Deer Industry News - Deer Industry New Zealand

Deer Industry News - Deer Industry New Zealand

Deer Industry News - Deer Industry New Zealand

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

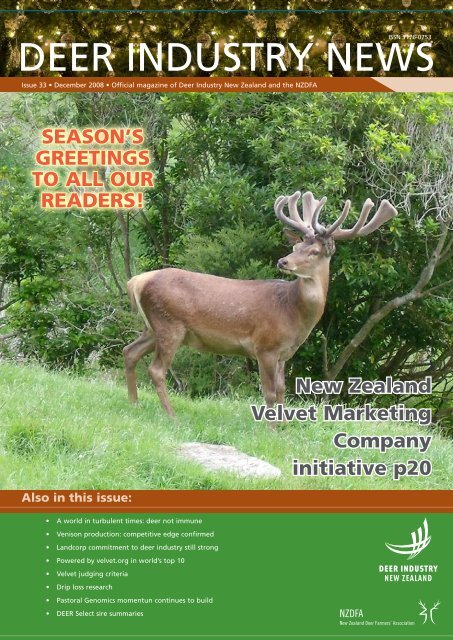

ISSN 1176-0753<br />

DEER INDUSTRY NEWS<br />

Issue 33 • December 2008 • Official magazine of <strong>Deer</strong> <strong>Industry</strong> <strong>New</strong> <strong>Zealand</strong> and the NZDFA<br />

Season’s<br />

Greetings<br />

to all our<br />

readers!<br />

Also in this issue:<br />

<strong>New</strong> <strong>Zealand</strong><br />

Velvet Marketing<br />

Company<br />

initiative p20<br />

• A world in turbulent times: deer not immune<br />

• Venison production: competitive edge confirmed<br />

• Landcorp commitment to deer industry still strong<br />

• Powered by velvet.org in world’s top 10<br />

• Velvet judging criteria<br />

• Drip loss research<br />

• Pastoral Genomics momentun continues to build<br />

• DEER Select sire summaries

editorial<br />

<strong>Deer</strong> a sound investment in turbulent times<br />

The world is in the throes of systemic<br />

adjustments that most of us have not<br />

witnessed in our lifetimes. Tighter credit<br />

markets, shrinking balance sheets and<br />

slowing economic activity will affect<br />

the markets in which we sell and the environment in which<br />

we grow and process our products. Your Board commits<br />

to maintaining prudent fiscal governance of DINZ while<br />

continuing to invest in promotion and other industry-good<br />

activities. Despite turbulent conditions, now is not the time<br />

to slow or stop industry development.<br />

With a new Government come new policies which affect the<br />

deer industry. I’d like to briefly run through my perspective<br />

on a number of them:<br />

Emissions Trading Scheme (ETS): DINZ welcomes a select<br />

committee review of the ETS but is concerned that the scope<br />

appears narrow. DINZ believes an intensity-based ETS rather<br />

than cap-and-trade is pragmatic and less likely to reduce our<br />

competitiveness. The pastoral sector must continue to work<br />

collectively on this issue.<br />

Resource Management Act (RMA): The RMA should not<br />

be a means to tie up projects in process costs and red tape.<br />

DINZ welcomes the Government’s commitment to introduce<br />

a reform bill in its first 100 days of office.<br />

Broadband: DINZ believes the Government has this wrong.<br />

A roll-out of ultra-fast broadband to 75 percent of <strong>New</strong><br />

<strong>Zealand</strong> homes will include few rural homes, where the<br />

Contents<br />

Editorial: In turbulent times, deer farming is a sound investment .................3<br />

DINZ news: Grand velvet photo competition ....................................................4<br />

CWD surveillance: come on southerners – do your bit! ...........................6<br />

NAIT show goes on ....................................................................................8<br />

Ticking the right boxes – it matters ..........................................................9<br />

NVSB Update ...........................................................................................10<br />

Venison production shows healthy gross margins .................................12<br />

General news: Landcorp would be hit hard by ETS .......................................15<br />

Animal Health Board Update ..................................................................16<br />

Time getting tight for Pest Management Strategy review ......................17<br />

Johne’s information networks taking shape ...........................................18<br />

Coming events and sire sales .................................................................18<br />

Elk/Wapiti: Utilising mother nature for bigger gains .............................19<br />

<strong>Industry</strong> news: <strong>New</strong> <strong>Zealand</strong> Velvet Marketing Company launched .............20<br />

Tyrolean dried venison .............................................................................22<br />

Venison <strong>Industry</strong> Strategic Intent ............................................................22<br />

Powered by velvet.org.nz in world’s top 10 .............................................24<br />

Wild Plaza ................................................................................................25<br />

Latest Chef Ambassador to endorse Cervena® in United States .........31<br />

Farmers’ markets in <strong>New</strong> <strong>Zealand</strong> ..........................................................32<br />

Market Talk: BOGO F&D Ltd ....................................................................33<br />

Market Report: Venison and velvet updates .................................................34<br />

Stagline: NZDFA velvet and hard antler competitions review ........................38<br />

Focus Farm and productivity group Conference 2008 ............................40<br />

North Island Velvet Competition .............................................................41<br />

Venison added to menu for local derby ..................................................42<br />

