Annual Report 2007 - CS LoxInfo

Annual Report 2007 - CS LoxInfo

Annual Report 2007 - CS LoxInfo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12 <strong>CS</strong> LOXINFO

d is Flat. by<br />

High<br />

Quality<br />

Internet<br />

<br />

4 Financial Highlights<br />

Contents<br />

7 Dividend Policy<br />

8 Message from Chairman of the Board<br />

and Chairman of the Executive<br />

Committee<br />

9 Message from Managing Director<br />

12 <strong>Report</strong> of the Audit Committee<br />

14 Directors and Management Team<br />

20 Corporate Governance<br />

45 Directors’ Shareholding in the Company<br />

and its Subsidiaries of the Year <strong>2007</strong><br />

48 Investment Structure of Shin Group<br />

50 Major Shareholders<br />

51 General Information of the Company and<br />

Subsidiaries<br />

56 Business Overview<br />

72 Major Developments<br />

76 Risk Factors<br />

79 Related Party Transactions<br />

86 Management’s Discussion and Analysis<br />

93 Board of Directors’ Responsibility for<br />

Financial <strong>Report</strong>ing<br />

94 Auditor’s <strong>Report</strong><br />

102 Consolidated and Company Financial<br />

Statements<br />

145 Remuneration of Auditors<br />

146 General Information on Reference<br />

Persons<br />

147 Investor Information<br />

148 Contributions to Society<br />

152 Glossary

The more freedom of connection, <br />

The more unlimited distance.<br />

<br />

<strong>CS</strong> LOXINFO

Internet<br />

Data<br />

Center<br />

<br />

<strong>CS</strong> LOXINFO

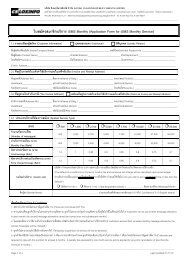

Financial Highlights<br />

<br />

(Unit : Million Baht)<br />

<strong>2007</strong><br />

<br />

2006<br />

<br />

2005<br />

<br />

2004<br />

OPERATING RESULTS<br />

<br />

Revenues from Sales and Services 2,518 2,460 2,249 1,982 <br />

Total Revenues 2,600 2,512 2,321 2,004 <br />

Gross Profit (Loss) 1,218 1,147 1,061 939 <br />

Net Profit (Loss) 261 213 196 328 <br />

FINANCIAL POSITION<br />

Total Assets 2,368 2,615 3,012 2,561 <br />

Total Liabilities 743 807 854 662 <br />

Total Shareholders’ equity 1,625 1,808 2,158 1,899 <br />

Net Cash Flows from Operation 584 704 530 447 <br />

FINANCIAL RATIO<br />

Current Ratio 1.66 1.88 1.88 2.52 <br />

Debt to Equity Ratio 0.46 0.45 0.40 0.35 <br />

Gross Profit (Loss) Margin 46.86% 45.66% 45.70% 46.85% <br />

Net Profit (Loss) Margin 10.08% 8.46% 8.46% 16.38% <br />

Return on Assets 10.51% 7.56% 7.05% 18.41% <br />

Return on Equity 15.26% 10.72% 9.68% 17.28% <br />

Basic Earning per Share 0.42 0.34 0.31 0.55 <br />

Dividend per Share 0.40 0.74 0.45 0.40 <br />

Book Value per Share 2.59 2.89 3.45 3.02 <br />

No. of Shares (Million Shares) 627 625 625 625<br />

Note: The Copany didn’t restate the year 2004’s comparative financial statements retrospectively for the deferred income tax<br />

accounting policy.<br />

<br />

<strong>CS</strong> LOXINFO

<strong>2007</strong><br />

2006<br />

2005<br />

2004<br />

Year<br />

<strong>2007</strong><br />

2006<br />

2005<br />

2004<br />

Year<br />

<strong>2007</strong><br />

2006<br />

2005<br />

2004<br />

Year<br />

<strong>2007</strong><br />

2006<br />

2005<br />

2004<br />

Year<br />

<br />

<strong>CS</strong> LOXINFO

Vision & Mission<br />

Customer <br />

are able <br />

to find or <br />

buy/sell local <br />

products & Services<br />

Target Market<br />

Business <br />

to <br />

Business<br />

<br />

Business <br />

to <br />

Consumer<br />

<br />

Distribution Channels<br />

• Print Classifies (Daily & Weekly)<br />

• YellowPages Directory <br />

• Websites<br />

• Mobile Service and Call Center 1188<br />

<br />

Existing Businesses<br />

• Internet Services<br />

• Print YellowPages Advertising<br />

• Mobile Contents Provider<br />

• Print Classifies (Auto, Job, Real Estate, Education, etc)<br />

Integrated Vision & Mission<br />

Develop the business into services that are extendable from the existing or related businesses aimed at<br />

searching information to buy, sell or exchange in different ways for a variety of products e.g. cars, jobs, home,<br />

education and etc. with type of services that will be able to provide better convenience for customers across<br />

different needs.<br />

<br />

<strong>CS</strong> LOXINFO

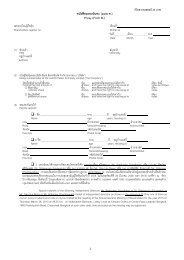

Dividend Policy <br />

<br />

<br />

The Company’s dividend policy<br />

The Company’s dividend policy is to pay dividend no less than 40 percent of net profit after tax, if the<br />

fund is not required elsewhere and subject to the economic and future project of the Company and the<br />

subsidiaries and the payment would have no significant effect on the running of the Company.<br />

<br />

<br />

The Company’s dividend payments during the past three years are as follows:-<br />

<br />

Dividend from Operations <strong>2007</strong> 2006 2005 <br />

<br />

<br />

<br />

Payout Ratio (%) * 49.10 217.56 143.49<br />

Total of dividend payment (Million Baht) 240.40 462.50 281.25<br />

Dividend per share (Baht) 0.40 0.74 0.45<br />

* Note: Payout Ratio year 2005 and year 2006 calculated from the consolidated net profit of the company (which equivalent<br />

to the stand alone net profit of the company), for Payout Ratio year <strong>2007</strong> calculated from the stand alone net profit <br />

of the company following by the company’ s dividend policy.<br />

<br />

<br />

• The subsidiaries of the Company’s dividend policy<br />

Loxley Information Services Company Limited, Teleinfo Media Public Company Limited, AD Venture<br />

Company Limited and Watta Classifieds Company Limited its subsidiaries of the Company have the<br />

dividend policy is to pay dividend no less than 50 percent of net profit.<br />

<br />

<br />

<strong>CS</strong> LOXINFO

Message from Chairman of the Board <br />

and Chairman of the Executive Committee<br />

<br />

Prof. Wongkulpat Snidvongs <br />

na Ayudyha, M.D. <br />

Chairman of the Board<br />

Dr. Dumrong Kasemset<br />

Chairman of the Executive Committee<br />

<br />

<strong>2007</strong> was another year that <strong>CS</strong> <strong>LoxInfo</strong> Public Company Limited could build<br />

a good level of returns to shareholders. On top of the high dividend payout, the<br />

Company was able to allocate 222 million Baht of net profit to repurchase the<br />

shares with an objective to manage shareholder return in the long run. <br />

<br />

For <strong>2007</strong>’s operating results, the Company reported total revenues of 2,600<br />

million Baht, 55% was from the internet business and 34% was from Teleinfo<br />

Media Public Company Limited who operates the YellowPages business. <br />

<br />

As for the new investment in the past year, the Company had invested in a<br />

60% stake in publishing businesses that primarily focused on selling classified ads<br />

for market popular products e.g. cars, jobs, homes, education. In view that such<br />

business is in line with the YellowPages business, which is categorized as another<br />

type of classified ad, thus when combining all products and services information,<br />

it puts the Company in a better position to carry on providing these service. <br />

<br />

In 2008, the Company plans to develop its products and services, especially<br />

online search and exchange of information via internet, call center or mobile phone<br />

in order to respond to varying needs of customers.<br />

<br />

In terms of the overall policy, the Company will place a strong emphasis on<br />

developing products and services that can satisfy demands from target customers,<br />

both corporate and individual. Moreover, the Company has realized the importance<br />

of being part of an enduring Thai society. From past to present, not only has the<br />

