Extension to File - City of Xenia

Extension to File - City of Xenia

Extension to File - City of Xenia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

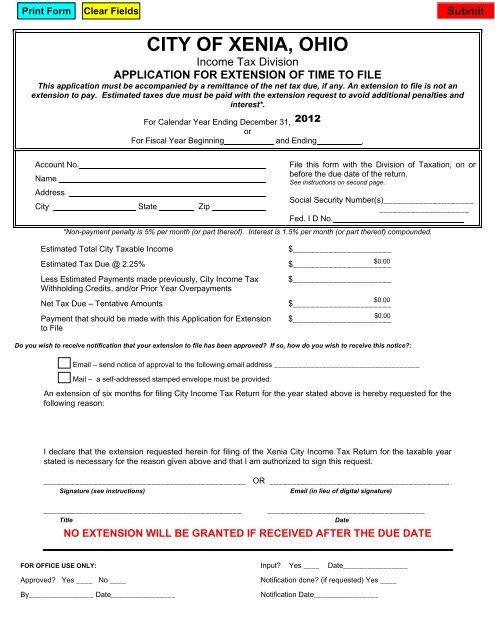

CITY OF XENIA, OHIO<br />

Income Tax Division<br />

APPLICATION FOR EXTENSION OF TIME TO FILE<br />

This application must be accompanied by a remittance <strong>of</strong> the net tax due, if any. An extension <strong>to</strong> file is not an<br />

extension <strong>to</strong> pay. Estimated taxes due must be paid with the extension request <strong>to</strong> avoid additional penalties and<br />

interest*.<br />

For Calendar Year Ending December 31, _____________<br />

or<br />

For Fiscal Year Beginning and Ending ,<br />

Account No.<br />

Name<br />

Address<br />

<strong>City</strong> State Zip<br />

<strong>File</strong> this form with the Division <strong>of</strong> Taxation, on or<br />

before the due date <strong>of</strong> the return.<br />

See instructions on second page.<br />

Social Security Number(s)____________________<br />

____________________<br />

Fed. I D No.<br />

*Non-payment penalty is 5% per month (or part there<strong>of</strong>). Interest is 1.5% per month (or part there<strong>of</strong>) compounded.<br />

Estimated Total <strong>City</strong> Taxable Income<br />

Estimated Tax Due @ 2.25%<br />

Less Estimated Payments made previously, <strong>City</strong> Income Tax<br />

Withholding Credits, and/or Prior Year Overpayments<br />

Net Tax Due – Tentative Amounts<br />

Payment that should be made with this Application for <strong>Extension</strong><br />

<strong>to</strong> <strong>File</strong><br />

$______________________<br />

$______________________<br />

$______________________<br />

$______________________<br />

$______________________<br />

Do you wish <strong>to</strong> receive notification that your extension <strong>to</strong> file has been approved? If so, how do you wish <strong>to</strong> receive this notice?:<br />

Email – send notice <strong>of</strong> approval <strong>to</strong> the following email address ____________________________________<br />

Mail – a self-addressed stamped envelope must be provided.<br />

An extension <strong>of</strong> six months for filing <strong>City</strong> Income Tax Return for the year stated above is hereby requested for the<br />

following reason:<br />

I declare that the extension requested herein for filing <strong>of</strong> the <strong>Xenia</strong> <strong>City</strong> Income Tax Return for the taxable year<br />

stated is necessary for the reason given above and that I am authorized <strong>to</strong> sign this request.<br />

_____________________________________________ OR ________________________________________<br />

Signature (see instructions)<br />

Email (in lieu <strong>of</strong> digital signature)<br />

____________________________________________<br />

Title<br />

___________________________________<br />

NO EXTENSION WILL BE GRANTED IF RECEIVED AFTER THE DUE DATE<br />

Date<br />

FOR OFFICE USE ONLY:<br />

Approved? Yes ____ No ____<br />

By________________ Date________________<br />

Input? Yes ____ Date________________<br />

Notification done? (if requested) Yes ____<br />

Notification Date________________

GENERAL PROVISIONS<br />

Upon written request <strong>of</strong> the taxpayer, made on or before the date for filing the return, the income tax administra<strong>to</strong>r<br />

may extend the time for filing such return for a period not <strong>to</strong> exceed six (6) months, or until the last day <strong>of</strong> the<br />

month following the month <strong>of</strong> the due date granted by the Federal Internal Revenue Service for filing <strong>of</strong> the<br />

