bb_041515_web

bb_041515_web

bb_041515_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

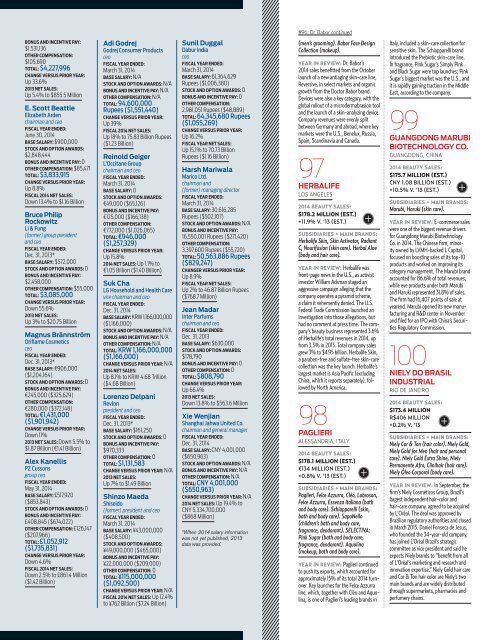

#96: Dr. Babor continued<br />

BONUS AND INCENTIVE PAY:<br />

$1,531,136<br />

OTHER COMPENSATION:<br />

$105,690<br />

TOTAL: $4,227,996<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 33.6%<br />

2013 NET SALES:<br />

Up 5.4% to $855.5 Million<br />

E. Scott Beattie<br />

Elizabeth Arden<br />

chairman and ceo<br />

FISCAL YEAR ENDED:<br />

June 30, 2014<br />

BASE SALARY: $900,000<br />

STOCK AND OPTION AWARDS:<br />

$2,848,444<br />

BONUS AND INCENTIVE PAY: 0<br />

OTHER COMPENSATION: $85,471<br />

TOTAL: $3,833,915<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 8.8%<br />

FISCAL 2014 NET SALES:<br />

Down 13.4% to $1.16 Billion<br />

Bruce Philip<br />

Rockowitz<br />

Li & Fung<br />

(former) group president<br />

and ceo<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2013*<br />

BASE SALARY: $572,000<br />

STOCK AND OPTION AWARDS: 0<br />

BONUS AND INCENTIVE PAY:<br />

$2,458,000<br />

OTHER COMPENSATION: $55,000<br />

TOTAL: $3,085,000<br />

CHANGE VERSUS PRIOR YEAR:<br />

Down 55.6%<br />

2013 NET SALES:<br />

Up 3% to $20.75 Billion<br />

Magnus Brännström<br />

Oriflame Cosmetics<br />

ceo<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2013*<br />

BASE SALARY: €906,000<br />

($1,204,164)<br />

STOCK AND OPTION AWARDS: 0<br />

BONUS AND INCENTIVE PAY:<br />

€245,000 ($325,629)<br />

OTHER COMPENSATION:<br />

€280,000 ($372,148)<br />

TOTAL: €1,431,000<br />

($1,901,942)<br />

CHANGE VERSUS PRIOR YEAR:<br />

Down 11%<br />

2013 NET SALES: Down 5.5% to<br />

$1.87 Billion (€1.41 Billion)<br />

Alex Kanellis<br />

PZ Cussons<br />

group ceo<br />

FISCAL YEAR ENDED:<br />

May 31, 2014<br />

BASE SALARY: £517,920<br />

($853,843)<br />

STOCK AND OPTION AWARDS: 0<br />

BONUS AND INCENTIVE PAY:<br />

£408,845 ($674,022)<br />

OTHER COMPENSATION: £126,147<br />

($207,966)<br />

TOTAL: £1,052,912<br />

($1,735,831)<br />

CHANGE VERSUS PRIOR YEAR:<br />

Down 4.6%<br />

FISCAL 2014 NET SALES:<br />

Down 2.5% to £861.4 Million<br />

($1.42 Billion)<br />

Adi Godrej<br />

Godrej Consumer Products<br />

ceo<br />

FISCAL YEAR ENDED:<br />

March 31, 2014<br />

BASE SALARY: N/A<br />

STOCK AND OPTION AWARDS: N/A<br />

BONUS AND INCENTIVE PAY: N/A<br />

OTHER COMPENSATION: N/A<br />

TOTAL: 94,600,000<br />

Rupees ($1,551,440)<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 39%<br />

FISCAL 2014 NET SALES:<br />

Up 18% to 75.83 Billion Rupees<br />

($1.23 Billion)<br />

Reinold Geiger<br />

L’Occitane Group<br />

chairman and ceo<br />

FISCAL YEAR ENDED:<br />

March 31, 2014<br />

BASE SALARY: 0<br />

STOCK AND OPTION AWARDS:<br />

€49,000 ($65,126)<br />

BONUS AND INCENTIVE PAY:<br />

€125,000 ($166,138)<br />

OTHER COMPENSATION:<br />

€772,000 ($1,026,065)<br />

TOTAL: €946,000<br />

($1,257,329)<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 15.8%<br />

2014 NET SALES: Up 1.1% to<br />

€1.05 Billion ($1.40 Billion)<br />

Suk Cha<br />

LG Household and Health Care<br />

vice chairman and ceo<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2014<br />