Company supported various kinds of social activities for the benefit of youths and<br />

several communities throughout Thailand, but also will continue to carry on<br />

activities that are successful and receive cooperation from social parties.<br />

<br />

On December 11, <strong>2007</strong>, the Board was awarded the “Board of the Year<br />

Award for Exemplary Practice” organized by the Thai Institute of Directors<br />

Association, in cooperation with the Stock Exchange of Thailand (SET), and Board<br />

of Trade of Thailand. This award was for the recognition of the Board of having<br />

responsibility to the shareholders, and monitored the corporate in line with the Good<br />

Corporate Governance Principle. It was of benefits to all shareholders fairly and<br />

equitably. On behalf of the Board, and the Executive Committee, we will strive for<br />

efficient management for the good performance, with maximize and continual profit. <br />

<br />

<br />

<br />

<br />

<br />

Prof. Wongkulpat Snidvongs na Ayudyha, M.D.<br />

Chairman of the Board<br />

Dr. Dumrong Kasemset<br />

Chairman of the Executive Committee<br />

<br />

<strong>CS</strong> LOXINFO

Message from Managing Director<br />

<strong>CS</strong> <strong>LoxInfo</strong> Public Company Limited <br />

and Teleinfo Media Public Company Limited<br />

<br />

In <strong>2007</strong>, the country’s overall internet business was still growing. For the<br />

internet business of <strong>CS</strong> <strong>LoxInfo</strong> Public Company Limited, it was still able to<br />

generate a good profit to shareholders compared to competitors in the market<br />

despite intense competition and Thai economic status which remained weak.<br />

<br />

For the YellowPages business, a media inwhich buyers look for sellers,<br />

it had further expanded into two dimensions. The first dimension expanded the<br />

existing target group that covers the purchasing and procurement of both<br />

government and private entities into personal consumptions that are necessary in<br />

daily life whereas the second dimension expanded sub-community areas in order to<br />

better facilitate specific consumptions in each city and each area. <br />

<br />

Such expansion spelled out two volumes of City YellowPages (City Pages)<br />

i.e. Nonthaburi and Pathumthani which in turn enlarged the customer base by<br />

approximately 10%. The Company is already set to expand into other provinces e.g.<br />

Phuket, Chiang Mai, Nakhon Ratchasima and Bangkok in the form of Urban Living<br />

YellowPages in the coming year. <br />

<br />

Overall, the Company will continue its policy of providing services aimed at<br />

developing products to increase variety and flexibility in order to serve various<br />

customer needs. In the mean time, the Company will still largely give importance to<br />

products and services in the private sector.<br />

<br />

Lastly, I and fellow teamwork in the Company are very determined to work<br />

hard to drive our business forward in a secure manner. At the same time, we would<br />

like to create benefit across all stakeholders, including shareholders, employees,<br />

government and Thai society as well as the development of information in Thailand.<br />

We therefore would like to thank all shareholders for your continued trust and<br />

