joe stegmayer & j.c. strutzel recipients of prestigious awards

joe stegmayer & j.c. strutzel recipients of prestigious awards

joe stegmayer & j.c. strutzel recipients of prestigious awards

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 1<br />

Jan / Feb 2012<br />

Web Edition<br />

A bi-monthly newsletter published exclusively for member companies<br />

CMHI’s Holiday Open House at The<br />

Mission Inn in Riverside on December<br />

8, 2011 provided an appropriate<br />

backdrop for the announcement <strong>of</strong> the<br />

<strong>recipients</strong> <strong>of</strong> the association’s highest<br />

honors. With over 190 CMHI members<br />

and industry friends in attendance,<br />

CMHI President Jess Maxcy presented<br />

two well deserving people with these<br />

honors:<br />

2011 Jack E. Wells Memorial<br />

Award<br />

JOE STEGMAYER & J.C. STRUTZEL<br />

RECIPIENTS OF PRESTIGIOUS AWARDS<br />

Joseph Stegmayer – Cavco<br />

Industries, Inc.<br />

Selected by a Committee <strong>of</strong> past<br />

Jack E. Wells Memorial Award<br />

<strong>recipients</strong> for his steadfast commitment<br />

and productive leadership on behalf <strong>of</strong><br />

the industry, Joseph “Joe” Stegmayer<br />

becomes the 62 nd recipient <strong>of</strong> this<br />

revered award.<br />

Joe is Chairman, President and Chief<br />

Executive Officer <strong>of</strong> Cavco Industries,<br />

Inc. headquartered in Phoenix, Arizona.<br />

The company is one <strong>of</strong> the largest in<br />

the systems built construction industry<br />

with 15 manufacturing plants in nine<br />

states. It produces a diverse product<br />

line <strong>of</strong> factory built homes, vacation<br />

cabins and commercial buildings. The<br />

company’s factories in Phoenix export<br />

product to Mexico, Canada, Japan and<br />

Israel.<br />

In 2009, the company acquired the<br />

operations <strong>of</strong> Fleetwood Homes <strong>of</strong><br />

Riverside, California. Fleetwood, which<br />

has produced and sold more than 1.3<br />

million homes since its inception 60<br />

years ago, operates as a subsidiary<br />

<strong>of</strong> Cavco. Last year the company<br />

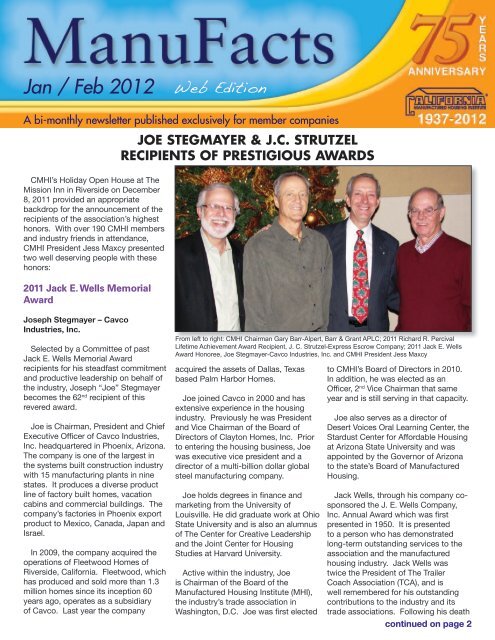

From left to right: CMHI Chairman Gary Barr-Alpert, Barr & Grant APLC; 2011 Richard R. Percival<br />

Lifetime Achievement Award Recipient, J. C. Strutzel-Express Escrow Company; 2011 Jack E. Wells<br />

Award Honoree, Joe Stegmayer-Cavco Industries, Inc. and CMHI President Jess Maxcy<br />

