Annual report: Period Ended 31 December 2012 - Invesco Perpetual

Annual report: Period Ended 31 December 2012 - Invesco Perpetual

Annual report: Period Ended 31 December 2012 - Invesco Perpetual

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 City Merchants High Yield Trust Limited<br />

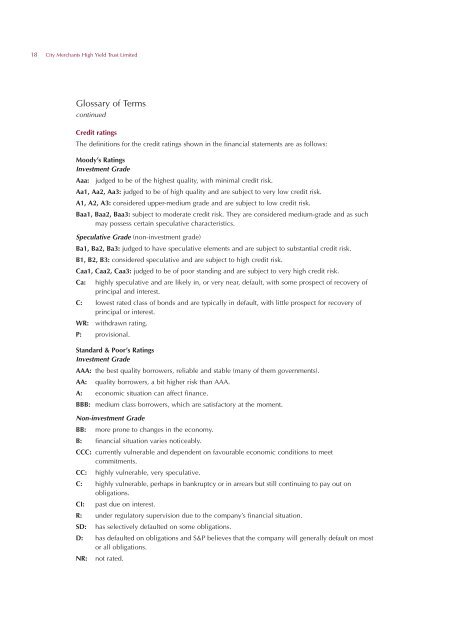

Glossary of Terms<br />

continued<br />

Credit ratings<br />

The definitions for the credit ratings shown in the financial statements are as follows:<br />

Moody’s Ratings<br />

Investment Grade<br />

Aaa: judged to be of the highest quality, with minimal credit risk.<br />

Aa1, Aa2, Aa3: judged to be of high quality and are subject to very low credit risk.<br />

A1, A2, A3: considered upper-medium grade and are subject to low credit risk.<br />

Baa1, Baa2, Baa3: subject to moderate credit risk. They are considered medium-grade and as such<br />

may possess certain speculative characteristics.<br />

Speculative Grade (non-investment grade)<br />

Ba1, Ba2, Ba3: judged to have speculative elements and are subject to substantial credit risk.<br />

B1, B2, B3: considered speculative and are subject to high credit risk.<br />

Caa1, Caa2, Caa3: judged to be of poor standing and are subject to very high credit risk.<br />

Ca: highly speculative and are likely in, or very near, default, with some prospect of recovery of<br />

principal and interest.<br />

C: lowest rated class of bonds and are typically in default, with little prospect for recovery of<br />

principal or interest.<br />

WR: withdrawn rating.<br />

P: provisional.<br />

Standard & Poor’s Ratings<br />

Investment Grade<br />

AAA: the best quality borrowers, reliable and stable (many of them governments).<br />

AA: quality borrowers, a bit higher risk than AAA.<br />

A: economic situation can affect finance.<br />

BBB: medium class borrowers, which are satisfactory at the moment.<br />

Non-investment Grade<br />

BB: more prone to changes in the economy.<br />

B: financial situation varies noticeably.<br />

CCC: currently vulnerable and dependent on favourable economic conditions to meet<br />

commitments.<br />

CC: highly vulnerable, very speculative.<br />

C: highly vulnerable, perhaps in bankruptcy or in arrears but still continuing to pay out on<br />

obligations.<br />

CI: past due on interest.<br />

R: under regulatory supervision due to the company’s financial situation.<br />

SD: has selectively defaulted on some obligations.<br />

D: has defaulted on obligations and S&P believes that the company will generally default on most<br />

or all obligations.<br />

NR: not rated.