2005 - The Weir Group

2005 - The Weir Group

2005 - The Weir Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

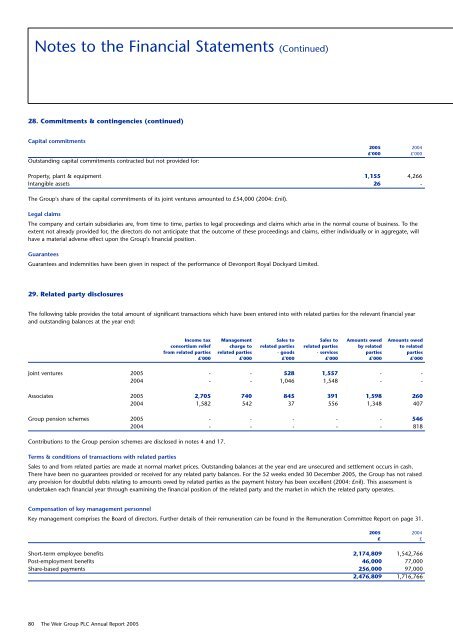

Notes to the Financial Statements (Continued)<br />

28. Commitments & contingencies (continued)<br />

Capital commitments<br />

Outstanding capital commitments contracted but not provided for:<br />

<strong>2005</strong> 2004<br />

£'000<br />

£'000<br />

Property, plant & equipment 1,155 4,266<br />

Intangible assets 26 -<br />

<strong>The</strong> <strong>Group</strong>'s share of the capital commitments of its joint ventures amounted to £54,000 (2004: £nil).<br />

Legal claims<br />

<strong>The</strong> company and certain subsidiaries are, from time to time, parties to legal proceedings and claims which arise in the normal course of business. To the<br />

extent not already provided for, the directors do not anticipate that the outcome of these proceedings and claims, either individually or in aggregate, will<br />

have a material adverse effect upon the <strong>Group</strong>'s financial position.<br />

Guarantees<br />

Guarantees and indemnities have been given in respect of the performance of Devonport Royal Dockyard Limited.<br />

29. Related party disclosures<br />

<strong>The</strong> following table provides the total amount of significant transactions which have been entered into with related parties for the relevant financial year<br />

and outstanding balances at the year end:<br />

Income tax Management Sales to Sales to Amounts owed Amounts owed<br />

consortium relief charge to related parties related parties by related to related<br />

from related parties related parties - goods - services parties parties<br />

£'000 £'000 £'000 £'000 £'000 £'000<br />

Joint ventures <strong>2005</strong> - - 528 1,557 - -<br />

2004 - - 1,046 1,548 - -<br />

Associates <strong>2005</strong> 2,705 740 845 391 1,598 260<br />

2004 1,582 542 37 556 1,348 407<br />

<strong>Group</strong> pension schemes <strong>2005</strong> - - - - - 546<br />

2004 - - - - - 818<br />

Contributions to the <strong>Group</strong> pension schemes are disclosed in notes 4 and 17.<br />

Terms & conditions of transactions with related parties<br />

Sales to and from related parties are made at normal market prices. Outstanding balances at the year end are unsecured and settlement occurs in cash.<br />

<strong>The</strong>re have been no guarantees provided or received for any related party balances. For the 52 weeks ended 30 December <strong>2005</strong>, the <strong>Group</strong> has not raised<br />

any provision for doubtful debts relating to amounts owed by related parties as the payment history has been excellent (2004: £nil). This assessment is<br />

undertaken each financial year through examining the financial position of the related party and the market in which the related party operates.<br />

Compensation of key management personnel<br />

Key management comprises the Board of directors. Further details of their remuneration can be found in the Remuneration Committee Report on page 31.<br />

<strong>2005</strong> 2004<br />

£ £<br />

Short-term employee benefits 2,174,809 1,542,766<br />

Post-employment benefits 46,000 77,000<br />

Share-based payments 256,000 97,000<br />

2,476,809 1,716,766<br />

80 <strong>The</strong> <strong>Weir</strong> <strong>Group</strong> PLC Annual Report <strong>2005</strong>