Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

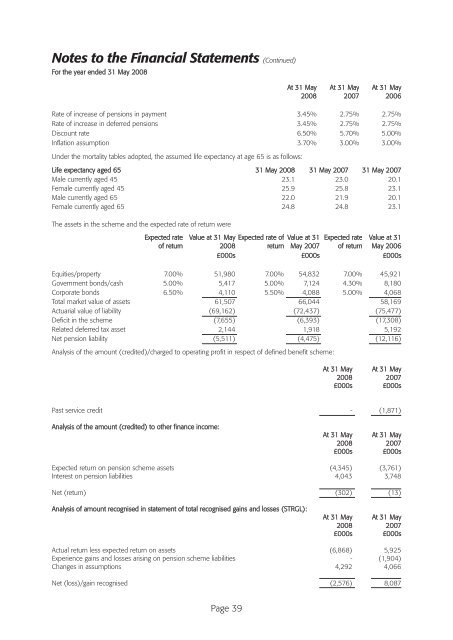

Notes to the Financial Statements (Continued)<br />

For the year ended 31 May 2008<br />

At 31 May<br />

2008<br />

At 31 May<br />

2007<br />

At 31 May<br />

2006<br />

Rate of increase of pensions in payment 3.45% 2.75% 2.75%<br />

Rate of increase in deferred pensions 3.45% 2.75% 2.75%<br />

Discount rate 6.50% 5.70% 5.00%<br />

Inflation assumption 3.70% 3.00% 3.00%<br />

Under the mortality tables adopted, the assumed life expectancy at age 65 is as follows:<br />

Life expectancy aged 65 31 May 2008 31 May 2007 31 May 2007<br />

Male currently aged 45 23.1 23.0 20.1<br />

Female currently aged 45 25.9 25.8 23.1<br />

Male currently aged 65 22.0 21.9 20.1<br />

Female currently aged 65 24.8 24.8 23.1<br />

The assets in the scheme and the expected rate of return were<br />

Expected rate<br />

of return<br />

Value at 31 May Expected rate of Value at 31 Expected rate Value at 31<br />

2008 return May 2007 of return May 2006<br />

£000s £000s £000s<br />

Equities/property 7.00% 51,980 7.00% 54,832 7.00% 45,921<br />

Government bonds/cash 5.00% 5,417 5.00% 7,124 4.30% 8,180<br />

Corporate bonds 6.50% 4,110 5.50% 4,088 5.00% 4,068<br />

Total market value of assets 61,507 66,044 58,169<br />

Actuarial value of liability (69,162) (72,437) (75,477)<br />

Deficit in the scheme (7,655) (6,393) (17,308)<br />

Related deferred tax asset 2,144 1,918 5,192<br />

Net pension liability (5,511) (4,475) (12,116)<br />

Analysis of the amount (credited)/charged to operating profit in respect of defined benefit scheme:<br />

At 31 May At 31 May<br />

2008 2007<br />

£000s £000s<br />

Past service credit - (1,871)<br />

Analysis of the amount (credited) to other finance income:<br />

At 31 May At 31 May<br />

2008 2007<br />

£000s £000s<br />

Expected return on pension scheme assets (4,345) (3,761)<br />

Interest on pension liabilities 4,043 3,748<br />

Net (return) (302) (13)<br />

Analysis of amount recognised in statement of total recognised gains and losses (STRGL):<br />

At 31 May At 31 May<br />

2008 2007<br />

£000s £000s<br />

Actual return less expected return on assets (6,868) 5,925<br />

Experience gains and losses arising on pension scheme liabilities - (1,904)<br />

Changes in assumptions 4,292 4,066<br />

Net (loss)/gain recognised (2,576) 8,087<br />

Page 39