support in the Company’s business.<br />

Mr. Anant Kaewruamvongs<br />

Managing Director<br />

<br />

Mr. Somchai Sinjananuruk<br />

Managing Director<br />

<br />

Mr. Anant Kaewruamvongs<br />

Managing Director<br />

<strong>CS</strong> <strong>LoxInfo</strong> Public Company Limited<br />

<br />

Mr. Somchai Sinjananuruk<br />

Managing Director<br />

Teleinfo Media Public Company Limited<br />

<br />

<strong>CS</strong> LOXINFO

Open-up your world the way you want; <br />

Everything is within reach.<br />

10<br />

<strong>CS</strong> LOXINFO

ADSL<br />

11<br />

<strong>CS</strong> LOXINFO

<strong>Report</strong> of the Audit Committee<br />

<br />

In year <strong>2007</strong>, the Audit Committee (AC)<br />

membership composition was unchanged consisting <br />

of Mr. Prathueng Srirodbang, the Chairman, with<br />

expertise in legal matters, Mr. Gan Hui Beng, and <br />

Dr. Sillapaporn Srijunpetch, the other members of the<br />

AC with expertise in management, finance, accounting,<br />

and auditing, and being in position for four years, four<br />

years, and two years, respectively. All members possess<br />

qualifications as prescribed by the SET, own no<br />

shares in the Company, take no part in business<br />

management, and are not consultants or business<br />

partners of the Company or its related companies, and<br />

have not been appointed to protect the interest of<br />

directors or major shareholders.<br />

In <strong>2007</strong>, the AC met six times in meetings<br />

involving top management, internal auditors, and<br />

external auditors to carry out its roles, duties and<br />

responsibilities under the Audit Committee Charter <br />

as well as to address matters specifically assigned by<br />

the Board. The following is a summary of significant<br />

matters addressed during the year.<br />

1. Reviewing for Good Corporate Governance.<br />

The AC monitored to ensure the Company complied<br />

with relevant laws and regulations, like the SET and<br />

SEC regulations and notifications, the rules and<br />

regulations of NTC, as well as the general business<br />

laws. The Committee also reviewed for adequate,<br />

accurate, and timely information disclosure by the<br />

Company, particularly in the areas of connected<br />

transactions, to ensure that they had been entered into<br />

on arm’s length basis under normal commercial terms. <br />

2. Reviewing Quarterly and Year End Financial <br />

Statements. The AC reviewed the financial<br />

statements for compliance with generally accepted<br />

accounting principles, and ensured information<br />

disclosed was clear, adequate, timely and meaningful<br />

for the shareholders and other users of the published<br />

financial statements. To this end, the AC reviewed<br />

the external auditor’s audit work plan, involved the<br />

external auditors in meetings to review the Financial<br />

Statements for material accounts, changes, adjustments,<br />

reserves, provisions and significant information<br />

disclosures. The AC met once with the external<br />

auditor and his audit team without management<br />

presence to affirm the auditor’s independence and to<br />

obtain independent feedback on the audit result and<br />

internal control environment. In year <strong>2007</strong>, the<br />

external audit findings did not reveal material<br />

financial reporting issues.<br />

3. Reviewing Company’s Risk Management.<br />

The AC reviewed the quarterly meeting minutes of<br />

the Company’s Risk Management Committee, paying<br />

particular attention to identification of risk factors and<br />

their treatment or mitigation, and provided<br />

constructive suggestions of ways identified risks<br />

could be more effectively managed. It was observed<br />

that the business environment in year <strong>2007</strong> had not<br />

changed dramatically from previous years. The major<br />

risks of the Company resided in the external<br />

operating environment relating to intense price<br />

competition, regulatory rules and conditions<br />

governing business operation, and third party support<br />

to the service infrastructure.<br />

12<br />

<strong>CS</strong> LOXINFO

4. Reviewing Company Internal Control. The<br />

AC reviewed the adequacy of internal control within<br />

the Company on a regular basis from the reports of<br />

both internal and external auditors. The AC would<br />

bring major items of concern to the attention of the<br />

Board together with the remedial action to be taken.<br />

This approach encouraged management of the<br />

Company to ensure adequate and effective internal<br />

control in achieving business focus, operations<br />

efficiency, effective risk management, safeguard of<br />

assets, and people management. Overall, the AC was<br />

of the opinion that the Company had adequate<br />

internal and management control.<br />

5. Overseeing Company Internal Audit Function.<br />

The Office of Internal Audit of the Company reports<br />

directly to the AC on a functional basis. During the<br />

year, the AC reviewed and approved the Internal<br />

Audit annual work plan covering both the Company<br />

and its subsidiaries. In the review, the AC took into<br />

account sufficiency of headcount, effectiveness of the<br />

internal auditing process, and provided constructive<br />

suggestions on improvements.<br />

6. Selection of External Auditors. The AC<br />

monitored the work quality and independence of the<br />

external auditors through the quarterly financial<br />

statements review and in private discussion. The AC<br />

also considered the scope of external audit work and<br />

related audit fee. For year <strong>2007</strong> external audit, the<br />

AC recommended the re-appointment of Pricewaterhouse<br />

Coopers ABAS (PwC) as the external auditors of the<br />

Company for one more year at a fee of Baht 1,660,925<br />

and to comply with SET regulation, another audit<br />

partner of PwC took over as the Company’s statutory<br />

auditor. In line with the Company’s practice of external<br />

auditors rotation, the AC evaluated and finally<br />

recommended KPMG to be the external auditors of<br />

the Company for year 2008.<br />

7. Self-assessment of the AC. The AC<br />

performed an assessment of its actual work covered<br />

in <strong>2007</strong> by reference to the AC charter and known<br />

best practices. The results showed that, on a practical<br />

basis, the scope of work covered by the AC in <strong>2007</strong><br />

was in line with both the AC charter and established<br />

good practices.<br />

In conclusion, in the year <strong>2007</strong>, the Audit<br />

Committee reviewed the performance of the Company<br />

and its subsidiaries in the areas of business<br />

operations, corporate governance, financial reporting,<br />

internal control and risk management, with the<br />

management, external auditors, and internal auditors,<br />

to ensure that the business of the Company was<br />

conducted with adequate internal control and risk<br />

management, and the reported financial statements<br />

were accurately prepared using generally accepted<br />

accounting principles.<br />

Mr. Prathueng Srirodbang<br />

Chairman of the Audit Committee<br />

February 19, 2008<br />

13<br />

<strong>CS</strong> LOXINFO

Director Team <br />

<br />

Prof. Wongkulpat Snidvongs na Ayudyha, M.D. <br />

Independent Director and Chairman of the Board<br />

<br />

Dr. Dumrong Kasemset<br />

Director and Chairman of the<br />

Executive Committee<br />

<br />

Mr. Pratheuang Srirodbang<br />

Independent Director and Chairman <br />

of the Audit Committee<br />

Mr. Gan Hui Beng<br />

Independent Director and Member <br />

of the Audit Committee<br />

14<br />

<strong>CS</strong> LOXINFO

Dr. Sillapaporn Srijunpetch<br />

Independent Director and Member <br />

of the Audit Committee<br />

<br />

<br />

Mr. Mark Chong Chin Kok<br />

Director and Member of the<br />

Executive Committee<br />

Mr. Viroj Tocharoenvanith<br />

Director<br />

Mr. Yongsit Rojsrivichaikul<br />

Director and Member of the<br />

Executive Committee<br />

Mr. Tanadit Charoenchan<br />

Director and Member of the<br />

Executive Committee <br />

15<br />

<strong>CS</strong> LOXINFO

Management Team <br />

<br />

Mr. Anant Kaewruamvongs<br />

Managing Director<br />

<br />

Mr. Anuwat Sanguansappayakorn<br />

Chief Financial Officer<br />

<br />

Mrs. Aksara Assavapokee<br />

Senior Director-Finance & Accounting <br />

<br />

Mr. Pinyo Po-ngern<br />

Director-Information System <br />

<br />

Dr. Somchai Kittichaikoolkit <br />

Director-Marketing <br />

<br />

Mr. Pote Punsiripote <br />

Director-Sales <br />

<br />

16<br />

<strong>CS</strong> LOXINFO

Mrs. Suwanund Jatesawangsri<br />

Director-Customer Services <br />

Mr. Kiat Intarasuriyawong<br />

Director-Technical & Operations <br />

Mrs. Suwanna Janesawatpong<br />

Director-Internal Audit <br />

Teleinfo Media Public Company Limited<br />

Mr. Somchai Sinjananuruk<br />

Managing Director<br />

Mr. Surachart Kukasamerat<br />

Deputy Managing Director-Sales<br />

17<br />

<strong>CS</strong> LOXINFO

Feel closer together,<br />

no matter the distance.<br />

18<br />

<strong>CS</strong> LOXINFO

IPSTAR<br />

19<br />

<strong>CS</strong> LOXINFO

Corporate Governance<br />

The Board of Directors of the Company (Board) equates good corporate<br />

governance with good corporate citizenship, and has over the years sought to<br />

improve and strengthen corporate governance practices within the Company. As a<br />

fitting reward of this focus and effort, on December 11, <strong>2007</strong>, the Board was a<br />

recipient of the “Board of the Year for Exemplary Practices” award in an event<br />

organized by the Thai Institute of Directors Association (IOD), in cooperation with<br />

the Stock Exchange of Thailand (SET), Board of Trade of Thailand, Federation of<br />

Thai Industries, Thai Bankers’ Association, Thai Listed Companies Association, and<br />

Federation of Thai Capital Market Organizations. This award was a recognition of<br />

boards that have performed their duties in accordance with good corporate<br />

governance (CG) principles, as well as attained an evaluation score of not less<br />

than 85% according to the criteria set by the Award Committee. The awards<br />

selection criteria were based on the OECD Principles of Good CG and the SET<br />

Guidelines for Board of Directors. <br />

<br />

Corporate Governance Policy<br />

The Company that leadership of a visionary and responsible Board of Directors, with accountability to<br />

stakeholders, that can motivate and guide management, using a sound management system that utilizes internal<br />

control to balance business priorities and operations transparency, while respecting the rights and equitable<br />

treatment of all shareholders, are the essential factors in maximizing long term shareholders value. To this end,<br />

the Board has established a good Corporate Governance Policy that addresses five key areas:-<br />

1. Board’s structure, composition, roles and responsibilities<br />

2. The rights and equitable treatment of Shareholders and the Roles of Stakeholders<br />

3. Information Disclosure and Transparency<br />

4. Internal Control and Risk Management<br />

5. Code of Conduct<br />

Since 2005, the Board has acknowledged the growing importance of Corporate Governance (CG) as<br />

representing a set of processes, policies, laws and institutions affecting the way in which a corporation is<br />

directed, administered or controlled. As a result, on an annual basis, the Board schedules a meeting in the early<br />

part of the year dedicated to the review and enhancement of the CG of the Company to ensure its relevance,<br />

compliance with SET mandates and guidelines, and adherence to good practices. In the Board of Directors<br />

Meeting No.3/2008, on March 19, 2008, CG Policy of the Company was reviewed. Moreover, to strengthen<br />

its focus on CG, the Board plans to set up a CG Committee.<br />

20<br />

<strong>CS</strong> LOXINFO

Chapter 1: Board of Directors<br />

<br />

<br />

1. Leadership and Vision<br />

The Board determined <strong>CS</strong> <strong>LoxInfo</strong> Public Company Limited (<strong>CS</strong>L), a company in Shin Corporation<br />

Group of companies, to be a leading Thai company, with successful, internationally acknowledged and<br />

implemented perspectives, whilst having a variety of businesses with state of the art technology, strong<br />

management and capable staff.<br />

The Board members have leadership, vision and independence in making decisions, and are responsible in<br />

governing the corporation and providing the greatest benefit to its stakeholders. As such, the duties, roles and<br />

responsibilities of the Chairman of the Board, the Chairman of the Executive Committee and the Managing<br />

Directors are clearly segregated.<br />

In determining the business direction, vision, mission and annual targets, the Board oversees overall<br />

business affairs of <strong>CS</strong>L Group, and makes approval of those above with the involving initiation of the<br />

management. After that, the Board will monitor the achievement of the approved direction and plans through<br />

the Executive Committee, on a regular basis.<br />

For 2008 the Board agreed to continue focusing on increasing benefits to its shareholders by targeting to<br />

corporate customers, which is the segment of our expertise and effective in generating both revenue and profit.<br />

By the way, we will also develop more of the content servicing to fulfill more of the customer needs. This<br />

should enable the synergy at the Group level to cover both consumer and corporate sectors with the concept of<br />

Localized Search and Transactions via various types of connection medium, ie., internet, mobile phone, or even<br />

the call center.<br />

<br />

<br />

2. Composition of the Board of Directors, the Appointment, and its Independence<br />

The Board consists of nine qualified and experienced directors in various fields, i.e., telecommunication,<br />

legal, accounting and finance. Four are representatives of two major shareholders; one is the representative for<br />

CAT Telecom Plc. serving on behalf of the concession grantor; four are independent directors, including the<br />

Chairman of the Board, who account for more than one third of the Board. The full Board is as follows:-<br />