acquired the assets <strong>of</strong> Dallas, Texas<br />

based Palm Harbor Homes.<br />

Joe joined Cavco in 2000 and has<br />

extensive experience in the housing<br />

industry. Previously he was President<br />

and Vice Chairman <strong>of</strong> the Board <strong>of</strong><br />

Directors <strong>of</strong> Clayton Homes, Inc. Prior<br />

to entering the housing business, Joe<br />

was executive vice president and a<br />

director <strong>of</strong> a multi-billion dollar global<br />

steel manufacturing company.<br />

Joe holds degrees in finance and<br />

marketing from the University <strong>of</strong><br />

Louisville. He did graduate work at Ohio<br />

State University and is also an alumnus<br />

<strong>of</strong> The Center for Creative Leadership<br />

and the Joint Center for Housing<br />

Studies at Harvard University.<br />

Active within the industry, Joe<br />

is Chairman <strong>of</strong> the Board <strong>of</strong> the<br />

Manufactured Housing Institute (MHI),<br />

the industry’s trade association in<br />

Washington, D.C. Joe was first elected<br />

to CMHI’s Board <strong>of</strong> Directors in 2010.<br />

In addition, he was elected as an<br />

Officer, 2 nd Vice Chairman that same<br />

year and is still serving in that capacity.<br />

Joe also serves as a director <strong>of</strong><br />

Desert Voices Oral Learning Center, the<br />

Stardust Center for Affordable Housing<br />

at Arizona State University and was<br />

appointed by the Governor <strong>of</strong> Arizona<br />

to the state’s Board <strong>of</strong> Manufactured<br />

Housing.<br />

Jack Wells, through his company cosponsored<br />

the J. E. Wells Company,<br />

Inc. Annual Award which was first<br />

presented in 1950. It is presented<br />

to a person who has demonstrated<br />

long-term outstanding services to the<br />

association and the manufactured<br />

housing industry. Jack Wells was<br />

twice the President <strong>of</strong> The Trailer<br />

Coach Association (TCA), and is<br />

well remembered for his outstanding<br />

contributions to the industry and its<br />

trade associations. Following his death<br />

continued on page 2

Front page continued...<br />

in 1971, the Board <strong>of</strong> Directors <strong>of</strong> TCA<br />

decided that the award would then be<br />

known as the Jack E. Wells Memorial<br />

Award.<br />

2011 Richard R. Percival<br />

Lifetime Achievement Award<br />

J. C. Strutzel – Express Escrow<br />

Company<br />

Honored for a “lifetime” <strong>of</strong> dedication<br />

and extraordinary achievement in the<br />

factory constructed housing industry,<br />

J.C. Strutzel, Chairman <strong>of</strong> the Board <strong>of</strong><br />

Express Escrow Company, becomes<br />

the 23 rd recipient <strong>of</strong> this award.<br />

For J.C. this truly is a lifetime<br />

achievement award. He is a<br />

“Mobilehome Brat”. His first exposure<br />

to the industry was in 1952 when his<br />

father, Jim acquired Mayflower Trailer<br />

Company. This was one among many<br />

<strong>of</strong> the early trailer manufacturers<br />

that evolved from building trailers<br />

to mobilehomes. Jim Strutzel twice<br />

served as President <strong>of</strong> the Trailer Coach<br />

Association and served many years on<br />

its Board <strong>of</strong> Directors. This afforded<br />

J.C. the opportunity to meet most<br />

<strong>of</strong> the pioneers in the mobilehome/<br />

manufactured housing industry.<br />

Following their example, J.C. has<br />

always actively and effectively served<br />

his associations: California Mobilehome<br />

Dealers Association (CMHA), Western<br />

Manufactured Housing Institute (WMHI)<br />

and the California Manufactured<br />

Housing Institute (CMHI).<br />

Prior to going into the escrow<br />

business, J.C. had work experience<br />

in manufactured home insurance,<br />

finance and manufacturing. These<br />

earlier experiences enabled him to<br />

acquire a unique understanding <strong>of</strong><br />

the interrelationships <strong>of</strong> the various<br />

segments <strong>of</strong> the industry.<br />

In 1970, J.C. graduated from<br />

Long Beach State University with<br />

a Bachelor’s Degree in Business<br />

Administration. He completed several<br />

units towards earning a Master’s<br />

Degree in Business Administration<br />

prior to opening Express Escrow for<br />

business in 1976. He subsequently<br />

changed his objective in supplemental<br />

learning to obtaining a real estate<br />

broker’s license, which he earned in<br />

1978.<br />

His breadth <strong>of</strong> technical knowledge<br />

enabled him to understand the<br />

prospective impact <strong>of</strong> various<br />

legislative proposals, making him<br />

potentially helpful to those who<br />

required assistance or clarification. Of<br />

particular note, he served as an expert<br />

for the California Banker’s Association<br />

(SB1035 Haynes, eff. 1984) and the<br />

State Controller’s Office (AB241 Hauser,<br />

eff. 1988). When the state experienced<br />

a high level <strong>of</strong> fraud involving a<br />

significant number <strong>of</strong> “mobilehome<br />

escrow” agents, J.C. was asked to<br />

conduct a training seminar for a state<br />

enforcement agency. As part <strong>of</strong> that<br />

engagement, J.C. prepared a 57 page<br />

audit manual to assist investigators.<br />

J.C. served as a member <strong>of</strong> the<br />

Formation Committee that led to the<br />

creation <strong>of</strong> CMHI in 1986. Since that<br />

time he has been an active member on<br />

CMHI’s Board <strong>of</strong> Directors and served<br />

as CMHI’s first Treasurer.<br />

J.C. has earned many industry honors<br />

over the years. In 1988, he was the<br />

recipient <strong>of</strong> the Jack E. Wells Memorial<br />

Award. In 1996, he was presented<br />

with CMHI’s Chairman’s Award by Jess<br />

Maxcy, then Chairman <strong>of</strong> the Board.<br />

In 1999, J.C. was awarded CMHI’s<br />

President’s Award.<br />

CMHI’s Lifetime Achievement Award<br />

was first presented in 1995. Long time<br />

industry veteran, Richard R. Percival<br />

– Zieman Manufacturing Company,<br />

was the first recipient <strong>of</strong> this award. In<br />

his honor, after his death in 2007, the<br />

award was renamed the Richard R.<br />

Percival Lifetime Achievement Award.<br />

The CMHI Board <strong>of</strong> Directors, staff<br />

and entire membership congratulate<br />

Joe and J.C. on their much deserved<br />

honors. Formal presentation <strong>of</strong> these<br />

<strong>awards</strong> will take place on Thursday,<br />

March 15 th , 2012 at the Jack E. Wells<br />

Awards Banquet at the Pechanga<br />

Resort and Casino in Temecula,<br />

California.<br />

CMHI ANNOUNCES 2012<br />

ANNUAL CONVENTION<br />

Page 2<br />

The Pechanga Resort and Casino in<br />

Temecula once again will be the host<br />

site for CMHI’s Annual Convention,<br />

March 14th –16th.<br />

The event kicks-<strong>of</strong>f on Wednesday,<br />

March 14th with the Board <strong>of</strong> Directors’<br />

Meetings and the Welcome Reception<br />

sponsored by Triad Financial Services.<br />

The Annual General Membership<br />

Meeting and Awards Luncheon will be<br />

held on Thursday March 15th. That<br />

evening, CMHI hosts its Annual Jack E.<br />

Wells Memorial Awards Banquet. On<br />

Friday, March 16th tee times have been<br />

reserved for those who dare to play<br />

Journey…..at Pechanga, a world class<br />

golf course 10,000 years in the making.<br />

CMHI convention attendees will enjoy<br />

$99 w/cart discounted green fees.<br />

Sleeping rooms are available at<br />

Pechanga at CMHI’s special room<br />

rate <strong>of</strong> $109 per night, single/double<br />

occupancy. Make your hotel room<br />

reservations before February 21, 2012-<br />

the cut <strong>of</strong>f date. To make your hotel<br />

room reservations:<br />

By Phone: (888)732-4264 and ask for<br />

“CMHI Room Block”<br />

Via Web: www.pechanga.com;<br />

Click on “Resort”; Click on “Room<br />

Reservations”; Select “Dates <strong>of</strong><br />

Stay”; Click on “Special Rates”; Click<br />

on “Group/Block” and enter code<br />

SCMHI12.<br />

For a complete 2012 Annual<br />

Convention Brochure and Registration<br />

Form please click here or go to CMHI’s<br />

website: www.cmhi.org. Convention<br />

Sponsorship information will be emailed<br />

shortly.<br />

If you have any questions, please call<br />

Kim or Connie at (909)987-2599. See<br />

you all there!

Page 3<br />

AB 317<br />

Mobilehomes:<br />

(Calderon, C.)<br />

2011/‘12 California Industry Legislation<br />

BILL DESCRIPTION STATUS CMHI<br />

POSITION<br />

AB 505<br />

Housing programs:<br />

Audits<br />

(Harkey)<br />

Revises the conditions under which a tenancy in a mobilehome<br />

space within a mobilehome park is exempt from a local rent control<br />

ordinance, rule, regulation, or initiative. Makes the exemptions<br />

applicable when the mobilehome space is not the sole residence<br />

<strong>of</strong> the mobilehome owner. Specifies the evidence upon which<br />

management <strong>of</strong> a mobilehome park may rely to determine whether a<br />

residence is the mobilehome owner's sole residence.<br />

As amended, this bill would require the State Auditor's <strong>of</strong>fice to<br />

perform an audit <strong>of</strong> the Department <strong>of</strong> Housing and Community<br />

Development every four years.<br />

Passed<br />

Assembly<br />

Committee<br />

on Housing &<br />

Community<br />

Development<br />

January 11,<br />

2012<br />

Two Year Bill<br />

Watch<br />

Two Year<br />

Bill<br />

Watch<br />

AB 579<br />

Mobilehome Parks:<br />

Liability:<br />

Attorney's Fees<br />

(Monning)<br />

Permits the award <strong>of</strong> attorney's fees and, in some cases, other<br />

litigation expenses, to a local governmental entity in an action<br />

brought by the owner <strong>of</strong> a mobilehome park to challenge the validity<br />

or application <strong>of</strong> a local ordinance, rule, regulation, or initiative<br />

measure that regulates space rent or is intended to benefit or protect<br />

residents in a mobilehome park, if the local governmental entity is<br />

determined to be the prevailing party.<br />

In Assembly<br />

Committee<br />

on Judiciary:<br />

Not Heard<br />

Watch<br />

Two Year<br />

Bill<br />

AB 928<br />

Housing and<br />

Community<br />

Development:<br />

Mobile Home<br />

Parks<br />

(Wieckowski)<br />

This bill is currently a "spot" bill. A "spot" bill is a placeholder for<br />

legislation that is yet to be determined. This bill will likely be used as<br />

a vehicle to introduce housing related legislation.<br />

Two Year Bill<br />

Watch<br />

SB 149<br />

Mobilehomes:<br />

(Correa)<br />

Makes a technical, nonsubstantive change to the Mobilehome<br />

Residency Law which governs tenancies in mobilehome parks and<br />

imposes various duties on the owners <strong>of</strong> mobilehome parks and the<br />

agents and representatives authorized to act on behalf <strong>of</strong> the owners.<br />

Passed Senate<br />

Committee on<br />

Transportation<br />

& Housing<br />

January 11,<br />

2012<br />

Watch<br />

Two Year<br />

Bill<br />

SB 376<br />

Real Estate<br />

Brokers<br />

(Fuller)<br />

Amends Business and Pr<strong>of</strong>essions Code Section 10131 and adds<br />

10131.8 to allow property management companies who manage<br />

properties for a fee and are already required to be licensed as real<br />

estate brokers by the Department <strong>of</strong> Real Estate (DRE), to make<br />

these used mobilehome loans under their DRE broker license and an<br />

MLO license instead <strong>of</strong> having to acquire an additional license as a<br />

