FORCANCER - Moores Cancer Center

FORCANCER - Moores Cancer Center

FORCANCER - Moores Cancer Center

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PHILANTHROPY NOTEBOOK<br />

As part of our ongoing commitment to help you<br />

make the most of your philanthropic support of<br />

the <strong>Cancer</strong> <strong>Center</strong> and other non-profit organizations,<br />

we are pleased to provide you with the<br />

following information on a unique way to use<br />

charitable remainder trusts.<br />

Charitable Trusts to<br />

Fund Educational Expenses<br />

Every spring marks a special turning point in the lives of<br />

thousands of teenagers: high school graduation. And each<br />

year many young people go on to begin their college studies.<br />

College can be a very special rite of passage, but as most<br />

parents and grandparents know, it<br />

can also be an expensive one.<br />

A growing number of charitably<br />

inclined individuals have discovered<br />

the value of a charitable remainder<br />

trust to fund the educational<br />

expenses of their children or<br />

grandchildren, and to maintain<br />

their philanthropic goals.<br />

Take for example Mr. and Mrs.<br />

Appleton, who promised to help<br />

pay for their granddaughter’s college<br />

expenses many years ago. To do<br />

this, the Appletons considered a<br />

variety of options, including selling<br />

their highly appreciated securities;<br />

however, this option would have<br />

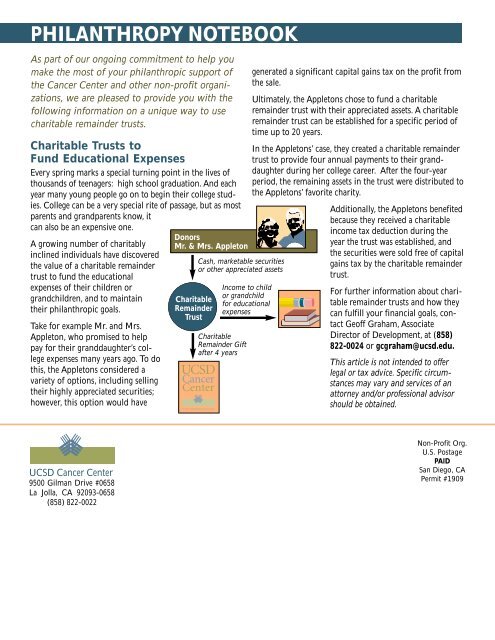

Donors<br />

Mr. & Mrs. Appleton<br />

Charitable<br />

Remainder<br />

Trust<br />

Cash, marketable securities<br />

or other appreciated assets<br />

Income to child<br />

or grandchild<br />

for educational<br />

expenses<br />

Charitable<br />

Remainder Gift<br />

after 4 years<br />

generated a significant capital gains tax on the profit from<br />

the sale.<br />

Ultimately, the Appletons chose to fund a charitable<br />

remainder trust with their appreciated assets. A charitable<br />

remainder trust can be established for a specific period of<br />

time up to 20 years.<br />

In the Appletons’ case, they created a charitable remainder<br />

trust to provide four annual payments to their granddaughter<br />

during her college career. After the four-year<br />

period, the remaining assets in the trust were distributed to<br />

the Appletons’ favorite charity.<br />

Additionally, the Appletons benefited<br />

because they received a charitable<br />

income tax deduction during the<br />

year the trust was established, and<br />

the securities were sold free of capital<br />

gains tax by the charitable remainder<br />

trust.<br />

For further information about charitable<br />

remainder trusts and how they<br />

can fulfill your financial goals, contact<br />

Geoff Graham, Associate<br />

Director of Development, at (858)<br />

822-0024 or gcgraham@ucsd.edu.<br />

This article is not intended to offer<br />

legal or tax advice. Specific circumstances<br />

may vary and services of an<br />

attorney and/or professional advisor<br />

should be obtained.<br />

UCSD <strong>Cancer</strong> <strong>Center</strong><br />

9500 Gilman Drive #0658<br />

La Jolla, CA 92093-0658<br />

(858) 822-0022<br />

Non-Profit Org.<br />

U.S. Postage<br />

PAID<br />

San Diego, CA<br />

Permit #1909