Name<br />

<br />

1. Prof. Wongkulpat Snidvongs <br />

na Ayudyha, M.D.*<br />

2. Mr. Prathueng Srirodbang<br />

<br />

3. Mr. Gan Hui Beng<br />

<br />

4. Dr. Sillapaporn Srijunpetch<br />

5. Mr. Viroj Tocharoenvanith<br />

<br />

<br />

Position<br />

Independent Director / Chairman of the Board <br />

<br />

Independent Director / Chairman of the Audit Committee<br />

/ Chairman of the Nomination Committee <br />

Independent Director / Member of the Audit Committee <br />

/ Member of Remuneration Committee<br />

Independent Director / Member of the Audit Committee <br />

Director / Representative of CAT Telecom<br />

<br />

Numbers of Shares<br />

holding <br />

(as at Dec 31, <strong>2007</strong>)<br />

-0-<br />

<br />

-0-<br />

<br />

-0-<br />

<br />

-0-<br />

-0-<br />

21<br />

<strong>CS</strong> LOXINFO

Name<br />

<br />

6. Mr. Mark Chong Chin Kok<br />

<br />

<br />

<br />

7. Dr. Dumrong Kasemset <br />

<br />

<br />

<br />

8. Mr. Yongsit Rojsrivichaikul<br />

<br />

9. Mr. Tanadit Charoenchan<br />

<br />

Position<br />

<br />

Director / Member of the Executive Committee /<br />

Member of the Remuneration Committee / <br />

Member of the Nomination Committee /<br />

Representative of major shareholder<br />

Director / Chairman of the Executive Committee / <br />

Chairman of the Compensation Committee / <br />

Member of the Nomination Committee / <br />

Representative of major shareholder<br />

<br />

Director / Member of the Executive Committee /<br />

Representative of major shareholder,<br />

Director / Member of the Executive Committee / <br />

Representative of major shareholder<br />

Numbers of Shares<br />

holding <br />

(as at Dec 31, <strong>2007</strong>)<br />

-0-<br />

<br />

<br />

<br />

-0-<br />

<br />

<br />

<br />

-0-<br />

<br />

-0-<br />

<br />

<br />

* Being appointed by the AGM No.1/<strong>2007</strong> on April 23, <strong>2007</strong> as the Director and Chairman of the Board <br />

• During <strong>2007</strong>, Mr. Vasant Chatikavanij resigned from his directorship which were a Director, a Member of the Executive Committee and a Member of <br />

the Remuneration Committee with effective date of December 26, <strong>2007</strong>.<br />

Secretary to the Board: Mr.Kamonmit Vudhijumnonk (Details of his profile and qualifications are <br />

shown on page 44)<br />

The Authorized Directors: Dr. Dumrong Kasemset or Mr. Yongsit Rojsrivichaikul or Mr. Tanadit<br />

Charoenchan cosigns with Mr. Viroj Tocharoenvanith or Mr. Mark Chong Chin Kok, altogether <br />

two directors, together with Company seal.<br />

Directors Nomination and Appointment Process <br />

The Company has appointed the Nomination Committee (NC) to consider setting standards and policies<br />

in nominating a qualified director under the Company’s Articles of Association and relevant laws, as well as to<br />

nominate such a qualified person to be a director of the Company where the office is vacant. The NC considers<br />

the educational background and professional experiences of the candidates. It provides sufficient useful<br />

information, for the consideration or decision making of the Board and the shareholders. <br />

Moreover, it was determined that in every <strong>Annual</strong> General Shareholders Meeting, one third of the<br />

directors shall resign from the position. In case that the number of the directors cannot be divided into three,<br />

the closest to one third of the directors shall resign from their positions. In the first and second year after the<br />

Company was listed on the Stock Exchange of Thailand, the directors who were required to resign, applied the<br />

method of drawing lots to determine who should resign. On subsequent years, the longest serving directors<br />

would resign and might be re-elected to resume their positions. <br />

In case the office of Director is vacant, due to reasons other than by the rotational scheme, the Board<br />

shall elect a person who is qualified and has no prohibited characteristics in accordance with Clause 68 of the<br />

Public Company Act, B.E. 2535. The successful candidate would replace the Director at the next meeting.<br />

Unless the remaining tenure of the Director vacating office is less than two months, a director who has elected<br />

as a replacement shall retain this position only up to the remaining tenure of such preceding director. <br />

As stipulated in the Company’s Articles of Association, the shareholders meeting shall elect directors<br />

under the following rules and procedures. <br />

<br />

1. All shareholders have votes equivalent to the number of shares being held. <br />

2. Each shareholder may use all votes set forth in (1) to elect one or more directors. In case of electing <br />

a number of directors, those votes may not be divided in any proportion for any particular director.<br />

3. Those who receive the highest respective votes shall be elected as directors in a number equal to those <br />

to be elected at such a meeting. In cases of tied votes cast, which would result in the number of <br />

directors greater than that permitted for the time being, the presiding chairman shall have a casting vote.<br />

<br />

22<br />

<strong>CS</strong> LOXINFO

The Company has not determined the maximum number of occasions a director can be re-elected, or his/<br />

her age, but will take into consideration his/her time, capability and knowledge devoted to the Company in<br />

performing duties. Except an independent director, he/she shall not serve the directorship for more than three<br />

consecutive terms or a total of nine years. <br />

<br />

Qualifications of the Board of Directors <br />

Directors of the Company have qualifications and characteristics as specified in the relevant laws. They<br />

have knowledge, capability and ethics in carrying out business and sufficient time to devote their knowledge and<br />

capabilities in performing duties for the Company. It is acceptable for them to be directors in other companies<br />

as long as such directorship does not hamper their performance in carrying out duties at the Company.<br />

The Company also encourages the directors to attend training classes for roles and responsibilities of<br />

being a director, e.g., DAP, DCP, etc. in order to have a thorough understanding of their roles. The profile of<br />

the Company and its subsidiaries, relevant rules and regulations, and the Director’s Handbook, are normally<br />

provided to the Directors, especially for new appointtees. Business environment updates of the Company and its<br />

subsidiaries, e.g., market situation, technology, laws and regulations, etc. are also made to the Board regularly.<br />

This should enable the Board to have sufficient information, knowledge and understanding about the business<br />

of the Company, as well as the most current roles and responsibilities of being a director. To date, all of our<br />

directors, including the Managing Director have already attended the DAP or DCP course. We also encourage<br />

the Directors to have continuing education programs, to enable them to perform their duties effectively,<br />

including corporate governance matters.<br />

<br />

Independence and Definition of the Independent Directors<br />

We define “Independent Director” in the Company’s CG policy as a director, who is fully qualified with<br />

regards to independence, in accordance with the SET’s guidelines. He/She shall be able to equitably safeguard<br />

the interests of shareholders and prevent a conflict of interest. He/She shall also be able to give independent<br />

opinions in the Board Meetings. Details of his/her qualifications are as follow:-<br />

1. Being a director who holds shares of not more than 0.5% of paid-up capital of the Company, affiliated<br />

company(s), associated company(s) or related company(s). Shares held by his/her relation(s) shall be<br />

included. <br />

2. Being a director who does not take part in the management of the Company, affiliated company(s), <br />

associated company(s), and related company or is a majority shareholder(s) of the Company, and is <br />

not an employee, staff member, or advisor who receives a regular salary from the Company, affiliated <br />

company(s), associated company(s), related company(s), or is a majority shareholder of the Company. <br />

3. Being a director who has no benefits or interests, directly or indirectly, in terms of financial and <br />

management of the Company, affiliated company(s), associated company(s), or majority shareholder(s) <br />

of the Company, and shall have no benefits or interests in such manner for a period of one year prior <br />

to the appointment as a director, except the Board has carefully considered and opined that such <br />

benefits or interests should have no impact on performing directorship duties and giving independent opinion. <br />

4. Being a director who is not a related person or close relative of any management member or majority <br />

shareholder(s) of the Company.<br />

5. Being a director who is not being appointed as a representative to safeguard the interests of the <br />

Company’s Directors, majority shareholder(s) or shareholders who relate to majority shareholder(s) of <br />

the Company. <br />

6. Being a director who is able to perform duties, give opinions or report on the result of the assignments <br />

made by the Board with no pressures due to circumstances or controls of the management, majority <br />

shareholder(s) of the Company, including their related persons or close relatives. <br />

