Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

Annual Report & Accounts - Countrywide Farmers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements (Continued)<br />

For the year ended 31 May 2008<br />

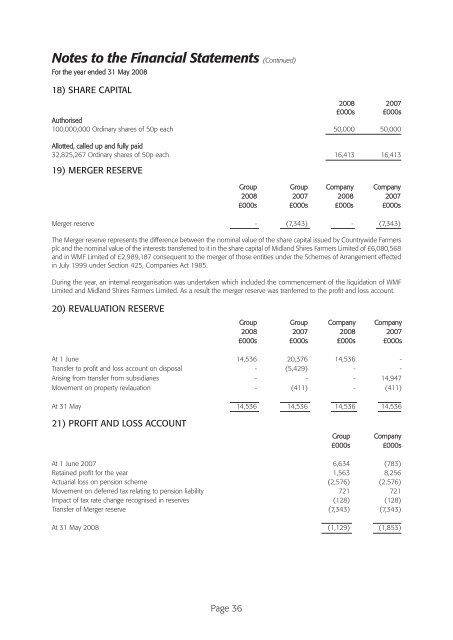

18) SHARE CAPITAL<br />

2008 2007<br />

£000s £000s<br />

Authorised<br />

100,000,000 Ordinary shares of 50p each 50,000 50,000<br />

Allotted, called up and fully paid<br />

32,825,267 Ordinary shares of 50p each 16,413 16,413<br />

19) MERGER RESERVE<br />

Group Group Company Company<br />

2008 2007 2008 2007<br />

£000s £000s £000s £000s<br />

Merger reserve - (7,343) - (7,343)<br />

The Merger reserve represents the difference between the nominal value of the share capital issued by <strong>Countrywide</strong> <strong>Farmers</strong><br />

plc and the nominal value of the interests transferred to it in the share capital of Midland Shires <strong>Farmers</strong> Limited of £6,080,568<br />

and in WMF Limited of £2,989,187 consequent to the merger of those entities under the Schemes of Arrangement effected<br />

in July 1999 under Section 425, Companies Act 1985.<br />

During the year, an internal reorganisation was undertaken which included the commencement of the liquidation of WMF<br />

Limited and Midland Shires <strong>Farmers</strong> Limited. As a result the merger reserve was tranferred to the profit and loss account.<br />

20) REVALUATION RESERVE<br />

Group Group Company Company<br />

2008 2007 2008 2007<br />

£000s £000s £000s £000s<br />

At 1 June 14,536 20,376 14,536 -<br />

Transfer to profit and loss account on disposal - (5,429) - -<br />

Arising from transfer from subsidiaries - - - 14,947<br />

Movement on property revlauation - (411) - (411)<br />

At 31 May 14,536 14,536 14,536 14,536<br />

21) PROFIT AND LOSS ACCOUNT<br />

Group Company<br />

£000s £000s<br />

At 1 June 2007 6,634 (783)<br />

Retained profit for the year 1,563 8,256<br />

Actuarial loss on pension scheme (2,576) (2,576)<br />

Movement on deferred tax relating to pension liability 721 721<br />

Impact of tax rate change recognised in reserves (128) (128)<br />

Transfer of Merger reserve (7,343) (7,343)<br />

At 31 May 2008 (1,129) (1,853)<br />

Page 36