2013 Event Program - Limra

2013 Event Program - Limra

2013 Event Program - Limra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

p r o g r a m

conference program<br />

Wednesday, 19 June, <strong>2013</strong><br />

5:30 p.m.<br />

Welcome Reception<br />

Thursday, 20 June, <strong>2013</strong><br />

7:30 a.m.<br />

Registration – Tower Ballroom Foyer<br />

8:45 a.m.<br />

Opening Remarks – Tower B<br />

9:00 – 10:00 a.m.<br />

Opening Keynote Speaker – Tower B<br />

The Art & Science of Commercialising<br />

the Customer Opportunity<br />

Maryan Broadbent<br />

Group Chief Customer Officer<br />

AIA<br />

The size of the protection gap is well<br />

documented, and so are the possibilities<br />

customer-centric insurance offers. Translating the<br />

concept of customer-centricity into a differentiated<br />

customer experience has the potential to greatly change<br />

the industry. But how well are we doing? And what can<br />

we learn from bringing the consumer perspective into<br />

our businesses?<br />

10:00 – 10:30 a.m.<br />

Networking Break – Tower Ballroom Foyer<br />

10:30 a.m. – 12:00 p.m.<br />

CEO Panel – Tower B<br />

Finding the Opportunities<br />

Lance Tay<br />

Chief Executive Officer<br />

Tokio Marine Life Insurance Singapore Ltd.<br />

Steve Jin<br />

President & Chief Executive Officer<br />

Hontai Life Insurance Company<br />

Taiwan<br />

William Kuan<br />

President Director<br />

PT Prudential Life Assurance<br />

Saloon Tham, Moderator<br />

Regional General Manager, Life & Health<br />

Allianz SE, Singapore Branch<br />

New regulations. Cultural, economic, and<br />

technological shifts. Increasing consumer<br />

demands. Today’s executives must lead their company<br />

through myriad challenges to achieve profitable results.<br />

The most successful CEOs face these challenges head<br />

on to find the hidden opportunities within them —<br />

building on core values while being open to innovative<br />

ideas and techniques for driving growth. This panel of<br />

seasoned CEOs will candidly share their viewpoints,<br />

experiences, and strategies for finding the opportunities<br />

that make them so successful.<br />

12:00 – 1:20 p.m.<br />

Lunch – Tower A<br />

2

1:20 – 2:20 p.m.<br />

Concurrent Sessions 1-3<br />

Session 1 – Tower B<br />

iGrowth Effectiveness: How Mobility,<br />

Distribution, and Operational Effectiveness<br />

Changed the Rules<br />

Vijay Chavan<br />

Co-Founder and Executive Director<br />

C2L BIZ Solutions Inc<br />

Consumer technologies have changed<br />

the rules for our industry. Now mobility<br />

is the name of the game and it is having a tremendous<br />

impact on distribution channels and the back office.<br />

To remain competitive, your company must adapt<br />

its processes to meet changing realities in market<br />

expectations. Come to this session to learn best<br />

practices happening in our industry and to exchange<br />

with peers on a lively, yet challenging, topic.<br />

Session 2 – Azalea Room<br />

Driving Takaful<br />

Syed Ismail Alhabshi<br />

Principal Consultant (Takaful)<br />

IBFIM<br />

The road to takaful success is not<br />

about enjoying the scenery, it’s about<br />

paying attention to the signposts that provide<br />

meaningful direction. Attend this session to learn<br />

key information about the signposts that make<br />

your journey easier to navigate.<br />

Session 3 – Magnolia Room<br />

Fishing for Growth Opportunities By<br />

Building a Better Customer Experience<br />

B Ashwin<br />

Chief Operating Officer<br />

ING Vysya Life Insurance Company<br />

Conventional market expansion alone<br />

no longer generates suitable growth<br />

in India. Learn how ING Vysya Life has created new<br />

opportunities by focusing on customer interactions<br />

and the customer experience. In this case study,<br />

Ashwin will discuss how the company has successfully<br />

established a dedicated relationship vertical that has<br />

improved customer retention and generated higher<br />

top-ups than the overall portfolio. He will also examine<br />

their initiative to identify high-propensity-to-buy<br />

segments for ING Life’s bancassurance customer base.<br />

2:30 – 3:30 p.m.<br />

Concurrent Sessions 4-6<br />

Session 4 – Magnolia Room<br />

Winning in a Digital World: The Power of<br />

Direct Marketing to Deliver Results Today<br />

Lisa Watson<br />