23<br />

<strong>CS</strong> LOXINFO

3. Chairman of the Board and Chairman of the Executive Committee<br />

The Company has a policy that the Chairman of the Board and the Chairman of the Executive Committee<br />

should be capable and possess appropriate experience and qualifications. They shall not be the same person, in<br />

order to balance the power between direction and management functions. The responsibilities of the Chairman<br />

of the Board and the Chairman of the Executive Committee are specified as follows:-<br />

• Chairman of the Board is a non-executive Director, has responsibility as the leader of the Directors, in <br />

directing and monitoring the performance of the Executive Committee in achieving its goals and <br />

objectives. He also chairs the Board meeting and the Shareholders meeting. Currently, our Chairman of <br />

the Board is the independent director.<br />

• Chairman of the Executive Committee takes responsibility as the leader of the executives of the Company,<br />

responsible to the Board for supervising the management of the Company to achieve planned assignment.<br />

<br />

<br />

<br />

4. Authorities, Scope of Duties, and Responsibilities of the Board<br />

The major authorities, duties, and responsibilities of the Board are as follows:-<br />

• To carry out duties in accordance with the laws, the objectives, the Articles of Association of the <br />

Company, and the resolutions of the shareholders’ meeting in good faith and with care to preserve <br />

the interests of the Company.<br />

• To determine vision, policy, and direction of the Company, as well as to oversee and superintend the <br />

executive to be in line with the policy effectively and efficiently for maximizing corporate value and <br />

shareholders’ wealth.<br />

• To consider to approve or propose to shareholder to approve where the case may be, the major <br />

transactions about business operations of the Company and its subsidiaries, such as new investment, <br />

asset acquisition or disposition, and other transactions specified by the law.<br />

• To approve or agree to the related transactions between the Company and its subsidiaries in <br />

compliance with the relevant notifications, regulations and guideline of the Stock Exchange of Thailand.<br />

• To arrange to have a reliable accounting system, financial reports, auditing, as well as oversee the <br />

evaluation process for an appropriate, effective, and efficient internal control, internal auditing, risk <br />

management, financial reporting, and monitoring.<br />

• To oversee for not having a case of conflict of interests between the concerned persons of the <br />

Company, as well as to approve the Connected transactions and Conflicting transactions.<br />

• To govern the Company to carry out the business ethically and in line with the principle of good <br />

Corporate Governance.<br />

• To review the Company’s CG Policy and assess due compliance at least annually.<br />

• To conduct Board appraisal, as a group, annually.<br />

• To appoint or delegate any power to any other persons to conduct the Company’s business subject to <br />

the control of and within the time as may be specified by the Board, whereby such appointment or <br />

delegation of power may, at anytime, be canceled, revoked, withdrawn or amended. Provided that the <br />

said appointment or delegation of power shall not be made in the manner that the Board or the <br />

person appointed or delegated then be able to approve any transaction to be entered into between the <br />

Board, the person appointed or delegated by the Board, or any person who may have conflicts of <br />

interest or any other benefits (as stipulated by the Office of the Securities and Exchange Commission)<br />

and the Company or the Company’s subsidiaries, unless the approval for such transactions is in <br />

compliance with the policy and rules already approved by the Board.<br />

• To determine each director and executive to have duty in preparing and submitting the <strong>Report</strong> of <br />

Securities Holding in the Company by himself (herself), his(her) spouse, his(her) immature children,<br />

to the SEC, by using the 59-1 and 59-2 form, and by the timeframe stipulated in the Notification of<br />

the SEC no. Sor Jor 14/2540.<br />

24<br />

<strong>CS</strong> LOXINFO

5. The Sub-Committees<br />

The Board has appointed four sub-committees to study and pre-review the matters under the Board’s<br />

responsibilities.<br />

5.1 Audit Committee<br />

5.2 Remuneration Committee<br />

5.3 Nomination Committee <br />

5.4 Executive Committee<br />

<br />

5.1 Audit Committee (AC)<br />

No. of Meeting Attendance /<br />

Name<br />

<br />

Position<br />

No. of Meetings in <strong>2007</strong><br />

1. Mr. Prathueng Srirodbang Chairman of the AC/Independent Director<br />

2. Mr. Gan Hui Beng Member of the AC/Independent Director<br />

3. Dr. Sillapaporn Srijunpetch Member of the AC/Independent Director<br />

6/6<br />

6/6<br />

6/6<br />

The AC consists of three independent directors. Two are financial and accounting experts Mr. Gan Hui<br />

Beng and Dr. Sillapaporn Srijunpetch, and one is a legal expert Mr. Prathueng Srirodbang. Every member has<br />

qualifications as specified under the guideline of the SET and meets the requirements of an independent<br />

director as defined in the Company’s CG policy. <br />

The AC has a three year term, the same as the directorship position. Those, who complete the term of the<br />

AC membership can be re-elected for no more than nine years or three consecutive terms. The authorized<br />

duties of the AC are as specified in the Charter of the AC. The AC also reviews the Charter for<br />

appropriateness on a yearly basis, and makes further proposals for approval by the Board. The details of the<br />

latest version of the AC Charter are as follows:-<br />

<br />

• To carry out a review of the Company’s financial statements with the management and external auditors <br />

to ensure that the statements accurately present the financial position of the Company and that they are <br />

prepared in accordance with generally accepted accounting principles.<br />

• To give recommendations to the Board about the changes to the Company’s accounting policies and <br />

financial authorities, delegated to EXCOM and the Managing Director.<br />

• To ensure that the company has appropriate and efficient internal control and audit systems.<br />

• To carry out a review to ensure that the Company operates in compliance with the Securities and <br />

Exchange Acts, the regulations of the Stock Exchange of Thailand and any other relevant laws.<br />

• To consider, select ,and propose the appointment and audit fees of the company’s external auditor to the <br />

Board, as well as approve its audit plan and meet privately with the external auditor at least once a year.<br />

• To review policies for the approval of non-audit services and make recommendations.<br />

• To review the work of the Risk Management Committee of the Company.<br />

• To review and provide opinions on material connected transactions for compliance and conflict-of-<br />

interests, as well as accurate and complete disclosure.<br />

• To review and give opinions on the performance of the Internal Audit Office and coordinate work with <br />

the Company’s external auditors.<br />

25<br />

<strong>CS</strong> LOXINFO

• To ensure all necessary assistance and cooperation required by the external and internal auditors are <br />

provided by the management.<br />

• To prepare an annual AC activities report which must be signed by the Chairman of the AC and <br />

disclosed in the Company’s annual report.<br />

• To consider ant appraise annually, the performance of the Assistant Director of Internal Audit.<br />

• To consider and approve the Internal Audit Charter, annual internal audit plan, budget and manpower <br />

of the Internal Audit Office and the adequacy of the internal audit function.<br />

• To report the AC activities to the Board at least once during each quarter.<br />

• To review the scope of duties, responsibilities and to conduct AC performance self-assessment <br />

on a yearly basis.<br />

• To have full access and the cooperation of management.<br />

• To have the power to invite members of the management, officers and employees of the Company or <br />

external parties, to give statements, to attend a meeting and to deliver necessary documents.<br />

• To have direct access to the external auditors in the investigation of any matter within its terms of reference.<br />

• To have the power to engage consultant(s) or independent person(s) to provide opinions or advice if <br />

necessary, in accordance with the Company’s regulations, and expenses (with no budget provided) <br />

under the approval of authority given by the Managing Director.<br />

• To carry out other works designated by the Board of Directors and agreed to by the AC.<br />

The AC has conducted a self-assessment for <strong>2007</strong>, by team, to review the actual performance against the<br />

Charter of the AC and Best Practice. The results were reported to the Board during Board Meeting No. 3/2008<br />

on March 19, 2008. The results showed that both the Charter of the AC and Best Practice was conformed to.<br />

<br />

5.2 Remuneration Committee (RC)<br />

No. of Meeting Attendance /<br />

Name<br />

<br />

<br />

Position<br />

No. of Meetings in <strong>2007</strong><br />

1. Dr. Dumrong Kasemset Chairman of the RC<br />

2/2<br />

2. Mr. Gan Hui Beng Member of the RC /<br />

2/2<br />

<br />

Independent Director<br />

<br />

3. Mr. Mark Chong Chin Kok Member of the RC<br />

0/2<br />

<br />

• Mr. Vasant Chatikavanij resigned from the Member of the RC with effective date of December 26, <strong>2007</strong>.<br />

