870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

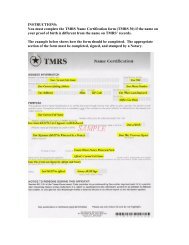

CONTRIBUTION RATE INFORMATION<br />

CONTINUED<br />

COMPARISON OF THE RATE CALCULATED IN THE VALUATION TO THE RATE<br />

FOR THE SAME PLAN OF BENEFITS BASED ON THE VALUATION FOR THE PREVIOUS YEAR<br />

NUMBER OF CITIES<br />

VALUATION<br />

DATE<br />

DECREASE OF<br />

0.50% OR MORE<br />

DECREASE OR INCREASE<br />

OF LESS THAN 0.50%<br />

INCREASE OF<br />

0.50% OR MORE TOTAL<br />

12/31/1999<br />

12/31/2000<br />

12/31/2001<br />

12/31/2002<br />

12/31/2003(O)<br />

12/31/2003(N)<br />

12/31/2004<br />

104<br />

87<br />

98<br />

91<br />

68<br />

48<br />

176<br />

523<br />

548<br />

556<br />

536<br />

542<br />

370<br />

517<br />

98<br />

104<br />

99<br />

142<br />

179<br />

371<br />

104<br />

725<br />

739<br />

753<br />

769<br />

789<br />

789<br />

797<br />

The financing objective for each <strong>TMRS</strong> plan is to finance long-term benefit promises through contributions<br />

that remain approximately level from year to year as a percent of the city's payroll. To test how well the<br />

financing objective is being achieved, an actuarial valuation is made each year to determine the city's contribution<br />

rate for the calendar year beginning one year after the valuation date.<br />

Another important test is made every five years to evaluate the actuarial assumptions used to calculate each<br />

city's contribution rate. As a result of the 1998-2002 study of actuarial experience, new actuarial assumptions<br />

were adopted by the Board of Trustees, effective with the December 31, 2003 valuation. In order to prevent<br />

burdensome cost increases as a consequence of the revisions in actuarial assumptions, an optional five-year<br />

phase-in of the increase attributable to assumption changes was implemented.<br />

The line above indicated as 12/31/2003(O) shows a summary of what the changes in the cities' contribution<br />

rates from 2004 to 2005 would have been if the old assumptions had been used. Line 12/31/2003(N) shows<br />

the changes with the new assumptions. Eight cities elected to phase-in the change. The phase-in rates are<br />

reflected in the 12/31/2004 line.<br />

The table above shows that for the 1999 to 2004 valuations, the change in the city's rate from one year to the<br />

next was less than 0.50% of payroll for a large majority of participating cities.<br />

T M R S COMPREHENSIVE ANNUAL FINANCIAL REPORT 2004<br />

101