Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

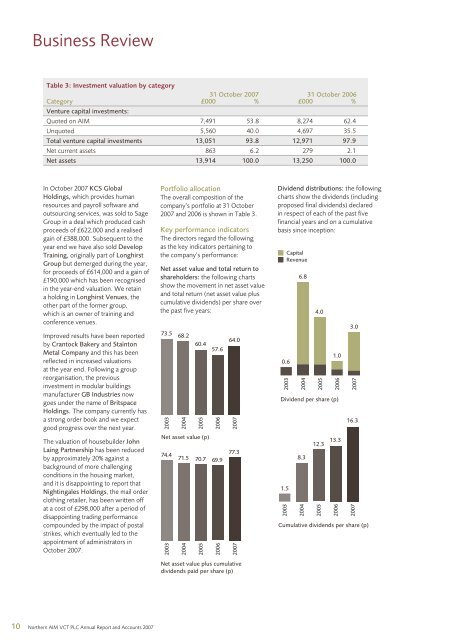

Business Review<br />

Table 3: Investment valuation by category<br />

31 October 2007 31 October 2006<br />

Category £000 % £000 %<br />

Venture capital investments:<br />

Quoted on AIM 7,491 53.8 8,274 62.4<br />

Unquoted 5,560 40.0 4,697 35.5<br />

Total venture capital investments 13,051 93.8 12,971 97.9<br />

Net current assets 863 6.2 279 2.1<br />

Net assets 13,914 100.0 13,250 100.0<br />

In October 2007 KCS Global<br />

Holdings, which provides human<br />

resources <strong>and</strong> payroll software <strong>and</strong><br />

outsourcing services, was sold to Sage<br />

Group in a deal which produced cash<br />

proceeds of £622,000 <strong>and</strong> a realised<br />

gain of £388,000. Subsequent to the<br />

year end we have also sold Develop<br />

Training, originally part of Longhirst<br />

Group but demerged during the year,<br />

for proceeds of £614,000 <strong>and</strong> a gain of<br />

£190,000 which has been recognised<br />

in the year-end valuation. We retain<br />

a holding in Longhirst Venues, the<br />

other part of the former group,<br />

which is an owner of training <strong>and</strong><br />

conference venues.<br />

Improved results have been <strong>report</strong>ed<br />

by Crantock Bakery <strong>and</strong> Stainton<br />

Metal Company <strong>and</strong> this has been<br />

reflected in increased valuations<br />

at the year end. Following a group<br />

reorganisation, the previous<br />

investment in modular buildings<br />

manufacturer GB Industries now<br />

goes under the name of Britspace<br />

Holdings. The company currently has<br />

a strong order book <strong>and</strong> we expect<br />

good progress over the next year.<br />

The valuation of housebuilder John<br />

Laing Partnership has been reduced<br />

by approximately 20% against a<br />

background of more challenging<br />

conditions in the housing market,<br />

<strong>and</strong> it is disappointing to <strong>report</strong> that<br />

Nightingales Holdings, the mail order<br />

clothing retailer, has been written off<br />

at a cost of £298,000 after a period of<br />

disappointing trading performance<br />

compounded by the impact of postal<br />

strikes, which eventually led to the<br />

appointment of administrators in<br />

October 2007.<br />

Portfolio allocation<br />

The overall composition of the<br />

company’s portfolio at 31 October<br />

2007 <strong>and</strong> 2006 is shown in Table 3.<br />

Key performance indicators<br />

The directors regard the following<br />

as the key indicators pertaining to<br />

the company’s performance:<br />

Net asset value <strong>and</strong> total return to<br />

shareholders: the following charts<br />

show the movement in net asset value<br />

<strong>and</strong> total return (net asset value plus<br />

cumulative dividends) per share over<br />

the past five years:<br />

73.5 68.2<br />

60.4<br />

57.6<br />

64.0<br />

2003<br />

2003<br />

2004<br />

2004<br />

2005<br />

Net asset value (p)<br />

74.4 71.5 70.7 69.9<br />

2005<br />

2006<br />

2006<br />

2007<br />

77.3<br />

2007<br />

Net asset value plus cumulative<br />

dividends paid per share (p)<br />

Dividend distributions: the following<br />

charts show the dividends (including<br />

proposed final dividends) declared<br />

in respect of each of the past five<br />

<strong>financial</strong> years <strong>and</strong> on a cumulative<br />

basis since inception:<br />

Capital<br />

Revenue<br />

0.6<br />

2003<br />

6.8<br />

2004<br />

4.0<br />

2005<br />

1.0<br />

2006<br />

Dividend per share (p)<br />

1.5<br />

2003<br />

8.3<br />

2004<br />

2005<br />

2006<br />

3.0<br />

2007<br />

12.3 13.3 16.3<br />

2007<br />

Cumulative dividends per share (p)<br />

10 Northern AIM VCT PLC <strong>Annual</strong> Report <strong>and</strong> Accounts 2007