2011 - South Carolina Association of Counties

2011 - South Carolina Association of Counties

2011 - South Carolina Association of Counties

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

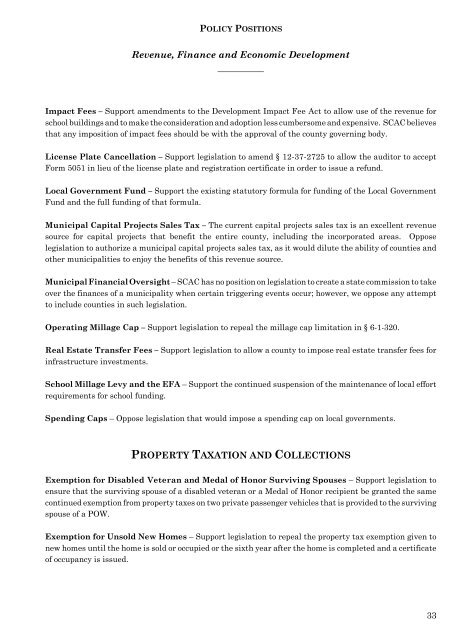

POLICY POSITIONS<br />

Revenue, Finance and Economic Development<br />

__________<br />

Impact Fees – Support amendments to the Development Impact Fee Act to allow use <strong>of</strong> the revenue for<br />

school buildings and to make the consideration and adoption less cumbersome and expensive. SCAC believes<br />

that any imposition <strong>of</strong> impact fees should be with the approval <strong>of</strong> the county governing body.<br />

License Plate Cancellation – Support legislation to amend § 12-37-2725 to allow the auditor to accept<br />

Form 5051 in lieu <strong>of</strong> the license plate and registration certificate in order to issue a refund.<br />

Local Government Fund – Support the existing statutory formula for funding <strong>of</strong> the Local Government<br />

Fund and the full funding <strong>of</strong> that formula.<br />

Municipal Capital Projects Sales Tax – The current capital projects sales tax is an excellent revenue<br />

source for capital projects that benefit the entire county, including the incorporated areas. Oppose<br />

legislation to authorize a municipal capital projects sales tax, as it would dilute the ability <strong>of</strong> counties and<br />

other municipalities to enjoy the benefits <strong>of</strong> this revenue source.<br />

Municipal Financial Oversight – SCAC has no position on legislation to create a state commission to take<br />

over the finances <strong>of</strong> a municipality when certain triggering events occur; however, we oppose any attempt<br />

to include counties in such legislation.<br />

Operating Millage Cap – Support legislation to repeal the millage cap limitation in § 6-1-320.<br />

Real Estate Transfer Fees – Support legislation to allow a county to impose real estate transfer fees for<br />

infrastructure investments.<br />

School Millage Levy and the EFA – Support the continued suspension <strong>of</strong> the maintenance <strong>of</strong> local effort<br />

requirements for school funding.<br />

Spending Caps – Oppose legislation that would impose a spending cap on local governments.<br />

PROPERTY TAXATION AND COLLECTIONS<br />

Exemption for Disabled Veteran and Medal <strong>of</strong> Honor Surviving Spouses – Support legislation to<br />

ensure that the surviving spouse <strong>of</strong> a disabled veteran or a Medal <strong>of</strong> Honor recipient be granted the same<br />

continued exemption from property taxes on two private passenger vehicles that is provided to the surviving<br />

spouse <strong>of</strong> a POW.<br />

Exemption for Unsold New Homes – Support legislation to repeal the property tax exemption given to<br />

new homes until the home is sold or occupied or the sixth year after the home is completed and a certificate<br />

<strong>of</strong> occupancy is issued.<br />

33