Chairman<br />

Direct Marketing Association of Singapore<br />

Regional Segment Manager<br />

Hewlett-Packard Asia Pacific<br />

Nothing may be more important to marketers today<br />

than the ability to truly leverage the assets of the digital<br />

world — because those who effectively do so are the<br />

ones who will win. In this session, Ms. Watson will share<br />

the latest data on the digital environment in Asia Pacific<br />

as well as case studies and success stories from around<br />

the world. You will hear how the most successful<br />

marketers are going back to direct marketing basics to<br />

create powerful customer experiences across multiple<br />

communications channels, including digital print!<br />

Session 5 – Azalea Room<br />

How Can Western Multinationals Perform<br />

More Successfully in Asia?<br />

Gordon Perchthold<br />

Senior Advisor<br />

Managing Across Asia<br />

Academic research over the past two<br />

decades has found that few Western<br />

multinationals (none in insurance) perform as well in<br />

Asia as in their home region. What does this mean for<br />

the growth objectives of Western multinationals now<br />

that Asia is the hub of global economic growth? This<br />

presentation will discuss the barriers that have prevented<br />

Western multinationals from performing better in Asia<br />

and the actions necessary to overcome them. Executives<br />

will leave this session reassessing some of their preconceptions<br />

and equipped with actionable ideas to enhance<br />

the performance of their business in Asia.<br />

3

Session 6 – Tower B<br />

The Dangers of Reviewable Products<br />

Darshan Singh<br />

Head of Actuarial Services<br />

Pacific Life Re Limited<br />

Singapore Branch<br />

Peter Erlandsen<br />

Managing Director, Asia<br />

Pacific Life Re Limited<br />

Singapore Branch<br />

At a time when people are searching for<br />

certainties and guarantees, many executives share an<br />

opinion that critical illness insurance sales are poised<br />

to soar to new heights. But will they? The speakers will<br />

review key factors driving the future of critical illness<br />

insurance, and delve into the dangers of under-pricing<br />

these products in the face of expected deteriorations.<br />

He will also discuss whether customers and advisors<br />

truly understand reviewability and what can be<br />

learned from other markets about reviewable business.<br />

3:30 – 4:00 p.m.<br />

Networking Break – Tower Ballroom Foyer<br />

4:00 – 5:00 p.m.<br />

General Session – Tower B<br />

What Brought Us Here Will Take Us There;<br />

A Re-commitment to Winning Principles<br />

Mark Wallis, CLU,ChFC, CFP, CLF<br />

Chief Agency Officer<br />

Zurich Life Insurance Hong Kong<br />

Much of what is done successfully is<br />

rooted in basic principles, yet we often<br />

ignore these principles and try to reinvent the process.<br />

Through understanding and a re-commitment to the<br />

winning principles that brought us here, we can move<br />

forward on our journey of success.<br />

5:30 p.m.<br />

Evening Reception – Tower A<br />

This special reception will immerse you in the brilliant<br />

flavors, sights, and sounds of Singapore’s multicultural<br />

heritage. Talented musicians will delight your<br />

ears, and local craftspeople will share their expertise<br />

in garland weaving, ketaput weaving, batik painting,<br />

and Chinese calligraphy.<br />

Friday, 21 June, <strong>2013</strong><br />

8:45 – 8:50 a.m.<br />

Welcome Back – Tower B<br />

8:50 – 9:50 a.m.<br />

General Session – Tower B<br />

Maximizing Potential within Aging Society Segments<br />

Rob Burr<br />

Head of Life & Health Asia, Managing Director<br />

Swiss Re<br />

Aging populations are having a tremendous<br />

impact on the life insurance industry. What new<br />

challenges are they creating for our industry and your company?<br />

What must we do to take advantage of this fast-growing segment?<br />

Mr. Burr will review key data and examine future determinants.<br />

9:50 – 10:50 a.m.<br />

General Session – Tower B<br />

Internationalizing Asia: How to Adapt to New Risks<br />

Alvin Y. Lee<br />

Executive Director, Risk Management Analytics<br />

MSCI Inc.<br />

Insurance companies in Asia face an uncertain<br />

investment environment driven by reductions<br />

in net income due to lower local bond yields and increasing<br />

