for household waste management which has been<br />

determined prior to 18 November 2010. Municipalities are entitled to adjust the tariff for household waste<br />

management due to the changes in the tariff for the municipal waste disposal in landfill sites and waste dumps<br />

approved by the LPUC or in the Natural Resources Tax (the “NRT”) for disposal of waste in the amount<br />

specified in the regulatory enactments. For more information on price controls in waste management industry<br />

please see: “Regulatory Information – Price Controls”.<br />

Certain Group Companies, including Eko Riga, Eko Kurzeme, Jumis, Jurmalas ATU and Kurzemes Ainava,<br />

concluded agreements with the municipalities on household waste management without undergoing the public<br />

procurement procedures, and therefore fees paid to the Group Companies for household waste management<br />

should comply with the tariffs approved by the authorities.<br />

There could be no assurance that the tariffs for household waste management would be in line with costs of<br />

household waste management borne by the Group Companies. As a consequence, this may result in decrease of<br />

profit margins and adversely affect the financial results of the Group.<br />

Increase in operating costs and/or inability to pass on any increases in costs on Group’s customers could<br />

adversely affect the Group’s profits.<br />

Operating costs the Group Companies doing business in the waste collection segment include, but are not limited<br />

to, fuel charges and costs of disposing of waste that cannot be recycled. The above mentioned costs depend on a<br />

variety of factors, many of which are beyond the Group’s control. The market price of fuel has historically<br />

fluctuated and fluctuations could continue. If the costs of fuel increase this could lead to increase in operating<br />

costs of the Group Companies. Waste collected by the Group Companies is disposed predominantly on the<br />

landfills and the Group Companies pay disposal charges. Disposal charges are set by the LPUC and depend on,<br />

inter alia, the level of the Natural Resource Tax imposed on the landfilled waste. If the disposal charges for<br />

landfilling of waste increase, this could increase the operating costs of Group Companies. Increase in operating<br />

costs due to, inter alia, factors mentioned above could not always be passed on customers by increasing the<br />

prices of services provided and therefore may have material adverse impact on the Group’s operations, prospects<br />

and financial results.<br />

The Group doesn’t conclude long-term agreements with its major customer.<br />

Certain Group Companies, including PET Baltija and Nordic Plast, cooperate with some major clients on the<br />

basis of separate orders without signing any long-term sales agreements. Therefore, there could be no assurance<br />

that the Group will continue to cooperate with its major clients on the current basis or at all.<br />

In the event the Group is not able to further cooperate with its major customers, it may have material adverse<br />

impact on the Group’s operations, prospects and financial results.<br />

Disruptions in the Group’s production facilities may have a material adverse impact on the Group.<br />

Certain Group Companies, namely PET Baltija and Nordic Plast, are engaged in recycling packaging waste into<br />

PET flakes and PE pellets. The recycling processes are sophisticated and therefore performed by specially<br />

equipped production facilities. The Group’s production facilities may be subject to disruptions, including<br />

breakdowns, accidents and/or other force majeure situations. Depending on how serious is the disruption, the<br />

production facilities may be partially or fully non-operational for certain period of time.<br />

In the event the Group’s production facilities are subject to disruptions, it may have material adverse impact on<br />

the Group’s operations, prospects and financial results. Please also see risk factor: “The Group’s insurance<br />

coverage may be insufficient for any incurred losses”.<br />

16

Prices for the Group’s products are subject to fluctuations.<br />

Certain Group Companies, namely Nordic Plast and PET Baltija, recycle secondary raw materials into products,<br />

which prices are subject to market volatility. Nordic Plast produces PE pellets, which prices are linked with,<br />

among other, the price of primary PE and, to some extent, with crude oil prices. PET Baltija produces PET<br />

flakes, which prices are variable depending on, inter alia, crude oil and cotton prices and virgin PET prices.<br />

There can be no assurance that future fluctuations in prices of products manufactured by the Group will not have<br />

an adverse effect on the Group’s results of operations. As of the date of the Prospectus, the Group does not have<br />

any specific hedging arrangements, including long-term sales agreements, in place to cover risk of product prices<br />

fluctuations and there can be no assurance that the Group will enter into such arrangements in the future. If the<br />

Group does enter into hedging arrangements, it cannot assure that hedging arrangements will not result in<br />

additional losses.<br />

The above mentioned factors could not be controlled by the Group and may have material adverse impact on the<br />

Group’s operations, prospects and financial results.<br />

Demand for certain services and products of the Group is subject to fluctuations.<br />

Demand for certain services and products provided by the Group may fluctuate. For example, in the summer<br />

time there is more packaging generated and placed on the market, households generate more waste, but the<br />

demand for street cleaning decreases. In the winter time the demand for street cleaning increases due to snowfall.<br />

Moreover, due to the market specificity, the Group does not sell PET flakes produced by PET Baltija in the<br />

second half of December.<br />

The above mentioned factors could not be controlled by the Group and may have material adverse impact on the<br />

Group’s operations, prospects and financial results.<br />

The Group has grown through acquisitions.<br />

The Group has developed its business and fuelled its growth through number of acquisitions and reorganisations<br />

(including mergers) of companies operating in waste management sector in Latvia. In accordance with Latvian<br />

law, the acquiring and/or merging company is liable for all historical obligations and liabilities, including tax<br />

liabilities, of the target entity. Therefore, there is a potential risk that the Group would be liable for any<br />

obligations and/or liabilities that could be material for Group’s business and/or financial position.<br />