finance lender by the Department <strong>of</strong> Corporations.<br />

In Assembly<br />

Appropriations<br />

Committee<br />

(In-Active)<br />

Support<br />

Two Year<br />

Bill

Page 4<br />

CMHPAC 2012 CAMPAIGN<br />

VOLUNTARY CONTRIBUTION FORM<br />

• All CMHPAC contributions are strictly voluntary.<br />

• Corporate checks CAN be used for PAC<br />

contributions in California according to law.<br />

• Corporate contributions are permissible in California<br />

according to law.<br />

• There is no federal or state deduction or tax credit<br />

for PAC contributions made by businesses or<br />

individuals.<br />

• Contributions to a PAC by individuals or<br />

corporations are limited to $6,500 per calendar year.<br />

• Contributions <strong>of</strong> any amount are appreciated.<br />

Retailers<br />

Manufacturers<br />

$150 Annually<br />

$250 Annually<br />

Suppliers<br />

·$400 members $200 Annually<br />

·$700 members $350 Annually<br />

Developers/Community Owners<br />

·$400 members $200 Annually<br />

·$700 members $350 Annually<br />

Financial Services<br />

Individuals &<br />

Affliliates<br />

CONTRIBUTION<br />

GUIDELINES<br />

$250 Annually<br />

$100 Annually<br />

Please make checks<br />

payable to:<br />

CMHPA C<br />

ALL PURPOSE ACCOUNT<br />

ID#890112<br />

10630 Town Center Dr., #120<br />

Rancho Cucamonga CA 91730<br />

The Fair Political Practices Commission (FPPC) REQUIRES the following:<br />

___________________________________________________________________<br />

Name<br />

___________________________________________________________________<br />

Employer<br />

___________________________________________________________________<br />

Address<br />

City, State, Zip<br />

___________________________________________________________________<br />

Occupation (If individual)<br />

ENCLOSED IS OUR/MY<br />

CMHPAC 2012 CAMPAIGN CONTRIBUTION<br />

IN THE AMOUNT OF<br />

$_____________

Page 5<br />

Manufactured and Mobile Home<br />

Manufactured, Modular and Mobile Home<br />

! !<br />

MORTGAGE<br />

!<br />

Serving the Manufactured and Mobile Home Community for over 32 years<br />

LOAN GUIDELINES<br />

QUALIFICATIONS<br />

Full Doc, Stated Income, Buy-Fors, & Self-Employed!<br />

PROGRAMS<br />

Fixed Rates to 30 Years, Adjustable to 25 Years,<br />

Purchase or Refinance, Cash-Out Available!<br />

DOWN PAYMENTS<br />

5% Down Conventional, 3% Down FHA<br />

$1.00 Down VA<br />

INTEREST RATES<br />

Fixed Rates as Low as 4.5%<br />

Adjustable as Low as 4.25%<br />

(APR 4.89%)<br />

(APR 4.625%)<br />

AGE OF HOME<br />

ALL Ages Financed! No Minimum or Maximum Age!<br />

HOME SIZES<br />

No Minimum Size! We Finance ALL Sizes!<br />

Even Park Models!<br />

CREDIT<br />

All Credit Types Available - Good Credit Rewarded<br />

COMMUNITIES<br />

Rental, Land-Owned, Co-Ops & Private Land!<br />

EASY Telephone Application with Immediate Personalized Service<br />

or Apply Online at www.CAMHF.com<br />

469 E. Mission Road San Marcos, CA 92069<br />

(800) 882-1999<br />

NMLS #325861 - DRE #01861592<br />

Contractor #701705 - Dealer #DL1218634

ViewPoint<br />

HAPPY NEW YEAR!<br />

Welcome to 2012 and CMHI’s<br />

75 th Anniversary!<br />

Seventy-five years ago we joined<br />

forces as the Trailer Coach Association<br />

(TCA). Since then we have transitioned<br />

from TCA to the Western Manufactured<br />

Housing Institute to California<br />

Manufactured Housing Institute – our<br />

nation’s oldest association representing<br />

all segments <strong>of</strong> our industry.<br />

Representing all segments <strong>of</strong> the<br />

industry has, at times, been a challenge<br />

but it has definitely been my experience<br />

that working together produces a<br />

greater total effect than that produced<br />

by the sum <strong>of</strong> individual efforts………<br />

synergy works!<br />

As we head into the New Year we<br />

need to keep in mind that if an issue<br />

is bad for one segment <strong>of</strong> our industry<br />

that means it is probably bad for our<br />

customers and that means it is bad for<br />

all <strong>of</strong> us. Here is a case in point…..<br />

A December 16, 2011 article posted<br />

on mydesert.com provided initial detail<br />

on a dispute concerning permissible<br />

fees that can be charged for a permit to<br />

install a manufactured home in a M/H<br />

park.<br />

The City <strong>of</strong> Desert Hot Springs,<br />

relying on the California Mitigation<br />

Fee Act (MFA) passed an ordinance<br />

which serves as the basis for<br />

imposing a development impact fee<br />

(DIF) <strong>of</strong> approximately $6,970 for<br />

a permit to install a manufactured<br />

home in a developed M/H park. As<br />

a consequence families wishing to<br />

purchase manufactured homes to be<br />

installed on the 78 vacant lots in Palm<br />

Vista Estates would be faced with<br />

an aggregate fee <strong>of</strong> approximately<br />

$543,660. If, as has been asserted, the<br />

city is actually charging up to $9,200<br />

per permit to install a manufactured<br />

home, the aggregate fee could be as<br />

high as $717,600.<br />

The owner <strong>of</strong> Palm Vista Estates and<br />

the California Department <strong>of</strong> Housing<br />

and Community Development (HCD)<br />

have challenged the applicability <strong>of</strong><br />

the DIF to manufactured homes to<br />

be installed in already permitted M/H<br />

parks. As posted in the WMA Newsline<br />

dated December 12, 2011:<br />

The following information is<br />

provided by Brad Harward,<br />

Manufactured Housing Programs<br />

Manager with the Department<br />

<strong>of</strong> Housing and Community<br />

Development (HCD) - Under the<br />

authority <strong>of</strong> the Mobilehome Parks<br />

Act (MPA), a city or county may<br />

assume enforcement responsibility<br />

from the State for the mobilehome<br />

parks within their jurisdiction. Such<br />

governmental agencies are then<br />

defined as a Local Enforcement<br />

Agency or LEA and assume the<br />

mandate to properly enforce the<br />

MPA.<br />

HCD staff has learned that some<br />

<strong>of</strong> the LEAs have been charging<br />

in excess <strong>of</strong> the HCD-mandated<br />

$196 permit fee for manufactured<br />

home installations. The overcharges<br />

range from several hundred to<br />

many thousands <strong>of</strong> dollars. These<br />

overcharges are occurring because<br />

the LEAs are calculating fees in<br />

excess <strong>of</strong> the pre-established<br />

MPA permit fees or by adding<br />

local mitigation fees. According<br />

to California State law, only a new<br />

mobilehome lot may be assessed<br />

mitigation fees and those fees are<br />

assessed at the time the park or lot<br />

is constructed, not when a home is<br />

installed on an existing lot. HCD is<br />

looking into the practices <strong>of</strong> at least<br />

four LEAs regarding the assessment<br />

<strong>of</strong> fees in excess <strong>of</strong> those permitted<br />

by the MPA for installation <strong>of</strong> the<br />

Page 6<br />

manufactured homes inside a park.<br />

The MPA, California Health and<br />

Safety Code Sections 18200 through<br />

18700, and its adopted regulations<br />

contained in the California Code<br />

<strong>of</strong> Regulations, Title 25, Chapter<br />

2 provides for the enforcement<br />

<strong>of</strong> mobilehome parks, including<br />

manufactured home installations and<br />

fees. The fees set forth are the only<br />

fees that may lawfully be assessed<br />

for the installation <strong>of</strong> a manufactured<br />

home inside a park. The current<br />

cost <strong>of</strong> a permit and inspection for<br />

the installation <strong>of</strong> a manufactured<br />

home in a park is $196 for the first<br />

hour and $41 for the second and<br />

subsequent half hour thereafter. An<br />

LEA is required to enforce the MPA<br />

and has no authority to exceed the<br />

statutorily mandated permit fees.<br />

The fee set by the regulations<br />

<strong>of</strong> the installation, or set-up <strong>of</strong> a<br />

manufactured home, includes permit<br />

issuance, travel, administrative time<br />

and the first hour <strong>of</strong> inspection.<br />

continued on page 7<br />

EXPRESS<br />

ESCROW<br />

COMPANY<br />

EXPERTS IN PERFECTING TITLE<br />

FOR PARK-OWNED HOMES<br />

California’s leading authority on<br />

technical issues concerning<br />

manufactured housing<br />

title and escrow<br />

Mobile/manufactured home and<br />

mobilehome park sales and<br />

refinance escrows<br />

Statewide service<br />

7812 EDINGER AVE. SUITE 300<br />

HUNTINGTON BEACH CA 92647<br />

(800) 669-6925 FAX (714) 848-9174<br />

info@ExpressEscrow.com

Page 7<br />

2012 CALENDAR OF EVENTS<br />

February 26th ~ 28th<br />

March 14th ~ 16th<br />

April 10th ~ 12th<br />

May 5th ~ 12th<br />

June 7th<br />

Calendar <strong>of</strong> Events<br />

MHI Legislative Conference<br />

Sheraton Crystal City<br />

Washington, D.C.<br />

Contact Cheryl Langley 703-558-0668<br />

Cheryl@mfghome.org<br />

CMHI 2012 Annual Convention<br />

CMHI Board <strong>of</strong> Directors’ Meeting<br />

CMHI Foundation Board Meeting<br />

Jack E. Wells Memorial Awards Banquet<br />

Pechanga Resort & Casino<br />

Temecula, CA<br />

Contact CMHI 909-987-2599<br />

kim@cmhi.org<br />

National Congress & Expo<br />

Caesar’s Palace<br />

Las Vegas, NV<br />

Contact Cheryl Langley 703-558-0668<br />

Cheryl@mfghome.org<br />

WMA Spring Seminar<br />

Grand Wailea Resort<br />

Maui, Hawaii<br />

Contact Regina Sanchez 916-448-7002<br />

regina@wma.org<br />

CMHI Board <strong>of</strong> Directors’ & CMHI<br />

Foundation Directors’ Meetings<br />

Northern California Chapter Meeting<br />

Sheraton Grand Hotel<br />

Sacramento, CA<br />

Contact CMHI 909-987-2599<br />

kim@cmhi.org<br />

ViewPoint continued...<br />

There are no additional add on, plan<br />

check, or mitigation fees allowed<br />

and an installation permit is not<br />

based on “valuation” <strong>of</strong> the home or<br />

total cost <strong>of</strong> the project. Although<br />

this is clear for the installation <strong>of</strong><br />

the actual “home”, there may be<br />

additional fees and sometimes plan<br />

check fees for the construction <strong>of</strong> a<br />

permanent foundation when that is<br />

utilized.<br />

The only exception is school impact<br />

fees, which may only be applied to<br />

the first manufactured home being<br />

placed on a lot that was developed<br />

on or after September 1, 1986.<br />

There are no school impact fees<br />

on replacement manufactured<br />

homes regardless <strong>of</strong> size. If you<br />

believe a local enforcement agency<br />

is charging excessive fees in your<br />

park, please notify us and HCD will<br />

investigate your complaint.<br />

Brad Harward can be reached a<br />

bharward@hcd.ca.gov or (916)324-<br />

4907.<br />

Now, can a case be made that<br />

inappropriate permit fees ranging from<br />

$7,000 to $9,200 just affects the park<br />

owner? Of course not! That is why<br />

CMHI, representing all segments <strong>of</strong> our<br />

industry, concurs with HCD’s position.<br />

Retroactive development impact fees<br />

do not make for affordable housing!<br />

October 7th ~ 9th<br />

December 6th<br />

MHI Annual Meeting<br />

Hotel Contessa<br />

San Antonio, TX<br />

Contact Cheryl Langley 703-558-0668<br />

Cheryl@mfghome.org<br />

CMHI Board <strong>of</strong> Directors’ & CMHI Foundation<br />

Directors’ Meetings<br />

2012 Holiday Open House<br />

The Mission Inn Hotel & Spa<br />

Riverside, CA<br />

Contact CMHI 909-987-2599<br />

kim@cmhi.org<br />

Disclaimer:<br />

Advertising Note: The content <strong>of</strong> any<br />

advertising insertion is prepared solely<br />

by the advertising member. By insertion,<br />

CMHI does not endorse the product or<br />

service being <strong>of</strong>fered nor is it, in any way,<br />

responsible nor liable for the content <strong>of</strong><br />

any such advertisement.

