bb_041515_web

bb_041515_web

bb_041515_web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

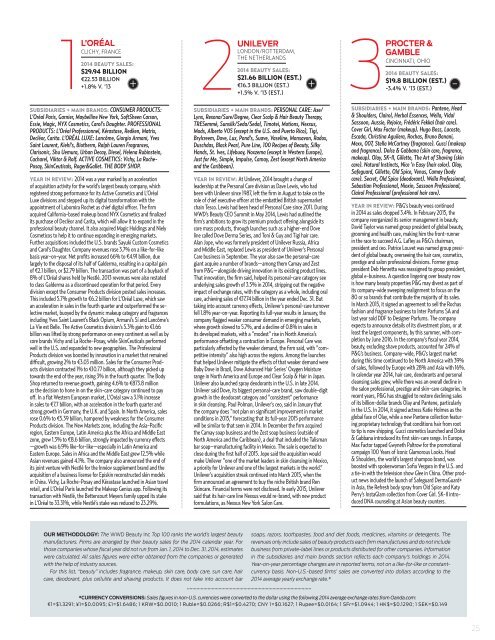

L’ORÉAL<br />

CLICHY, FRANCE<br />

2014 BEAUTY SALES:<br />

$29.94 BILLION<br />

€22.53 BILLION<br />

+1.8% V. ’13<br />

2UNILEVER<br />

LONDON/ROTTERDAM,<br />

THE NETHERLANDS<br />

2014 BEAUTY SALES:<br />

$21.66 BILLION (EST.)<br />

€16.3 BILLION (EST.)<br />

+1.5% V. ’13 (EST.)<br />

3PROCTER &<br />

GAMBLE<br />

CINCINNATI, OHIO<br />

2014 BEAUTY SALES:<br />

$19.8 BILLION (EST.)<br />

-3.4% V. ’13 (EST.)<br />

+ + -<br />

SUBSIDIARIES + MAIN BRANDS: CONSUMER PRODUCTS:<br />

L’Oréal Paris, Garnier, Maybelline New York, SoftSheen Carson,<br />

Essie, Magic, NYX Cosmetics, Carol’s Daughter. PROFESSIONAL<br />

PRODUCTS: L’Oréal Professionnel, Kérastase, Redken, Matrix,<br />

Decléor, Carita. L’ORÉAL LUXE: Lancôme, Giorgio Armani, Yves<br />

Saint Laurent, Kiehl’s, Biotherm, Ralph Lauren Fragrances,<br />

Clarisonic, Shu Uemura, Urban Decay, Diesel, Helena Rubinstein,<br />

Cacharel, Viktor & Rolf. ACTIVE COSMETICS: Vichy, La Roche-<br />

Posay, SkinCeuticals, Roger&Gallet. THE BODY SHOP.<br />

YEAR IN REVIEW: 2014 was a year marked by an acceleration<br />

of acquisition activity for the world’s largest beauty company, which<br />

registered strong performance for its Active Cosmetics and L’Oréal<br />

Luxe divisions and stepped up its digital transformation with the<br />

appointment of Lubomira Rochet as chief digital officer. The firm<br />

acquired California-based makeup brand NYX Cosmetics and finalized<br />

its purchase of Decléor and Carita, which will allow it to expand in the<br />

professional beauty channel. It also acquired Magic Holdings and Niely<br />

Cosmeticos to help it to continue expanding in emerging markets.<br />

Further acquisitions included the U.S. brands Sayuki Custom Cosmetics<br />

and Carol’s Daughter. Company revenues rose 3.7% on a like-for-like<br />

basis year-on-year. Net profits increased 66% to €4.91 billion, due<br />

largely to the disposal of its half of Galderma, resulting in a capital gain<br />

of €2.1 billion, or $2.79 billion. The transaction was part of a buyback of<br />

8% of L’Oréal shares held by Nestlé. 2013 revenues were also restated<br />

to class Galderma as a discontinued operation for that period. Every<br />

division except the Consumer Products division posted sales increases.<br />

This included 5.7% growth to €6.2 billion for L’Oréal Luxe, which saw<br />

an acceleration in sales in the fourth quarter and outperformed the selective<br />