capital requirements from regulators. How will your company<br />

overcome these challenges and build a robust strategy for<br />

increasing investment returns and controlling risk? Asia’s<br />

deregulation delivers many opportunities for insurers to<br />

internationalize their portfolios and improve returns and<br />

margins through effective multi-asset strategies.<br />

10:50 – 11:15 a.m.<br />

Networking Break – Tower Ballroom Foyer<br />

11:15 a.m. – 12:15 p.m.<br />

General Session – Tower B<br />

Creating Today’s Learning Culture<br />

Jacqueline (Jacquie) Lucas<br />

Director of International <strong>Program</strong>s<br />

The Centre for International Assessment and Development<br />

LIMRA<br />

Building today’s sales organization goes<br />

way beyond the recruiting process. It’s about ensuring that<br />

your company delivers upon the recruiting promise and<br />

provides the right mix of training opportunities to support<br />

today’s recruits and develop them into the sales leaders of<br />

tomorrow.<br />

4

12:15 – 1:30 p.m.<br />

Luncheon – Tower A<br />

1:30 – 2:30 p.m.<br />

Concurrent Sessions 7 & 8<br />

Session 7 – Tower B<br />

The Rapidly Evolving Future of Bancassurance<br />

Michael B. Marshall<br />

Corporate Vice President, International Research<br />

LIMRA<br />

As bank penetration of insurance markets<br />

continues to grow, the models for success<br />

are changing. Due to a tightening of capital requirements<br />

and an increase in technology-driven customer preferences,<br />

bancassurance is being forced into a more targeted,<br />

challenging realm. Michael will explore the channel’s<br />

future and identify elements that will drive profitability.<br />

Session 8 – Azalea Room<br />

The Era of Big Data and Implications for<br />

Insurance<br />

Na Jia<br />

Senior Partner and Chief Marketing Officer<br />

ReMark International<br />

The enabling forces and challenging<br />

hurdles of Big Data are beginning to<br />

impact our industry. Attend this session to delve into<br />

the consequences of this revolutionary force and examine<br />

its impact on how people consume media, how people<br />

behave toward sales promotion, and how business is<br />

conducted.<br />

2:35 – 3:35 p.m.<br />

Concurrent Sessions 9 &10<br />

Session 9 – Tower B<br />

Driving Growth with Learning<br />

Mark Adel, FLMI, FFSI, AAPA, AIRC<br />

Second Vice President, Education and Training<br />

LIMRA and LOMA<br />

Can your company successfully drive<br />

growth if your employees are not learning?<br />

Will your organization be able to act on valuable opportunities<br />

if your work force lacks the industry knowledge,<br />

skills, and motivation to excel? In this session you will<br />

learn about proven approaches and new practices that<br />

insurers are using to drive growth with learning and<br />

professional development.<br />

Session 10 – Azalea Room<br />

Voluntary Employee Benefit <strong>Program</strong>s:<br />

A Cost Effective Way To Grow Your Business<br />

Gaurang Pandya, MBA, CFP<br />

Vice President, Global Strategic Initiatives<br />

Prudential Financial, Inc. (PFI)*<br />

Pavan Virmani<br />

Head, Group Sales<br />

Aviva Ltd.<br />

William J. Velto, Moderator<br />

President and CEO<br />

The Velto Group Inc.<br />

Executives on this panel will share their<br />

experiences on how they have developed<br />

successful voluntary employee benefit strategies in Asia<br />

and other regions. Attend this panel session to learn<br />

how companies can grow their middle market business,<br />

increase policyholder persistency, and also recruit and<br />

retain quality agents/advisors by offering voluntary<br />

employee benefits.<br />

3:35 – 4:00 p.m.<br />

Networking Break – Tower Ballroom Foyer<br />

4:00 – 5:00 p.m.<br />

Closing Keynote Speaker – Tower B<br />

Driving Sustainable Growth: Building a Business<br />

that Prospers in Good Times and in Bad<br />

William Toppeta<br />

Senior Adviser<br />

Promontory Financial Group, LLC<br />

The stakeholders in every business<br />

want sustainable growth. Building an<br />

enterprise that endures requires laser-like focus on a<br />

number of key areas as well as tremendous discipline.<br />

What are the salient focal points for leaders which will<br />

lead to long-term success?<br />

5:00 p.m.<br />

Adjournment<br />

*Disclaimer: Prudential Financial, Inc. of the United States is not affiliated with<br />