Page 8<br />

Uncompromising Quality,<br />

Value and Design<br />

NEW<br />

Standard<br />

Feature<br />

F E A T U R I N G<br />

The SilverShield<br />

7 Years <strong>of</strong> Coverage<br />

on Over 40 Items<br />

see details at<br />

WWW.SILVERCREST.COM<br />

www.silvercrest.com • e-mail: info@silvercrest.com<br />

299 North Smith Avenue • P.O. Box 759<br />

Corona, CA 92878-0759<br />

951/734-6610 • 800/382-0709

Around California<br />

WELCOME NEW MEMBERS<br />

Retailer Division<br />

Fountain <strong>of</strong> Youth Spa Corp.<br />

Jolene Wade, San Diego<br />

Leo Fuller & Associates*<br />

Leo Fuller, Redlands<br />

M-C Manufactured Homes LLC*<br />

Michael Converse, Corralitos<br />

Financial Services Division<br />

CountryPlace Mortgage*<br />

Kory Beickel, Mesa AZ<br />

*Pending Executive Committee Approval<br />

Phase I Formaldehyde<br />

Reminder<br />

The “sell through period” for<br />

manufactured homes containing Phase<br />

I Medium Density Fiberboard (MDF) is<br />

currently scheduled to expire on June<br />

30, 2012. CMHI is currently working<br />

with the Air Resources Board to obtain<br />

an extension <strong>of</strong> the “sell through<br />

period” beyond June 30th.<br />

The emission standard for Phase I<br />

MDF is 0.21ppm.<br />

The “sell through period” for homes<br />

containing Phase I Thin Medium<br />

Density Fiberboard (TMDF) is scheduled<br />

to expire on June 30, 2013.<br />

Retailers can verify the status<br />

<strong>of</strong> inventory homes by reading<br />

the certification provided by the<br />

manufacturer on the home invoice.<br />

CMHI members should review<br />

Special Bulletin 2011-02: click here.<br />

Members will also be kept informed<br />

by CMHI Special Bulletins as to our<br />

progress on securing a Phase I “sell<br />

through period” extension for MDF.<br />

Meet CMHI 1 st Vice Chairman<br />

- David Durant, Macy Homes<br />

David Durant’s career in the<br />

manufactured housing industry began<br />

in 1974 when his father, Robert Durant<br />

became the General Manager <strong>of</strong> the<br />

Fleetwood Festival plant in Reform,<br />

Alabama. What a culture shock that<br />

experience was to a native California<br />

boy. One year after arriving in Alabama,<br />

Fleetwood closed the plant. Then the<br />

Durant family was sent to Waco, Texas<br />

where Robert ran the Terry travel trailer<br />

plant for four years.<br />

In 1980, David and his father took<br />

over a camper shell manufacturing<br />

business in Fillmore, California where<br />

they built and shipped truck camper<br />

shells all over California. During this<br />

time, they ventured out and opened<br />

truck camper shell accessory stores.<br />

One <strong>of</strong> the stores was located in<br />

Oxnard. Their landlord at the time<br />

was Harry Macy, Jr. who owned Macy<br />

Homes.<br />

Macy Homes was started in 1951<br />

by Harry’s father to provide housing<br />

for the region’s migrant sugar beet<br />

factory workers. Harry had been in<br />

the business for 43 years and was<br />

ready for retirement. He approached<br />

the Durant’s about purchasing the<br />

business. On January 1, 1994, the<br />

Durant’s took over Macy Homes and<br />

sold their truck camper shell accessory<br />

business.<br />

Seventeen days later on January<br />

18, 1994, the Northridge Earthquake<br />

rocked the area. David feels strongly<br />

that from all adversity comes<br />

opportunity. The mobile home and<br />

manufactured housing business had<br />

decreased significantly in the early<br />

90’s. “I believe that the Northridge<br />

Earthquake played a large part in our<br />

Page 9<br />

success the first few years,” said<br />

David. For their first couple <strong>of</strong> years as<br />

owners <strong>of</strong> Macy Homes the majority <strong>of</strong><br />

the business was replacing earthquake<br />

damaged homes.<br />

Over the years Macy Homes<br />

expanded by opening a resale<br />

department and satellite sales <strong>of</strong>fices.<br />

Today they operate sales centers in<br />

Ventura, Nipomo and Atascadero.<br />

Each sales center has model homes<br />

on display. “It is my goal to continue<br />

to provide quality housing and efficient<br />

service to our customers. Even in<br />

these tough economic times, Macy<br />

Homes is surviving on referrals from<br />

satisfied customers we have had over<br />

the years,” Durant stated.<br />

Macy Homes has been a supportive<br />

and active member <strong>of</strong> CMHI since<br />

August 1994. David Durant has served<br />

on CMHI Board <strong>of</strong> Directors since 2007<br />

and was elected 2nd Vice Chairman in<br />

2009 for which he served two terms.<br />

He was elected as 1st Vice Chairman in<br />

March 2011. In addition, Macy Homes,<br />

Inc. was awarded CMHI’s Retailer <strong>of</strong><br />

the Year Award in 2005.<br />

Champion Home Builders<br />

Introduces Powerful Retailer<br />

Sales Tool<br />

On November 3, 2011, Champion<br />

Home Builders announced the launch<br />

<strong>of</strong> the company’s new Internet-based<br />

retailer sales tool, DiVE IN (Design<br />

Interactive Viewing Experience).<br />

The technology enables Champion<br />

retailers to present custom design<br />

options for the company’s modular<br />

and manufactured homes to match<br />

the lifestyle <strong>of</strong> their clientele. Retailers<br />

and customers can choose from a<br />

variety <strong>of</strong> floor plans such as alternate<br />

kitchen layouts, flexible spaces and<br />

master bath suite designs. Users can<br />

also manage exterior designs and<br />

colors, take a “virtual tour” <strong>of</strong> each<br />

home’s living space and see images <strong>of</strong><br />

completed homes. This new resource<br />

is available on the company’s Web site,<br />

www.championhomes.com.<br />

Source: Enhanced Online News – November 3,<br />

2011<br />

continued on page 10

Around California continued...<br />

California BOE Warns<br />

Beware <strong>of</strong> Misleading<br />

Business Solicitations<br />

Recently, businesses in California<br />

have reported to the California’s<br />

State Board <strong>of</strong> Equalization (BOE)<br />

that they have received notices from<br />

the “California Labor Compliance<br />

Bureau,” requesting immediate<br />

payment <strong>of</strong> a “processing fee” <strong>of</strong> $275.<br />

The California Labor Compliance<br />

Bureau IS NOT a government<br />

agency. The notices use publicly<br />

available information such as BOE<br />

account numbers and industry codes<br />

to make them appear to be <strong>of</strong>ficial<br />

correspondence.<br />

The “processing fee” is purportedly<br />

for labor-related notices that California<br />

employers are required to post at<br />

their business premises informing<br />

employees <strong>of</strong> their legal rights under<br />

the National Labor Relations Act. The<br />

notices in question are available free<br />

<strong>of</strong> charge from the National Labor<br />

Relations Board (NLRB) on their<br />

website here: https://www.nlrb.gov/<br />

poster.<br />

The BOE is not affiliated in any way<br />

with the California Labor Compliance<br />

Bureau. Correspondence from the<br />

BOE will always feature the BOE’s<br />

title and/or logo and contain contact<br />

information. If you receive a notice<br />

and question whether it is <strong>of</strong>ficial BOE<br />

correspondence, you should contact<br />

your local BOE <strong>of</strong>fice. A list <strong>of</strong> contact<br />

numbers <strong>of</strong> BOE field <strong>of</strong>fices can be<br />

