ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

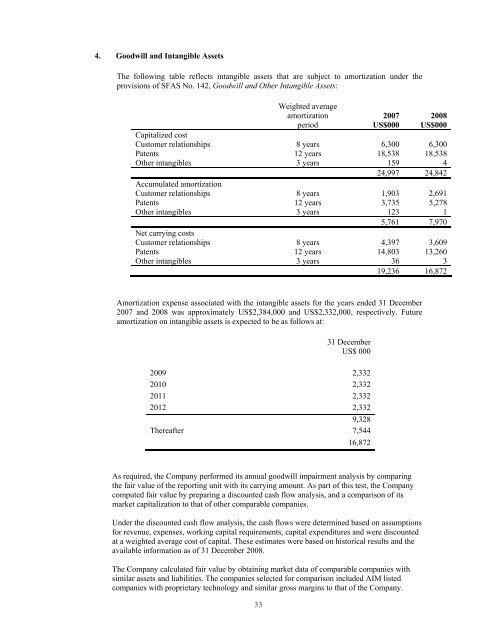

4. Goodwill and Intangible Assets<br />

The following table reflects intangible assets that are subject to amortization under the<br />

provisions of SFAS No. 142, Goodwill and Other Intangible Assets:<br />

Weighted average<br />

amortization<br />

period<br />

2007<br />

US$000<br />

2008<br />

US$000<br />

Capitalized cost<br />

Customer relationships 8 years 6,300 6,300<br />

Patents 12 years 18,538 18,538<br />

Other intangibles 3 years 159 4<br />

24,997 24,842<br />

Accumulated amortization<br />

Customer relationships 8 years 1,903 2,691<br />

Patents 12 years 3,735 5,278<br />

Other intangibles 3 years 123 1<br />

5,761 7,970<br />

Net carrying costs<br />

Customer relationships 8 years 4,397 3,609<br />

Patents 12 years 14,803 13,260<br />

Other intangibles 3 years 36 3<br />

19,236 16,872<br />

Amortization expense associated with the intangible assets for the years ended 31 December<br />

2007 and 2008 was approximately US$2,384,000 and US$2,332,000, respectively. Future<br />

amortization on intangible assets is expected to be as follows at:<br />

31 December<br />

US$ 000<br />

2009 2,332<br />

2010 2,332<br />

2011 2,332<br />

2012 2,332<br />

9,328<br />

Thereafter 7,544<br />

16,872<br />

As required, the Company performed its annual goodwill impairment analysis by comparing<br />

the fair value of the reporting unit with its carrying amount. As part of this test, the Company<br />

computed fair value by preparing a discounted cash flow analysis, and a comparison of its<br />

market capitalization to that of other comparable companies.<br />

Under the discounted cash flow analysis, the cash flows were determined based on assumptions<br />

for revenue, expenses, working capital requirements, capital expenditures and were discounted<br />

at a weighted average cost of capital. These estimates were based on historical results and the<br />

available information as of 31 December 2008.<br />

The Company calculated fair value by obtaining market data of comparable companies with<br />

similar assets and liabilities. The companies selected for comparison included AIM listed<br />

companies with proprietary technology and similar gross margins to that of the Company.<br />

33