BASE SALARY: KRW 1,166,000,000<br />

($1,166,000)<br />

STOCK AND OPTION AWARDS: N/A<br />

BONUS AND INCENTIVE PAY: N/A<br />

OTHER COMPENSATION: N/A<br />

TOTAL: KRW 1,166,000,000<br />

($1,166,000)<br />

CHANGE VERSUS PRIOR YEAR: N/A<br />

2014 NET SALES:<br />

Up 8.1% to KRW 4.68 Trillion<br />

($4.68 Billion)<br />

Lorenzo Delpani<br />

Revlon<br />

president and ceo<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2013*<br />

BASE SALARY: $161,250<br />

STOCK AND OPTION AWARDS: 0<br />

BONUS AND INCENTIVE PAY:<br />

$970,333<br />

OTHER COMPENSATION: 0<br />

TOTAL: $1,131,583<br />

CHANGE VERSUS PRIOR YEAR: N/A<br />

2013 NET SALES:<br />

Up 7% to $1.49 Billion<br />

Shinzo Maeda<br />

Shiseido<br />

(former) president and ceo<br />

FISCAL YEAR ENDED:<br />

March 31, 2014<br />

BASE SALARY: ¥43,000,000<br />

($408,500)<br />

STOCK AND OPTION AWARDS:<br />

¥49,000,000 ($465,000)<br />

BONUS AND INCENTIVE PAY:<br />

¥22,000,000 ($209,000)<br />

OTHER COMPENSATION: 0<br />

TOTAL: ¥115,000,000<br />

($1,092,500)<br />

CHANGE VERSUS PRIOR YEAR: N/A<br />

FISCAL 2014 NET SALES: Up 12.4%<br />

to ¥762 Billion ($7.24 Billion)<br />

Sunil Duggal<br />

Dabur India<br />

ceo<br />

FISCAL YEAR ENDED:<br />

March 31, 2014<br />

BASE SALARY: 61,364,629<br />

Rupees ($1,006,380)<br />

STOCK AND OPTION AWARDS: 0<br />

BONUS AND INCENTIVE PAY: 0<br />

OTHER COMPENSATION:<br />

2,981,051 Rupees ($48,889)<br />

TOTAL: 64,345,680 Rupees<br />

($1,055,269)<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 16.2%<br />

FISCAL YEAR NET SALES:<br />

Up 15.1% to 70.73 Billion<br />

Rupees ($1.16 Billion)<br />

Harsh Mariwala<br />

Marico Ltd.<br />

chairman and<br />

(former) managing director<br />

FISCAL YEAR ENDED:<br />

March 31, 2014<br />

BASE SALARY: 30,616,285<br />

Rupees ($502,107)<br />

STOCK AND OPTION AWARDS: N/A<br />

BONUS AND INCENTIVE PAY:<br />

16,550,001 Rupees ($271,420)<br />

OTHER COMPENSATION:<br />

3,397,600 Rupees ($55,720)<br />

TOTAL: 50,563,886 Rupees<br />

($829,247)<br />

CHANGER VERSUS PRIOR YEAR:<br />

Up 8.9%<br />

FISCAL YEAR NET SALES:<br />

Up 2% to 46.87 Billion Rupees<br />

($768.7 Million)<br />

Jean Madar<br />

Inter Parfums<br />

chairman and ceo<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2013<br />

BASE SALARY: $630,000<br />

STOCK AND OPTION AWARDS:<br />

$178,790<br />

BONUS AND INCENTIVE PAY: 0<br />

OTHER COMPENSATION: 0<br />

TOTAL: $808,790<br />

CHANGE VERSUS PRIOR YEAR:<br />

Up 66.4%<br />

2013 NET SALES:<br />

Down 13.8% to $563.6 Million<br />

Xie Wenjian<br />

Shanghai Jahwa United Co.<br />

chairman and general manager<br />

FISCAL YEAR ENDED:<br />

Dec. 31, 2014<br />

BASE SALARY: CNY 4,001,000<br />

($650,963)<br />

STOCK AND OPTION AWARDS: N/A<br />

BONUS AND INCENTIVE PAY: N/A<br />

OTHER COMPENSATION: N/A<br />

TOTAL: CNY 4,001,000<br />

($650,963)<br />

CHANGE VERSUS PRIOR YEAR: N/A<br />

2014 NET SALES: Up 19.4% to<br />

CNY 5,334,700,000<br />

($868 Million)<br />

*When 2014 salary information<br />

was not yet published, 2013<br />

data was provided.<br />

(men’s grooming). Babor Face Design<br />

Collection (makeup).<br />

YEAR IN REVIEW: Dr. Babor’s<br />

2014 sales benefitted from the October<br />

launch of a new antiaging skin-care line,<br />

Reversive, in select markets and organic<br />

growth from the Doctor Babor brand.<br />

Devices were also a key category, with the<br />

global rollout of a microdermabrasion tool<br />

and the launch of a skin-analyzing device.<br />

Company revenues were evenly split<br />

between Germany and abroad, where key<br />

markets were the U.S., Benelux, Russia,<br />

Spain, Scandinavia and Canada.<br />

97<br />

HERBALIFE<br />

LOS ANGELES<br />

2014 BEAUTY SALES:<br />

$178.2 MILLION (EST.)<br />

+11.9% V. ’13 (EST.)<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Herbalife Skin, Skin Activator, Radiant<br />