found here: http://www.boe.ca.gov/<br />

info or call the BOE’s Information Call<br />

Center at (800)400-7115.<br />

The NLRB can assist businesses with<br />

questions regarding required notices at<br />

(202)273-0064.<br />

Source: SteelNews – October 31, 2011<br />

State Unemployment<br />

Insurance Fund Debt Leads<br />

to Higher Federal Taxes<br />

Absent an act <strong>of</strong> Congress, California<br />

employers will be paying higher taxes<br />

starting January 1, 2012 because<br />

the State <strong>of</strong> California has not repaid<br />

money it borrowed from the federal<br />

government to pay unemployment<br />

insurance (UI) benefits.<br />

California’s UI Trust Fund has<br />

been insolvent since January 2009,<br />

due in part to the large numbers<br />

<strong>of</strong> unemployed Californians. Also<br />

contributing to the UI fund’s insolvency<br />

has been legislation that imposed<br />

benefit increases in 2001 without<br />

including cost-saving reforms.<br />

The tax increase amounts to $21<br />

per year for any employee who makes<br />

$7,000 or more in 2012. California<br />

employers pay UI taxes on the first<br />

$7,000 <strong>of</strong> wages per employee.<br />

Therefore, the Federal Unemployment<br />

Tax Act (FUTA) credit for California<br />

employers will decrease from 5.4<br />

percent to 5.1 percent on January 1,<br />

2012, a 0.3 percent credit reduction.<br />

These additional taxes paid will <strong>of</strong>fset<br />

California’s federal loan balance.<br />

Statewide, the tax increase amounts<br />

to an estimated $289.8 million in 2012<br />

and $615.7 million in 2013, according<br />

to the California Employment<br />

Development Department’s (EDD)<br />

Unemployment Insurance Forecast.<br />

EDD is advising any employers with<br />

questions on the FUTA credit reduction<br />

to contact the IRS at www.irs.gov.<br />

Home Buyer Assistance<br />

Available<br />

The City <strong>of</strong> Gilroy has resumed its<br />

Home Buyer Assistance Program.<br />

Originally intended to help city<br />

employees, teachers and firefighters<br />

become first time home owners,<br />

effective November 1, 2011, the<br />

program was modified to provide<br />

assistance to all middle and low<br />

income residents <strong>of</strong> the city.<br />

Page 10<br />

Supported by Gilroy’s Housing Trust<br />

Fund, the Home Buyer Assistance<br />

Program provides a pool <strong>of</strong> $200,000<br />

for specified loans to qualified buyers.<br />

Program Basics<br />

• 15 year loans<br />

• Manufactured homes eligible for<br />

$10,000 loan<br />

• Interest Rate: First 5 years – 0%<br />

Second 5 years – 5%<br />

Last 5 years – 8%<br />

Home buyer qualifications include<br />

household income limits and<br />

completion <strong>of</strong> a financial planning<br />

class.<br />

Application guidelines are available<br />

at: http://www.ci.gilroy.ca.us or call<br />

Regina Brisco at (408)846-0242.<br />

Source: Gilroy Dispatch – December 27, 2011<br />

CMHI Foundation Jerral<br />

Hancock Update - His<br />

Rugged Road to Recovery<br />

LANCASTER ~ Jerral Hancock wears<br />

a black T-shirt that tells a lot <strong>of</strong> his<br />

story: “When I die I’ll go to Heaven,<br />

because I surely have spent my time in<br />

Hell.”<br />

For Hancock, “Hell” began on May<br />

28, 2007 – his 21st birthday. He was<br />

piloting his M-1A Abrams Tank down a<br />

Baghdad street when it was caught in a<br />

fiery explosion.<br />

He woke up a month later in a<br />

hospital. His left arm was sheared <strong>of</strong>f<br />

from his shoulder as an EFP blasted<br />

through the vehicle’s floor showering<br />

hot metal inside the tank. In addition,<br />

he suffered a spinal cord injury leaving<br />

his right arm nearly useless and<br />

causing paralysis from the chest down.<br />

During his aftercare odyssey,<br />

Hancock suffered through several<br />

complex surgeries and went for<br />

advanced therapies at Stanford<br />

University Medical Center under the<br />

care <strong>of</strong> the VA’s Palo Alto Polytrauma<br />

continued on page 12

Page 11

Page 12<br />

Around California continued...<br />

Rehabilitation Center. With his mother<br />

and wife at his side, Jerral navigated in<br />

and out <strong>of</strong> many medication regimes<br />

and agonizing physical therapy.<br />

It was during this time (July 2007)<br />

that Jess Maxcy, CMHI members and<br />

the CMHI Foundation found out about<br />

Jerral’s traumatizing ordeal. Through<br />

a charitable campaign, the CMHI<br />

Foundation and CMHI membership<br />

raised significant funds to pay <strong>of</strong>f the<br />

mortgage to Hancock’s manufactured<br />

home, which he was purchasing for<br />

his young family when his body was<br />

ruined in the explosion and, to the<br />

conversion <strong>of</strong> making it accessible for<br />

his wheelchair. “That Jess Maxcy did<br />

all right,” Hancock said. “He came to<br />

visit me up in Palo Alto.”<br />

life as possible. “I can’t sit around the<br />

house all day. I’ve got to be out and<br />

moving around,” Jerral states.<br />

Source: Blue Star Riders Newsletter –<br />

November 2011<br />

Bob Huff Elevated to Senate<br />

Republican Leader<br />

Business Properties Association,<br />

the American Council <strong>of</strong> Engineering<br />

Companies, California and the<br />

Inland Empire Caucus, which serves<br />

citizens with disabilities. He was also<br />

recognized as the 2011 Job Champion<br />

<strong>of</strong> Anaheim by the Anaheim Chamber<br />

<strong>of</strong> Commerce and received a perfect<br />

score in the 2011 California Chamber<br />

<strong>of</strong> Commerce Legislative Scorecard.<br />

One <strong>of</strong> Senator Huff’s proudest<br />

accomplishments is getting SB161<br />

signed into law in 2011, which places<br />

the health and welfare <strong>of</strong> California<br />

schoolchildren first, by allowing trained<br />

volunteers to administer emergency<br />

medication to students with epilepsy<br />

when they suffer a seizure at school.<br />

CMHI Foundation President Jess Maxcy visits<br />

with Army Spc. Jerral Hancock at the Palo Alto<br />

Polytrauma Rehabilitation Center.<br />

Jerral Hancock continues to trudge<br />

forward. For a man who survived<br />

a blast <strong>of</strong> the type that has killed<br />

thousands <strong>of</strong> American troops, he<br />

operates outside the bounds <strong>of</strong> selfpity.<br />

His humor is tough-minded and<br />

ironic. These days he can manage<br />

movement in his specialized wheelchair<br />

that looks about the size <strong>of</strong> a riding<br />

lawnmower. He has an advanced<br />

prosthetic arm custom made for him.<br />

The micro-processor driven appendage<br />

is state-<strong>of</strong>-the-art. Because Hancock<br />

was so severely burned it makes it<br />

difficult for the sensors to interface<br />

with his muscle movements. But, with<br />

lots <strong>of</strong> work and help from prosthetic<br />

experts, it will hopefully be useful to<br />

him.<br />

And that is how life is proceeding<br />

now for this American soldier brave<br />

enough to go to the world’s most<br />

dangerous combat zone. Hancock<br />

remains hopeful for as near a normal<br />

Senator Bob Huff (R-Diamond Bar)<br />

has been elected Senate Republican<br />

Leader following a vote <strong>of</strong> the Senate<br />

Republican Caucus. The 29 th District<br />

Senator, who previously served as<br />

Republican Caucus Leader and Vice<br />

Chair <strong>of</strong> the Senate Budget Committee,<br />

