Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

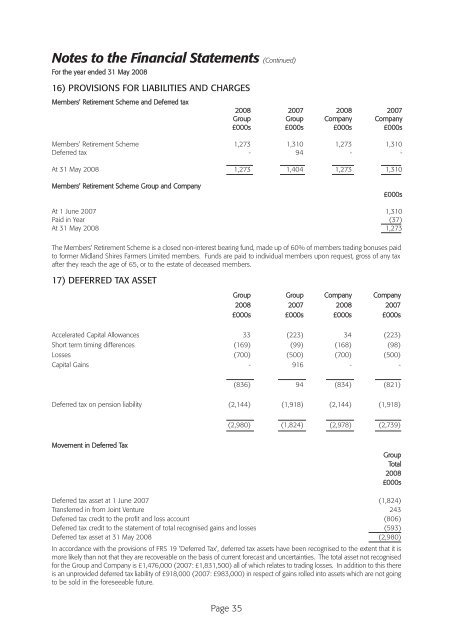

Notes to the Financial Statements (Continued)<br />

For the year ended 31 May 2008<br />

16) PROVISIONS FOR LIABILITIES AND CHARGES<br />

Members' Retirement Scheme and Deferred tax<br />

2008 2007 2008 2007<br />

Group Group Company Company<br />

£000s £000s £000s £000s<br />

Members' Retirement Scheme 1,273 1,310 1,273 1,310<br />

Deferred tax - 94 - -<br />

At 31 May 2008 1,273 1,404 1,273 1,310<br />

Members' Retirement Scheme Group and Company<br />

£000s<br />

At 1 June 2007 1,310<br />

Paid in Year (37)<br />

At 31 May 2008 1,273<br />

The Members' Retirement Scheme is a closed non-interest bearing fund, made up of 60% of members trading bonuses paid<br />

to former Midland Shires <strong>Farmers</strong> Limited members. Funds are paid to individual members upon request, gross of any tax<br />

after they reach the age of 65, or to the estate of deceased members.<br />

17) DEFERRED TAX ASSET<br />

Group Group Company Company<br />

2008 2007 2008 2007<br />

£000s £000s £000s £000s<br />

Accelerated Capital Allowances 33 (223) 34 (223)<br />

Short term timing differences (169) (99) (168) (98)<br />

Losses (700) (500) (700) (500)<br />

Capital Gains - 916 - -<br />

(836) 94 (834) (821)<br />

Deferred tax on pension liability (2,144) (1,918) (2,144) (1,918)<br />

(2,980) (1,824) (2,978) (2,739)<br />

Movement in Deferred Tax<br />

Group<br />

Total<br />

2008<br />

£000s<br />

Deferred tax asset at 1 June 2007 (1,824)<br />

Transferred in from Joint Venture 243<br />

Deferred tax credit to the profit and loss account (806)<br />

Deferred tax credit to the statement of total recognised gains and losses (593)<br />

Deferred tax asset at 31 May 2008 (2,980)<br />

In accordance with the provisions of FRS 19 'Deferred Tax', deferred tax assets have been recognised to the extent that it is<br />

more likely than not that they are recoverable on the basis of current forecast and uncertainties. The total asset not recognised<br />

for the Group and Company is £1,476,000 (2007: £1,831,500) all of which relates to trading losses. In addition to this there<br />

is an unprovided deferred tax liability of £918,000 (2007: £983,000) in respect of gains rolled into assets which are not going<br />

to be sold in the foreseeable future.<br />

Page 35