As a consequence, the above mentioned factors may have material adverse impact on the Group’s operations,<br />

prospects and financial results.<br />

Further expansion through acquisitions entails certain risks, which could have adverse consequences for the<br />

Group's business.<br />

The Group may consider further growing through acquisitions in the near future. In particular, the Group may<br />

want to enter into or strengthen its presence in certain markets through the acquisition of other waste<br />

management businesses. If the Group made an acquisition it would need to integrate new operations, products,<br />

services and personnel into the Group’s business. The Group’s ability to realise the expected benefits from future<br />

acquisitions will depend, in large part, on its ability to integrate new operations with existing operations in a<br />

timely and effective manner and to manage a greater number of portfolio assets. In addition, the Group’s<br />

potential acquisition plans involve numerous risks, including the following: the Group's acquisitions may not be<br />

profitable or generate anticipated cash flows, the Group may fail to expand its corporate infrastructure to<br />

facilitate the integration of its operations with those of acquired assets, the Group may face difficulties entering<br />

into markets and geographic areas where it has limited or no experience, the Group may have potential<br />

difficulties in integrating its operations and systems with those of acquired companies, the Group may face<br />

possible anti-monopoly review by relevant competition authorities that could result in such authorities seeking to<br />

prohibit or unwind its acquisition of new businesses, and the possibility that the failure of the Group's acquisition<br />

strategy could hamper its continued growth and profitability.<br />

As a consequence, the above mentioned factors may have material adverse impact on the Group’s operations,<br />

prospects and financial results.<br />

17

The lease agreements concluded by the Group may be terminated or the Group may not be able to prolong<br />

them.<br />

The Group leases number of real estates, including warehouse and industrial premises, which have material<br />

importance for the Group’s business and operations (for more information on leased real estate please see:<br />

“Business Overview - Real Estate”). Although, most of the lease agreements are long-term, there could be no<br />

assurance that they would not be terminated before expiry of their term or the Group would be able to prolong<br />

them on reasonable conditions or at all. Termination of the lease agreements concluded by the Group or inability<br />

to prolong them may have material adverse impact on the Group’s operations, prospects and financial results.<br />

A number of lease agreements have not been registered with the Land Register and in case of transfer of<br />

ownership to properties these leases may cease to be valid.<br />

Under Latvian law lease agreements may be registered with the Land Register. In case of change of the owner of<br />

the real property, the new owner will not be bound by the lease agreement and will be entitled to terminate lease<br />

agreement prior to its term if the lease agreement is not registered in the Land Register. Certain lease agreements<br />

concluded by the Group Companies have not been registered with the Land Register. Consequently, in case the<br />

change of ownership of leased premises, new owners would not be obliged to perform the obligations of the<br />

lessor under such agreements and the Group Companies might have an obligation to abandon the leased<br />

premises. Such events may have material adverse impact on the Group’s operations, prospects and financial<br />

results.<br />

Failure to register transfer of title to real properties as a result of merger of Tukuma Ainava into Kurzemes<br />

Ainava with the public registers and failure to register respective amendments to Nordea Financing<br />

Agreements and security agreements in the public registers may lead to event of default under Nordea<br />

Financing Agreements.<br />

On 19 April 2012 merger of Tukuma Ainava into its subsidiary Kurzemes Ainava has been registered with the<br />

Commercial Register. According to the Latvian Commercial Law on the indicated date Eko Baltija acquired all<br />

shares of Kurzemes Ainava owned by Tukuma Ainava, Kurzemes Ainava acquired all assets, rights and<br />

obligations of Tukuma Ainava and Tukuma Ainava ceased to exist.<br />

Transfer of title to the real properties from Tukuma Ainava to Kurzemes Ainava as a result of merger of Tukuma<br />

Ainava into Kurzemes Ainava has not been registered with the Land Register. Consequently, currently<br />

Kurzemes Ainava is not considered as the owner of real properties in its relations with third parties and may not<br />

execute ownership rights until such registration. Moreover, Nordea Financing Agreements foresee several<br />

mortgages over real properties formerly owned by Tukuma Ainava. Mortgage agreements have been amended<br />

respectively providing that Kurzemes Ainava pledges real properties previously owned by Tukuma Ainava.<br />

However, these amendments were not and may not be registered with Land Register until registration of transfer<br />

of title to the real properties. Lack of registration of transfer of title to real properties and lack of registration of<br />

the amendments (novations) with the Land Register may lead that it will become impossible for Nordea Bank to<br />

enforce these securities which would constitute the event of default under Nordea Financing Agreements. Such<br />

default would entitle Nordea Bank to require full repayment of outstanding loans from Group Companies and<br />

satisfying its outstanding claims by: (i) enforcement of financial collaterals; (ii) taking over the receivables of the<br />

Group Companies; (iii) enforcement of guarantees; (iv) sale of pledged assets (including pledged Shares)<br />

without court proceedings or auction at a freely determined price; and/or (v) sale of the mortgaged assets at<br />

auction at the terms and conditions approved by court or on the basis of court decision on recovering of the debt<br />

secured by mortgage.<br />

The occurrence of any of the indicated events may have material adverse impact on the Group’s operations,<br />