was a unanimous selection to succeed<br />

Senator Bob Dutton.<br />

“I’d like to thank my Senate<br />

Republican colleagues for their<br />

unwavering support and look forward<br />

to working with Majority Leader Darrell<br />

Steinberg and the Governor on the<br />

state budget and other issues facing<br />

California,” said Senator Huff. “The<br />

Governor had indicated that he will<br />

work with Republicans when possible,<br />

and Senate Republicans are open<br />

to compromise and crafting true,<br />

bipartisan solutions.”<br />

Senator Huff was first elected to the<br />

State Assembly in 2004 after serving<br />

nine years on the Diamond Bar City<br />

Council, including two stints as Mayor.<br />

He was later elected to serve the 29 th<br />

Senate District in 2008.<br />

Senator Huff was recognized as<br />

Legislator <strong>of</strong> the Year in 2011 by the<br />

League <strong>of</strong> California Cities, Citizens<br />

Against Lawsuit Abuse, the California<br />

Rebates for Energy Star<br />

Homes<br />

2012 is the<br />

last year to<br />

claim the<br />

$500 incentive<br />

from Pacific<br />

Gas & Electric<br />

Company<br />

Since January 2010, Pacific Gas &<br />

Electric Company (PG&E) has provided<br />

a $500 per home rebate to retailers and<br />

communities for new ENERGY STAR<br />

manufactured homes connected to<br />

PG&E service. For more information,<br />

contact Gwynne Koch, Program<br />

Manager, Systems Building Research<br />

Alliance, at (212)496-0900x120 or<br />

gkoch@research-alliance.org, or visit<br />

the SBRA website www.researchalliance.org/pages/es_PGE.htm.<br />

continued on page 14

Page 13<br />

BUILDERS RISK<br />

Protection From Loan Closing to Occupancy –<br />

COURSE OF CONSTRUCTION<br />

INSURANCE<br />

With Just One Policy!<br />

When you add Builders Risk Endorsement to one <strong>of</strong> our manufactured/modular homeowners<br />

policies, we provide certain protections that continues from delivery all the way through<br />

construction to occupancy.<br />

Meets Lender Requirements for<br />

Homeowners Insurance<br />

Coverage Includes:<br />

• Personal liability<br />

• Coverage for theft <strong>of</strong><br />

building materials on site<br />

• Coverage for damage to<br />

any site improvements<br />

Once the home is occupied,<br />

the Builders Risk endorsement<br />

expires – while homeowners<br />

protection continues!<br />

For more information,<br />

Call<br />

Manufactured Housing Insurance Services at<br />

1-866-644-7111<br />

http://www.MHIS.info<br />

Why have more than one policy<br />

when you don't need to?<br />

A MERICAN MODERN INSURANCE G ROUP

Around California continued...<br />

In Memoriam – Michael<br />

‘Mike’ Spence<br />

Former CMHI<br />

Member Michael<br />

Spence passed<br />

away on June 29,<br />

2011 in Sun City,<br />

California at the<br />

age <strong>of</strong> 56. Mike<br />

was a successful<br />

businessman<br />

in owning and<br />

operating his<br />

manufactured home sales company,<br />

Integrity Mobile/Manufactured Homes<br />

in Oceanside. He had retired 3½ years<br />

ago and since then he was enjoying<br />

experiencing life in Arkansas, Arizona<br />

and back to California in his RV.<br />

Mike was a beloved husband, father,<br />

grandfather, brother and son to all<br />

his family. He was also a wonderful<br />

friend. He possessed a special gift <strong>of</strong><br />

making those in need feel better and<br />

had a sense <strong>of</strong> humor that made those<br />

around him laugh and smile even in the<br />

worst <strong>of</strong> times.<br />

Mike’s biggest loves in life were<br />

his precious daughters whom he<br />

adored: Delilah Spence <strong>of</strong> Hollywood,<br />

FL; Carrie Gavin <strong>of</strong> Carson City, NV;<br />

Johnna Ali <strong>of</strong> Sacramento, CA and<br />

Sara Bennett <strong>of</strong> Bonsall, CA. In<br />

addition, he is survived by his wife,<br />

Karen Spence <strong>of</strong> Sun City, CA; father,<br />

Dean Spence <strong>of</strong> Bullhead City, AZ;<br />

mother, Shirley Shelgren <strong>of</strong> Roswell,<br />

NM; two sisters, two brothers and nine<br />

grandchildren.<br />

Mike will be truly missed. A private<br />

family memorial was held in Wichita,<br />

Kansas and internment was at Fort<br />

Rosecrans National Cemetery in San<br />

Diego.<br />

Source: San Diego Union Tribune – July 9, 2011<br />

Retired Industry Members –<br />

Where Are They Now?<br />

Marty Lagin, Former Fleetwood<br />

Dealer<br />

U.S. Army veteran Marty Lagin, a<br />

radio operator with the 304th Infantry<br />

Regiment, landed with the troops in<br />

Le Havre, France in December 1944<br />

during the Battle <strong>of</strong> the Bulge. “I used<br />

to carry a 30-pound radio on my back,<br />

along with my rifle,” Lagin said <strong>of</strong> his<br />

cumbersome trip up to the front lines.<br />

It was late January 1945, and by<br />

then, the Allies had the upper hand<br />

and were pushing into Germany.<br />

Casualties had thinned the ranks <strong>of</strong><br />

Lagin’s company. On their way into<br />

Alsdorf, Germany, Private First Class<br />

Lagin filled the leadership vacuum.<br />

His captain had been shot up and<br />

the lieutenant was nowhere around.<br />

“I couldn’t find him. I couldn’t find<br />

anybody. I said, ‘Come on guys! We’re<br />

going up that hill’”. He and his men<br />

crossed the Nims River and took the<br />

high ground. They were discovered the<br />

next day by the Germans.<br />

February 27, 1945, was Lagin’s last<br />

day on the battlefield. His company<br />

took many mortar rounds and one <strong>of</strong><br />

the explosions knocked Lagin down.<br />

Lagin spent three hours on the ground<br />

before being carried away to safety.<br />

After spending the night in a stone<br />

house in a nearby village, he was taken<br />

by litter jeep to Luxembourg the next<br />

day.<br />

“I knew I couldn’t move my legs.<br />

It didn’t bother me that much. I<br />

thought ‘I’m out <strong>of</strong> it now’”. Two<br />

young surgeons removed a fragment<br />

<strong>of</strong> shrapnel that had wounded Lagin’s<br />

spine. “When they took the metal out<br />

<strong>of</strong> my back, my right leg jumped; my<br />

left leg remained partially paralyzed,”<br />

Lagin states. He spent two months<br />

in a hospital in England and then was<br />

transported back to New York where<br />

he spent five months rehabilitating and<br />

retraining his weakened leg. Marty<br />

was awarded the Bronze Star and<br />

the Purple Heart for his bravery and<br />

service.<br />

Page 14<br />

In 1955, he moved to Los Angeles’<br />

west side and began a long, successful<br />

career in the manufactured housing<br />

industry. When he started out in the<br />

business, the average home was about<br />

600 square feet. By the time he retired,<br />

manufactured homes were being built<br />

out to over 2,000 square feet. “The<br />

houses kept getting bigger and more<br />

livable for families,” he said.<br />

In 1999, he appeared in a national TV<br />

commercial for Boston-based Fidelity<br />

Investments. The commercial was<br />

filmed at the cemetery in Normandy,<br />

France and in the fields <strong>of</strong> Alsdorf,<br />

Germany, near the site where Lagin<br />

had been wounded 54 years earlier.<br />

Now at age 86, Marty is enjoying his<br />

retirement with his wife, Rhoda in La<br />

Quinta.<br />

NOTE: This news feature will appear<br />

regularly. If you have stories <strong>of</strong> retired<br />

industry/CMHI members, please<br />

submit them to Kim Lear at -<br />

kim@cmhi.org.