<br />

The RC consists of three directors. Two are representatives of the major shareholders, and one is an<br />

independent director. The scope of duties and responsibilities are as follows:-<br />

• To appropriately determine necessary remuneration, both monetary and non-monetary, annually in <br />

order to provide necessary incentives and retain the Board, Sub-Committees and senior executives of <br />

the Company.<br />

• To prepare policies and criterias to determine remuneration of the Board and senior executives, for <br />

approval by the Shareholders Meeting, and/or the Board, depending on each case.<br />

• <strong>Report</strong> to the Board, and be responsible for providing explanations and clarifications about <br />

26<br />

<strong>CS</strong> LOXINFO

emuneration of the Board and senior executives in Shareholders Meetings.<br />

• To report on the remuneration policies, rationale and objectives, as well as to make disclosures in the <br />

annual report.<br />

• Others, as assigned by the Board.<br />

In <strong>2007</strong>, the RC met twice to consider and approve the allocation of warrants under ESOP Grant V<br />

program to the directors and staff, as well as approve the remunerations for independent directors and external<br />

directors.<br />

5.3 Nomination Committee (NC)<br />

<br />

Name<br />

1. Mr. Prathueng Srirodbang<br />

<br />

2. Dr. Dumrong Kasemset <br />

3. Mr. Mark Chong Chin Kok<br />

<br />

Position<br />

Chairman of the NC / <br />

Independent Director<br />

Member of the NC<br />

Member of the NC<br />

No. of Meeting Attendance /<br />

No. of Meetings in <strong>2007</strong><br />

3/3<br />

<br />

3/3<br />

1/3<br />

The NC consists of three directors. Two are representatives of major shareholders and one is an<br />

independent director acting as the Chairman of the Committee. The scope of duties and responsibilities are as<br />

follows:-<br />

• To determine policies and criteria for nominating the Board and Sub-Committees of the Company.<br />

• To nominate directors by considering suitable candidates for approval by the Board, and/or the <br />

Shareholders Meeting, depending on each case.<br />

• To consider suitable candidates to be nominated as Chairman of the EXCOM, if there is vacancy, as <br />

well as to determine criteria for succeeding the senior executives.<br />

• Others, as assigned by the Board.<br />

In <strong>2007</strong>, the NC met three times to consider appointing directors and determining their authority for the<br />

replacement of retired directors, in accordance with the company’s Articles of Association. <br />

<br />

5.4 Executive Committee (EXCOM)<br />

<br />

Name<br />

<br />

Position<br />

1. Dr. Dumrong Kasemset Chairman of the EXCOM<br />

2. Mr. Mark Chong Chin Kok Member of the EXCOM<br />

3. Mr. Tanadit Charoenchan Member of the EXCOM<br />

4. Mr. Yongsit Rojsrivichaikul Member of the EXCOM<br />

No. of Meeting Attendance /<br />

No. of Meetings in <strong>2007</strong><br />

13/13<br />

7/13<br />

10/11<br />

10/12<br />

• Mr. Vasant Chatikavanij resigned from the Member of the EXCOM with effective date of December 26, <strong>2007</strong>.<br />

The EXCOM consists of the directors of the Company and Executive Chairman of Satellite and<br />

International Business Line as the Chairman of the EXCOM. The scope of duties and responsibilities are as<br />

follow:-<br />

27<br />

<strong>CS</strong> LOXINFO

• To determine the policies, directions, strategies and core management structure for business operations <br />

in line with economic and competitive conditions that have been defined and declared to Shareholders, <br />

for approval by the Board.<br />

• To determine the business plans, budgets, and working authority limits of the Company for approval by <br />

the Board.<br />

• To monitor efficient policy implementation and operating procedures according to favorable business <br />

conditions.<br />

• To monitor the Company’s operating performance to be in line with the approved business plan.<br />

• To consider any material investment projects.<br />

• To report the Company’s performance to the Board on the monthly basis.<br />

• Having authority to approve financial transactions of not higher than 400 million baht. In case of the <br />

finance banking transactions, for example, deposit, lending, hedging instrument on foreign exchange<br />

and interest rate, the transaction value and details requires the Board’s approval. The EXCOM may <br />

delegate an executive or individual to carry out or acknowledge a business according to the discretion <br />

of the EXCOM.<br />

• The approval of the EXCOM or the delegates shall not be for the connected transaction(s) or where <br />

the Committee may have a conflict of interest according to the Articles of Association of the Company <br />

or that defined by the regulatory body (ies).<br />

• Others, as assigned by the Board.<br />

Management Team <br />

As of December 31, <strong>2007</strong> the Company’s Management is composed of the following people:-<br />

<br />

Name<br />

Position<br />

<br />

1. Dr. Dumrong Kasemset Chairman of the EXCOM <br />

2. Mr. Anant Kaewruamvongs Managing Director <br />

3. Mr. Anuwat Sanguansappayakorn Chief Financial Officer <br />

4. Mrs. Aksara Assavapokee Senior Director - Finance & Accounting <br />

5. Mr. Pinyo Po-ngern Director - Information System <br />

6. Dr. Somchai Kittichaikoolkit Director - Marketing <br />

7. Mr. Pote Punsiripote Director - Sales <br />

8. Mrs. Suwanund Jatesawangsri Director - Customer Services <br />

9. Mr. Kiat Intarasuriyawong Director - Technical & Operations <br />

10. Mrs. Suwanna Janesawatpong Director - Office of Internal Audit <br />

Scope of Authorities and Responsibilities of the Managing Director<br />

The Managing Director (MD) has authority according to that being delegated by the Board, which is in<br />

compliance with the rules, regulations, and Articles of Association of the Company. The MD did not conduct<br />

or enter into transaction that he or conflicting person may have conflict of interests with the Company or the<br />

subsidiaries, as defined by the Notifications of the SEC. Exemption is on the case of related transactions where<br />

no approval is required from a shareholders’ meeting, as announced by the SET regarding the Principle,<br />

Procedure, and Disclosure of Related Transactions of the listed companies, and the approval of internal<br />

management of the Company and its subsidiaries.<br />

28<br />

<strong>CS</strong> LOXINFO

Approval authority of the MD<br />

The MD has been delegated of the financial authority from the Board at the maximum of 10 million baht<br />

for budgeted capital expenditure.<br />

<br />

<br />

6. The Meeting of the Board of Directors<br />

The Board has policy to schedule the Board’s meetings of at least six times a year. The meetings are normally<br />

pre-scheduled for the entire year. Special meeting can be held where necessary. In organizing a meeting, the<br />

Chairman of the Board and Chairman of the EXCOM will agree to with the agenda items. Secretary to the<br />

Board will coordinate with the relevant parties and distribute the notice to the meeting along with the meeting<br />

agendas and meeting document to the directors at not less than seven days in prior to the meeting date for the<br />

Board to have sufficient time to digest the information. In year <strong>2007</strong>, the Board met for nine times.<br />

Normally, each meeting would take about two to three hours, with the Chairman of the Board chairing<br />

the meeting. He is responsible for overseeing the meeting process and managing time for each agenda to be<br />

sufficient for the directors to discuss and express their opinions independently, taking into consideration the<br />

benefit of the shareholders and stakeholders on a fair basis. Management will provide sufficient information for<br />

the Board consideration. Where a director may have conflict of interest with any meeting agenda, he/she will<br />

not be present in the meeting for that agenda item. <br />

After that, the Secretary to the Board will finish preparing the minutes of the meeting by 14 days, keep<br />

such the minutes and supplemented documents, as well as support and follow up matters for facilitating the<br />

