VISA Steel Limited Annual Report 2010-11

VISA Steel Limited Annual Report 2010-11

VISA Steel Limited Annual Report 2010-11

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> -<strong>11</strong><br />

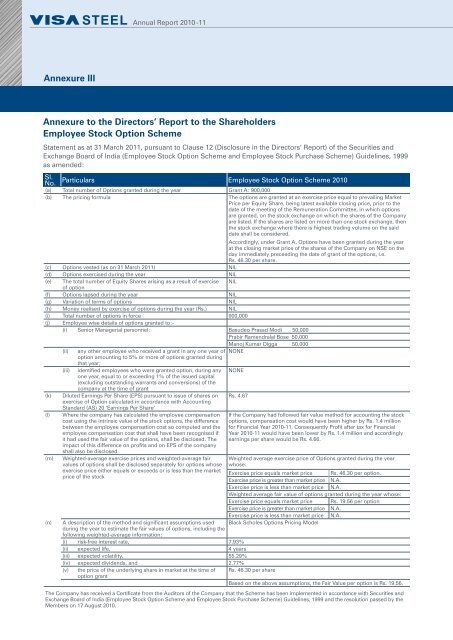

Annexure III<br />

Annexure to the Directors’ <strong>Report</strong> to the Shareholders<br />

Employee Stock Option Scheme<br />

Statement as at 31 March 20<strong>11</strong>, pursuant to Clause 12 (Disclosure in the Directors’ <strong>Report</strong>) of the Securities and<br />

Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999<br />

as amended:<br />

Sl.<br />

No.<br />

Particulars Employee Stock Option Scheme <strong>2010</strong><br />

(a) Total number of Options granted during the year Grant A: 900,000<br />

(b) The pricing formula The options are granted at an exercise price equal to prevailing Market<br />

Price per Equity Share, being latest available closing price, prior to the<br />

date of the meeting of the Remuneration Committee, in which options<br />

are granted, on the stock exchange on which the shares of the Company<br />

are listed. If the shares are listed on more than one stock exchange, then<br />

the stock exchange where there is highest trading volume on the said<br />

date shall be considered.<br />

Accordingly, under Grant A, Options have been granted during the year<br />

at the closing market price of the shares of the Company on NSE on the<br />

day immediately preceeding the date of grant of the options, i.e.<br />

Rs. 46.30 per share.<br />

(c) Options vested (as on 31 March 20<strong>11</strong>) NIL<br />

(d) Options exercised during the year NIL<br />

(e) The total number of Equity Shares arising as a result of exercise NIL<br />

of option<br />

(f) Options lapsed during the year NIL<br />

(g) Variation of terms of options NIL<br />

(h) Money realised by exercise of options during the year (Rs.) NIL<br />

(i) Total number of options in force 900,000<br />

(j) Employee wise details of options granted to:-<br />

(i) Senior Managerial personnel: Basudeo Prasad Modi 50,000<br />

Prabir Ramendralal Bose 50,000<br />

Manoj Kumar Digga 50,000<br />

(ii) any other employee who received a grant in any one year of NONE<br />

option amounting to 5% or more of options granted during<br />

that year;<br />

(iii) identified employees who were granted option, during any NONE<br />

one year, equal to or exceeding 1% of the issued capital<br />

(excluding outstanding warrants and conversions) of the<br />

company at the time of grant<br />

(k) Diluted Earnings Per Share (EPS) pursuant to issue of shares on Rs. 4.67<br />

exercise of Option calculated in accordance with Accounting<br />

Standard (AS) 20 ‘Earnings Per Share’<br />

(l) Where the company has calculated the employee compensation<br />

cost using the intrinsic value of the stock options, the difference<br />

between the employee compensation cost so computed and the<br />

employee compensation cost that shall have been recognised if<br />

it had used the fair value of the options, shall be disclosed. The<br />

impact of this difference on profits and on EPS of the company<br />

shall also be disclosed<br />

If the Company had followed fair value method for accounting the stock<br />

options, compensation cost would have been higher by Rs. 1.4 million<br />

for Financial Year <strong>2010</strong>-<strong>11</strong>. Consequently Profit after tax for Financial<br />

Year <strong>2010</strong>-<strong>11</strong> would have been lower by Rs. 1.4 million and accordingly<br />

earnings per share would be Rs. 4.66.<br />

(m)<br />

(n)<br />

Weighted-average exercise prices and weighted-average fair<br />

values of options shall be disclosed separately for options whose<br />

exercise price either equals or exceeds or is less than the market<br />

price of the stock<br />

Weighted average exercise price of Options granted during the year<br />

whose:<br />

Exercise price equals market price Rs. 46.30 per option.<br />

Exercise price is greater than market price N.A.<br />

Exercise price is less than market price N.A.<br />

Weighted average fair value of options granted during the year whose:<br />

Exercise price equals market price Rs. 19.56 per option<br />

Exercise price is greater than market price N.A.<br />

Exercise price is less than market price N.A.<br />

A description of the method and significant assumptions used Black Scholes Options Pricing Model<br />

during the year to estimate the fair values of options, including the<br />

following weighted-average information:<br />

(i) risk-free interest rate, 7.93%<br />

(ii) expected life, 4 years<br />

(iii) expected volatility, 55.29%<br />

(iv) expected dividends, and 2.77%<br />

(v) the price of the underlying share in market at the time of<br />

option grant<br />

Rs. 46.30 per share<br />

Based on the above assumptions, the Fair Value per option is Rs. 19.56.<br />

The Company has received a Certificate from the Auditors of the Company that the Scheme has been implemented in accordance with Securities and<br />

Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999 and the resolution passed by the<br />

Members on 17 August <strong>2010</strong>.