Prudential plc. which is headquartered in the United Kingdom. 5

speaker biographies<br />

Mark Adel, FLMI, FFSI, AAPA, AIRC<br />

Second Vice President, Education and Training<br />

LIMRA and LOMA<br />

Adel’s primary role is to provide learning solutions that meet<br />

the needs of insurers and their employees. The tools he employs<br />

include LOMA designations, e-learning, instructor-led training,<br />

and custom learning paths. After joining LOMA in 1997<br />

to write industry textbooks, he moved to his current position<br />

in Product Management. Before LOMA, he spent 18 years in<br />

group insurance, first as a Contract Analyst at Aetna, and then<br />

at Prudential Financial as Regional Director of Contracts, where<br />

he was responsible for Compliance, Contract Issue, and New<br />

Business.<br />

Syed Ismail Alhabshi<br />

Principal Consultant (Takaful)<br />

IBFIM<br />

Tuan Syed co-founded an audit and taxation company in<br />

1988 before joining Syarikat Takaful Malaysia in 1991. In 2004<br />

he became responsible for managing commission data related<br />

issues and oversaw a team that piloted a project enabling the<br />

sale of Family Takaful products through designated salaried<br />

sales staff. In 2008 he joined Takaful Ikhlas Sdn. Bhd. as<br />

the Assistant Vice President of the Financial Institution<br />

Department, Marketing Division, and General Manager<br />

of the IIUM Endowment Fund (IEF), a division under the<br />

International Islamic University. During his tenure at IEF he<br />

was awarded the 2009 Most Creative Zakat Agent, managing<br />

to collect a total of RM14 million in donations during the<br />

two year period. Tuan Syed is now the Principal Consultant<br />

with IBFIM and has been instrumental in preparing a license<br />

to practice examination for aspiring agents, the Takaful Basic<br />

Examination (TBE). He is also an IBFIM accredited trainer.<br />

Ashwin B<br />

Chief Operating Officer<br />

ING Vysya Life Insurance Company<br />

Ashwin B joined ING Life India as the Chief Operating<br />

Officer in August 2008, and is responsible for leading the<br />

Operations and Customer Services, Project Management,<br />

Business Analytics, and Corporate Services functions. He has<br />

also recently been entrusted with the responsibility of setting<br />

up and building the group business. Ashwin has 25 years of<br />

experience in sales, customer service, and operations across<br />

the life insurance, retail banking, and consumer durables<br />

industries. He received a degree in mechanical engineering<br />

from IIT Roorkee and has done Masters in Management<br />

Studies from NMIMS (Mumbai) in Marketing and Finance.<br />

Maryan Broadbent<br />

Group Chief Customer Officer<br />

AIA<br />

A mathematician by training, Maryan has specialized for almost<br />

20 years in understanding consumer behaviour and translating it<br />

into action, in both client and consultant roles. She has developed<br />

and applied these principles in a career that has included strategy<br />

and marketing at RBS, customer centricity roles at GE Consumer<br />

Finance and Alico, and as Chief Customer Officer at MetLife<br />

International. Having worked in the UK, Australia, and Japan,<br />

Maryan is now Group Chief Customer Officer for AIA in Hong<br />

Kong, where she works with AIA’s 16 markets. Maryan has long<br />

been an advocate of combining multiple data sources with left<br />

and right brain thinking to bring the voice of the<br />

customer into business decisions.<br />

Robert Burr<br />

Head of Life & Health Asia, Managing Director<br />

Swiss Re<br />

Burr has over 25 years’ experience in life and health re/insurance,<br />

and has held senior roles within global marketing and advertising<br />

agencies. At these agencies he specialized in the financial services<br />

sector, with clients such as American Express and Standard<br />

Chartered Bank. Burr joined Swiss Re in 2011, where he leads life<br />

and health reinsurance client management and marketing activities.<br />

In this role, Burr is responsible for ensuring that the needs of<br />

clients are met with innovative strategies and products. He also<br />

sits on the Emerging Markets Committee, committed to expanding<br />

Swiss Re’s presence in Asia. Before joining Swiss Re, he was<br />

Vice President and Chief Marketing Officer for Sun Life Financial,<br />

