870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO FINANCIAL STATEMENTS<br />

CONTINUED<br />

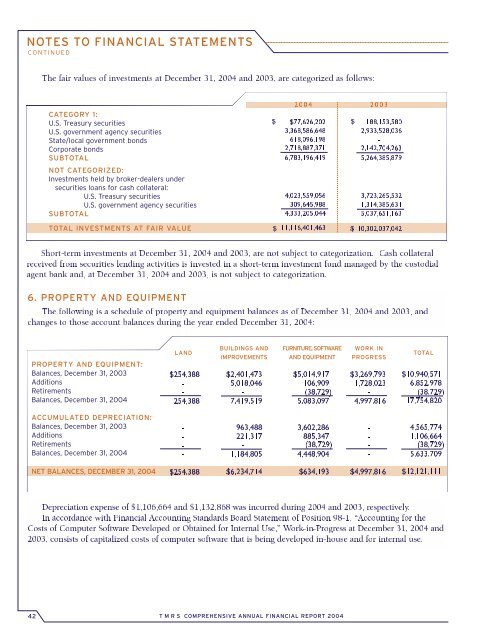

The fair values of investments at December 31, 2004 and 2003, are categorized as follows:<br />

CATEGORY 1:<br />

U.S. Treasury securities<br />

U.S. government agency securities<br />

State/local government bonds<br />

Corporate bonds<br />

SUBTOTAL<br />

NOT CATEGORIZED:<br />

Investments held by broker-dealers under<br />

securities loans for cash collateral:<br />

U.S. Treasury securities<br />

U.S. government agency securities<br />

SUBTOTAL<br />

2004<br />

$ $77,626,202<br />

3,368,586,648<br />

618,096,198<br />

2,718,887,371<br />

6,783,196,419<br />

$<br />

4,023,559,056<br />

309,645,988<br />

4,333,205,044<br />

2003<br />

188,153,580<br />

2,933,528,036<br />

-<br />

2,142,704,263<br />

5,264,385,879<br />

3,723,265,532<br />

1,314,385,631<br />

5,037,651,163<br />

TOTAL INVESTMENTS AT FAIR VALUE<br />

$<br />

11,116,401,463<br />

$ 10,302,037,042<br />

Short-term investments at December 31, 2004 and 2003, are not subject to categorization. Cash collateral<br />

received from securities lending activities is invested in a short-term investment fund managed by the custodial<br />

agent bank and, at December 31, 2004 and 2003, is not subject to categorization.<br />

6. PROPERTY AND EQUIPMENT<br />

The following is a schedule of property and equipment balances as of December 31, 2004 and 2003, and<br />

changes to those account balances during the year ended December 31, 2004:<br />

PROPERTY AND EQUIPMENT:<br />

Balances, December 31, 2003<br />

Additions<br />

Retirements<br />

Balances, December 31, 2004<br />

LAND<br />

$254,388<br />

-<br />

-<br />

254,388<br />

BUILDINGS AND<br />

IMPROVEMENTS<br />

$2,401,473<br />

5,018,046<br />

-<br />

7,419,519<br />

FURNITURE, SOFTWARE<br />

AND EQUIPMENT<br />

WORK IN<br />

PROGRESS<br />

TOTAL<br />

$5,014,917<br />

106,909<br />

(38,729)<br />

$3,269,793<br />

1,728,023<br />

-<br />

$10,940,571<br />

6,852,978<br />

(38,729)<br />

5,083,097 4,997,816 17,754,820<br />

ACCUMULATED DEPRECIATION:<br />

Balances, December 31, 2003<br />

Additions<br />

Retirements<br />

Balances, December 31, 2004<br />

-<br />

-<br />

-<br />

-<br />

963,488<br />

221,317<br />

-<br />

1,184,805<br />

3,602,286<br />

885,347<br />

(38,729)<br />

-<br />

-<br />

-<br />

4,565,774<br />

1,106,664<br />

(38,729)<br />

4,448,904<br />

-<br />

5,633,709<br />

NET BALANCES, DECEMBER 31, 2004<br />

$254,388<br />

$6,234,714<br />

$634,193<br />

$4,997,816<br />

$12,121,111<br />

Depreciation expense of $1,106,664 and $1,132,868 was incurred during 2004 and 2003, respectively.<br />

In accordance with Financial Accounting Standards Board Statement of Position 98-1, “Accounting for the<br />

Costs of Computer Software Developed or Obtained for Internal Use,” Work-in-Progress at December 31, 2004 and<br />

2003, consists of capitalized costs of computer software that is being developed in-house and for internal use.<br />

42<br />

T M R S COMPREHENSIVE ANNUAL FINANCIAL REPORT 2004