Economist knocks ETS into shape ..........................................................44<br />

Research: Collaboration points way to Johne’s-resilient bloodlines .............45<br />

Learning how venison holds its water ....................................................46<br />

NZDFA invited to invest in pastoral genomics programme ....................48<br />

Scientist honoured for deer vaccine work ...............................................49<br />

DEER Select Sire Summaries: 1 December 2008 ...................................50<br />

need is actually greatest. Farming families are remote, but<br />

are comfortable collaborating with each other to achieve a<br />

better result. The internet, particularly Web 2.0, is all about<br />

collaboration and removing distance. The $48 million for the<br />

Broadband Challenge Fund is only 3 percent of the size of<br />

the Government’s planned $1.5 billion investment in ultrafast<br />

broadband. The Government does not appear to have a<br />

specific goal for rural broadband access. One is required.<br />

Research, Science and Technology: The Government<br />

appears to have decided to discontinue the R&D tax credit<br />

and the $700 million Fast Forward Fund. It will instead<br />

invest more money in research consortia, more secure Crown<br />

research institute (CRI) funding, have Prime Minister’s<br />

prizes for science and create a role called Prime Minister’s<br />

Science Adviser. DINZ supports more investment in consortia<br />

for industry-researcher-Crown collaboration. There should<br />

be circumstances where the Government invests more<br />

than 50 percent where warranted. DINZ supports more<br />

secure funding for CRIs to provide more career certainty<br />

for scientists. However, there is a risk that CRIs will act in<br />

isolation, or worse, on political whims. <strong>Industry</strong> involvement<br />

is necessary to avoid wasted, ill-directed use of resources. We<br />

do not want researchers to climb a ladder only to find it’s up<br />

against the wrong wall.<br />

The venison schedule is 60 percent higher than the 10-year<br />

average for this time of year. Prices have increased faster<br />

than for competing proteins, some of which are seeing price<br />

softening. This is a real threat. It is more important than ever<br />

for producers to stay connected to the market through close,<br />

committed relationships with processor/marketers who in<br />

turn have close, committed relationships with distributors in<br />

touch with the final consumer. The industry needs to avoid<br />

the trading of venison in the market and procurement-driven<br />

rather than market-driven schedules.<br />

Turning now to the financial performance of our industry,<br />

there is always a lot of discussion about the most profitable<br />

livestock farming option. At present, venison offers very<br />

attractive returns in terms of cents per kilogram of dry matter<br />

consumed. I am very pleased to see confidence returning<br />

to the deer industry, and I’m sure financial institutions will<br />

support developing and growing deer units, based on the<br />

very compelling evidence provided in this issue of <strong>Deer</strong><br />

<strong>Industry</strong> <strong><strong>New</strong>s</strong> (pages 12-14).<br />

I wish readers a happy and safe Christmas. I hope you have a<br />

refreshing break and come back ready for a positive 2009.<br />

John Scurr, Chairman<br />

<strong>Deer</strong> <strong>Industry</strong> <strong>New</strong> <strong>Zealand</strong><br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong> is published by <strong>Deer</strong> <strong>Industry</strong> <strong>New</strong> <strong>Zealand</strong> six times a year in February, April,<br />

June, August, October and December. It is circulated to all known deer farmers, processors, exporters<br />

and others with an interest in the deer industry. The opinions expressed in <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong> do not<br />

necessarily reflect the views of <strong>Deer</strong> <strong>Industry</strong> <strong>New</strong> <strong>Zealand</strong> or the NZ <strong>Deer</strong> Farmers’ Association.<br />

Circulation enquiries: <strong>Deer</strong> <strong>Industry</strong> <strong>New</strong> <strong>Zealand</strong>,<br />

PO Box 10-702, Wellington, Ph 04 471 6114, Fax 04 472 5549, Email info@deernz.org<br />

Editorial and advertising enquiries: Words & Pictures, PO Box 27-221, Wellington, Ph 04 384 4688,<br />

Fax 04 384 4667, Email din@wordpict.co.nz<br />

Cover: Katherine Sharp of Stag Genetics, Anakoha Bay, Picton, was the deserving winner of our Grand<br />

Velvet Photo competition with this finely composed shot.<br />

Issue No 33 • December 2008 3

news<br />

Grand velvet photo competition:<br />

The Winners!<br />

A late flurry of entries meant our judges were kept busy right down to the wire, sifting through the many wonderful<br />

photos submitted for our Grand Velvet photo competition. We now have a great new pool of images for helping<br />

promote our velvet antler products to the world.<br />

Judges’ comments<br />

First Prize: $600<br />

The overall winner is Katherine Sharp of Stag<br />

Genetics, Anakoha Bay, Picton, with this stag in an<br />

excellent pose, against a nice backdrop of native bush,<br />

emphasising <strong>New</strong> <strong>Zealand</strong>’s clean green environment.<br />

It’s our cover shot for this issue of <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>.<br />