Asia, where he oversaw Asia’s product development process<br />

and the integration of marketing insights into this process. Prior<br />

to this, Burr was Vice President, Marketing, AIG Life, a role which<br />

included managing their accident health business across Asia.<br />

Vijay Chavan<br />

Co-Founder and Executive Director<br />

C2L BIZ Solutions Inc<br />

Chavan has 28 years’ experience in the IT industry, creating and<br />

establishing companies, conceptualizing and architecting insurance<br />

enterprise platforms, and improving business development<br />

plans. He has spent over 23 years in the insurance industry and<br />

has created a world-class enterprise platform (IP) for the global<br />

insurance industry. Within five years of founding C2L BIZ Solutions,<br />

a company focused on providing business and IT solutions<br />

to global Insurance industry, Chavan has released 8 successful IP’s<br />

addressing evolving business challenges faced by global insurance<br />

carriers. His extensive IT knowledge, global experience, understanding<br />

of industry challenges and trends, and ability to conceptualize<br />

solutions with measurable business outcomes makes him<br />

a leading authority on technology and client business.<br />

7

Peter Erlandsen<br />

Managing Director, Asia<br />

Pacific Life Re Limited<br />

Singapore Branch<br />

Peter Erlandsen leads the Pacific Life Re Asia team to develop<br />

innovative, client-centric reinsurance solutions for its clients.<br />

He has over 25 years life insurance industry experience,<br />

working for several multi-national companies in six countries<br />

and on four continents. These companies include MetLife,<br />

Manulife, Winterthur Life, and Swiss Re. Erlandsen’s experience<br />

is broad and covers areas such as marketing, product<br />

design, financial reporting, and capital and process improvement.<br />

He is also an actuary and accountant.<br />

Na Jia, FSA<br />

Senior Partner and Chief Marketing Officer<br />

ReMark International<br />

Jia is a Fellow of the Society of Actuaries with over 12 years<br />

of experience advising life insurers and reinsurers. She is a<br />

recognised expert in marketing strategy, product development,<br />

and pricing for direct distribution who has consulted to leading<br />

financial institutions including Bank of China Insurance,<br />

Hyundai, Generali, ING, Prudential, Great Eastern, Etiqa/<br />

Maybank, Takaful Ikhlas and Manulife. Jia is currently Chief<br />

Marketing Officer of ReMark International. Prior to joining<br />

the direct marketing consultancy industry, she worked for<br />

Swiss Re in Australia, Switzerland, the United Kingdom, and<br />

South Korea.<br />

Steve Jin<br />

President & CEO<br />

Hontai Life Insurance Company, Taiwan<br />

Prior to joining Hontai, Jin served as president and CEO of<br />

Prudential Life of Taiwan where he oversaw all management<br />

and operation functions providing individual life insurance<br />

products to the Taiwan marketplace. Other past roles for Jin<br />

include Managing Director for The Prudential Insurance<br />

Company of America where he successfully built agencies in<br />

California and Hawaii, as well as vice president and Chief<br />

Marketing Officer for Life of Georgia in Taiwan. In this<br />

position, he guided the agency force to substantial growth in<br />

size and productivity. Jin was also a top sales manager and<br />

assistant general manager for New York Life in Texas before<br />

transferring to international operations.<br />

William Kuan<br />

President Director<br />

PT Prudential Life Assurance<br />

As President Director for PT Prudential Life Assurance,<br />

Indonesia, William leads their insurance operations and business<br />

development in Indonesia. He has been with Prudential<br />

for more than 13 years, having held senior roles at Prudential<br />

Malaysia across various functions including Finance, Strategy<br />

and Partnership Distribution. In 2006, he was appointed Chief<br />

Financial Officer and in 2010 assumed the role of President and<br />

Chief Executive Officer of Prudential Indonesia. William holds<br />

an MBA from RMIT University, Australia, and has also completed<br />

The Strategic Leadership <strong>Program</strong> from the University<br />

of Oxford, England. Professionally, he is a Fellow Member<br />

of the Australian Society of CPAs (FCPA) and a qualified<br />

