bb_041515_web

bb_041515_web

bb_041515_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

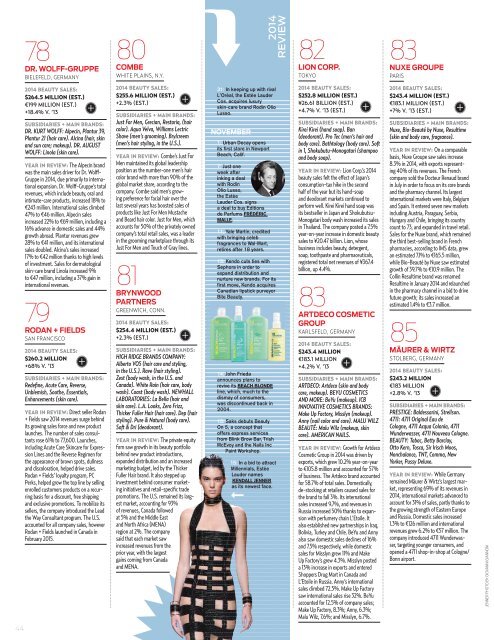

78<br />

DR. WOLFF-GRUPPE<br />

BIELEFELD, GERMANY<br />

80<br />

COMBE<br />

WHITE PLAINS, N.Y.<br />

<br />

2014<br />

REVIEW<br />

82<br />

LION CORP.<br />

TOKYO<br />

83<br />

NUXE GROUPE<br />

PARIS<br />

2014 BEAUTY SALES:<br />

$264.5 MILLION (EST.)<br />

€199 MILLION (EST.)<br />

+18.4% V. ’13<br />

SUBSIDIARIES + MAIN BRANDS:<br />

DR. KURT WOLFF: Alpecin, Plantur 39,<br />

Plantur 21 (hair care). Alcina (hair, skin<br />

and sun care; makeup). DR. AUGUST<br />

WOLFF: Linola (skin care).<br />

YEAR IN REVIEW: The Alpecin brand<br />

was the main sales driver for Dr. Wolff-<br />

Gruppe in 2014, due primarily to international<br />

expansion. Dr. Wolff-Gruppe’s total<br />

revenues, which include beauty, oral and<br />

intimate-care products, increased 18% to<br />

€243 million. International sales climbed<br />

47% to €46 million. Alpecin sales<br />

increased 22% to €69 million, including a<br />

16% advance in domestic sales and 44%<br />

growth abroad. Plantur revenues grew<br />

28% to €41 million, and its international<br />

sales doubled. Alcina’s sales increased<br />

17% to €42 million thanks to high levels<br />

of investment. Sales for dermatological<br />

skin-care brand Linola increased 9%<br />

to €47 million, including a 37% gain in<br />

international revenues.<br />

79<br />

RODAN + FIELDS<br />

SAN FRANCISCO<br />

2014 BEAUTY SALES:<br />

$260.2 MILLION<br />

+68% V. ’13<br />

+<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Redefine, Acute Care, Reverse,<br />

Unblemish, Soothe, Essentials,<br />

Enhancements (skin care).<br />

YEAR IN REVIEW: Direct seller Rodan<br />

+ Fields saw 2014 revenues surge behind<br />

its growing sales force and new product<br />

launches. The number of sales consultants<br />

rose 61% to 77,600. Launches,<br />

including Acute Care Skincare for Expression<br />

Lines and the Reverse Regimen for<br />

the appearance of brown spots, dullness<br />

and discoloration, helped drive sales.<br />

Rodan + Fields’ loyalty program, PC<br />

Perks, helped grow the top line by selling<br />

enrolled customers products on a recurring<br />

basis for a discount, free shipping<br />

and exclusive promotions. To mobilize its<br />

sellers, the company introduced the Lead<br />

the Way Consultant program. The U.S.<br />

accounted for all company sales, however<br />

Rodan + Fields launched in Canada in<br />

February 2015.<br />

2014 BEAUTY SALES:<br />

$255.6 MILLION (EST.)<br />

+2.3% (EST.)<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Just For Men, Grecian, Restoria, (hair<br />

