A N N U A L R E P O R T 2 0 0 2 - Ramirent

A N N U A L R E P O R T 2 0 0 2 - Ramirent

A N N U A L R E P O R T 2 0 0 2 - Ramirent

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

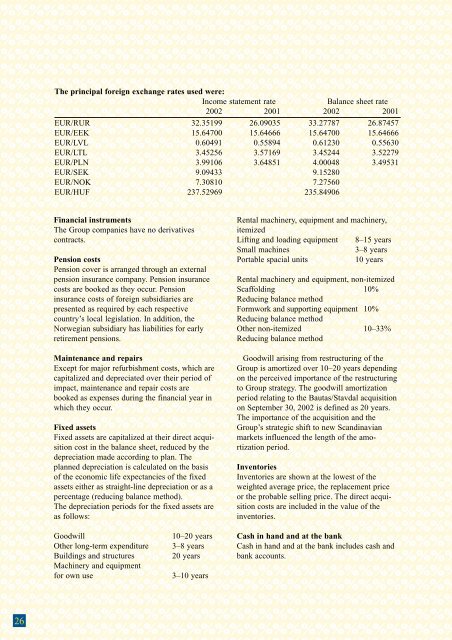

The principal foreign exchange rates used were:<br />

Income statement rate<br />

Balance sheet rate<br />

2002 2001 2002 2001<br />

EUR/RUR 32.35199 26.09035 33.27787 26.87457<br />

EUR/EEK 15.64700 15.64666 15.64700 15.64666<br />

EUR/LVL 0.60491 0.55894 0.61230 0.55630<br />

EUR/LTL 3.45256 3.57169 3.45244 3.52279<br />

EUR/PLN 3.99106 3.64851 4.00048 3.49531<br />

EUR/SEK 9.09433 9.15280<br />

EUR/NOK 7.30810 7.27560<br />

EUR/HUF 237.52969 235.84906<br />

Financial instruments<br />

The Group companies have no derivatives<br />

contracts.<br />

Pension costs<br />

Pension cover is arranged through an external<br />

pension insurance company. Pension insurance<br />

costs are booked as they occur. Pension<br />

insurance costs of foreign subsidiaries are<br />

presented as required by each respective<br />

country’s local legislation. In addition, the<br />

Norwegian subsidiary has liabilities for early<br />

retirement pensions.<br />

Maintenance and repairs<br />

Except for major refurbishment costs, which are<br />

capitalized and depreciated over their period of<br />

impact, maintenance and repair costs are<br />

booked as expenses during the financial year in<br />

which they occur.<br />

Fixed assets<br />

Fixed assets are capitalized at their direct acquisition<br />

cost in the balance sheet, reduced by the<br />

depreciation made according to plan. The<br />

planned depreciation is calculated on the basis<br />

of the economic life expectancies of the fixed<br />

assets either as straight-line depreciation or as a<br />

percentage (reducing balance method).<br />

The depreciation periods for the fixed assets are<br />

as follows:<br />

Rental machinery, equipment and machinery,<br />

itemized<br />

Lifting and loading equipment 8–15 years<br />

Small machines3–8 years<br />

Portable spacial units<br />

10 years<br />

Rental machinery and equipment, non-itemized<br />

Scaffolding 10%<br />

Reducing balance method<br />

Formwork and supporting equipment 10%<br />

Reducing balance method<br />

Other non-itemized 10–33%<br />

Reducing balance method<br />

Goodwill arising from restructuring of the<br />

Group is amortized over 10–20 years depending<br />

on the perceived importance of the restructuring<br />

to Group strategy. The goodwill amortization<br />

period relating to the Bautas/Stavdal acquisition<br />

on September 30, 2002 is defined as 20 years.<br />

The importance of the acquisition and the<br />

Group’s strategic shift to new Scandinavian<br />

markets influenced the length of the amortization<br />

period.<br />

Inventories<br />

Inventories are shown at the lowest of the<br />

weighted average price, the replacement price<br />

or the probable selling price. The direct acquisition<br />

costs are included in the value of the<br />

inventories.<br />

Goodwill<br />

Other long-term expenditure<br />

Buildings and structures<br />

Machinery and equipment<br />

for own use<br />

10–20 years<br />

3–8 years<br />

20 years<br />

3–10 years<br />

Cash in hand and at the bank<br />

Cash in hand and at the bank includes cash and<br />

bank accounts.<br />

26