Condition of deer: Some great photos were spoiled by<br />

shabby winter coats still being shed, which is obviously<br />

what typically happens this time of year.<br />

Backgrounds: Try to avoid features such as fences,<br />

yards, dead trees, tracks or buildings in the background<br />

unless they’re a part of the story you’re conveying.<br />

Framing: <strong>Deer</strong> don’t always cooperate by standing still,<br />

but try to think about the composition of the photo.<br />

What part will features such as trees, water, horizons and<br />

pasture play in the shot? Will they enhance the photo<br />

or be a distraction. How does a group of animals look<br />

together? Are any partially obscured or facing the wrong<br />

way?<br />

Cropping: Be careful not to crop photos too tightly.<br />

Some great shots were spoiled when the lower legs or<br />

back end of an animal were cut off. On the other hand,<br />

cropping can also be used to create an unusual effect.<br />

Light conditions: Difficult light conditions can become<br />

an asset. For example, backlit animals and their velvet<br />

can look stunning in silhouette. Strong sunlight can be<br />

good, but it also creates strong shadows. The diffused<br />

light during bright but overcast weather can help pick<br />

out details and give an almost luminous look to your<br />

subjects.<br />

Picture resolution: Make sure your digital camera<br />

is set at high resolution. Some wonderful photos were<br />

Second Prize: $250<br />

Third Prize: $150<br />

Chris Petersen’s photography featured over many years in<br />

the Warnham & Woburn photo awards, and this delightful<br />

photo captures his stags advancing expectantly on the<br />

photographer after a late spring snowfall in the Te Anau<br />

Basin.<br />

Tom May’s stag looks in excellent form – happy with life and<br />

rather pleased with himself. This is a nicely composed photo<br />

showing a healthy stag, a good head of velvet and a wellmanaged<br />

farming environment.<br />

4<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

news<br />

too small for us to publish. A good<br />

front-page photo will be at least 2000<br />

pixels along its shortest edge (about 5<br />

megapixels total). A photo taken for a<br />

poster should be even larger. This gives<br />

us the flexibility to crop the photo.<br />

Focus/depth of field: Difficult with<br />

a moving target, we know, but sharper<br />

focus on the main subjects would<br />

have brought more entrants into the<br />

reckoning. Using a telephoto lens your<br />

depth of field (the area in focus) will<br />

be quite narrow, but if you get it right<br />

a sharply focused deer with the trees/<br />

pasture slightly blurred can look very<br />

effective. A tripod can be useful in<br />

these situations.<br />

Date stamp: Some cameras<br />

automatically include the date and<br />

time on the image. Please turn this<br />

feature off! Photoshop tells us when<br />

the photo was taken, the camera and<br />

settings, without the information being<br />

part of the photo image.<br />

And finally…<br />

Our special thanks to all those who<br />

got out there and stalked their stags<br />

with a camera. You’ve helped us<br />

compile a great resource for the good<br />

of all the industry and we intend to<br />

share the best of your efforts through<br />

this magazine and our promotional<br />

material.<br />

Rhys Griffiths<br />

Velvet Marketing Services Manager<br />

Highly commended<br />

Our shortlist also featured a number<br />

of other excellent entries which<br />

showed real flair, imagination and<br />

thoughtfulness but unfortunately<br />

just missed out on a place. <strong>Deer</strong> are<br />

never easy to photograph at the best<br />

of times, though these following<br />

pictures seem to have caught them<br />

perfectly. We would like to mention<br />

the following photographers for<br />

their efforts, under a “Highly<br />

Commended” section and they<br />

will receive a bottle of something<br />

pleasant in recognition of a nicely<br />

composed photo. Your entries will<br />

be published and acknowledged in<br />

future issues of <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong><br />

as space permits:<br />

(Top) Tom Loveridge of Taranaki,<br />

with his portrait of stags in velvet<br />

against the majestic background of<br />

Mount Taranaki.<br />

(Middle) Trevor Thomas of Central<br />

Hawke’s Bay with this great<br />

grouping of stags.<br />

(Bottom) Angela Kelly of<br />

Rotorua submitted this fantastic<br />

shot of Mac taken by Tracey<br />

Robinson Photography. The judges<br />

acknowledge that the quality of this<br />

photo was superb!<br />

<br />

<br />

<br />

<br />

<br />

!"<br />

#$%<br />

!"<br />

&<br />

'%(<br />

)*!%<br />

$<br />

$<br />

<br />

+( <br />

Issue No 33 • December 2008 5

news<br />

CWD surveillance: come on southerners – do your bit!<br />

The deer industry’s centre of gravity might be slowly moving south, but it’s the southern South Island that needs to lift<br />

its game when it comes to vigilance against chronic wasting disease (CWD).<br />

A review of the CWD surveillance programme by Dr Lachlan<br />

McIntyre, MAF’s Senior Adviser – Surveillance Group<br />

(Animals), shows that the overall number of brain samples<br />

submitted between 2002 and now (4,500) is satisfactory.<br />

However the geographic spread of samples has been very<br />

uneven, and MAF would like to see more submissions<br />

coming from areas that are currently very lightly sampled.<br />

Very few samples are currently received from South<br />

Canterbury, Otago and Southland. The only areas to have<br />

been sending in plentiful samples are the central North Island<br />

and central Canterbury.<br />

CWD is a member of the ‘family’ of transmissible spongiform<br />

encephalopathies (TSEs), which includes mad cow disease.<br />

No TSEs have been detected in <strong>New</strong> <strong>Zealand</strong>, but a credible<br />