color). Aqua Velva, Williams Lectric<br />

Shave (men’s grooming). Brylcreem<br />

(men’s hair styling, in the U.S.).<br />

YEAR IN REVIEW: Combe’s Just For<br />

Men maintained its global leadership<br />

position as the number-one men’s hair<br />

color brand with more than 90% of the<br />

global market share, according to the<br />

company. Combe said men’s growing<br />

preference for facial hair over the<br />

last several years has boosted sales of<br />

products like Just For Men Mustache<br />

and Beard hair color. Just for Men, which<br />

accounts for 50% of the privately owned<br />

company’s total retail sales, was a leader<br />

in the grooming marketplace through its<br />

Just For Men and Touch of Gray lines.<br />

81<br />

BRYNWOOD<br />

PARTNERS<br />

GREENWICH, CONN.<br />

2014 BEAUTY SALES:<br />

$254.4 MILLION (EST.)<br />

+2.3% (EST.)<br />

+<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

HIGH RIDGE BRANDS COMPANY:<br />

Alberto VO5 (hair care and styling,<br />

in the U.S.). Rave (hair styling).<br />

Zest (body wash, in the U.S. and<br />

Canada). White Rain (hair care, body<br />

wash). Coast (body wash). NEWHALL<br />

LABORATORIES: La Bella (hair and<br />

skin care). L.A. Looks, Zero Frizz,<br />

Thicker Fuller Hair (hair care). Dep (hair<br />

styling). Pure & Natural (body care).<br />

Soft & Dri (deodorant).<br />

YEAR IN REVIEW: The private equity<br />

fi rm saw growth in its beauty portfolio<br />

behind new product introductions,<br />

expanded distribution and an increased<br />

marketing budget, led by the Thicker<br />

Fuller Hair brand. It also stepped up<br />

investment behind consumer marketing<br />

initiatives and retail-specific trade<br />

promotions. The U.S. remained its largest<br />

market, accounting for 93%<br />

of revenues, Canada followed<br />

at 5% and the Middle East<br />

and North Africa (MENA)<br />

region at 2%. The company<br />

said that each market saw<br />

increased revenues from the<br />

prior year, with the largest<br />

gains coming from Canada<br />

and MENA.<br />

31: In keeping up with rival<br />

L’Oréal, the Estée Lauder<br />

Cos. acquires luxury<br />

skin-care brand Rodin Olio<br />

Lusso.<br />

NOVEMBER<br />

1: Urban Decay opens<br />

its first store in Newport<br />

Beach, Calif.<br />

7: Just one<br />

week after<br />

inking a deal<br />

with Rodin<br />

Olio Lusso,<br />

the Estée<br />

Lauder Cos. signs<br />

a deal to buy Editions<br />

de Parfums FRÉDÉRIC<br />

MALLE.<br />

11: Yale Martin, credited<br />

with bringing celeb<br />

fragrances to Wal-Mart,<br />

retires after 18 years.<br />

13: Kendo cuts ties with<br />

Sephora in order to<br />

expand distribution and<br />

nurture new brands. For its<br />

first move, Kendo acquires<br />

Canadian lipstick purveyor<br />

Bite Beauty.<br />

14: John Frieda<br />

announces plans to<br />

revive its BEACH BLONDE<br />

line, which, much to the<br />

dismay of consumers,<br />

was discontinued back in<br />

2004.<br />

15: Saks debuts Beauty<br />

On 5, a concept that<br />

offers express services<br />

from Blink Brow Bar, Trish<br />

McEvoy and the Nails Inc<br />

Paint Workshop.<br />

15: In a bid to attract<br />

Millennials, Estée<br />

Lauder names<br />

KENDALL JENNER<br />

as its newest face.<br />

<br />

2014 BEAUTY SALES:<br />

$252.8 MILLION (EST.)<br />

¥26.61 BILLION (EST.)<br />

+4.7% V. ’13 (EST.)<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Kirei Kirei (hand soap). Ban<br />