Chartered Accountant. Currently he is serving as Co-Chairman<br />

of The Indonesian Life Association (AAJI).<br />

Alvin Y. Lee<br />

Executive Director, Risk Management Analytics<br />

MSCI Inc.<br />

Alvin Lee and his team work with institutional investors, asset<br />

managers, and institutions to analyze the enterprise investment,<br />

credit, and counterparty risks of their investment, trading,<br />

lending, and intermediary activities. Mr. Lee was previously<br />

Head of Asia at RiskMetrics Group, which was acquired<br />

by MSCI in 2010. Before that, he was a Vice President at<br />

JP Morgan, where he led their risk management solutions<br />

and advisory services for Asian institutions, as well as product<br />

development. Mr. Lee holds Bachelors and Masters degrees in<br />

Engineering from Stanford University.<br />

Jacqueline (Jacquie) Lucas<br />

Director of International <strong>Program</strong>s<br />

The Centre for International Assessment and Development<br />

LIMRA<br />

As the Director of International <strong>Program</strong>s for LIMRA’s<br />

Centre for International Assessment and Development,<br />

Lucas is responsible for updating existing content and marketing<br />

materials, building client and trainer relationships, and<br />

providing consulting expertise to help our business partners<br />

reach and exceed their professional business goals. Prior to<br />

LIMRA, Lucas spent 12 years with AXA Equitable, a member<br />

of the global AXA Group. While there, she held many positions<br />

with a wide range of responsibilities including field training,<br />

running several large branch organizations, and maintaining<br />

AXA’s training content to identify, develop and implement<br />

training solutions designed to support recruiting effectiveness,<br />

veteran productivity, and management development. Lucas<br />

holds Series 7, Series 66, and Series 24 FINRA licenses.<br />

8

Michael B. Marshall<br />

Corporate Vice President, International Research<br />

LIMRA<br />

Marshall, who joined LIMRA in 2012, directs LIMRA’s international<br />

research program, which conducts a wide variety of<br />

research on markets throughout the world. He supervises and<br />

conducts research on distribution, consumer behavior and<br />

sentiment, products, retirement, and technology, identifying<br />

insights and trends valuable to members as they grow their business<br />

and enter new markets. Prior to joining LIMRA, Marshall<br />

spent 22 years with New York Life, culminating as corporate vice<br />

president and director of research. In that capacity, he became<br />

a recognized industry expert on studying distribution trends<br />

and consumer behavior. He is a founding member of the<br />

Financial Industry Research Study Team, established in 1994<br />

and represented by senior researchers from leading life and<br />

investment companies, research suppliers and industry<br />

organizations. Marshall is a graduate of Oberlin College and<br />

received his M.B.A. from Harvard Business School.<br />

Gaurang Pandya, MBA, CFP<br />

Vice President, Global Strategic Initiatives<br />

Prudential Financial, Inc. (PFI)<br />

With over 20 years of industry experience, Pandya has<br />

extensive background in business development, marketing,<br />

sales, distribution, and field operations. Pandya assumed his<br />

current role in 2010, and supports PFI’s life insurance joint<br />

venture in China. He joined PFI in 1994 in its mutual funds<br />

product development area, where he helped develop wrapfee-based<br />

programs for the retirement plans market and<br />

a similar program for offshore clients. In 1995 he moved<br />

to the marketing and field development division of PFI’s<br />

U.S. Individual Insurance Group, supporting over 10,000<br />

insurance agents. He then joined the company’s International<br />

Alternative Distribution Group in 1999 to develop operations<br />

infrastructure for their start-up business in Japan, including<br />

finance, marketing, distribution, sales promotion, systems, call<br />

center, and Internet. From 2002 until early 2005, Pandya was<br />

responsible for business development in Europe, notably in<br />

Germany and The Netherlands. He then joined International<br />

Investments in 2005 and was responsible for global marketing<br />

and client services.<br />

Prudential Financial, Inc. of the United States is not affiliated with Prudential plc. which is<br />

