Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

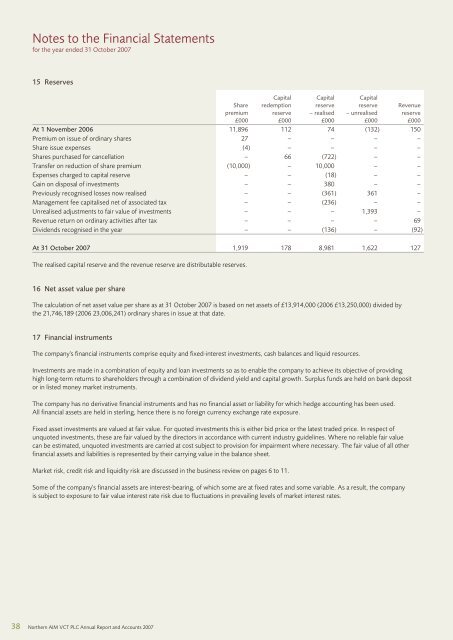

Notes to the Financial Statements<br />

for the year ended 31 October 2007<br />

15 Reserves<br />

Capital Capital Capital<br />

Share redemption reserve reserve Revenue<br />

premium reserve – realised – unrealised reserve<br />

£000 £000 £000 £000 £000<br />

At 1 November 2006 11,896 112 74 (132) 150<br />

Premium on issue of ordinary shares 27 – – – –<br />

Share issue expenses (4) – – – –<br />

Shares purchased for cancellation – 66 (722) – –<br />

Transfer on reduction of share premium (10,000) – 10,000 – –<br />

Expenses charged to capital reserve – – (18) – –<br />

Gain on disposal of investments – – 380 – –<br />

Previously recognised losses now realised – – (361) 361 –<br />

Management fee capitalised net of associated tax – – (236) – –<br />

Unrealised adjustments to fair value of investments – – – 1,393 –<br />

Revenue return on ordinary activities after tax – – – – 69<br />

Dividends recognised in the year – – (136) – (92)<br />

At 31 October 2007 1,919 178 8,981 1,622 127<br />

The realised capital reserve <strong>and</strong> the revenue reserve are distributable reserves.<br />

16 Net asset value per share<br />

The calculation of net asset value per share as at 31 October 2007 is based on net assets of £13,914,000 (2006 £13,250,000) divided by<br />

the 21,746,189 (2006 23,006,241) ordinary shares in issue at that date.<br />

17 Financial instruments<br />

The company's <strong>financial</strong> instruments comprise equity <strong>and</strong> fixed-interest investments, cash balances <strong>and</strong> liquid resources.<br />

Investments are made in a combination of equity <strong>and</strong> loan investments so as to enable the company to achieve its objective of providing<br />

high long-term returns to shareholders through a combination of dividend yield <strong>and</strong> capital growth. Surplus funds are held on bank deposit<br />

or in listed money market instruments.<br />

The company has no derivative <strong>financial</strong> instruments <strong>and</strong> has no <strong>financial</strong> asset or liability for which hedge accounting has been used.<br />

All <strong>financial</strong> assets are held in sterling, hence there is no foreign currency exchange rate exposure.<br />

Fixed asset investments are valued at fair value. For quoted investments this is either bid price or the latest traded price. In respect of<br />

unquoted investments, these are fair valued by the directors in accordance with current industry guidelines. Where no reliable fair value<br />

can be estimated, unquoted investments are carried at cost subject to provision for impairment where necessary. The fair value of all other<br />

<strong>financial</strong> assets <strong>and</strong> liabilities is represented by their carrying value in the balance sheet.<br />

Market risk, credit risk <strong>and</strong> liquidity risk are discussed in the business review on pages 6 to 11.<br />

Some of the company's <strong>financial</strong> assets are interest-bearing, of which some are at fixed rates <strong>and</strong> some variable. As a result, the company<br />

is subject to exposure to fair value interest rate risk due to fluctuations in prevailing levels of market interest rates.<br />

38 Northern AIM VCT PLC <strong>Annual</strong> Report <strong>and</strong> Accounts 2007