ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

11. Commitments and Contingencies<br />

The Company has entered into employment agreements with certain members of senior<br />

management. The terms of these agreements range from six months to one year and include<br />

non-compete and nondisclosure provisions as well as providing for defined severance<br />

payments in the event of termination or change in control.<br />

The Company has entered into a 5 year or minimum purchase obligation of US$625,000 with<br />

a supplier as of 31 December 2007. There is a related contingent liability of US$43,000 to<br />

cancel the contract as of 31 December 2008 which declines over 5 years on a pro-rated basis.<br />

The Company is subject to various unresolved legal actions which arise in the normal course<br />

of its business. Although it is not possible to predict with certainty the outcome of these<br />

unresolved legal actions or the range of possible losses, the Company believes these<br />

unresolved legal actions will not have a material effect on its financial statements.<br />

12. Income Taxes<br />

<strong>Somero</strong> adopted FIN 48 on January 1, 2007. FIN 48 clarifies the accounting for uncertainty<br />

in income taxes recognized in an enterprise’s financial statements in accordance with FASB<br />

Statement No. 109, Accounting for Income Taxes. FIN 48 prescribes a recognition threshold<br />

and measurement attribute for the financial statement recognition and measurement of a tax<br />

position taken or expected to be taken in a tax return. This pronouncement also provides<br />

guidance on derecognition, classification, interest and penalties, accounting in interim<br />

periods, disclosure and transition.<br />

At 31 December 2008, the Company had a gross unrecognized tax benefit (including interest<br />

and penalties) of $4,000. Accrued interest and penalties related to unrecognized tax benefits<br />

are not included in tax expense.<br />

<strong>Somero</strong> is subject to U.S. federal income tax as well as income tax of multiple state<br />

jurisdictions. The Company began business in 2005 and therefore the statute of limitations<br />

for all federal, foreign and state income tax matters for tax years from 2005 forward are still<br />

open. <strong>Somero</strong> has no federal, foreign or state income tax returns currently under examination.<br />

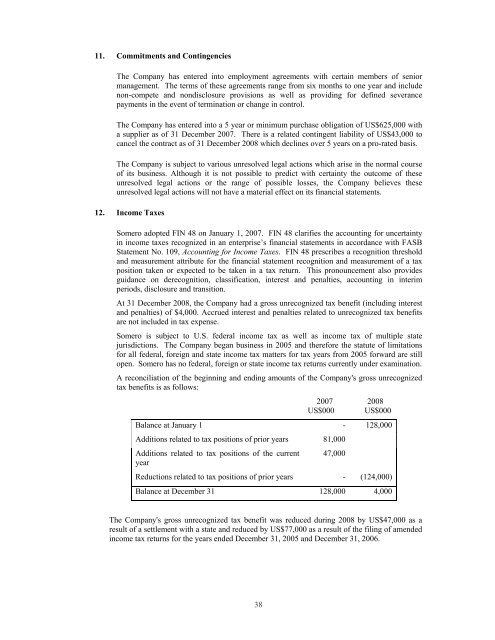

A reconciliation of the beginning and ending amounts of the Company's gross unrecognized<br />

tax benefits is as follows:<br />

2007 2008<br />

US$000 US$000<br />

Balance at January 1 - 128,000<br />

Additions related to tax positions of prior years 81,000<br />

Additions related to tax positions of the current<br />

year<br />

47,000<br />

Reductions related to tax positions of prior years - (124,000)<br />

Balance at December 31 128,000 4,000<br />

The Company's gross unrecognized tax benefit was reduced during 2008 by US$47,000 as a<br />

result of a settlement with a state and reduced by US$77,000 as a result of the filing of amended<br />

income tax returns for the years ended December 31, 2005 and December 31, 2006.<br />

38