BOOTH WHO? - Washington State Digital Archives

BOOTH WHO? - Washington State Digital Archives

BOOTH WHO? - Washington State Digital Archives

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Chapter 14: Taxing times<br />

“The future of the state is a lot more important than who is governor,” Booth said<br />

on the eve of the 1987 legislative session. If pushing higher taxes to achieve educational<br />

reform cost him re-election, so be it. “I can live with that. There is life after politics.” It<br />

wasn’t just rhetoric, his former aides emphasize. “Creating the nation’s best schools” was<br />

his highest priority.<br />

With charts, handouts and a platoon of aides, Booth outlined his plan to<br />

simultaneously cut some taxes and raise others to make up the difference and still leave<br />

$510 million for better schools and<br />

universities in the 1987-89 biennium.<br />

He wanted to reduce the sales tax,<br />

trim the business-and-occupation tax,<br />

provide tax breaks to small businesses<br />

and make other adjustments that<br />

would cost the state a total of $717<br />

million. Concurrently, he had a plan to<br />

generate $1.2 billion. Extending the<br />

6 percent sales tax to “professional<br />

services” – doctors, dentists,<br />

accountants and lawyers – would<br />

bring in $948 million. Extending it to<br />

“consumer services” – barbers, beauty<br />

parlors, health spas, cable TV and<br />

other entertainment – would bring<br />

in another $113 million. He’d raise an additional $70 million by taxing the fees charged by<br />

financial institutions (with an exemption for residential mortgages), and $17 million more<br />

by boldly going where no one who solicited the support of those who buy ink by the barrel<br />

had ever dared to tread – a tax on newspaper sales and advertising.<br />

The governor pointed out that the cities and counties stood to gain some $272<br />

million by charging their own local sales taxes on services. All this would be a very tough<br />

sell, he acknowledged – impossible, in fact, without bipartisan support. Republicans<br />

promptly pronounced the plan dead on arrival. “We’d like him to spend at least half the<br />

time he’s spent on increasing revenue on reforming spending,” said Bob Williams. A new<br />

poll revealed that education was far and away the top issue for registered voters, but 61<br />

percent disapproved of the governor’s plan to extend the sales tax to services.<br />

School was still out on his plan to give teachers and other state employees 3<br />

percent raises in September of the next two years. Booth said his budget accomplished<br />

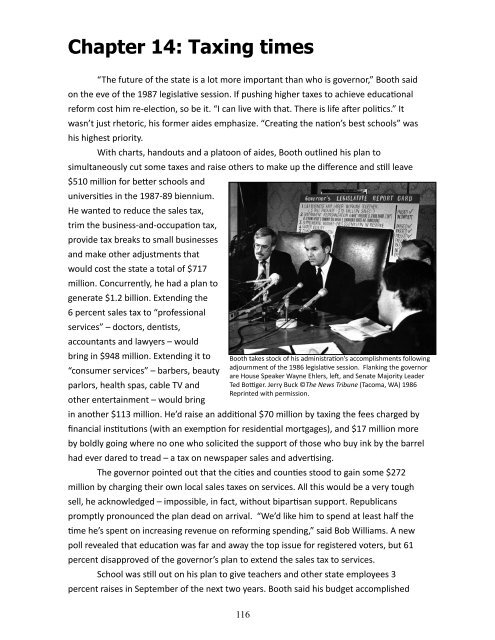

Booth takes stock of his administration’s accomplishments following<br />

adjournment of the 1986 legislative session. Flanking the governor<br />

are House Speaker Wayne Ehlers, left, and Senate Majority Leader<br />

Ted Bottiger. Jerry Buck ©The News Tribune (Tacoma, WA) 1986<br />

Reprinted with permission.<br />

116