IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

IRS Form 990-PF for 2009 - Blue Shield of California Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

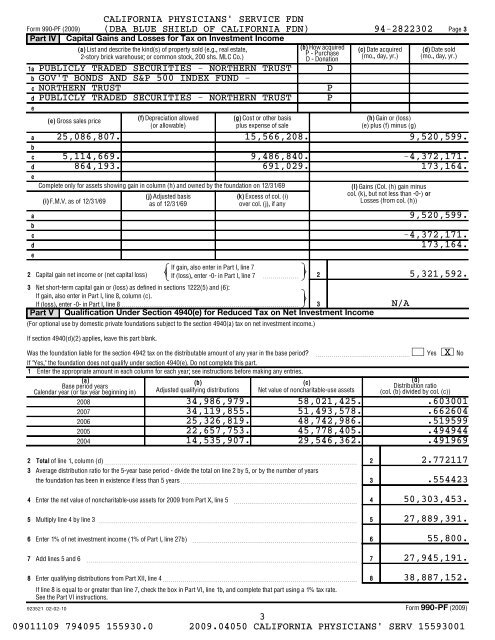

<strong>Form</strong> <strong>990</strong>-<strong>PF</strong> (<strong>2009</strong>)<br />

1a<br />

b<br />

c<br />

d<br />

e<br />

a<br />

b<br />

c<br />

d<br />

e<br />

a<br />

b<br />

c<br />

d<br />

e<br />

(e) Gross sales price<br />

(a) List and describe the kind(s) <strong>of</strong> property sold (e.g., real estate,<br />

(b) How acquired (c) Date acquired (d) Date sold<br />

P - Purchase<br />

2-story brick warehouse; or common stock, 200 shs. MLC Co.)<br />

D - Donation<br />

(mo., day, yr.) (mo., day, yr.)<br />

(f) Depreciation allowed<br />

(g) Cost or other basis<br />

(h) Gain or (loss)<br />

(or allowable)<br />

plus expense <strong>of</strong> sale<br />

(e) plus (f) minus (g)<br />

Complete only <strong>for</strong> assets showing gain in column (h) and owned by the foundation on 12/31/69 (l) Gains (Col. (h) gain minus<br />

(j) Adjusted basis<br />

(k) Excess <strong>of</strong> col. (i)<br />

col. (k), but not less than -0-) or<br />

(i) F.M.V. as <strong>of</strong> 12/31/69<br />

Losses (from col. (h))<br />

as <strong>of</strong> 12/31/69<br />

over col. (j), if any<br />

If gain, also enter in Part I, line 7<br />

2 Capital gain net income or (net capital loss) If (loss), enter -0- in Part I, line 7 ~~~~~~ 2<br />

3<br />

Part IV<br />

CALIFORNIA PHYSICIANS' SERVICE FDN<br />

(DBA BLUE SHIELD OF CALIFORNIA FDN) 94-2822302<br />

Capital Gains and Losses <strong>for</strong> Tax on Investment Income<br />

PUBLICLY TRADED SECURITIES - NORTHERN TRUST<br />

GOV'T BONDS AND S&P 500 INDEX FUND -<br />

NORTHERN TRUST<br />

PUBLICLY TRADED SECURITIES - NORTHERN TRUST<br />

Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):<br />

If gain, also enter in Part I, line 8, column (c).<br />

If (loss), enter -0- in Part I, line 8 <br />

Part V<br />

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)<br />

If section 4940(d)(2) applies, leave this part blank.<br />

Was the foundation liable <strong>for</strong> the section 4942 tax on the distributable amount <strong>of</strong> any year in the base period?<br />

If "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.<br />

1 Enter the appropriate amount in each column <strong>for</strong> each year; see instructions be<strong>for</strong>e making any entries.<br />

(a) (b) (c)<br />

Base period years<br />

Calendar year (or tax year beginning in) Adjusted qualifying distributions Net value <strong>of</strong> noncharitable-use assets<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

3<br />

Page 3<br />

25,086,807. 15,566,208. 9,520,599.<br />

5,114,669. 9,486,840. -4,372,171.<br />

864,193. 691,029. 173,164.<br />

rqs<br />

Qualification Under Section 4940(e) <strong>for</strong> Reduced Tax on Net Investment Income<br />

pmo<br />

pmo<br />

D<br />

P<br />

P<br />

N/A<br />

9,520,599.<br />

-4,372,171.<br />

173,164.<br />

5,321,592.<br />

<br />

X<br />

~~~~~~~~~~~~~~~~ Yes No<br />

(d)<br />

Distribution ratio<br />

(col. (b) divided by col. (c))<br />

34,986,979. 58,021,425. .603001<br />

34,119,855. 51,493,578. .662604<br />

25,326,819. 48,742,986. .519599<br />

22,657,753. 45,778,405. .494944<br />

14,535,907. 29,546,362. .491969<br />

2<br />

3<br />

Total <strong>of</strong> line 1, column (d) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2<br />

Average distribution ratio <strong>for</strong> the 5-year base period - divide the total on line 2 by 5, or by the number <strong>of</strong> years<br />

the foundation has been in existence if less than 5 years~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

3<br />

2.772117<br />

.554423<br />

4<br />

Enter the net value <strong>of</strong> noncharitable-use assets <strong>for</strong> <strong>2009</strong> from Part X, line 5<br />

~~~~~~~~~~~~~~~~~~~~~<br />

4<br />

50,303,453.<br />

5<br />

Multiply line 4 by line 3 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

5<br />

27,889,391.<br />

6<br />

Enter 1% <strong>of</strong> net investment income (1% <strong>of</strong> Part I, line 27b) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

6<br />

55,800.<br />

7<br />

Add lines 5 and 6 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

7<br />

27,945,191.<br />

8 Enter qualifying distributions from Part XII, line 4~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.<br />

See the Part VI instructions.<br />

8<br />

38,887,152.<br />

923521 02-02-10<br />

<strong>990</strong>-<strong>PF</strong><br />

3<br />

09011109 794095 155930.0 <strong>2009</strong>.04050 CALIFORNIA PHYSICIANS' SERV 15593001<br />

<strong>Form</strong> (<strong>2009</strong>)