PARK HILL SCHOOL DISTRICT FINANCIAL STATEMENTS with ...

PARK HILL SCHOOL DISTRICT FINANCIAL STATEMENTS with ...

PARK HILL SCHOOL DISTRICT FINANCIAL STATEMENTS with ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

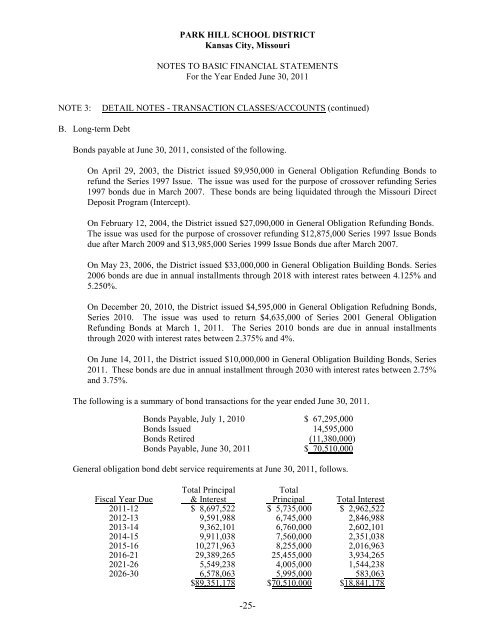

<strong>PARK</strong> <strong>HILL</strong> <strong>SCHOOL</strong> <strong>DISTRICT</strong><br />

Kansas City, Missouri<br />

NOTES TO BASIC <strong>FINANCIAL</strong> <strong>STATEMENTS</strong><br />

For the Year Ended June 30, 2011<br />

NOTE 3:<br />

DETAIL NOTES - TRANSACTION CLASSES/ACCOUNTS (continued)<br />

B. Long-term Debt<br />

Bonds payable at June 30, 2011, consisted of the following.<br />

On April 29, 2003, the District issued $9,950,000 in General Obligation Refunding Bonds to<br />

refund the Series 1997 Issue. The issue was used for the purpose of crossover refunding Series<br />

1997 bonds due in March 2007. These bonds are being liquidated through the Missouri Direct<br />

Deposit Program (Intercept).<br />

On February 12, 2004, the District issued $27,090,000 in General Obligation Refunding Bonds.<br />

The issue was used for the purpose of crossover refunding $12,875,000 Series 1997 Issue Bonds<br />

due after March 2009 and $13,985,000 Series 1999 Issue Bonds due after March 2007.<br />

On May 23, 2006, the District issued $33,000,000 in General Obligation Building Bonds. Series<br />

2006 bonds are due in annual installments through 2018 <strong>with</strong> interest rates between 4.125% and<br />

5.250%.<br />

On December 20, 2010, the District issued $4,595,000 in General Obligation Refudning Bonds,<br />

Series 2010. The issue was used to return $4,635,000 of Series 2001 General Obligation<br />

Refunding Bonds at March 1, 2011. The Series 2010 bonds are due in annual installments<br />

through 2020 <strong>with</strong> interest rates between 2.375% and 4%.<br />

On June 14, 2011, the District issued $10,000,000 in General Obligation Building Bonds, Series<br />

2011. These bonds are due in annual installment through 2030 <strong>with</strong> interest rates between 2.75%<br />

and 3.75%.<br />

The following is a summary of bond transactions for the year ended June 30, 2011.<br />

Bonds Payable, July 1, 2010 $ 67,295,000<br />

Bonds Issued 14,595,000<br />

Bonds Retired (11,380,000)<br />

Bonds Payable, June 30, 2011 $ 70,510,000<br />

General obligation bond debt service requirements at June 30, 2011, follows.<br />

Total Principal Total<br />

Fiscal Year Due & Interest Principal Total Interest<br />

2011-12 $ 8,697,522 $ 5,735,000 $ 2,962,522<br />

2012-13 9,591,988 6,745,000 2,846,988<br />

2013-14 9,362,101 6,760,000 2,602,101<br />

2014-15 9,911,038 7,560,000 2,351,038<br />

2015-16 10,271,963 8,255,000 2,016,963<br />

2016-21 29,389,265 25,455,000 3,934,265<br />

2021-26 5,549,238 4,005,000 1,544,238<br />

2026-30 6,578,063 5,995,000 583,063<br />

$89,351,178 $70,510,000 $18,841,178<br />

-25-