(deodorant). Pro Tec (men’s hair and<br />

body care). Bathtology (body care). Soft<br />

in 1, Shokubutu-Monogatari (shampoo<br />

and body soap).<br />

YEAR IN REVIEW: Lion Corp.’s 2014<br />

beauty sales felt the effect of Japan’s<br />

consumption-tax hike in the second<br />

half of the year but its hand-soap<br />

and deodorant markets continued to<br />

perform well. Kirei Kirei hand soap was<br />

its bestseller in Japan and Shokubutsu-<br />

Monogatari body wash increased its sales<br />

in Thailand. The company posted a 7.5%<br />

year-on-year increase in domestic beauty<br />

sales to ¥20.47 billion. Lion, whose<br />

business includes beauty, detergent,<br />

soap, toothpaste and pharmaceuticals,<br />

registered total net revenues of ¥367.4<br />

billion, up 4.4%.<br />

83<br />

ARTDECO COSMETIC<br />

GROUP<br />

KARLSFELD, GERMANY<br />

2014 BEAUTY SALES:<br />

$243.4 MILLION<br />

€183.1 MILLION<br />

+4.2% V. ’13<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

ARTDECO: Artdeco (skin and body<br />

care, makeup). BEYU COSMETICS<br />

AND MORE: BeYu (makeup). ICB<br />

INNOVATIVE COSMETICS BRANDS:<br />

Make Up Factory, Misslyn (makeup).<br />

Anny (nail color and care). MALU WILZ<br />

BEAUTÉ: Malu Wilz (makeup, skin<br />

care). AMERICAN NAILS.<br />

YEAR IN REVIEW: Growth for Artdeco<br />

Cosmetic Group in 2014 was driven by<br />

exports, which grew 10.2% year-on-year<br />

to €105.8 million and accounted for 57%<br />

of business. The Artdeco brand accounted<br />

for 58.7% of total sales. Domestically,<br />

de-stocking at retailers caused sales for<br />

the brand to fall 3%. Its international<br />

sales increased 9.7%, and revenues in<br />

Russia increased 50% thanks to expansion<br />

with perfumery chain L’Etoile. It<br />

also established new partnerships in Iraq,<br />

Bolivia, Turkey and Chile. BeYu and Anny<br />

also saw domestic sales declines of 16%<br />

and 7.5% respectively, while domestic<br />

sales for Misslyn grew 11% and Make<br />

Up Factory’s grew 4.3%. Misslyn posted<br />

a 13% increase in exports and entered<br />

Shoppers Drug Mart in Canada and<br />

L’Etoile in Russia. Anny’s international<br />

sales climbed 72.5%. Make Up Factory<br />

saw international sales rise 32%. BeYu<br />

accounted for 12.5% of company sales;<br />

Make Up Factory, 8.3%; Anny, 6.3%;<br />

Malu Wilz, 7.6%; and Misslyn, 6.7%.<br />

2014 BEAUTY SALES:<br />

$243.4 MILLION (EST.)<br />

€183.1 MILLION (EST.)<br />

+7% V. ’13 (EST.)<br />

+ +<br />

SUBSIDIARIES + MAIN BRANDS:<br />

Nuxe, Bio-Beauté by Nuxe, Resultime<br />

(skin and body care, fragrance).<br />

YEAR IN REVIEW: On a comparable<br />

basis, Nuxe Groupe saw sales increase<br />

8.3% in 2014, with exports representing<br />

40% of its revenues. The French<br />

company sold the Docteur Renaud brand<br />

in July in order to focus on its core brands<br />

and the pharmacy channel. Its largest<br />

international markets were Italy, Belgium<br />

and Spain. It entered seven new markets<br />

including Austria, Paraguay, Serbia,<br />

Hungary and Chile, bringing its country<br />

count to 73, and expanded in travel retail.<br />

Sales for the Nuxe brand, which remained<br />

the third best-selling brand in French<br />

pharmacies, according to IMS data, grew<br />

an estimated 7.1% to €165.5 million,<br />

while Bio-Beauté by Nuxe saw estimated<br />

growth of 39.7% to €10.9 million. The<br />

Collin Resultime brand was renamed<br />

Resultime in January 2014 and relaunched<br />

in the pharmacy channel in a bid to drive<br />

future growth; its sales increased an<br />

estimated 1.4% to €3.7 million.<br />

85<br />

MÄURER & WIRTZ<br />

STOLBERG, GERMANY<br />

2014 BEAUTY SALES:<br />

$243.2 MILLION<br />

€183 MILLION<br />

+2.8% V. ’13<br />

+<br />

SUBSIDIARIES + MAIN BRANDS:<br />

PRESTIGE: Baldessarini, Strellson.<br />

4711: 4711 Original Eau de<br />

Cologne, 4711 Acqua Colonia, 4711<br />

Wunderwasser, 4711 Nouveau Cologne.<br />

BEAUTY: Tabac, Betty Barclay,<br />

Otto Kern, Tosca, Sir Irisch Moos,<br />

Nonchalance, TNT, Comma, New<br />

Yorker, Pussy Deluxe.<br />

YEAR IN REVIEW: While Germany<br />

remained Mäurer & Wirtz’s largest market,<br />

representing 69% of its revenues in<br />

2014, international markets advanced to<br />

account for 31% of sales, partly thanks to<br />

the growing strength of Eastern Europe<br />

and Russia. Domestic sales increased<br />

1.3% to €126 million and international<br />

revenues grew 6.2% to €57 million. The<br />

company introduced 4711 Wunderwasser,<br />

targeting younger consumers, and<br />

opened a 4711 shop-in-shop at Cologne/<br />

Bonn airport.<br />

JENNER PHOTO BY GIOVANNI GIANNONI<br />

44