IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

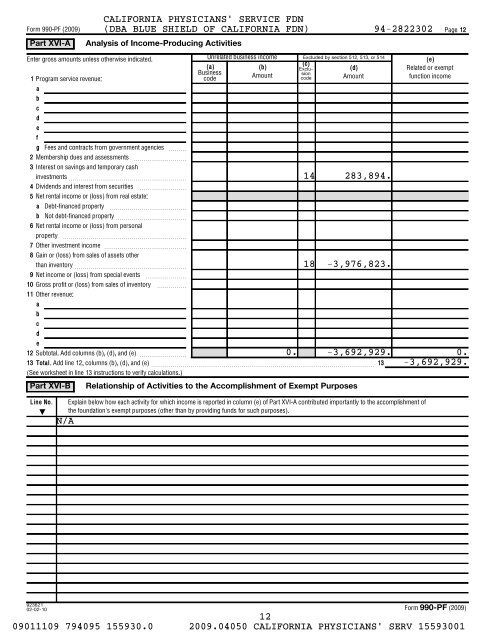

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

Part XVI-A<br />

Enter gross amounts unless otherwise indicated.<br />

1 Program service revenue:<br />

Unrelated business income<br />

(a) (b)<br />

(c)<br />

(d)<br />

Amount<br />

Amount<br />

Business<br />

code<br />

Excluded by section 512, 513, or 514<br />

a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

g Fees and contracts from government agencies ~~~<br />

2 Membership dues and assessments ~~~~~~~~~<br />

3 Interest on savings and temporary cash<br />

investments ~~~~~~~~~~~~~~~~~~~~<br />

4 Dividends and interest from securities ~~~~~~~~<br />

5 Net rental income or (loss) from real estate:<br />

a Debt-financed property ~~~~~~~~~~~~~<br />

b Not debt-financed property ~~~~~~~~~~~~<br />

6 Net rental income or (loss) from personal<br />

property ~~~~~~~~~~~~~~~~~~~~~<br />

7 Other investment income ~~~~~~~~~~~~~~<br />

8 Gain or (loss) from sales <strong>of</strong> assets other<br />

than inventory ~~~~~~~~~~~~~~~~~~~<br />

9 Net income or (loss) from special events ~~~~~~~<br />

10 Gross pr<strong>of</strong>it or (loss) from sales <strong>of</strong> inventory ~~~~~<br />

11 Other revenue:<br />

a<br />

b<br />

c<br />

d<br />

e<br />

12 Subtotal. Add columns (b), (d), and (e) ~~~~~~~~<br />

13 Total. Add line 12, columns (b), (d), and (e) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 13<br />

(See worksheet in line 13 instructions to verify calculations.)<br />

Part XVI-B<br />

CALIFORNIA PHYSICIANS' SERVICE FDN<br />

(DBA BLUE SHIELD OF CALIFORNIA FDN) 94-2822302<br />

Analysis <strong>of</strong> Income-Producing Activities<br />

Exclusion<br />

code<br />

14 283,894.<br />

18 -3,976,823.<br />

Relationship <strong>of</strong> Activities to the Accomplishment <strong>of</strong> Exempt Purposes<br />

(e)<br />

Related or exempt<br />

function income<br />

Page 12<br />

0. -3,692,929. 0.<br />

-3,692,929.<br />

Line No.<br />

<<br />

N/A<br />

Explain below how each activity <strong>for</strong> which income is reported in column (e) <strong>of</strong> Part XVI-A contributed importantly to the accomplishment <strong>of</strong><br />

the foundation's exempt purposes (other than by providing funds <strong>for</strong> such purposes).<br />

923621<br />

02-02-10<br />

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

12<br />

09011109 794095 155930.0 <strong>2009</strong>.04050 CALIFORNIA PHYSICIANS' SERV 15593001