market, buoyed by the dynamic makeup category and fragrances<br />

including Yves Saint Laurent’s Black Opium, Armani’s Sí and Lancôme’s<br />

La Vie est Belle. The Active Cosmetics division’s 5.3% gain to €1.66<br />

billion was lifted by strong performance on every continent as well as by<br />

core brands Vichy and La Roche-Posay, while SkinCeuticals performed<br />

well in the U.S. and expanded to new geographies. The Professional<br />

Products division was boosted by innovation in a market that remained<br />

difficult, growing 2% to €3.03 million. Sales for the Consumer Products<br />

division contracted 1% to €10.77 billion, although they picked up<br />

towards the end of the year, rising 3% in the fourth quarter. The Body<br />

Shop returned to revenue growth, gaining 4.6% to €873.8 million<br />

as the decision to hone in on the skin-care category continued to pay<br />

off. In a flat Western European market, L’Oréal saw a 3.1% increase<br />

in sales to €7.7 billion, with an acceleration in the fourth quarter and<br />

strong growth in Germany, the U.K. and Spain. In North America, sales<br />

rose 0.6% to €5.39 billion, hampered by weakness for the Consumer<br />

Products division. The New Markets zone, including the Asia-Pacific<br />

region, Eastern Europe, Latin America plus the Africa and Middle East<br />

zone, grew 1.3% to €8.6 billion, strongly impacted by currency effects<br />

—growth was 6.9% like-for-like—especially in Latin America and<br />

Eastern Europe. Sales in Africa and the Middle East grew 12.5% while<br />

Asian revenues gained 4.1%. The company also announced the end of<br />

its joint venture with Nestlé for the Innéov supplement brand and the<br />

acquisition of a business license for Episkin reconstructed skin models<br />

in China. Vichy, La Roche-Posay and Kérastase launched in Asian travel<br />

retail, and L’Oréal Paris launched the Makeup Genius app. Following its<br />

transaction with Nestlé, the Bettencourt Meyers family upped its stake<br />

in L’Oréal to 33.31%, while Nestlé’s stake was reduced to 23.29%.<br />

SUBSIDIARIES + MAIN BRANDS: PERSONAL CARE: Axe/<br />

Lynx, Rexona/Sure/Degree, Clear Scalp & Hair Beauty Therapy,<br />

TRESemmé, Sunsilk/Seda/Sedal, Timotei, Motions, Nexxus,<br />

Mods, Alberto V05 (except in the U.S. and Puerto Rico), Tigi,<br />

Brylcreem, Dove, Lux, Pond’s, Suave, Vaseline, Monsavon, Radox,<br />

Duschdas, Black Pearl, Pure Line, 100 Recipes of Beauty, Silky<br />

Hands, St. Ives, Lifebuoy, Noxzema (except in Western Europe),<br />

Just for Me, Simple, Impulse, Camay, Zest (except North America<br />

and the Cari<strong>bb</strong>ean).<br />

YEAR IN REVIEW: At Unilever, 2014 brought a change of<br />

leadership at the Personal Care division as Dave Lewis, who had<br />

been with Unilever since 1987, left the firm in August to take on the<br />

role of chief executive officer at the embattled British supermarket<br />

chain Tesco. Lewis had been head of Personal Care since 2011. During<br />

WWD’s Beauty CEO Summit in May 2014, Lewis had outlined the<br />

firm’s ambitions to grow its premium product offering alongside its<br />

core mass products, through launches such as a higher-end Dove<br />

line called Dove Derma Series, and Toni & Guy and Tigi hair care.<br />

Alan Jope, who was formerly president of Unilever Russia, Africa<br />

and Middle East, replaced Lewis as president of Unilever’s Personal<br />

Care business in September. The year also saw the personal-care<br />

giant acquire a number of brands—among them Camay and Zest<br />

from P&G—alongside driving innovation in its existing product lines.<br />

That innovation, the firm said, helped its personal-care category see<br />

underlying sales growth of 3.5% in 2014, stripping out the negative<br />

impact of exchange rates, with the category as a whole, including oral<br />

care, achieving sales of €17.74 billion in the year ended Dec. 31. But<br />

taking into account currency effects, Unilever’s personal-care turnover<br />

fell 1.8% year-on-year. Reporting its full-year results in January, the<br />

company flagged weaker consumer demand in emerging markets,<br />

where growth slowed to 5.7%, and a decline of 0.8% in sales in<br />

its developed markets, with a “modest” rise in North America’s<br />

performance offsetting a contraction in Europe. Personal Care was<br />

particularly affected by the weaker demand, the firm said, with “competitive<br />

intensity” also high across the regions. Among the launches<br />

that helped Unilever mitigate the effects of that weaker demand were<br />

Baby Dove in Brazil, Dove Advanced Hair Series’ Oxygen Moisture<br />

range in North America and Europe and Clear Scalp & Hair in Japan.<br />

Unilever also launched spray deodorants in the U.S. in late 2014.<br />

Unilever said Dove, its biggest personal-care brand, saw double-digit<br />

growth in the deodorant category and “consistent” performance<br />

in skin cleansing. Paul Polman, Unilever’s ceo, said in January that<br />

the company does “not plan on significant improvement in market<br />

conditions in 2015,” forecasting that its full-year 2015 performance<br />

will be similar to that seen in 2014. In December the firm acquired<br />

the Camay soap business and the Zest soap business (outside of<br />

North America and the Cari<strong>bb</strong>ean), a deal that included the Talisman<br />

