2005 - The Weir Group

2005 - The Weir Group

2005 - The Weir Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

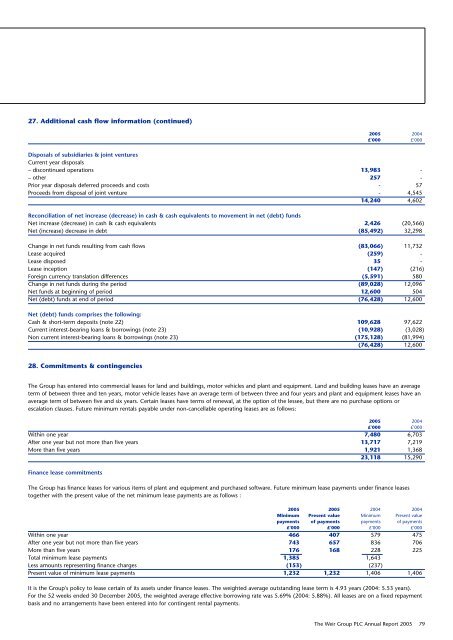

27. Additional cash flow information (continued)<br />

<strong>2005</strong> 2004<br />

£'000<br />

£'000<br />

Disposals of subsidiaries & joint ventures<br />

Current year disposals<br />

– discontinued operations 13,983 -<br />

– other 257 -<br />

Prior year disposals deferred proceeds and costs - 57<br />

Proceeds from disposal of joint venture - 4,545<br />

14,240 4,602<br />

Reconciliation of net increase (decrease) in cash & cash equivalents to movement in net (debt) funds<br />

Net increase (decrease) in cash & cash equivalents 2,426 (20,566)<br />

Net (increase) decrease in debt (85,492) 32,298<br />

Change in net funds resulting from cash flows (83,066) 11,732<br />

Lease acquired (259) -<br />

Lease disposed 35 -<br />

Lease inception (147) (216)<br />

Foreign currency translation differences (5,591) 580<br />

Change in net funds during the period (89,028) 12,096<br />

Net funds at beginning of period 12,600 504<br />

Net (debt) funds at end of period (76,428) 12,600<br />

Net (debt) funds comprises the following:<br />

Cash & short-term deposits (note 22) 109,628 97,622<br />

Current interest-bearing loans & borrowings (note 23) (10,928) (3,028)<br />

Non current interest-bearing loans & borrowings (note 23) (175,128) (81,994)<br />

(76,428) 12,600<br />

28. Commitments & contingencies<br />

<strong>The</strong> <strong>Group</strong> has entered into commercial leases for land and buildings, motor vehicles and plant and equipment. Land and building leases have an average<br />

term of between three and ten years, motor vehicle leases have an average term of between three and four years and plant and equipment leases have an<br />

average term of between five and six years. Certain leases have terms of renewal, at the option of the lessee, but there are no purchase options or<br />

escalation clauses. Future minimum rentals payable under non-cancellable operating leases are as follows:<br />

<strong>2005</strong> 2004<br />

£'000<br />

£'000<br />

Within one year 7,480 6,703<br />

After one year but not more than five years 13,717 7,219<br />

More than five years 1,921 1,368<br />

23,118 15,290<br />

Finance lease commitments<br />

<strong>The</strong> <strong>Group</strong> has finance leases for various items of plant and equipment and purchased software. Future minimum lease payments under finance leases<br />

together with the present value of the net minimum lease payments are as follows :<br />

<strong>2005</strong> <strong>2005</strong> 2004 2004<br />

Minimum Present value Minimum Present value<br />

payments of payments payments of payments<br />

£'000 £'000 £'000 £'000<br />

Within one year 466 407 579 475<br />

After one year but not more than five years 743 657 836 706<br />

More than five years 176 168 228 225<br />

Total minimum lease payments 1,385 1,643<br />

Less amounts representing finance charges (153) (237)<br />

Present value of minimum lease payments 1,232 1,232 1,406 1,406<br />

It is the <strong>Group</strong>'s policy to lease certain of its assets under finance leases. <strong>The</strong> weighted average outstanding lease term is 4.93 years (2004: 5.53 years).<br />

For the 52 weeks ended 30 December <strong>2005</strong>, the weighted average effective borrowing rate was 5.69% (2004: 5.88%). All leases are on a fixed repayment<br />

basis and no arrangements have been entered into for contingent rental payments.<br />

<strong>The</strong> <strong>Weir</strong> <strong>Group</strong> PLC Annual Report <strong>2005</strong> 79