headquartered in the United Kingdom.<br />

Gordon Perchthold<br />

Senior Advisor<br />

Managing Across Asia<br />

Perchthold has worked throughout Asia for half of his 30 year<br />

career. A management consultant, partner, and/or managing<br />

partner with Accenture, Deloitte and its spin-off in Japan<br />

(ABeam Consulting), The RFP Company, and his successor<br />

firm Managing Across Asia, Perchthold has conducted over 150<br />

projects for over 50 multinational management teams across<br />

21 countries to restructure their Asia regional office, develop<br />

regional and country level business strategies and operating<br />

models, facilitate management workshops, structure and<br />

execute multi-country projects leveraging and building capabilities<br />

of internal client resources, and directed/project manage<br />

numerous implementation initiatives. He co-authored “Extract<br />

Value From Consultants: How to Hire, Use, and Fire Them”<br />

to help users of consulting services to realize better business<br />

results from using consultants, particularly in Asia.<br />

Darshan Singh<br />

Head of Actuarial Services<br />

Pacific Life Re Limited, Singapore Branch<br />

Darshan has primary responsibility for pricing and financial<br />

reporting for Pacific Life Re Singapore Branch. He guides<br />

clients in matters related to product development, distribution<br />

strategy, pricing, actuarial training, regulatory filing of products<br />

and rates, and the development of tailored reinsurance solutions<br />

to optimize financial needs. He has worked extensively<br />

with clients to assist in pricing and experience analyses, as well<br />

as wider product development including tiered CI products,<br />

simplified issue products, longevity swaps, and critical illness<br />

/ disability income hybrid products. He has been active in the<br />

industry through presenting at UK and Asian actuarial conferences,<br />

membership of conference organizing committees, and<br />

professional working groups.<br />

Lance Tay<br />

Chief Executive Officer<br />

Tokio Marine Life Insurance Singapore Ltd.<br />

Prior to Tay’s current appointment, he was a Senior Vice<br />

President and Head of Partnership Distribution at Tokio Marine.<br />

Lance has over 28 years experience in the life insurance industry<br />

and has held various senior positions in Singapore and the<br />

region, including as Deputy CEO of John Hancock Singapore<br />

and as CEO of John Hancock Indonesia. Prior to joining Tokio<br />

Marine, he was the Chief Marketing Officer of AIA Singapore<br />

where he oversaw the marketing operation, product development<br />

& management and all profit centers of the company.<br />

Saloon Tham<br />

Regional General Manager, Life & Health<br />

Allianz SE, Singapore Branch<br />

Tham joined Allianz Asia Pacific as Regional Head of Life<br />

Insurance in October 2012. Previously, he was Regional President<br />

for ACE Life, managing the company’s life operations in<br />

China, Hong Kong, Taiwan, Korea, Thailand, Vietnam and<br />

Indonesia. At ACE, Tham also set up a new life Insurance<br />

business for their strategic partner in China, Huatai Insurance<br />

(General) Company. With over 20 years of experience in the<br />

life insurance industry, Tham has held leadership positions at<br />

New York Life Insurance in the U.S., Taiwan, Indonesia, and the<br />

Philippines.<br />

9

William Toppeta<br />

Senior Adviser<br />

Promontory Financial Group, LLC<br />

Toppeta leverages his extensive high-level industry experience<br />

and Promontory’s resources to strategically guide insurers as<br />

they navigate an environment of increasing global competition,<br />

mounting pressure for cross-border regulatory standardization,<br />

heightened governance, and post-crisis financial stresses. Before<br />

joining Promontory, Toppeta was President of MetLife’s non-<br />

U.S. operations, responsible for all of the company’s insurance<br />

and employee-benefits business in over 60 countries. In this role<br />

he worked closely with numerous regulatory authorities around<br />

the world. During his career with MetLife, he also was President<br />

and CEO of MetLife’s Canadian business, head of client services<br />

and chief administrative officer in the U.S., led the company’s<br />

U.S. retail business and agency sales force, and held senior legal<br />

positions and served on the board of Metropolitan Property<br />

and Casualty Insurance Co. He is a member of the Council on<br />

Foreign Relations and of the New York Bar. He is a director and<br />

former chairman of the Coalition of Service Industries and<br />

trustee of Fordham University.<br />

William J. Velto<br />

President and CEO<br />

The Velto Group Inc.<br />

Velto is President and CEO of The Velto Group, an international<br />

marketing and distribution consulting firm that specializes<br />

in the creation and execution of voluntary benefits distribution<br />

strategies worldwide. Velto and his team have successfully created<br />

local distribution strategies in over 30 countries during the<br />

past 8 years. Their processes have included tied agents, brokers,<br />

and banks in their distribution strategy and the use of face to<br />

face, statement marketing, and e-commerce for enrollments.<br />

Velto is the former Worldwide CEO of AIG’s International<br />

General Insurance Company’s Voluntary Employee Benefits Division.<br />

His prior experiences include distribution and product<br />

line executive positions with MetLife and Allstate’s Workplace<br />

Division. Velto is a past president of the Mass Marketing Insurance<br />