C, Nourifusion (skin care). Herbal Aloe<br />

(body and hair care).<br />

YEAR IN REVIEW: Herbalife was<br />

front-page news in the U.S., as activist<br />

investor William Ackman staged an<br />

aggressive campaign alleging that the<br />

company operates a pyramid scheme,<br />

a claim it vehemently denied. The U.S.<br />

Federal Trade Commission launched an<br />

investigation into those allegations, but<br />

had no comment at press time. The company’s<br />

beauty business represented 3.6%<br />

of Herbalife’s total revenues in 2014, up<br />

from 3.3% in 2013. Total company sales<br />

grew 3% to $4.95 billion. Herbalife Skin,<br />

a paraben-free and sulfate-free skin-care<br />

collection was the key launch. Herbalife’s<br />

largest market is Asia Pacific (excluding<br />

China, which it reports separately), followed<br />

by North America.<br />

98<br />

PAGLIERI<br />

ALESSANDRIA, ITALY<br />

2014 BEAUTY SALES:<br />

$178.1 MILLION (EST.)<br />

€134 MILLION (EST.)<br />

+0.8% V. ’13 (EST.)<br />

+<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Paglieri, Felce Azzurra, Cléo, Labrosan,<br />

Felce Azzurra, Essenza Italiana (bath<br />

and body care). Schiapparelli (skin,<br />

bath and body care). SapoNello<br />

(children’s bath and body care,<br />

fragrance, deodorant). SELECTIVA:<br />

Pink Sugar (bath and body care,<br />

fragrance, deodorant). Aquolina<br />

(makeup, bath and body care).<br />

YEAR IN REVIEW: Paglieri continued<br />

to push its exports, which accounted for<br />

approximately 15% of its total 2014 turnover.<br />

Key launches for the Felce Azzurra<br />

line, which, together with Cléo and Aquolina,<br />

is one of Paglieri’s leading brands in<br />

Italy, included a skin-care collection for<br />

sensitive skin. The Schiapparelli brand<br />

introduced the Prebiotic skin-care line.<br />

In fragrance, Pink Sugar’s Simply Pink<br />

and Black Sugar were top launches; Pink<br />

Sugar’s biggest market was the U.S., and<br />

it is rapidly gaining traction in the Middle<br />

East, according to the company.<br />

99<br />

GUANGDONG MARUBI<br />

BIOTECHNOLOGY CO.<br />

GUANGDONG, CHINA<br />

2014 BEAUTY SALES:<br />

$175.7 MILLION (EST.)<br />

CNY 1.08 BILLION (EST.)<br />

+10.5% V. ’13 (EST.)<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Marubi, Haruki (skin care).<br />

YEAR IN REVIEW: E-commerce sales<br />

were one of the biggest revenue drivers<br />

for Guangdong Marubi Biotechnology<br />

Co. in 2014. The Chinese firm, minority<br />

owned by LVMH-backed L Capital,<br />

focused on boosting sales of its top-10<br />

products and worked on improving its<br />

category management. The Marubi brand<br />

accounted for 86.6% of total revenues,<br />

while eye products under both Marubi<br />

and Haruki represented 31.8% of sales.<br />

The firm had 16,407 points of sale at<br />

yearend. Marubi opened its new manufacturing<br />

and R&D center in November<br />

and filed for an IPO with China’s Securities<br />

Regulatory Commission.<br />

100<br />

NIELY DO BRASIL<br />

INDUSTRIAL<br />

RIO DE JANEIRO<br />

2014 BEAUTY SALES:<br />

$173.4 MILLION<br />

R$406 MILLION<br />

+0.2% V. ’13<br />

+<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Niely Cor & Ton (hair color). Niely Gold,<br />

Niely Gold for Men (hair and personal<br />

care). Niely Gold Extra Shine, Niely<br />

Permanente Afro, Clinihair (hair care).<br />

Niely Óleo Corporal (body care).<br />

YEAR IN REVIEW: In September, the<br />

firm’s Niely Cosméticos Group, Brazil’s<br />

largest independent hair-color and<br />

hair-care company, agreed to be acquired<br />

by L’Oréal. The deal was approved by<br />

Brazilian regulatory authorities and closed<br />

in March 2015. Daniel Fonseca de Jesus,<br />

who founded the 34-year-old company,<br />

has joined L’Oréal Brazil’s strategic<br />

committee as vice president and said he<br />

expects Niely brands to “benefit from all<br />

of L’Oréal’s marketing and research and<br />

innovation expertise.” Niely Gold hair care<br />

and Cor & Ton hair color are Niely’s two<br />

main brands and are widely distributed<br />

through supermarkets, pharmacies and<br />

perfumery chains.