Board to perform duties in compliance with applicable laws, rules and regulations, and shareholders’ meeting<br />

resolutions.<br />

<br />

In <strong>2007</strong>, in summary, there were below meetings.<br />

Meeting<br />

<br />

<br />

Director<br />

EXCOM<br />

AGM BDM ACM NCM RCM <br />

Meeting<br />

<br />

1. Prof. Wongkulpat Snidvongs<br />

na Ayudyha, M.D.*<br />

2. Dr. Dumrong Kasemset <br />

3. Mr. Prathueng Srirodbang<br />

4. Mr. Gan Hui Beng<br />

5. Dr. Sillapaporn Srijunpetch<br />

6. Mr. Viroj Tocharoenvanith<br />

7. Mr. Mark Chong Chin Kok<br />

8. Mr. Yongsit Rojsrivichaikul<br />

9. Mr. Tanadit Charoenchan<br />

-<br />

<br />

1/1<br />

1/1<br />

1/1<br />

1/1<br />

1/1<br />

1/1<br />

1/1<br />

1/1<br />

No. of Meeting Attendance / No. of Meeting in <strong>2007</strong><br />

5/5<br />

<br />

9/9<br />

9/9<br />

8/9<br />

9/9<br />

8/9<br />

6/9<br />

6/6<br />

6/7<br />

-<br />

<br />

-<br />

6/6<br />

6/6<br />

6/6<br />

-<br />

-<br />

-<br />

-<br />

-<br />

<br />

3/3<br />

3/3<br />

-<br />

-<br />

-<br />

1/3<br />

-<br />

-<br />

* Being appointed by the AGM No. 1/<strong>2007</strong> on April 23, <strong>2007</strong> as the Director and Chairman of the Board. <br />

• Mr. Vasant Chatikavanij resigned from the directorship with effective date of December 26, <strong>2007</strong>.<br />

-<br />

<br />

2/2<br />

-<br />

2/2<br />

-<br />

-<br />

0/2<br />

-<br />

-<br />

-<br />

<br />

13/13<br />

-<br />

-<br />

-<br />

-<br />

7/13<br />

10/11<br />

10/12<br />

29<br />

<strong>CS</strong> LOXINFO

7. Directors and Managements Remuneration<br />

On every February, the RC considers, analyzes, and recommends remuneration of the directors to the<br />

Board for further recommending to the shareholders for approval. The RC also approves the remuneration<br />

calculation scheme of the management. The remuneration of the directors and the management shall get along<br />

well with their duties and responsibilities, be comparable to the industry standard, and attractive enough to<br />

retain the qualified directors and management.<br />

The Company has policy to remunerate only to the independent directors and external directors. The<br />

executive directors do not receive remuneration as a director.<br />

The remuneration for each management will link with the operating performance of the Company and<br />

his/her working performance. The warrants for purchasing the Company’s common shares are also offered to<br />

the management and employees under the Employee Stock Option Program (ESOP) to attract and retain them<br />

with the Company. <br />

In year <strong>2007</strong>, the Company paid following remuneration.<br />

1. Monetary Remuneration for the Board<br />

• Total monetary remuneration for the Board, only independent directors or non-executive directors, <br />

for the period as at December 31, <strong>2007</strong> comprised of director monthly compensation, annual <br />

remuneration and meeting fees totaling Baht 3,707,696 for five directors. The details of which are as<br />

follow:- (Executive directors did not receive remuneration as directors.) <br />

<br />

Name<br />

<br />

1. Prof. Wongkulpat Snidvongs <br />

na Ayudyha, M.D.<br />

2. Mr. Prathueng Srirodbang<br />

3. Mr. Gan Hui Beng<br />

4. Dr. Sillapaporn Srijunpetch <br />

5. Mr. Viroj Tocharoenvanith <br />

Position<br />

<br />

Independent Director and Chairman of the Board <br />

<br />

Independent Director and Chairman of the AC <br />

Independent Director and Member of the AC <br />

Independent Director and Member of the AC <br />

Director and representative of CAT Telecom Plc.<br />

Remuneration <br />

for <strong>2007</strong>*<br />

(Million Baht)<br />

1.037<br />

<br />

0.820<br />

0.675<br />

0.675<br />

0.500<br />

* Director monthly compensation and meeting fees for the period of January to December <strong>2007</strong>, and accrued annual remuneration which<br />

would be paid in February 2008.<br />

<br />

<br />

2. Monetary Remuneration for the Executives<br />

• Total monetary remuneration for the Executives, for the period ended December 31, <strong>2007</strong> comprised <br />

of salary, bonus, provident fund, and other fringe benefits was Baht 20,821,950 (excluded the <br />

Executive Chairman who receives remuneration from Shin Satellite Plc., the indirect shareholder of <br />

the Company).<br />

3. Other Remunerations <br />

3.1 Other Remuneration for the Board members<br />

Apart from the monetary remuneration for the independent directors and external directors, the <br />

Company provided non-monetary remuneration to the Chairman of the Board, who is an <br />

independent director, in form of fringe benefit of car and fuel.<br />

30<br />

<strong>CS</strong> LOXINFO

3.2 Employee Stock Option Program (ESOP)<br />

The Company plans to issue and offer warrants to purchase the Company’s ordinary shares to the<br />

directors and employees to motivate and reward their past performances which should thereby <br />

benefit the Company in the long run. Under a continuous program, the Company will issue and <br />

offer such warrants continually for five-year period subject to shareholders’ approval in each year. At<br />

the end of <strong>2007</strong>, the Company has issued and offered five programs. The details of which are as follow:-<br />

<br />

Descriptions Program 1 Program 2 Program 3 Program 4 Program 5<br />

Offering Size<br />

Offering Price <br />

Warrant Term<br />

Exercise Ratio*<br />

Exercise Price* <br />

(Baht per share)<br />

Issuance and Subscription Date <br />

The director and<br />

management of<br />

<br />

the Company and its<br />

subsidiaries receiving of<br />

the warrants<br />

1. Mr. Anant Kaewruamvongs<br />

2. Dr. Somchai Kittichaikoolkit <br />

3,096,300 2,213,700 ** 8,559,100 8,354,300 8,354,400<br />

Bt 0<br />

Not more than 5 years from the Issuance and Subscription Date<br />

1 unit of warrant per 1.24101 1 unit of warrant<br />

per 1.21856<br />

1 unit of warrant<br />

per 1.4758<br />

1 unit of warrant<br />

per 1 <br />

<br />

7.252 7.487 5.686 3.120 3.580<br />

14-May-04 16-May-05 31-May-05 31-May-06 30-May-07 <br />

Descriptions Program 1 Program 2 Program 3 Program 4 Program 5<br />

No. of % of No.<br />

Warrant of<br />

allocated Warrant<br />

(Units) issued<br />

1,000,000<br />

550,000<br />

3. Mr. Anuwat Sanguansappayakorn -<br />

4. Mrs. Aksara Assavapokee 174,200<br />

5. Mr. Somchai Sinjananurux -<br />

6. Mr. Surachart Kukasamerat -<br />

7. Mr. Charles Han<br />

-<br />

8. Mr. Pote Punsiripote<br />

-<br />

32.30<br />

17.76<br />

-<br />

5.63<br />

-<br />

-<br />

-<br />

-<br />

No. of<br />

Warrant<br />

allocated<br />

(Units)<br />

704,600<br />

202,000<br />

162,200<br />

426,400<br />

-<br />

-<br />

-<br />

-<br />

% of No.<br />

of<br />

Warrant<br />

issued<br />

24.4<br />

7<br />

5.62<br />

14.78<br />

-<br />

-<br />

-<br />

-<br />

No. of % of No.<br />

Warrant of<br />

allocated Warrant<br />

(Units) issued<br />

966,400<br />

250,000<br />

350,000<br />

572,700<br />

771,700<br />

753,300<br />

-<br />

-<br />

No. of % of No.<br />

Warrant of<br />

allocated Warrant<br />

(Units) issued<br />

No. of % of No.<br />

Warrant of<br />

allocated Warrant<br />

(Units) issued<br />

* The Company has adjusted the warrant right, as a result of 2006 dividend payment at a rate of more than 50% of net income after corporate income tax <br />

under the conditions specified in the prospectus. The latest right adjustment on both the exercise ratio and exercise price was on March 28, <strong>2007</strong>.<br />

