IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

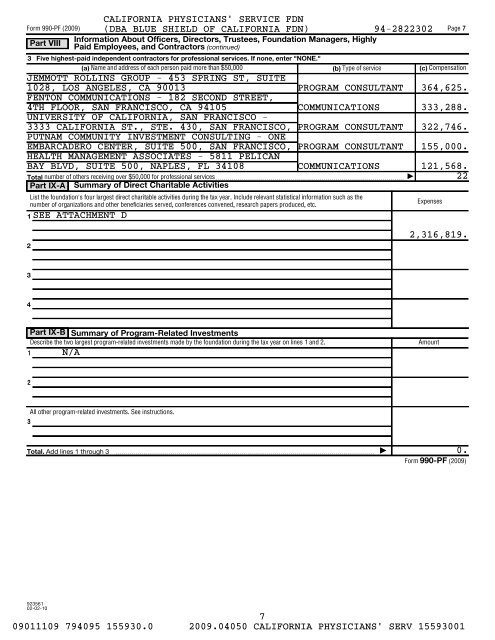

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

3 Five highest-paid independent contractors <strong>for</strong> pr<strong>of</strong>essional services. If none, enter "NONE."<br />

(a) Name and address <strong>of</strong> each person paid more than $50,000 (b) Type <strong>of</strong> service<br />

(c) Compensation<br />

Total number <strong>of</strong> others receiving over $50,000 <strong>for</strong> pr<strong>of</strong>essional services<br />

1<br />

Part VIII<br />

Part IX-A<br />

CALIFORNIA PHYSICIANS' SERVICE FDN<br />

(DBA BLUE SHIELD OF CALIFORNIA FDN) 94-2822302<br />

In<strong>for</strong>mation About Officers, Directors, Trustees, <strong>Foundation</strong> Managers, Highly<br />

Paid Employees, and Contractors (continued)<br />

JEMMOTT ROLLINS GROUP - 453 SPRING ST, SUITE<br />

1028, LOS ANGELES, CA 90013 PROGRAM CONSULTANT 364,625.<br />

FENTON COMMUNICATIONS - 182 SECOND STREET,<br />

4TH FLOOR, SAN FRANCISCO, CA 94105 COMMUNICATIONS 333,288.<br />

UNIVERSITY OF CALIFORNIA, SAN FRANCISCO -<br />

3333 CALIFORNIA ST., STE. 430, SAN FRANCISCO, PROGRAM CONSULTANT 322,746.<br />

PUTNAM COMMUNITY INVESTMENT CONSULTING - ONE<br />

EMBARCADERO CENTER, SUITE 500, SAN FRANCISCO, PROGRAM CONSULTANT 155,000.<br />

HEALTH MANAGEMENT ASSOCIATES - 5811 PELICAN<br />

BAY BLVD, SUITE 500, NAPLES, FL 34108 COMMUNICATIONS 121,568.<br />

22<br />

Summary <strong>of</strong> Direct Charitable Activities<br />

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical in<strong>for</strong>mation such as the<br />

number <strong>of</strong> organizations and other beneficiaries served, conferences convened, research papers produced, etc.<br />

SEE ATTACHMENT D<br />

9<br />

Expenses<br />

Page 7<br />

2<br />

2,316,819.<br />

3<br />

4<br />

1<br />

Part IX-B Summary <strong>of</strong> Program-Related Investments<br />

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2.<br />

N/A<br />

Amount<br />

2<br />

3<br />

All other program-related investments. See instructions.<br />

Total. Add lines 1 through 3<br />

<br />

J<br />

<strong>990</strong>-<strong>PF</strong><br />

0.<br />

<strong>Form</strong> (<strong>2009</strong>)<br />

923561<br />

02-02-10<br />

7<br />

09011109 794095 155930.0 <strong>2009</strong>.04050 CALIFORNIA PHYSICIANS' SERV 15593001