Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

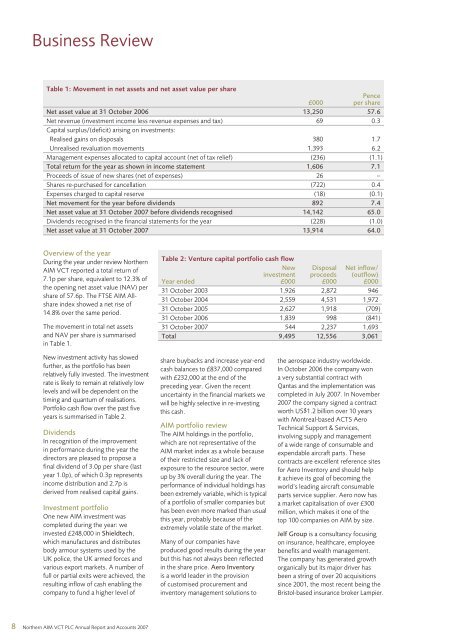

Business Review<br />

Table 1: Movement in net assets <strong>and</strong> net asset value per share<br />

Pence<br />

£000 per share<br />

Net asset value at 31 October 2006 13,250 57.6<br />

Net revenue (investment income less revenue expenses <strong>and</strong> tax) 69 0.3<br />

Capital surplus/(deficit) arising on investments:<br />

Realised gains on disposals 380 1.7<br />

Unrealised revaluation movements 1,393 6.2<br />

Management expenses allocated to capital account (net of tax relief) (236) (1.1)<br />

Total return for the year as shown in income statement 1,606 7.1<br />

Proceeds of issue of new shares (net of expenses) 26 –<br />

Shares re-purchased for cancellation (722) 0.4<br />

Expenses charged to capital reserve (18) (0.1)<br />

Net movement for the year before dividends 892 7.4<br />

Net asset value at 31 October 2007 before dividends recognised 14,142 65.0<br />

Dividends recognised in the <strong>financial</strong> <strong>statements</strong> for the year (228) (1.0)<br />

Net asset value at 31 October 2007 13,914 64.0<br />

Overview of the year<br />

During the year under review Northern<br />

AIM VCT <strong>report</strong>ed a total return of<br />

7.1p per share, equivalent to 12.3% of<br />

the opening net asset value (NAV) per<br />

share of 57.6p. The FTSE AIM Allshare<br />

index showed a net rise of<br />

14.8% over the same period.<br />

The movement in total net assets<br />

<strong>and</strong> NAV per share is summarised<br />

in Table 1.<br />

Table 2: Venture capital portfolio cash flow<br />

New Disposal Net inflow/<br />

investment proceeds (outflow)<br />

Year ended £000 £000 £000<br />

31 October 2003 1,926 2,872 946<br />

31 October 2004 2,559 4,531 1,972<br />

31 October 2005 2,627 1,918 (709)<br />

31 October 2006 1,839 998 (841)<br />

31 October 2007 544 2,237 1,693<br />

Total 9,495 12,556 3,061<br />

New investment activity has slowed<br />

further, as the portfolio has been<br />

relatively fully invested. The investment<br />

rate is likely to remain at relatively low<br />

levels <strong>and</strong> will be dependent on the<br />

timing <strong>and</strong> quantum of realisations.<br />

Portfolio cash flow over the past five<br />

years is summarised in Table 2.<br />

Dividends<br />

In recognition of the improvement<br />

in performance during the year the<br />

directors are pleased to propose a<br />

final dividend of 3.0p per share (last<br />

year 1.0p), of which 0.3p represents<br />

income distribution <strong>and</strong> 2.7p is<br />

derived from realised capital gains.<br />

Investment portfolio<br />

One new AIM investment was<br />

completed during the year: we<br />

invested £248,000 in Shieldtech,<br />

which manufactures <strong>and</strong> distributes<br />

body armour systems used by the<br />

UK police, the UK armed forces <strong>and</strong><br />

various export markets. A number of<br />

full or partial exits were achieved, the<br />

resulting inflow of cash enabling the<br />

company to fund a higher level of<br />

share buybacks <strong>and</strong> increase year-end<br />

cash balances to £837,000 compared<br />

with £232,000 at the end of the<br />

preceding year. Given the recent<br />

uncertainty in the <strong>financial</strong> markets we<br />

will be highly selective in re-investing<br />

this cash.<br />

AIM portfolio review<br />

The AIM holdings in the portfolio,<br />

which are not representative of the<br />

AIM market index as a whole because<br />

of their restricted size <strong>and</strong> lack of<br />

exposure to the resource sector, were<br />

up by 3% overall during the year. The<br />

performance of individual holdings has<br />

been extremely variable, which is typical<br />

of a portfolio of smaller companies but<br />

has been even more marked than usual<br />

this year, probably because of the<br />

extremely volatile state of the market.<br />

Many of our companies have<br />

produced good results during the year<br />

but this has not always been reflected<br />

in the share price. Aero Inventory<br />

is a world leader in the provision<br />

of customised procurement <strong>and</strong><br />

inventory management solutions to<br />

the aerospace industry worldwide.<br />

In October 2006 the company won<br />

a very substantial contract with<br />

Qantas <strong>and</strong> the implementation was<br />

completed in July 2007. In November<br />

2007 the company signed a contract<br />

worth US$1.2 billion over 10 years<br />

with Montreal-based ACTS Aero<br />

Technical Support & Services,<br />

involving supply <strong>and</strong> management<br />

of a wide range of consumable <strong>and</strong><br />

expendable aircraft parts. These<br />

contracts are excellent reference sites<br />

for Aero Inventory <strong>and</strong> should help<br />

it achieve its goal of becoming the<br />

world’s leading aircraft consumable<br />

parts service supplier. Aero now has<br />

a market capitalisation of over £300<br />

million, which makes it one of the<br />

top 100 companies on AIM by size.<br />

Jelf Group is a consultancy focusing<br />

on insurance, healthcare, employee<br />

benefits <strong>and</strong> wealth management.<br />

The company has generated growth<br />

organically but its major driver has<br />

been a string of over 20 acquisitions<br />

since 2001, the most recent being the<br />

Bristol-based insurance broker Lampier.<br />

8 Northern AIM VCT PLC <strong>Annual</strong> Report <strong>and</strong> Accounts 2007