Page 15<br />

Around California continued...<br />

Thank<br />

You<br />

California Manufactured Housing Institute<br />

Expresses Gratitude to<br />

2011 Holiday Open House Sponsors<br />

Alpert, Barr & Grant APLC<br />

California MH Education<br />

CMH Family <strong>of</strong> Brands<br />

DanKat Industries<br />

J & H Asset Property Mgmt.<br />

Skyline Homes<br />

Wells Fargo Home Mortgage<br />

Bessire & Casenhiser, Inc.<br />

California Southwestern Insurance<br />

C U Factory Built Lending<br />

Express Escrow Company<br />

Manufactured Housing Insurance Services<br />

Southern California Edison

Across the Nation<br />

First GSE Reform Bill<br />

Unveiled in Senate<br />

On November 9, 2011, Sen. Bob<br />

Corker (R-TN) introduced legislation<br />

(currently unnumbered) to eliminate<br />

Fannie Mae and Freddie Mac, as well<br />

as spur the development <strong>of</strong> a private<br />

mortgage-backed securities market.<br />

The bill, known as the Mortgage<br />

Market Privatization and<br />

Standardization Act, would gradually<br />

reduce the portfolio <strong>of</strong> mortgagerelated<br />

assets guaranteed by Fannie<br />

Mae and Freddie Mac and take steps<br />

to bring uniformity and transparency to<br />

the housing market. This includes:<br />

Winding Down <strong>of</strong> Fannie Mae<br />

and Freddie Mac: Reduces each<br />

year the percentage <strong>of</strong> newly issued<br />

mortgage-backed securities’ (MBS)<br />

principal that is guaranteed by Fannie<br />

Mae and Freddie Mac. The percentage<br />

guaranteed must be reduced to zero<br />

within 10 years, at which point MBS<br />

will be wholly privatized.<br />

Mortgage Market Transparency:<br />

Creates an industry-financed database<br />

that makes uniform performance and<br />

origination data on mortgages available<br />

to the public through the Federal<br />

Housing Finance Agency (FHFA).<br />

Creation <strong>of</strong> a new TBA Market:<br />

Initiates a process for creating<br />

deliverability rules and technology<br />

necessary for the “to-be announced”<br />

(TBA) futures market with no<br />

government guarantee.<br />

Monetization <strong>of</strong> Business Assets:<br />

Directs the sale <strong>of</strong> any technology,<br />

home price indices, and systems<br />

currently owned by the GSEs to private<br />

investors.<br />

Uniform Underwriting Standards:<br />

Replaces the Qualified Residential<br />

Mortgage and risk retention with a five<br />

percent minimum down payment and<br />

full documentation requirement.<br />

Residential Mortgage Market<br />

Uniformity: Creates a uniform<br />

pooling and servicing agreement<br />

(PSA) and a new electronic registration<br />

system (MERS 2) where all loans are<br />

transferred under one system regulated<br />

by the FHFA and instructs federal<br />

regulators to develop uniform practices<br />

and streamline mortgage regulations.<br />

For more information CMHI members<br />

can contact Jason Boehlert at MHI<br />

(703)558-0660 or jboehlert@mfghome.<br />

org.<br />

Source: MHI News Wire – November 15, 2011<br />

Congress Reauthorizes<br />

Program for Preferential<br />

Tax Treatment <strong>of</strong> Imported<br />

Lumber<br />

After months <strong>of</strong> delay, manufactured<br />

home builders will now be able<br />

to purchase imported lumber<br />

duty free. On October 21, 2011,<br />

President Obama signed legislation<br />

to reauthorize the U.S. Generalized<br />

System <strong>of</strong> Preferences (GSP) program<br />

through July 31, 2013. The GSP is<br />

a program that provides preferential<br />

duty-free entry for up to 4,800 products<br />

including lumber, from 129 designated<br />

beneficiary countries and territories.<br />

The GSP program expired December<br />

31, 2010 and while the program has<br />

enjoyed widespread bipartisan support<br />

in Congress, reauthorization was<br />

delayed because <strong>of</strong> a controversy over<br />

its impact on one U.S. producer <strong>of</strong><br />

one product imported from one GSP<br />

beneficiary.<br />

The lapse in the program resulted in<br />

substantial increases (as much as 10<br />

percent) in the cost <strong>of</strong> plywood and<br />

other lumber material used to build<br />

manufactured and modular homes.<br />

Thanks to Sherry Norris, Executive<br />

Director <strong>of</strong> the Alabama Manufactured<br />

Housing Association for initiating<br />

a grassroots lobbying effort to<br />

reauthorize the GSP program.<br />

CMHI members can contact Lois<br />

Starkey at MHI (703)558-0654 or<br />

lstarkey@mfghome.org.<br />

Source: MHI Weekly Review – November 4,<br />

2011<br />

NFPA Report Affirms<br />

Manufactured Homes Do<br />

Not Pose Significant Fire<br />

Risk<br />

Page 16<br />

(Arlington, VA – October 27, 2011) –<br />

Last week, the National Fire Protection<br />

Association (NFPA) testified before<br />

a federal advisory committee that<br />

occupants <strong>of</strong> manufactured homes are<br />

no more likely to die from a fire in their<br />

home than occupants <strong>of</strong> other single<br />

family homes.<br />

During the Manufactured Housing<br />

Consensus Committee (MHCC)<br />

meeting, the NFPA testified on its<br />

report, Manufactured Home Fires<br />

which concludes that the fire death<br />

rate for homes built to the federal<br />

Manufactured Home Construction<br />

Standards is “comparable” to other<br />

single family homes. NFPA announced<br />

that it published a correction to its<br />

July 2011 report, saying that the<br />

number <strong>of</strong> deaths from fires per 1,000<br />

manufactured homes is 2.4 percent<br />

not 13.3 percent and is within the<br />

range (2.3 – 2.6 percent) estimated for<br />

other single family homes. In addition,<br />

the report concludes that the rate <strong>of</strong><br />

fire injury and the incidents <strong>of</strong> fires<br />

for manufactured home occupants is<br />

less than for occupants <strong>of</strong> other single<br />

family homes.<br />

“This report concludes what the<br />

industry and our customers have<br />

known all along. Manufactured<br />

homes are built with consumer safety<br />

considerations first and foremost, and<br />

manufactured homes are built to high<br />

quality, stringent standards to keep<br />

customers safe,” said MHI President<br />

Thayer Long.<br />

MHCC members also heard from<br />

industry representatives, including<br />

a third party inspection agency and<br />

several state regulators that the current<br />

fire safety standards for manufactured<br />

homes are more stringent than for<br />

site built homes constructed to the<br />

International Residential Code (IRC).<br />

Flame spread, egress, and smoke<br />

detector requirements are three<br />

examples.<br />

continued on page 18

Page 17<br />

What do you expect<br />

from your Home Builder?<br />

Cavco Durango <strong>of</strong>fers Endless Selection,<br />

Lasting Value, Custom Choices, Quality Service<br />

and Over 40 Years <strong>of</strong> Building Experience.<br />

Ask us<br />

about our<br />

NEW SOLAR<br />

powered homes!<br />

TM<br />

602-278-3554 | 800-422-8264<br />

www.cavcohomes.com/durango<br />

©2008 Cavco Industries, Inc. | All Rights Reserved

Across the Nation continued...<br />

The MHCC is authorized by<br />

the U.S. Congress to provide the<br />

federal Department <strong>of</strong> Housing<br />

and Urban Development (HUD)<br />

with recommendations regarding<br />

manufactured housing construction<br />

standards and related regulations, and<br />

is composed <strong>of</strong> 21 voting members<br />

representing manufacturers and<br />

retailers, consumers, organizations<br />

with general interests in manufactured<br />

housing, and public <strong>of</strong>ficials.<br />

Source: Manufactured Housing Institute (MHI)<br />

Energy Efficiency Home Tax<br />

Credit Expired on December<br />

31, 2011<br />

Urge Congress to Act<br />

The federal tax credit for<br />

manufacturers who build energy<br />

efficient homes (Section 45L) expired<br />

on December 31, 2011. After<br />

extending the Social Security payroll<br />

tax cut, unemployment benefits and<br />

Medicare payments to physicians,<br />

Congress adjourned for the holiday<br />

recess. A host <strong>of</strong> temporary tax<br />

incentives, frequently called “tax<br />

extenders”-including the New Energy<br />

Efficient Tax Credit for manufactured<br />

and modular homes was not included<br />

in the year-end tax deal. Specifically,<br />

manufacturers who build ENERGY<br />

STAR homes are eligible to receive<br />

a $1,000 tax credit while modular<br />

home builders are eligible to receive<br />

a $2,000 tax credit by exceeding the<br />

International Energy Conservation<br />

Code (IECC) by 50 percent.<br />

MHI, along with its broad-based<br />

coalition <strong>of</strong> energy efficiency and<br />

environmental organizations, housing<br />

associations, public interest groups and<br />

corporations sent letters to Members<br />

<strong>of</strong> Congress urging them to extend<br />

the New Home Energy Efficient Tax<br />

Credit. Stimulating the economy will<br />

be high on the priority list for Congress.<br />

Senate Finance Committee Chairman<br />

Max Baucus (D-MT) vowed to continue<br />

working in January to extend tax cuts<br />

for individuals and small businesses.<br />

Baucus has been quietly working<br />

with his colleagues and fighting to<br />

find a bipartisan path forward for the<br />

tax extenders, including the research<br />

and development tax credit and jobcreating<br />

clean energy tax incentives.<br />

The House <strong>of</strong> Representatives<br />

returns to Washington, D.C. on<br />

Tuesday, January 17 th while the Senate<br />

reconvenes on Monday, January 23 rd .<br />

Upon the return <strong>of</strong> our elected <strong>of</strong>ficials,<br />

