870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

870173 TMRS CAFR new8 fix 049-081.qxd - Texas Municipal ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

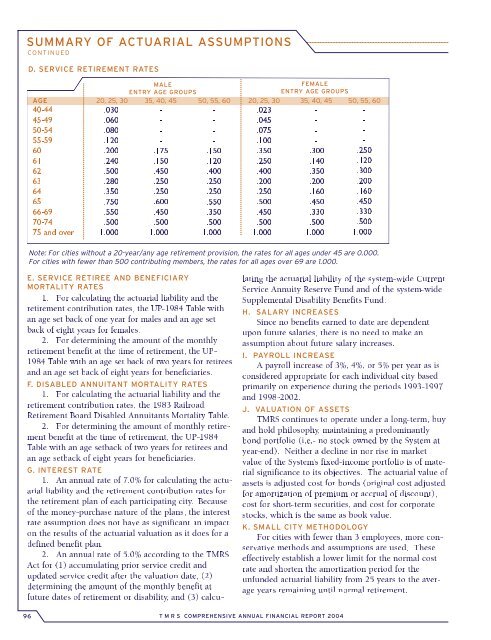

SUMMARY OF ACTUARIAL ASSUMPTIONS<br />

CONTINUED<br />

D. SERVICE RETIREMENT RATES<br />

MALE<br />

ENTRY AGE GROUPS<br />

FEMALE<br />

ENTRY AGE GROUPS<br />

AGE 20, 25, 30 35, 40, 45 50, 55, 60 20, 25, 30 35, 40, 45 50, 55, 60<br />

40-44<br />

45-49<br />

50-54<br />

55-59<br />

60<br />

61<br />

62<br />

63<br />

64<br />

65<br />

66-69<br />

70-74<br />

75 and over<br />

.030<br />

.060<br />

.080<br />

.120<br />

.200<br />

.240<br />

.500<br />

.280<br />

.350<br />

.750<br />

.550<br />

.500<br />

1.000<br />

-<br />

-<br />

-<br />

-<br />

.175<br />

.150<br />

.450<br />

.250<br />

.250<br />

.600<br />

.450<br />

.500<br />

1.000<br />

-<br />

-<br />

-<br />

-<br />

.150<br />

.120<br />

.400<br />

.250<br />

.250<br />

.550<br />

.350<br />

.500<br />

1.000<br />

.023<br />

.045<br />

.075<br />

.100<br />

.350<br />

.250<br />

.400<br />

.200<br />

.250<br />

.500<br />

.450<br />

.500<br />

1.000<br />

-<br />

-<br />

-<br />

-<br />

.300<br />

.140<br />

.350<br />

.200<br />

.160<br />

.450<br />

.330<br />

.500<br />

1.000<br />

-<br />

-<br />

-<br />

-<br />

.250<br />

.120<br />

.300<br />

.200<br />

.160<br />

.450<br />

.330<br />

.500<br />

1.000<br />

Note: For cities without a 20-year/any age retirement provision, the rates for all ages under 45 are 0.000.<br />

For cities with fewer than 500 contributing members, the rates for all ages over 69 are 1.000.<br />

E. SERVICE RETIREE AND BENEFICIARY<br />

MORTALITY RATES<br />

1. For calculating the actuarial liability and the<br />

retirement contribution rates, the UP-1984 Table with<br />

an age set back of one year for males and an age set<br />

back of eight years for females.<br />

2. For determining the amount of the monthly<br />

retirement benefit at the time of retirement, the UP-<br />

1984 Table with an age set back of two years for retirees<br />

and an age set back of eight years for beneficiaries.<br />

F. DISABLED ANNUITANT MORTALITY RATES<br />

1. For calculating the actuarial liability and the<br />

retirement contribution rates, the 1983 Railroad<br />

Retirement Board Disabled Annuitants Mortality Table.<br />

2. For determining the amount of monthly retirement<br />

benefit at the time of retirement, the UP-1984<br />

Table with an age setback of two years for retirees and<br />

an age setback of eight years for beneficiaries.<br />

G. INTEREST RATE<br />

1. An annual rate of 7.0% for calculating the actuarial<br />

liability and the retirement contribution rates for<br />

the retirement plan of each participating city. Because<br />

of the money-purchase nature of the plans, the interest<br />

rate assumption does not have as significant an impact<br />

on the results of the actuarial valuation as it does for a<br />

defined benefit plan.<br />

2. An annual rate of 5.0% according to the <strong>TMRS</strong><br />

Act for (1) accumulating prior service credit and<br />

updated service credit after the valuation date, (2)<br />

determining the amount of the monthly benefit at<br />

future dates of retirement or disability, and (3) calculating<br />

the actuarial liability of the system-wide Current<br />

Service Annuity Reserve Fund and of the system-wide<br />

Supplemental Disability Benefits Fund.<br />

H. SALARY INCREASES<br />

Since no benefits earned to date are dependent<br />

upon future salaries, there is no need to make an<br />

assumption about future salary increases.<br />

I. PAYROLL INCREASE<br />

A payroll increase of 3%, 4%, or 5% per year as is<br />

considered appropriate for each individual city based<br />

primarily on experience during the periods 1993-1997<br />

and 1998-2002.<br />

J. VALUATION OF ASSETS<br />

<strong>TMRS</strong> continues to operate under a long-term, buy<br />

and hold philosophy, maintaining a predominantly<br />

bond portfolio (i.e.- no stock owned by the System at<br />

year-end). Neither a decline in nor rise in market<br />

value of the System’s <strong>fix</strong>ed-income portfolio is of material<br />

significance to its objectives. The actuarial value of<br />

assets is adjusted cost for bonds (original cost adjusted<br />

for amortization of premium or accrual of discount),<br />

cost for short-term securities, and cost for corporate<br />

stocks, which is the same as book value.<br />

K. SMALL CITY METHODOLOGY<br />

For cities with fewer than 3 employees, more conservative<br />

methods and assumptions are used. These<br />

effectively establish a lower limit for the normal cost<br />

rate and shorten the amortization period for the<br />

unfunded actuarial liability from 25 years to the average<br />

years remaining until normal retirement.<br />

96<br />

T M R S COMPREHENSIVE ANNUAL FINANCIAL REPORT 2004