FIA ACCA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

146<br />

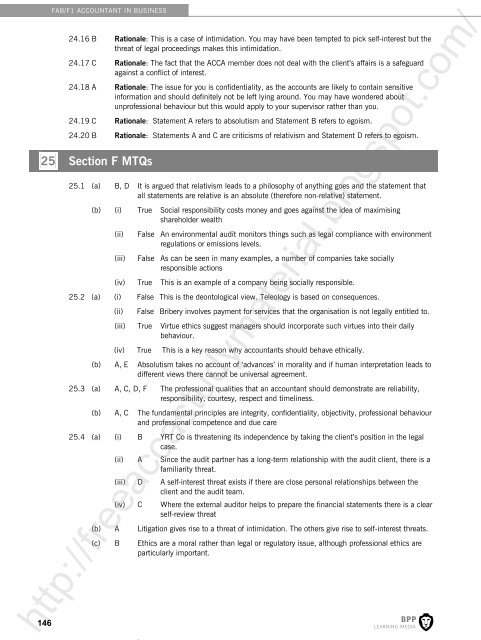

FAB/F1 ACCOUNTANT IN BUSINESS<br />

24.16 B Rationale: This is a case of intimidation. You may have been tempted to pick self-interest but the<br />

threat of legal proceedings makes this intimidation.<br />

24.17 C Rationale: The fact that the <strong>ACCA</strong> member does not deal with the client’s affairs is a safeguard<br />

against a conflict of interest.<br />

24.18 A Rationale: The issue for you is confidentiality, as the accounts are likely to contain sensitive<br />

information and should definitely not be left lying around. You may have wondered about<br />

unprofessional behaviour but this would apply to your supervisor rather than you.<br />

24.19 C Rationale: Statement A refers to absolutism and Statement B refers to egoism.<br />

24.20 B Rationale: Statements A and C are criticisms of relativism and Statement D refers to egoism.<br />

25 Section F MTQs<br />

25.1 (a) B, D It is argued that relativism leads to a philosophy of anything goes and the statement that<br />

all statements are relative is an absolute (therefore non-relative) statement.<br />

(b) (i) True Social responsibility costs money and goes against the idea of maximising<br />

shareholder wealth<br />

(ii)<br />

(iii)<br />

False An environmental audit monitors things such as legal compliance with environment<br />

regulations or emissions levels.<br />

False As can be seen in many examples, a number of companies take socially<br />

responsible actions<br />

(iv) True This is an example of a company being socially responsible.<br />

25.2 (a) (i) False This is the deontological view. Teleology is based on consequences.<br />

(ii)<br />

False Bribery involves payment for services that the organisation is not legally entitled to.<br />

(iii) True Virtue ethics suggest managers should incorporate such virtues into their daily<br />

behaviour.<br />

(iv) True This is a key reason why accountants should behave ethically.<br />

(b) A, E Absolutism takes no account of ‘advances’ in morality and if human interpretation leads to<br />

different views there cannot be universal agreement.<br />

25.3 (a) A, C, D, F The professional qualities that an accountant should demonstrate are reliability,<br />

responsibility, courtesy, respect and timeliness.<br />

(b) A, C The fundamental principles are integrity, confidentiality, objectivity, professional behaviour<br />

and professional competence and due care<br />

25.4 (a) (i) B YRT Co is threatening its independence by taking the client’s position in the legal<br />

case.<br />

(ii) A Since the audit partner has a long-term relationship with the audit client, there is a<br />

familiarity threat.<br />

(iii) D A self-interest threat exists if there are close personal relationships between the<br />

client and the audit team.<br />

(iv) C Where the external auditor helps to prepare the financial statements there is a clear<br />

self-review threat<br />

(b) A Litigation gives rise to a threat of intimidation. The others give rise to self-interest threats.<br />

(c) B Ethics are a moral rather than legal or regulatory issue, although professional ethics are<br />

particularly important.<br />

http://freeaccastudymaterial.blogspot.com/