MHI would like to be well-positioned<br />

to advocate for the passage <strong>of</strong> the<br />

extension <strong>of</strong> the ENERGY STAR tax<br />

credit for manufactured and modular<br />

homes.<br />

CMHI members are encouraged<br />

to call or write their district<br />

representatives. Contact information<br />

for congressional <strong>of</strong>fices is available at:<br />

http://www.manufacturedhousing.org/<br />

government_affairs/find_congress.asp.<br />

If you have any questions, contact Rae<br />

Ann Bevington at MHI (703)558-0675 or<br />

Rbevington@mfghome.org.<br />

Source: MHI Housing Alert – January 3, 2012<br />

House Committee<br />

Set to Evaluate HUD’s<br />

Implementation <strong>of</strong> the 2000<br />

Improvement Act<br />

On February 1st, the House Financial<br />

Services Subcommittee on Insurance,<br />

Housing and Community Opportunity<br />

will hold a hearing examining the<br />

Department <strong>of</strong> Housing and Urban<br />

Development’s (HUD’s) record in<br />

fully implementing the Manufactured<br />

Housing Improvement Act <strong>of</strong> 2000.<br />

MHI has been working closely<br />

with the committee staff to provide<br />

substantive background information<br />

on a variety <strong>of</strong> areas regarding HUD’s<br />

activities in updating codes and<br />

standards for the industry. MHI will<br />

also have a representative testifying<br />

before the panel.<br />

CMHI members can contact Jason<br />

Boehlert at (703)558-0600 or jboehlert@<br />

mfghome.org.<br />

Source: MHI Week in Review – January 20, 2012<br />

Page 18<br />

DOE Rule for New Energy<br />

Efficiency Standards for<br />

Manufactured Housing Now<br />

at OMB for Review<br />

The U.S. Department <strong>of</strong> Energy<br />

(DOE) has completed its draft rule to<br />

establish energy efficiency standards<br />

for manufactured housing and has<br />

sent it to the White House Office <strong>of</strong><br />

Management and Budget (OMB) for<br />

review. OMB and other interested<br />

federal agencies will have a chance to<br />

comment on the draft rule before it is<br />

published in the Federal Register as a<br />

proposed rule. It could take up to three<br />

months or more for comments to be<br />

received by OMB.<br />

Although the draft rule is not available<br />

to the public, MHI believes it will<br />

call for energy efficiency standards<br />

based on the 2012 edition <strong>of</strong> the<br />

International Energy Conservation<br />

Code, and establish a system <strong>of</strong> DOE<br />

enforcement, including civil penalties,<br />

to address violations <strong>of</strong> the standards.<br />

MHI believes that the draft rule will give<br />

DOE wide discretion to enforce energy<br />

efficiency standards for manufactured<br />

homes. After the rule is proposed,<br />

DOE will host a public meeting in<br />

Washington, D.C. to accept comments<br />

and information regarding the proposal.<br />

There will likely be a 60-day comment<br />

period for written comments.<br />

MHI continues to prepare a technical<br />

response to the proposed rule, and<br />

is working with the Systems Building<br />

Research Alliance (SBRA) on alternate<br />

technologies, construction designs and<br />

methods for meeting the new energy<br />

standards. MHI continues to lobby key<br />

members <strong>of</strong> Congress for a change<br />

in the law to reassert HUD’s authority<br />

to implement and enforce energy<br />

standards for manufactured housing.<br />

CMHI members can contact Lois<br />

Starkey at (703)558-0654 or lstarkey@<br />

mfghome.org or Rae Ann Bevington<br />

at (703)558-0675 or rbevington@<br />

mfghome.org<br />

Source: MHI Week in Review – January 20, 2012

Page 19<br />

YOU ARE OUR #1 PRiORitY<br />

WE HAVE WHAT IT TAKES TO MEET ALL YOUR NEEDS<br />

OF<br />

DS<br />

CMH<br />

FAMILY OF<br />

BRANDS<br />

Contact Us tODAY!<br />

CLAYTON HOMES<br />

FAMILY 231 N. OF Apache Road<br />

BRANDS Buckeye, AZ 85326<br />

(623) 386-4495<br />

claytonhomes.com<br />

GOLDEN WEST HOMES<br />

3100 N. Perris Drive<br />

Perris, CA 92571<br />

(951) 657-1611<br />

goldenwesthomes.com<br />

GOLDEN WEST HOMES<br />

2445 Pacific Blvd, SW<br />

Albany, OR 87321<br />

(541) 926-8631<br />

goldenwesthomes.com<br />

KARSTEN HOMES<br />

2445 Pacific Blvd, SW<br />

Albany, OR 87321<br />

(541) 926-8631<br />

karstenhomes.com<br />

DS<br />

FAMILY OF BRANDS<br />

KARSTEN HOMES<br />

9998 Old Placerville Rd.<br />

Sacramento, CA 95827<br />

(916) 363-2681<br />

karstenhomes.com<br />

MARLETTE HOMES<br />

400 W. Elm Street<br />

Hermiston, OR 97838<br />

(541) 567-5546<br />

marlettehomes.com<br />

SCHULT HOMES<br />

231 N. Apache Road<br />

Buckeye, AZ 85326<br />

(623) 386-4495<br />

schulthomes.com<br />

erty <strong>of</strong> ADS Phoenix, Inc. and may not be used or reproduced in any form without express written consent.

Page 20<br />

Lawrence O.<br />

McDermott<br />

California—RCE 23107—LS 3905<br />

www.mobilehomeparkdesignexpert.com<br />

Mobile Home Park Design<br />

Entitlements—Planning—Title 25 Expert<br />

Civil Engineering—Utility Engineering<br />

ACSM/ALTA SURVEYS<br />

7 ~ 10 DAY SERVICE<br />

40 YEARS EXPERIENCE<br />

MOBILE HOME PARKS<br />

COMMERCIAL<br />

Project Overview Reports<br />

General Property Information<br />

Physical Characteristics<br />

Utility Systems Information<br />

Facility Conditions—Cost Estimates<br />

18075 LaVentana, Murrieta, CA, 92562<br />

(951)304-0111 (951)696-5218 Fax<br />

E-mail:larry0007@verizon.net<br />

RETAILER TOOL KIT NOW<br />

ON CMHI.ORG<br />

CMHI is committed to your business’<br />

success. We’ve added the ability to<br />

post your manufactured homes for sale<br />

on the CMHI website.<br />

CMHI.org sees a tremendous amount<br />

<strong>of</strong> traffic from consumers looking for<br />

information on manufactured homes.<br />

These potential customers can now<br />

see your homes for sale while browsing<br />

for other industry related information.<br />

The Retailer Tool Kit (RTK) is a<br />

service based product that allows<br />

you to upload homes for sale to your<br />

website without the need <strong>of</strong> costly<br />

webmasters or in a manner that lacks<br />

the pr<strong>of</strong>essional edge provided from a<br />

trained designer.<br />

The RTK resizes your images, creates<br />

slideshows and updates inventory in an<br />

easy to use manner.<br />

The RTK is a product <strong>of</strong> SGDesign<br />

which has 16 years industry experience<br />

helping businesses succeed on the<br />

ManuFacts is a bi-monthly newsletter<br />

published by the California<br />

Manufactured Housing Institute (CMHI)<br />

exclusively for member companies.<br />

CMHI is a nonpr<strong>of</strong>it trade association<br />

representing companies that build, sell<br />

and finance factory constructed homes<br />

and manage factory constructed home<br />

communities; and supply goods and<br />

services to the industry.<br />

The Institute was founded to advance<br />

the availability and ownership <strong>of</strong><br />

quality, high- value homes, marketed<br />

by licensed retailers, by promoting the<br />

purchase <strong>of</strong> factory constructed homes<br />

and the development <strong>of</strong> desirable<br />

sites and communities in California.<br />

The Institute’s public, government<br />

and consumer relations programs are<br />

directed toward these goals.<br />

CMHI Chairman - Gary L. Barr,<br />

Alpert, Barr & Grant APLC<br />

CMHI President - Jess Maxcy<br />

CMHI Foundation President - Jess<br />

Maxcy<br />

Published at - 10630 Town Center<br />

Drive, Suite 120, Rancho<br />

Cucamonga, CA 91730<br />

Telephone (909) 987-2599<br />

Fax (909) 989-0434<br />

www.cmhi.org<br />

Internet. The RTK is being <strong>of</strong>fered to all<br />

CMHI Retailers free <strong>of</strong> charge.<br />

Simply login at :<br />

http://RetailerToolKit.com<br />

and use your current CMHI Member<br />

user and password.<br />

There is a limitation <strong>of</strong> 3 homes when<br />

used with CMHI.org. The full RTK<br />

Subscription provides unlimited homes<br />

as well as many other special features<br />

to make your website successful.<br />

Please see the RTK website for more<br />

details or contact Steve Guluk at<br />

(949) 661-9333.

Page 21<br />

Make Money by Helping<br />

Customers Save Money<br />

Southern California Edison is now <strong>of</strong>fering home retailers and communities<br />

a $500 incentive for selling new ENERGY STAR® manufactured homes<br />

The ENERGY STAR® Manufactured Housing Program is a win-win for home buyers and sellers<br />

alike, with customers purchasing a more comfortable and efficient home that will help lower<br />