and robust surveillance programme is necessary if our TSEfree<br />

status is to be preserved.<br />

Canada’s experience with BSE is a sobering reminder of<br />

the impact it can have. Beef animals there plunged in value<br />

from $1300 to $130 after the disease was discovered. If CWD<br />

was found in <strong>New</strong> <strong>Zealand</strong> it would affect not only the deer<br />

industry but also sheep and beef would be<br />

affected because of increased scrutiny from<br />

our markets.<br />

MAF and DINZ pay farmers $100 + GST<br />

for each deer brain submitted for sampling,<br />

while vets are paid $160 + GST for their<br />

part. The scheme is designed to target<br />

animals most likely to be at risk and showing<br />

symptoms consistent with CWD. These<br />

include deer two years and older showing<br />

signs of ill-thrift and wasting, behavioural<br />

changes, nervous disease or pneumonia. Illthrift<br />

is the main symptom cited when deer<br />

are selected for monitoring.<br />

Dr McIntyre says scouring is not considered<br />

an indicator, the weight loss being caused<br />

by not eating. He notes that affected animals<br />

may urinate excessively, which could give the<br />

appearance in females of scouring on the hindquarters.<br />

At a glance<br />

He says some vets are taking advantage of Tb testing to<br />

look over stock and identify any likely candidates for CWD<br />

surveillance, and suspects a number of those chosen are in<br />

fact suffering from Johne’s disease.<br />

In his report, Dr McIntyre recommends that future sampling<br />

be focused on areas where few or no brain samples have<br />

been submitted, with an awareness programme in undersampled<br />

regions to improve the response.<br />

“We recommend the current surveillance programme<br />

continues with modification to restrict sampling to farms<br />

which have been either minimally sampled or not at all. At<br />

present we’re getting too many samples from a small number<br />

of farms and not enough from a wider range of farms.” The<br />

total sample numbers per year could be allowed to decline,<br />

the report continues, but infrastructure should be maintained<br />

• MAF pays farmers<br />

$100 + GST per<br />

brain submitted.<br />

• Vet must see live<br />

animal to confirm<br />

it is a candidate for<br />

monitoring.<br />

• <strong>Deer</strong> must be at<br />

least 2 years old.<br />

• Suspect symptoms<br />

include illthrift,<br />

wasting, behavioural<br />

changes, nervous<br />

disease, pneumonia.<br />

Dr. Lachlan McIntyre: Many of the animals selected for CWD<br />

testing may be infected with Johne’s disease.<br />

so that a rapid increase in sampling can be<br />

implemented if necessary. From November MAF<br />

has limited the number of samples accepted from<br />

individual farms to two per submission.<br />

Speaking to NZDFA Branch Chairmen at their<br />

October meeting, Dr McIntyre said the fact we<br />

had imported deer from North America, where<br />

CWD is in the deer population means it is wise<br />

to monitor our own animals closely. He said it<br />

probably affects Red deer, but there is no history<br />

of exposure to confirm susceptibility. He said<br />

the disease is spread by prions, not bacteria or<br />

viruses, and these are probably ingested. If the<br />

disease were present in <strong>New</strong> <strong>Zealand</strong> it could be<br />

spread among deer through normal husbandry<br />

practices such as scanning, Tb testing and<br />

velvetting.<br />

“The incubation period can be years, but<br />

the actual disease progresses over weeks or months,” he<br />

explained.<br />

He said samples for testing could also be taken from other<br />

parts of the deer such as the peripheral lymph nodes,<br />

but these methods have yet to be validated by the world<br />

organisation for animal health (OIE).<br />

On the question of why sampling for CWD monitoring has<br />

been lacking in the South, he said he understood much Tb<br />

testing is done by non vets, meaning less opportunity for vets<br />

to get onto farms and do the sampling. One Branch Chairman<br />

suggested the demands of the dairy industry meant vets had<br />

little time for the CWD monitoring work.<br />

Dr McIntyre reminded farmers that the vet needs to see the<br />

live animal to confirm it is a candidate for monitoring. The<br />

farmer killing the animal and bringing the head into the vet<br />

for sampling is not acceptable, he said.<br />

6<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

news<br />

NAIT show goes on<br />

The NAIT juggernaut rolls on, with a series of farmer meetings and presentations at A&P shows held during November<br />

and December to sell the concept to the rural sector. The roadshow’s public meetings will be completed by Christmas,<br />

but consultation through some on-farm field days will continue until March next year. It’s hoped these will be held on<br />

farms where RFID technology is working, so that the impact at a farm level can be discussed.<br />

