Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

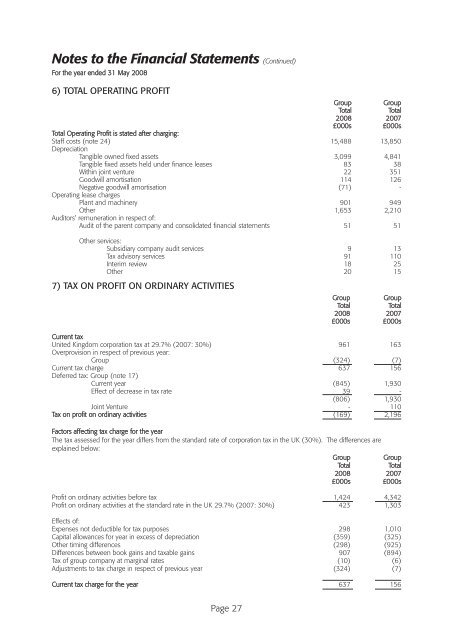

Notes to the Financial Statements (Continued)<br />

For the year ended 31 May 2008<br />

6) TOTAL OPERATING PROFIT<br />

Group Group<br />

Total<br />

Total<br />

2008 2007<br />

£000s £000s<br />

Total Operating Profit is stated after charging:<br />

Staff costs (note 24) 15,488 13,850<br />

Depreciation<br />

Tangible owned fixed assets 3,099 4,841<br />

Tangible fixed assets held under finance leases 83 38<br />

Within joint venture 22 351<br />

Goodwill amortisation 114 126<br />

Negative goodwill amortisation (71) -<br />

Operating lease charges<br />

Plant and machinery 901 949<br />

Other 1,653 2,210<br />

Auditors' remuneration in respect of:<br />

Audit of the parent company and consolidated financial statements 51 51<br />

Other services:<br />

Subsidiary company audit services 9 13<br />

Tax advisory services 91 110<br />

Interim review 18 25<br />

Other 20 15<br />

7) TAX ON PROFIT ON ORDINARY ACTIVITIES<br />

Group Group<br />

Total<br />

Total<br />

2008 2007<br />

£000s £000s<br />

Current tax<br />

United Kingdom corporation tax at 29.7% (2007: 30%) 961 163<br />

Overprovision in respect of previous year:<br />

Group (324) (7)<br />

Current tax charge 637 156<br />

Deferred tax: Group (note 17)<br />

Current year (845) 1,930<br />

Effect of decrease in tax rate 39 -<br />

(806) 1,930<br />

Joint Venture - 110<br />

Tax on profit on ordinary activities (169) 2,196<br />

Factors affecting tax charge for the year<br />

The tax assessed for the year differs from the standard rate of corporation tax in the UK (30%). The differences are<br />

explained below:<br />

Group Group<br />

Total<br />

Total<br />

2008 2007<br />

£000s £000s<br />

Profit on ordinary activities before tax 1,424 4,342<br />

Profit on ordinary activities at the standard rate in the UK 29.7% (2007: 30%) 423 1,303<br />

Effects of:<br />

Expenses not deductible for tax purposes 298 1,010<br />

Capital allowances for year in excess of depreciation (359) (325)<br />

Other timing differences (298) (925)<br />

Differences between book gains and taxable gains 907 (894)<br />

Tax of group company at marginal rates (10) (6)<br />

Adjustments to tax charge in respect of previous year (324) (7)<br />

Current tax charge for the year 637 156<br />

Page 27