** At Extraordinary General Shareholders Meeting No. 2/2004, held on June 14, 2004, the shareholders approved the issuing and offering of 2,885,900 <br />

units of warrants for ESOP Grant 2. However, the Company could only allocate 2,213,700 units and the remaining warrants expired without being <br />

allocated to other programs.<br />

11.29<br />

2.92<br />

4.09<br />

6.69<br />

9.02<br />

8.80<br />

-<br />

-<br />

1,002,500<br />

417,700<br />

417,700<br />

501,300<br />

835,400<br />

853,400<br />

459,500<br />

-<br />

12<br />

5<br />

5<br />

6<br />

10<br />

10<br />

5.5<br />

-<br />

2,690,100<br />

540,000<br />

917,400<br />

1,186,500<br />

-<br />

-<br />

-<br />

715,900<br />

32.20<br />

6.46<br />

10.98<br />

14.20<br />

-<br />

-<br />

-<br />

8.57<br />

31<br />

<strong>CS</strong> LOXINFO

8. Succession Plan<br />

CG policy of the Company specified that there should be a succession plan for the position of Chairman<br />

of the EXCOM and senior management to build up a confidence among shareholders and staff that the<br />

operations of the Company will not be interrupted. The NC was assigned in determining the criteria and the<br />

succession plan. <br />

<br />

<br />

9. The Meeting of Non-executive Directors (NED)<br />

CG policy of the Company also specified that there should be the meeting of the NED without the<br />

presence of executive directors from time to time as appropriate, in order to be an opportunity for the NED to<br />

discuss any subjects of interest related to the business operations of the Company. The conclusions made at<br />

each meeting shall also be reported to the Board and the Chief Executive Officer.<br />

On Nov 14, <strong>2007</strong>, the NED, consisted of 4 independent directors and 1 external director met as the first<br />

NED meeting of the Company. The Chairman of the Board presided over the meeting. The major matters<br />

agreed and presented to the Board Meeting No. 9/<strong>2007</strong> on November 14, <strong>2007</strong> were the plan that the<br />

Company may establish a CG Committee, and the importance of having a continuous adequate level of internal<br />

control system and internal auditing under the concept of COSO standard. COSO stands for The Committee of<br />

Sponsoring Organizations of the Treadway Commission, the US commission concerning the studying and<br />

analysis of fraudulent financial reportings and developing recommendations for public companies and their<br />

independent auditors, for the US SEC and other regulators, and for educational institutions.<br />

<br />

<br />

10. The Performance Assessment of the Board of Directors<br />

In the Board Meeting No. 3/2008 on March 19, 2008 the Board has conducted self-assessment for the<br />

year <strong>2007</strong> as a group, to assess the effectiveness and efficiency of the Board performance. In overall, the Board<br />

was satisfied with the aggregated diversified knowledge and experiences of the Board members, as well as the<br />

openness and teamwork environment of the Board. However, Board members also recommended more<br />

information to be provided in prior to the meeting, e.g., background information about business plan, working<br />

reports from the sub-committees, etc.<br />

<br />

Chapter 2: Shareholders’ Rights and Equitable Treatment and Roles of the Stakeholders<br />

<br />

<br />

<br />

1. Shareholders’ Rights and equitable treatment<br />

The Board respects the shareholders rights and has duty in protection of the benefit of every shareholder<br />

equitably, in regardless of type of shareholders, i.e., retail, foreign, institutional, or wholesale investor. Every<br />

shareholder shall have below rights and equitability.<br />

• Right in receiving shares certificate, shares transferring, acknowledging the information about operating<br />

performance and business policy, regularly and timely.<br />

• Right in receiving profit sharing, equitably.<br />

• Right in attending the shareholders meeting, expressing opinion, giving recommendation, and being <br />

involved in decision making in significant changes. <br />

• Right in appointing the directors.<br />

<br />

32<br />

<strong>CS</strong> LOXINFO

2. Shareholders’ Meeting<br />

The Company has policy to conduct the shareholders’ meeting to be in compliance with the law, the<br />

Articles of Association and the guideline stipulated by the regulatory bodies. In year <strong>2007</strong>, there was one<br />

shareholders’ meetings, an <strong>Annual</strong> General Meeting (AGM). We regard the convenience of the shareholders in<br />

attending the meeting as the major factor in organizing each meeting. We used the Auditorium, at 9 th Floor of<br />

Shinawatra Tower III on Vibhavadi Rangsit Road, Bangkok, which can serve up to 300 attendees.<br />

In the Shareholders’ meeting, every shareholder has rights and equitable treatment in acknowledging<br />

information by receiving of the notice to the meeting and meeting document by 14 days in prior to the<br />

meeting. The document normally contains necessary information, opinion of the Board, background or rationale<br />

information for each agenda which deem useful for the consideration of the shareholders. <br />

In the notice to the meeting, we always notify the document requiring for meeting registration, as well as<br />

proxy form and instruction together with name list and profile of at least one independent director to be the<br />

agent for the shareholders who cannot attend the meeting. All such the notice and meeting document will<br />

always be published in the Company’s website for not less than 14 days, and in newspaper for 3 consecutive<br />

days in prior to the meeting. The minutes of the meeting shall also be published in the website for the<br />

shareholders’ access by 14 days after the meeting date.<br />

In meeting registration, we use the advanced and reliable registration system to facilitate the shareholders<br />

and quick votes counting. The registration process will also be prepared to be ready at least two hours before<br />

beginning of the meeting.<br />

In <strong>2007</strong> AGM, the Chairman of the Board and the directors have attended the meetings, with the details<br />

on page 29, to answer inquiries might arise. Before beginning of the meeting, the Chairman of the Meetings<br />

explained the voting method for common understanding of the shareholders. The voting results were recorded<br />

in the registration system. We also followed the Article of Associations of the Company by using one share<br />

one vote basis for all agendas. When the Chairman conducted the meetings by agenda, he encouraged the<br />

shareholders to express opinion and inquire the meeting with sufficient timeframe. When there was no more<br />

query in an agenda, the voting results, which the shareholders had voted during the registration process, would<br />

be announced. There was also no case that various unrelated matters were gathered for approval in one agenda item.<br />

<br />

<br />

3. Role of the Stakeholders<br />

The Company is aware of the rights of stakeholders and has policy to ensure the importance of the rights<br />

by the appropriate prioritization of all stakeholders, which are shareholders, employees, executives, customers,<br />

partners, creditors, society, and the public. Cooperation between stakeholders shall be made according to their<br />

roles and responsibilities so that the Company can run smoothly and strongly to fairly benefit all groups of<br />

stakeholders as follow:-<br />

Shareholders : We strive to be a good representative of shareholders in carrying out business to <br />

maximize shareholders satisfaction with regards to the sustainable growth of the value <br />

of the Company in the long run, good and continual return, and the transparent and <br />

reliable information disclosure to the shareholders. <br />

Employees : We concentrate on the employees, the most valuable resource and the critical factor <br />

to the corporate success. Therefore, we attempt developing them for their continual <br />

growth, for building up skills, knowledge, and corporate culture, for their own benefit <br />

in a good working environment. We provide them the trainings both by their own <br />

33<br />

<strong>CS</strong> LOXINFO

Customers<br />

Partners<br />

Creditors<br />

interest for their professional development (Individual Development Plan), and by the value<br />

that we would like to cultivate them.<br />

We pay attention to the staff employment, appointment, transfer, on ethical basis. We <br />

stand on the compliance with the labor law or higher standard. We are also <br />

responsible to make a safety working environment. <br />

: We strive to make our customers confident and satisfy with the top quality services <br />

with continual improvement at appropriate charges. We provide them the undistorted <br />

service information, keep good relationship, and do not disclose their information <br />

without prior permission except for the information shall be disclosed to the public by law.<br />

: We are aware of the importance of partners and regard them as a critical factor in <br />

mutual building up of value to the customers. Therefore, we make relationship with <br />

groups of partner equitably for mutual business interest with no breaching of <br />

reputation, or law. <br />

: We pay attention to the importance of the creditors and strive to keep good <br />

relationship with them on the best interest of the Company. We also hold to the <br />

contract conditions committed with the creditors.<br />

Competitors : We are aware of the benefits from competition toward business management and <br />

continual service quality improvement for the good sake of customers. Therefore, we <br />

have policy to support and promote for the free and fair trade, and have no policy to <br />