The discussion document on NAIT received nearly 100<br />

submissions, including separate contributions from DINZ,<br />

<strong>Deer</strong> <strong>Industry</strong> Association and NZDFA. MAF had extended<br />

the closing date for submissions to allow Federated Farmers<br />

to complete their membership survey, and the analysis of<br />

submissions plus the feedback received during the NAIT<br />

roadshow is now scheduled to be completed by March 2009.<br />

NAIT Project Manager Craig Purcell says feedback from the<br />

meetings will help shape the design of NAIT. When he spoke<br />

to <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong> he had just attended farmer meetings<br />

at Winton and Gore, where there was a strong presence from<br />

deer farmers.<br />

“They reinforced their concerns around ownership of the<br />

data, and that had been reported by other sectors. They also<br />

made the point about the high proportion of deer – about<br />

70 percent – that go direct to slaughter when they leave the<br />

farm. We knew about this, but it’s been helpful to hear about<br />

the concerns first hand.”<br />

Concerns from both cattle and deer farmers about loss of tags<br />

have been coming through strongly at the meetings. “That’s<br />

something we’ll look at more closely.”<br />

Feedback received from farmers who attended the Southland<br />

meetings was tinged with some frustration that the meetings<br />

were challenging to run, with the floor often dominated by<br />

Federated Farmers advocating their strong position. Media<br />

have referred to these meetings as “testy”. The deer farmers<br />

at the meetings said that while the responses given to<br />

concerns raised seemed to be stock answers to justify the<br />

current stance, and while deer farmers’ positions were well<br />

known to NAIT, it was nonetheless useful to have that grass<br />

roots perspective. <strong>Deer</strong> farmers however, in spite of that of<br />