Federal Income Tax Return.<br />

Such request shall be filed with the <strong>City</strong> <strong>of</strong> <strong>Xenia</strong>, Income Tax Division, 101 N Detroit St., P O Box 490, <strong>Xenia</strong> OH<br />

45385-0490 on or before the date the request is normally due. If your extension <strong>to</strong> file request is not approved,<br />

the person filing this request will be notified by mail or email.<br />

A copy <strong>of</strong> this application must be attached <strong>to</strong> the income tax return when filed.<br />

INSTRUCTIONS<br />

IMPORTANT - Show <strong>City</strong> account No., Social Security<br />

No. and/or Federal I D No.<br />

1. WHEN TO FILE – A taxpayer desiring an extension<br />

<strong>of</strong> time for filing a <strong>City</strong> income tax return (Form R or R-<br />

B) must submit an application on or before the due<br />

date <strong>of</strong> the return.<br />

Non-payment penalty <strong>of</strong> 5% per month (or<br />

part there<strong>of</strong>) will accrue on any tax due on<br />

the return, from the regular due date <strong>of</strong><br />

the return until paid. Compounded<br />

interest will accrue at the rate <strong>of</strong> 1.5% per<br />

month (or part there<strong>of</strong>) on any balance<br />

due on the return, from the regular due<br />

date <strong>of</strong> the return until paid. If less than<br />

80% <strong>of</strong> the tax has been paid thru timely<br />

estimate payments, a penalty for the<br />

underpayment <strong>of</strong> estimated taxes may also<br />

be charged in addition <strong>to</strong> the interest.<br />

2. HOW AND WHERE TO FILE – Complete this form<br />

forward <strong>to</strong> the <strong>City</strong> <strong>of</strong> <strong>Xenia</strong>, Division <strong>of</strong> Taxation, 101<br />

N Detroit St., P O Box 490, <strong>Xenia</strong> OH 45385-0490. If<br />

you wish <strong>to</strong> receive a copy <strong>of</strong> your approved<br />

extension, an e-mail address or a self-addressed,<br />

stamped envelope must be submitted with the form. If<br />

your request is disapproved, the person filing this<br />

request will be notified by mail. A copy <strong>of</strong> the<br />

extension must be attached <strong>to</strong> your return when it<br />

is filed.<br />

3. REASONS FOR EXTENSION – The <strong>City</strong> <strong>of</strong> <strong>Xenia</strong><br />

will grant a reasonable extension <strong>of</strong> time for filing a<br />

return if the taxpayer files a timely application.<br />

4. SIGNATURE – <strong>Extension</strong> requests should be<br />

signed by the individual taxpayer, an <strong>of</strong>ficer <strong>of</strong> a<br />

corporation, a member <strong>of</strong> a partnership or the firm<br />

employed <strong>to</strong> complete the annual return. When<br />

submitting electronically, the form may be signed<br />

digitally or an email address may be entered in lieu <strong>of</strong><br />

a signature.<br />

5. BLANKET REQUESTS – Blanket requests for<br />

extensions will be granted only if the list contains all<br />

the pertinent information, especially SSN’s and<br />

FID’s.<br />

6. PERIOD OF EXTENSIONS – Generally, an<br />

extension <strong>of</strong> time <strong>to</strong> file on an initial application will<br />

follow the guidelines as set forth by the federal<br />

government (IRS) – <strong>of</strong> 6 months. A longer period <strong>of</strong><br />

time will not be granted unless accompanied by a<br />

Federal extension request, with a sufficient need for<br />

such an extended period clearly shown.<br />

UNDER NO CIRCUMSTANCES WILL AN EXTENSION BE GRANTED IF RECEIVED<br />

AFTER THE DUE DATE.