ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In addition, the Company calculated a weighted average fair value by placing a 90% weighting<br />

on the discounted cash flow approach and a 10% weighting on the comparable market<br />

approach. The analysis resulted in the weighted average fair value of the Compay exceeding<br />

the carrying value of the Company.<br />

Based upon the fact that the Company’s analysis resulted in the fair value of the Company<br />

exceeding the book value, management concluded that goodwill is not impaired at 31<br />

December 2008 and no adjustments to goodwill were recorded.<br />

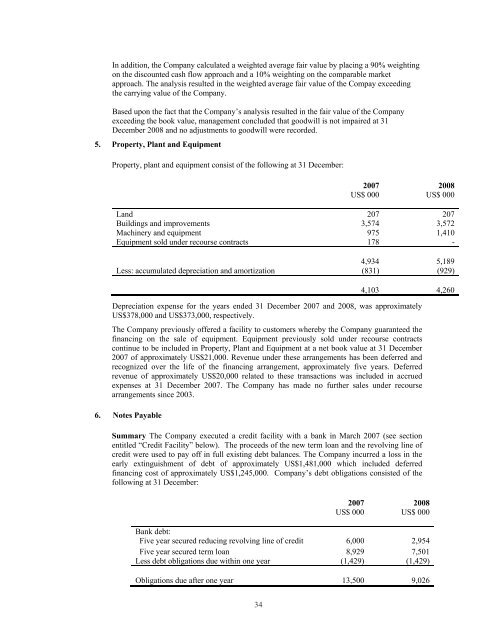

5. Property, Plant and Equipment<br />

Property, plant and equipment consist of the following at 31 December:<br />

2007 2008<br />

US$ 000 US$ 000<br />

Land 207 207<br />

Buildings and improvements 3,574 3,572<br />

Machinery and equipment 975 1,410<br />

Equipment sold under recourse contracts 178 -<br />

4,934 5,189<br />

Less: accumulated depreciation and amortization (831) (929)<br />

4,103 4,260<br />

Depreciation expense for the years ended 31 December 2007 and 2008, was approximately<br />

US$378,000 and US$373,000, respectively.<br />

The Company previously offered a facility to customers whereby the Company guaranteed the<br />

financing on the sale of equipment. Equipment previously sold under recourse contracts<br />

continue to be included in Property, Plant and Equipment at a net book value at 31 December<br />

2007 of approximately US$21,000. Revenue under these arrangements has been deferred and<br />

recognized over the life of the financing arrangement, approximately five years. Deferred<br />

revenue of approximately US$20,000 related to these transactions was included in accrued<br />

expenses at 31 December 2007. The Company has made no further sales under recourse<br />

arrangements since 2003.<br />

6. Notes Payable<br />

Summary The Company executed a credit facility with a bank in March 2007 (see section<br />

entitled “Credit Facility” below). The proceeds of the new term loan and the revolving line of<br />

credit were used to pay off in full existing debt balances. The Company incurred a loss in the<br />

early extinguishment of debt of approximately US$1,481,000 which included deferred<br />

financing cost of approximately US$1,245,000. Company’s debt obligations consisted of the<br />

following at 31 December:<br />

2007 2008<br />

US$ 000 US$ 000<br />

Bank debt:<br />

Five year secured reducing revolving line of credit 6,000 2,954<br />

Five year secured term loan 8,929 7,501<br />

Less debt obligations due within one year (1,429) (1,429)<br />

Obligations due after one year 13,500 9,026<br />

34