willingness to listen, felt it was going to be very difficult to<br />

make changes they see as critical to the scheme’s design.<br />

Craig Purcell says farmers want the transition to NAIT to<br />

be slower, while those in the rest of the value chain want it<br />

implemented quickly. The dairy sector is “very comfortable”<br />

with the NAIT concept, which won’t demand much change<br />

except the requirement to tag young calves going to rearers.<br />

A number of beef farmers had highlighted the paradox of<br />

having NAIT-tagged cattle running with un-tagged sheep<br />

on the same property. “Rome wasn’t built in a day,” Craig<br />

comments. “Our brief is to make sure it’s relatively simple to<br />

clip on another species later on.”<br />

He says the one-on-one conversations held around the<br />

country have been very fruitful. “We talked to more than 100<br />

people at the Canterbury show with discussions ranging from<br />

one minute to well over an hour.”<br />

MAF’s Ian Govey concurs. He says the face-to-face meetings<br />

are yielding excellent feedback, with many practical issues<br />

being teased out more than they may have been in the<br />

written submissions. The 2011 implementation date still<br />

stands, but will ultimately depend on a number of factors,<br />

including the enabling legislation, he says.<br />

Federated Farmers wasted no time attacking the NAIT<br />

proposal through the media, and the manner the scheme is<br />

being introduced based around their interpretation of a draft<br />

cost benefit analysis and views related to the biosecurity<br />

argument if all species are not included.<br />

The submissions of NZDFA and DINZ are broadly in line<br />

with each other, and express similar reservations. Differences<br />

centre around the benefits of the NAIT scheme. NZDFA<br />

says the scheme will have no benefit until all livestock<br />

including pigs and sheep are brought on board to satisfy the<br />

biosecurity aspects. DINZ takes a pragmatic view that there<br />

will be a competitive marketing advantage to be had from<br />

moving to a NAIT programme from the current AHB system,<br />

regardless of whether all livestock classes are on board.<br />

Key points in the DINZ submission included:<br />

• support in principle for traceability and a lifetime<br />

individual animal passport based on a unique animal<br />

identity<br />

• opposition to the mandatory inclusion of deer in NAIT<br />

in 2011 unless appropriate technology is available<br />

• concerns about potential costs and proposed governance<br />

structure for the system<br />

• support for the Animal Health Board (AHB) model as a<br />

governance structure utilising the incorporated society<br />

governance model<br />

• commitment to further investigating UHF and unique<br />

global ID system technology (which may also be more<br />

suitable for sheep) as a more appropriate pathway for<br />

NAIT implementation<br />

• support for investigating re-use of RFID tags to help<br />

lower costs<br />

• concern about fitting Fallow deer and animals on game<br />

estates into the system.<br />

Key points in the NZDFA submission included:<br />

• opposition to mandatory introduction until all relevant<br />

species are included in the scheme.<br />

• concern that 70 percent of deer make only one trip –<br />

direct to slaughter from the farm where they were born<br />

– and so present a very low biosecurity risk<br />

• support for using the AHB’s database and governance<br />

structure as a basis for NAIT<br />

• delaying mandatory inclusion of deer until UHF<br />

technology is properly evaluated and commercially<br />

available if proven<br />

• support for a 50:50 split between the Crown and<br />

industry for operating costs, rather than the 35:65 split<br />

proposed<br />

• commitment to use Focus Farms to evaluate use of both<br />

LF and UHF tags as a precursor to eventual acceptance<br />

of the appropriate technology by farmers<br />

• belief that there is no support from deer farmers for<br />

either the introductory or mandatory phases of NAIT as<br />

proposed<br />

8<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

news<br />

On the plus<br />

side….<br />

Speaking to NZDFA Branch<br />

Chairmen in October, <strong>New</strong> <strong>Zealand</strong><br />

Food Safety Authority Verification<br />

Agency Technical Manager, Chris<br />

Mawson said other countries<br />

such as Canada, the United States<br />

and Britain had been forced into<br />

traceability systems. He said<br />

the world was moving in that<br />

direction and our producers had an<br />

opportunity to learn from others’<br />

experience before deciding how we<br />

could use the technology to our<br />

advantage.<br />

“Current food safety risks [from<br />

<strong>New</strong> <strong>Zealand</strong> animal products]<br />

are fairly negligible, but we have<br />

an opportunity [through NAIT] to<br />

further demonstrate how our riskbased<br />

systems work.<br />

“From a biosecurity perspective,<br />

our experience with the Waiheke<br />

Island hoax showed there are<br />

significant gaps in our ability to<br />

quickly identify and trace animals<br />

in a disease emergency. Those<br />

gaps can be closed by an electronic<br />

programme.<br />

“A number of food processors<br />

are identifying individual animal<br />

traceability as important and<br />

probably a key part of their<br />

marketing of animal products.”<br />

• belief that market access,<br />

traceability and food safety<br />

requirements are adequately<br />

catered for by existing industry<br />

programmes.<br />

A recent prototype trial involving 26<br />

Waikato and King Country farmers<br />

will be used to help refine the NAIT<br />

proposal. Meat processors, sales<br />

organisations and transport companies<br />

were also involved. The study<br />

showed that farmers could easily<br />

grasp the system, according the NAIT<br />

independent chairman, Ian Corney.<br />

www.nait.org.nz<br />

Ticking the right boxes – it matters<br />

If the requirements to fill out animal status declaration forms (ASDs) seem<br />

pedantic, get used to it!<br />

That was the message to deer<br />

farmers from NZ Food Safety<br />

Authority Verification Agency<br />

Technical Manager, Chris Mawson<br />

at the October Branch Chairmen’s<br />

meeting. Chris was explaining the<br />

rationale behind the Authority’s<br />

On-Farm Verification programme<br />

(see <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong> October<br />

2008, page 9).<br />

The boosted programme started<br />

this month and will see an increase<br />

in the number of livestock farms<br />

visited by the NZFSA Verification<br />

Chris Mawson: Reminder that ASD forms are<br />

Authority veterinarians. Of the statutory declarations and need to be done<br />

600 sheep, beef and deer farms to correctly.<br />

be visited annually (up from the<br />

current 240), it’s likely that 80-100 will be deer farms.<br />

This is to strengthen assurances to overseas markets that we are complying with<br />

both their requirements and our own.<br />

Chris explained that the EU Veterinary agreement signed in 1996 is still a world<br />

leader in terms of trade access through a bilateral agreement. It’s based on the<br />

concept of equivalence, i.e. accepting that our programmes deliver the same<br />

outcomes as the EU’s own law. A key principle of this agreement is that we<br />

demonstrate compliance with our own rules and standards. Systems such as ASDs<br />

are scrutinised for compliance and accuracy by importing country regulatory<br />

authorities, so their full and accurate completion by farmers is essential said Chris.<br />

The visits will be done by NZFSA VA vets from about 60 licensed plants. Southland<br />

Branch Chairman, Brian Russell said he’d heard of one on-farm visit that had<br />

taken five hours, with the vet clearly unfamiliar with deer farming. Waikato’s Steve<br />

Borland added that an audit on his dairy runoff had taken about four hours. Chris<br />

Mawson acknowledged that there had been such occurrences in the past. The<br />

changes made by the Agency to the programme and selection of people who have<br />

a good understanding of <strong>New</strong> <strong>Zealand</strong> farming practices, should preclude this type<br />

of situation reoccurring. He had anticipated the visits would be completed in two to<br />

three hours, and that there would be clear advance notice and explanation of what<br />

information was required and what the review process would be.<br />

He reminded the Chairmen that ASD forms are a statutory declaration and so should<br />

be done correctly. It needs to be made clear on the form who is signing them and<br />

the information needs to be supported by farm records.<br />

Animal welfare requirements, a voluntary part of the audit process, are included<br />

in the programme in order to gain an understanding of farmers’ knowledge about<br />

this aspect of farming. Animal welfare is gaining a higher profile in many countries<br />

and <strong>New</strong> <strong>Zealand</strong> farmers need to be aware of this, he said. Wairarapa Branch<br />

Chairman, Tony Bayliss pointed out that welfare requirements during transport are<br />

not part of the audit. Chris Mawson conceded that live animal transporters are not<br />

targeted, but the on-farm verification programme will look at farmers’ understanding<br />

of the requirements for the transport of animals. The welfare of animals on arrival<br />

of animals at processing plants is monitored by Verification Agency vets on a daily<br />

basis and any issues arising regarding transport are dealt with immediately.<br />

He said velvetting was one area likely to be of interest to overseas authorities, partly<br />

because it’s not done in many countries and the Verification Agency and MAF had<br />

done a lot of work with the deer industry to ensure compliance with the welfare<br />

requirements for this activity.<br />

Issue No 33 • December 2008 9

news<br />

NVSB Update<br />

The end of the last velvetting season was one of the tidiest in the experience of DINZ Quality Manger John Tacon.<br />