bar soap–manufacturing facility in Mexico. The sale is expected to<br />

close during the first half of 2015. Jope said the acquisition would<br />

make Unilever “one of the market leaders in skin cleansing in Mexico,<br />

a priority for Unilever and one of the largest markets in the world.”<br />

Unilever’s acquisition streak continued into March 2015, when the<br />

firm announced an agreement to buy the niche British brand Ren<br />

Skincare. Financial terms were not disclosed. In early 2015, Unilever<br />

said that its hair-care line Nexxus would re-brand, with new product<br />

formulations, as Nexxus New York Salon Care.<br />

SUBSIDIARIES + MAIN BRANDS: Pantene, Head<br />

& Shoulders, Clairol, Herbal Essences, Wella, Vidal<br />

Sassoon, Aussie, Rejoice, Frédéric Fekkai (hair care).<br />

Cover Girl, Max Factor (makeup). Hugo Boss, Lacoste,<br />

Escada, Christina Aguilera, Rochas, Bruno Banani,<br />

Mexx, 007, Stella McCartney (fragrance). Gucci (makeup<br />

and fragrance). Dolce & Ga<strong>bb</strong>ana (skin care, fragrance,<br />

makeup). Olay, SK-II, Gillette, The Art of Shaving (skin<br />

care). Natural Instincts, Nice ’n Easy (hair color). Olay,<br />

Safeguard, Gillette, Old Spice, Venus, Camay (body<br />

care). Secret, Old Spice (deodorant). Wella Professional,<br />

Sebastian Professional, Nioxin, Sassoon Professional,<br />

Clairol Professional (professional hair care).<br />

YEAR IN REVIEW: P&G’s beauty woes continued<br />

in 2014 as sales dropped 3.4%. In February 2015, the<br />

company reorganized its senior management in beauty.<br />

David Taylor was named group president of global beauty,<br />

grooming and health care, making him the front-runner<br />

in the race to succeed A.G. Lafley as P&G’s chairman,<br />

president and ceo. Patrice Louvet was named group president<br />

of global beauty, overseeing the hair care, cosmetics,<br />

prestige and salon professional divisions. Former group<br />

president Deb Henretta was reassigned to group president,<br />

global e-business. A question lingering over beauty now<br />

is how many beauty properties P&G may divest as part of<br />

its company-wide sweeping realignment to focus on the<br />

80 or so brands that contribute the majority of its sales.<br />

In March 2015, it signed an agreement to sell the Rochas<br />

fashion and fragrance business to Inter Parfums SA and<br />

last year sold DDF to Designer Parfums. The company<br />

expects to announce details of its divestment plans, or at<br />

least the largest components, by this summer, with completion<br />

by June 2016. In the company’s fiscal year 2014,<br />

beauty, excluding shave products, accounted for 24% of<br />

P&G’s business. Company-wide, P&G’s largest market<br />

during this time continued to be North America with 39%<br />

of sales, followed by Europe with 28% and Asia with 16%.<br />

In calendar year 2014, hair care, deodorants and personal<br />

cleansing sales grew, while there was an overall decline in<br />

the salon professional, prestige and skin-care categories. In<br />

recent years, P&G has struggled to restore declining sales<br />

of its billion-dollar brands Olay and Pantene, particularly<br />

in the U.S. In 2014, it signed actress Katie Holmes as the<br />

global face of Olay, while a new Pantene collection featuring<br />

proprietary technology that conditions hair from root<br />

to tip is now shipping. Gucci cosmetics launched and Dolce<br />

& Ga<strong>bb</strong>ana introduced its first skin-care range. In Europe,<br />

Max Factor tapped Gwyneth Paltrow for the promotional<br />

campaign 100 Years of Iconic Glamorous Looks. Head<br />

& Shoulders, the world’s largest shampoo brand, was<br />

boosted with spokeswoman Sofia Vergara in the U.S. and<br />

a tie-in with the television show Glee in China. Other product<br />

news included the launch of Safeguard DermaGuard+<br />

in Asia, the Refresh body spray from Old Spice and Katy<br />

Perry’s InstaGlam collection from Cover Girl. SK-II introduced<br />

DNA counseling at Asian beauty counters.<br />

OUR METHODOLOGY: The WWD Beauty Inc Top 100 ranks the world’s largest beauty<br />

manufacturers. Firms are arranged by their beauty sales for the 2014 calendar year. For<br />

those companies whose fiscal year did not run from Jan. 1, 2014 to Dec. 31, 2014, estimates<br />

were calculated. All sales figures were either obtained from the companies or generated<br />

with the help of industry sources.<br />

For this list, “beauty” includes fragrance, makeup, skin care, body care, sun care, hair<br />

care, deodorant, plus cellulite and shaving products. It does not take into account bar<br />

soaps, razors, toothpastes, food and diet foods, medicines, vitamins or detergents. The<br />

revenues only include sales of beauty products each firm manufactures and do not include<br />

business from private-label lines or products distributed for other companies. Information<br />

in the subsidiaries and main brands section reflects each company’s holdings in 2014.<br />

Year-on-year percentage changes are in reported terms, not on a like-for-like or constantcurrency<br />

basis. Non-U.S.-based firms’ sales are converted into dollars according to the<br />

2014 average yearly exchange rate.*<br />

*CURRENCY CONVERSIONS: Sales figures in non-U.S. currencies were converted to the dollar using the following 2014 average exchange rates from Oanda.com:<br />

€1=$1.3291; ¥1=$0.0095; £1=$1.6486; 1 KRW=$0.0010; 1 Ruble=$0.0266; R$1=$0.4270; CNY 1=$0.1627; 1 Rupee=$0.0164; 1 SFr=$1.0944; 1 HK$=$0.1290; 1 SEK=$0.149<br />

25