Institute and a member of LIMRA’s Worksite Marketing<br />

Advisory Committee. In addition, he has served on the Insurance<br />

Carriers’ Voluntary Employee Benefit Board and as Chair<br />

of the Northeast Mass Marketing Directors Study Group.<br />

Pavan Virmani<br />

Head, Group Sales<br />

Aviva Ltd.<br />

Virmani has worked in the life and health insurance industry<br />

in Asia for more than a dozen years. During that time, he has<br />

led business divisions and initiatives in bancassurance, business<br />

development, distribution, and mergers and acquisitions<br />

throughout the Asia-Pacific. Virmani has been with Aviva for<br />

seven years, leading group insurance distribution since January<br />

2010. Aviva Ltd. is a market leader in Singapore’s employee benefits<br />

and healthcare segment, insuring over 600,000 customers<br />

and 3,000 companies — and committed to serving its customers<br />

and building an ever-stronger, sustainable business.<br />

Mark S. Wallis, CLU, ChFC, CFP, CLF<br />

Chief Agency Officer<br />

Zurich Life Insurance Hong Kong<br />

With an extensive background of country and regional management<br />

in Asia, Wallis has over 30 years of experience in the<br />

insurance and financial services industry. He began his career<br />

in North America as a life insurance agent and advanced into<br />

a variety of field management roles, receiving several national<br />

awards at New York Life. In 2002 he moved to Seoul to become<br />

EVP and CDO of New York Life International (NYLI).<br />

In 2004, Wallis joined AIA (AIG) as Regional Vice President,<br />

APLO, to establish the firm’s regional strategy for distribution<br />

development and best practices. In 2008 he returned to NYLI<br />

in a regional role working in Shanghai and Chengdu to develop<br />

agency distribution. Wallis currently serves as the Chief Agency<br />

Officer for Zurich Life Insurance Hong Kong and provides<br />

distribution support for other Zurich Agency markets in Asia.<br />

A native of the United States and raised in Hong Kong, he has a<br />

strong passion for life insurance and its benefits.<br />

Lisa Watson<br />

Chairman, Direct Marketing Association of Singapore<br />

Regional Segment Manager, Hewlett-Packard Asia Pacific<br />

In Asia since 1991, Watson is an expert business and marketing<br />

specialist with agency, technology, and consulting experience.<br />

She is an active advocate of the direct marketing industry and<br />

has served as Chairman of the Direct Marketing Association<br />

of Singapore since 2002. She also sits on the Global Advisory<br />

Board of the U.S. Direct Marketing Association and the<br />

Advertising Standards Authority of Singapore. Watson joined<br />

Hewlett-Packard in 2010 after more than 20 years of helping<br />

clients increase their returns on marketing investment through<br />

strategies, skills, and technology that leverage the power of<br />

data and intelligence. She had founded her own company, Ibis<br />

Intelligence Services, in Singapore in 2001, and one of her key<br />

assignments was as a senior director with Oracle Corporation.<br />

Prior to this she spent over 15 years in advertising and direct<br />

marketing agencies including Leo Burnett, Young & Rubicam,<br />

Wunderman, and OgilvyOne. Watson has worked with clients<br />

in numerous industries and geographies, from Apple to Procter<br />

& Gamble, to Xerox/Fuji Xerox.

hotel map<br />

11

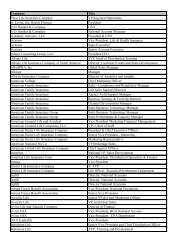

21 st Annual Strategic Issues Conference<br />

19-21 June, <strong>2013</strong> • Shangri-La Hotel • Singapore<br />

SCHEDULE AT A GLANCE<br />

Wednesday, 19 June<br />

5:30 p.m. Welcome Reception<br />

Thursday, 20 June<br />

7:30 a.m. Registration Reopens TOWER FOYER<br />

8:45 – 9:00 a.m. Opening Remarks TOWER B<br />

9:00 – 10:00 a.m. Opening Keynote Speaker<br />

10:00 – 10:30 a.m. Networking Break<br />

10:30 a.m. – 12:00 p.m. CEO Panel<br />

12:00 – 1:20 p.m. Luncheon TOWER A<br />

1:20 – 2:20 p.m. Concurrent Sessions<br />

1. iGrowth Effectiveness: How Mobility, Distribution, and<br />

Operational Effectiveness Changed the Rules TOWER B<br />

2. Driving Takaful AZALEA ROOM<br />

3. Fishing for Growth Opportunities by Building a<br />

Better Customer Experience MAGNOLIA ROOM<br />

2:30 – 3:30 p.m. Concurrent Sessions<br />

4. Winning in a Digital World: The Power of Direct<br />

Marketing to Deliver Results Today MAGNOLIA ROOM<br />

5. How Can Western Multinationals Perform More<br />

Successfully in Asia? AZALEA ROOM<br />

Friday, 21 June<br />

8:45 – 8:50 a.m. Opening Remarks TOWER B<br />

8:50 – 10:50 a.m. General Sessions<br />

10:50 – 11:15 a.m. Networking Break<br />

11:15 a.m. – 12:15 p.m. General Session<br />

12:15 – 1:30 p.m. Luncheon TOWER A<br />

1:30 – 2:30 p.m. Concurrent Sessions<br />

7. The Rapidly Evolving Future of Bancassurance TOWER B<br />

8. The Era of Big Data and Implications<br />

for Insurance AZALEA ROOM<br />

2:35 – 3:35 p.m. Concurrent Sessions<br />

9. Driving Growth with Learning TOWER B<br />

10. Voluntary Employee Benefit <strong>Program</strong>s: A Cost Effective<br />

Way to Grow Your Business AZALEA ROOM<br />

3:35 – 4:00 p.m. Networking Break<br />

4:00 – 5:00 p.m. Closing Keynote Speaker<br />

Thank You to Our Sponsors<br />

6. The Dangers of Reviewable Products TOWER B<br />

3:30 – 4:00 p.m. Networking Break<br />

4:00 – 5:00 p.m. General Session TOWER B<br />

5:30 p.m. Evening Reception TOWER A<br />

mark your calendars!<br />

Join us next year for the<br />

22nd LIMRA & LOMA<br />

Strategic Issues Conference<br />

in Taiwan, 18-20 June, 2014!<br />

005719-513-(562-51-2-J28)