Reporting to the Branch Chairmen in October<br />

he said there were currently 1,067 certified<br />

velvetters. A further 150 are in abeyance and<br />

6 had been suspended for non-payment of<br />

fees going into this season. Overall there were<br />

80 new velvetters joining the programme, but<br />

there was a loss of about 99 on the previous<br />

year, mainly through people exiting the<br />

industry.<br />

John said many signing up to the programme<br />

for the first time are long-term farmers, and<br />

there had been a big increase in enquiries and<br />

new contracts for the programme.<br />

The number of ID tags issued so far this<br />

season was down about 60,000 on last season<br />

and that difference was unlikely to close by<br />

more than about 15,000. This would represent<br />

a drop of about 18 percent on the tags issued<br />

last season – an indication that there are fewer stags out<br />

there.<br />

John said there had been significant concern from velvet<br />

processors about the proposed new velvet ID tags with<br />

readability an issue with blood splash. There are still plenty<br />

of tags in stock to be used up, but NVSB is investigating<br />

getting the tags printed here in <strong>New</strong> <strong>Zealand</strong> again once<br />

those are used up.<br />

He said last season was the first time the proportion of<br />

certified velvetters being audited had dropped from 20<br />

percent to 10 percent. Eventually 113 of the 143 notified<br />

audits were done.<br />

The main issues identified in the audits were familiar ones:<br />

hygiene, handling and operator safety.<br />

Vet training days were being offered through the NVSB<br />

auditors again this year; there had been a good response<br />

from Southland vets but not so from other regions.<br />

There will be no significant changes to the NVSB Manual<br />

during the current update, John reported. The 49 changes<br />

being made are mainly housekeeping to tidy up minor<br />

anomalies. The manual is out of print and a new edition will<br />

be produced soon.<br />

All the sales<br />

with all the<br />

details<br />

DINZ Quality Manager John<br />

Tacon: a significant increase<br />

in enquiries about NVSB<br />

programme.<br />

The NVSB is due for review, but this won’t<br />

happen until possible changes to the Agricultural<br />

Compounds and Veterinary Medicines Act are<br />

confirmed.<br />

Transport and welfare<br />

The changed standard for antler length during<br />

transport (maximum 110 mm) is once again a<br />

QA rather than a welfare issue – unless a stag<br />

arrives at the processor with a broken antler. John<br />

said any issues about antler length will now be<br />

communicated to farmers by NZFSA Verification<br />

Agency through the processor.<br />

There had been a number of welfare issues (on<br />

farm and transport related) over the past year, John<br />

noted. Twenty farmers signed admissions of guilt to<br />

various velvetting and transporting offences including<br />

performing illegal surgical procedures and ill treatment of<br />

animals. This action precluded them from going to court in<br />

these instances, although the admissions could be used as<br />

evidence in subsequent cases.<br />

John said that in the few cases where deer have arrived dead<br />

at processing plants, one of the main causes is the use of<br />

trucks with large cattle pens. The pens must be divided with<br />

a centre gate and there is a maximum of eight per pen at 100<br />

kg, he reminded farmers.<br />

DINZ had an good working relationship with the MAF<br />

Enforcement Group and NZFSA VA, and John commended<br />

those groups for their positive and inclusive attitude.<br />

Finally John announced some changes in the <strong>Deer</strong>QA<br />

Transport committee. Ken Swainson has stood down after<br />

being on the committee since its inception in 1992, and was<br />

thanked for his sterling service over that period. There are<br />

two new members: former Branch Chairman Pip Rutland<br />

and David Wearing of Canterbury’s Central <strong>Deer</strong> Freighters.<br />

The <strong>Deer</strong>QA Transport Programme continues to thrive with<br />

all venison processors accepting only accredited transporters<br />

delivering deer to their plants. With new drivers coming in<br />

to the industry on a regular basis, driver training courses<br />

are still run on an as-required basis in various regions<br />

throughout the country.<br />

Contact Sharon or Rebecca Phone: (07) 332 5892 Fax: (07) 332 5891 Email: tradedeer@xtra.co.nz<br />

Website: www.tradedeer.co.nz<br />

10<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

news<br />

Venison production shows healthy gross margins<br />

There’s money in deer. It seems like a long time since that could be said with conviction, but the analysis tells a very<br />

positive story. In fact some venison enterprises are offering the best returns for investment on <strong>New</strong> <strong>Zealand</strong> farms.<br />

