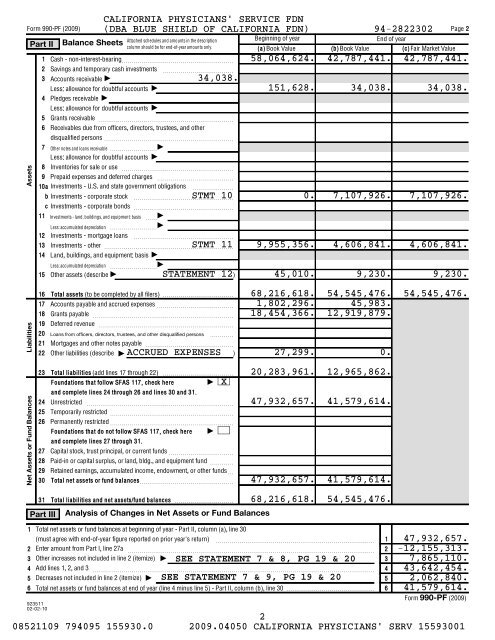

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

Assets<br />

Liabilities<br />

Net Assets or Fund Balances<br />

Part II<br />

923511<br />

02-02-10<br />

Attached schedules and amounts in the description<br />

column should be <strong>for</strong> end-<strong>of</strong>-year amounts only.<br />

1 Cash - non-interest-bearing~~~~~~~~~~~~~~~~~~~<br />

2 Savings and temporary cash investments ~~~~~~~~~~~~<br />

3 Accounts receivable9<br />

Less: allowance <strong>for</strong> doubtful accounts<br />

9<br />

4 Pledges receivable<br />

9<br />

Less: allowance <strong>for</strong> doubtful accounts<br />

9<br />

5 Grants receivable ~~~~~~~~~~~~~~~~~~~~~~~<br />

6 Receivables due from <strong>of</strong>ficers, directors, trustees, and other<br />

disqualified persons ~~~~~~~~~~~~~~~~~~~~~~<br />

7 Other notes and loans receivable ~~~~~~~~<br />

9<br />

Less: allowance <strong>for</strong> doubtful accounts<br />

9<br />

8 Inventories <strong>for</strong> sale or use ~~~~~~~~~~~~~~~~~~~<br />

9 Prepaid expenses and deferred charges ~~~~~~~~~~~~~<br />

10a<br />

Investments - U.S. and state government obligations ~~~~~~~<br />

b Investments - corporate stock ~~~~~~~~~~~~~~~~~<br />

STMT 10<br />

c Investments - corporate bonds ~~~~~~~~~~~~~~~~~<br />

11 Investments - land, buildings, and equipment: basis ~~<br />

Less: accumulated depreciation ~~~~~~~~<br />

9<br />

12 Investments - mortgage loans ~~~~~~~~~~~~~~~~~<br />

13 Investments - other ~~~~~~~~~~~~~~~~~~~~~~<br />

STMT 11<br />

14 Land, buildings, and equipment: basis<br />

9<br />

Less: accumulated depreciation ~~~~~~~~<br />

15 Other assets (describe<br />

9<br />

STATEMENT 12 )<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

Total assets (to be completed by all filers) <br />

Accounts payable and accrued expenses ~~~~~~~~~~~~~<br />

Grants payable ~~~~~~~~~~~~~~~~~~~~~~~~<br />

Deferred revenue ~~~~~~~~~~~~~~~~~~~~~~~<br />

Loans from <strong>of</strong>ficers, directors, trustees, and other disqualified persons ~~~~<br />

Mortgages and other notes payable ~~~~~~~~~~~~~~~<br />

Other liabilities (describe<br />

)<br />

23 Total liabilities (add lines 17 through 22) <br />

<strong>Foundation</strong>s that follow SFAS 117, check here<br />

X<br />

9<br />

and complete lines 24 through 26 and lines 30 and 31.<br />

24 Unrestricted ~~~~~~~~~~~~~~~~~~~~~~~~~<br />

25 Temporarily restricted ~~~~~~~~~~~~~~~~~~~~~<br />

26 Permanently restricted~~~~~~~~~~~~~~~~~~~~~<br />

<strong>Foundation</strong>s that do not follow SFAS 117, check here<br />

9<br />

and complete lines 27 through 31.<br />

27<br />

28<br />

29<br />

30<br />

Capital stock, trust principal, or current funds ~~~~~~~~~~~<br />

Paid-in or capital surplus, or land, bldg., and equipment fund ~~~~<br />

Retained earnings, accumulated income, endowment, or other funds~<br />

Total net assets or fund balances~~~~~~~~~~~~~~~~<br />

31<br />

Part III<br />

Balance Sheets<br />

CALIFORNIA PHYSICIANS' SERVICE FDN<br />

(DBA BLUE SHIELD OF CALIFORNIA FDN) 94-2822302<br />

9<br />

9<br />

34,038.<br />

Total liabilities and net assets/fund balances <br />

Analysis <strong>of</strong> Changes in Net Assets or Fund Balances<br />

Page 2<br />

Beginning <strong>of</strong> year<br />

End <strong>of</strong> year<br />

(a) Book Value (b) Book Value (c) Fair Market Value<br />

58,064,624. 42,787,441. 42,787,441.<br />

151,628. 34,038. 34,038.<br />

1 Total net assets or fund balances at beginning <strong>of</strong> year - Part II, column (a), line 30<br />

(must agree with end-<strong>of</strong>-year figure reported on prior year's return) ~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

2 Enter amount from Part I, line 27a ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

3 Other increases not included in line 2 (itemize)<br />

9 SEE STATEMENT 7 & 8, PG 19 & 20<br />

4 Add lines 1, 2, and 3 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

5 Decreases not included in line 2 (itemize) SEE STATEMENT 7 & 9, PG 19 & 20<br />

9<br />

6 Total net assets or fund balances at end <strong>of</strong> year (line 4 minus line 5) - Part II, column (b), line 30 <br />

0. 7,107,926. 7,107,926.<br />

9,955,356. 4,606,841. 4,606,841.<br />

45,010. 9,230. 9,230.<br />

68,216,618. 54,545,476. 54,545,476.<br />

1,802,296. 45,983.<br />

18,454,366. 12,919,879.<br />

ACCRUED EXPENSES 27,299. 0.<br />

20,283,961. 12,965,862.<br />

47,932,657. 41,579,614.<br />

47,932,657. 41,579,614.<br />

68,216,618. 54,545,476.<br />

SEE STATEMENT 8<br />

SEE STATEMENT 9<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

47,932,657.<br />

-12,155,313.<br />

7,865,110.<br />

43,642,454.<br />

2,062,840.<br />

41,579,614.<br />

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

2<br />

08521109 794095 155930.0 <strong>2009</strong>.04050 CALIFORNIA PHYSICIANS' SERV 15593001