A comprehensive gross margin analysis<br />

comparing relative profitability across<br />

all major <strong>New</strong> <strong>Zealand</strong> farm enterprises,<br />

produced by Southland farm consultant<br />

Graham Butcher from Rural Solutions,<br />

show returns from finishing purchased<br />

weaner deer tops all farming options in<br />

the Southland-based model. Relativities<br />

are also confirmed in a North Island model<br />

(page 14).<br />

Finishing weaner deer returned 22.64<br />

cents/kg DM consumed, compared to<br />

11.90 cents for a Southland dairy farm<br />

conversion, 15.10 cents from an existing<br />

Southland dairy unit, and 13.68 cents for<br />

bull beef rearing (Table 1).<br />

Graham’s in-depth breakdown has<br />

produced some revealing data on the<br />

best options for land use in the region,<br />

challenging perceptions on farming<br />

investment. It’s a very robust analysis that<br />

takes all direct costs into account, truly<br />

reflecting what it costs to grow farmed<br />

animals.<br />

The most profitable land use option is<br />

finishing weaner deer, followed by summer<br />

and winter lamb trading, then crossbreeding and finishing using an<br />

Elk/Wapiti terminal sire, ahead of all dairy enterprises (Table 1).<br />

Table 1: Gross margin analysis based on cents/kg<br />

dry matter consumed.<br />

Enterprise<br />

The returns from dairy farming are likely to be lower than many<br />

would expect, but as we went to press, Fonterra was announcing<br />

further ‘softness’ in prices from the $6/kg used in this model. Whole<br />

milk powder prices had declined 49 percent since July and EU skim<br />

milk prices were down 45 percent. Further downward price pressure<br />

was expected.<br />

Rural Solutions’ analysis has taken into account all of the direct<br />

expenses associated with each enterprise type to truly compare<br />

bottom lines.<br />

“It takes more grass to graze dairy heifers, and costs reflect that,”<br />

says Graham Butcher. “The results represent the true total costs<br />

of production by including all of the management and pasture<br />

production expenses that occur in a normal dairy operation.”<br />

Considered analysis of the relative returns for future land use across<br />

<strong>New</strong> <strong>Zealand</strong> is crucial, and Graham is urging farmers to take a long<br />

and critical look at all the figures as they weigh up their long-term<br />

options.<br />

The analysis is a starting point to critically examine how to make<br />

more profit from dry matter produced .<br />

“Understand what is needed to produce the best profit from your<br />

land type, before deciding on land-use and livestock changes. There<br />

are opportunities for improving production, and improving returns<br />

from existing land types, so objectively comparing gross margins<br />

on all livestock types is very important for farmers and their bank<br />

advisers to ensure any decisions are based on solid data.<br />

“For example, farmers will likely increase pasture production to<br />

convert an existing sheep, beef or deer farm to dairying. But if the<br />

farm is capable of growing substantially more grass, they should sit<br />

down and look at how that extra dry matter can be best used.<br />

c/kgDM<br />

consumed<br />

Purchase weaner deer, finishing (above average) 22.64<br />

Purchase weaner deer, finishing, with conversion costs 20.23<br />

Summer lamb trading 19.34<br />

Winter lamb trading 17.92<br />

Terminal Sire ( Elk wapiti) crossbreeding and early finishing 16.45<br />

Southland dairy (established) 15.10<br />

Terminal Sire crossbreeding & early finishing with conversion 13.88<br />

Bull beef, rearing 13.68<br />

Breeding Red hinds, finishing 12.93<br />

Bull beef, 100kg purchase 12.86<br />

Dairy cows, winter at 13 kg/$30 12.81<br />

Dairy heifer grazing 12.21<br />

Southland dairy, with conversion 11.90<br />

Breeding Red Hinds, finishing with conversion costs 10.81<br />

Breeding ewes [140 percent, 50 percent hogget mating] 9.29<br />

Autumn-purchase steer calves 9.19<br />

Red Hinds, selling weaners 9.15<br />

Breeding cow, finishing 8.95<br />

Breeding ewes [135 percent, no hogget mating] 8.38<br />

Breeding cow [calving year 2, sell weaners] 7.37<br />

Breeding ewes, store [135 percent, no hogget mating] 7.06<br />

Hinds, selling weaners with conversion costs 6.43<br />

“It may be that utilising existing deer<br />

fences and restocking provides the returns<br />

farmers will be looking for in the current<br />

economic climate.”<br />

Graham believes it’s very easy to be swayed<br />

by attractive milk solids payout figures, but<br />

there are considerable extra direct costs and<br />

increases in other farm expenses to factor<br />

in on dairy in day-to-day management,<br />

compared to all other land uses. There is also<br />

more debt servicing and compliance costs<br />

involved with a dairying conversion.<br />

“Analyse carefully – take into account debt<br />

loading and how comfortable you are with<br />

debt, along with lifestyle preferences. Don’t<br />

base the decision solely on gross income.”<br />

Based on current costs, these returns show<br />

deer farming, and in particular finishing<br />

weaners, is profitable. Buying an existing<br />

deer farm, restocking or even converting<br />

sheep and beef to deer are all attractive<br />

and profitable options to consider.<br />

About the analysis<br />

Graham Butcher’s detailed gross margin<br />

analysis of sheep, beef, dairy and deer enterprises presents a return<br />

based on cents per kilogram of dry matter consumed, an accepted<br />

practice for comparing land uses. While it is a relative rather<br />

than absolute approach – individual farms’ costs will differ – it is<br />

nonetheless a good guide for profit.<br />

Basing his assumptions on standard <strong>New</strong> <strong>Zealand</strong> farm models using<br />

Farmax and StockPol, the analysis presents relative profit objectively,<br />

comparing only the direct costs from the different production systems.<br />

Income is based on current schedules (November 2008).<br />

Costs of management, feeding and animal health that are inherently<br />

the same are not included in the calculation.<br />

The analysis takes into account the current cost of direct expenses<br />

on stock, feed, animal health and management, and the capital<br />

costs of improvements specific to the production system, but not<br />

farm loans or drawings. It also gives profits from finishing and from<br />

purchasing deer with no conversion costs and then compares that<br />

with conversion factored in.<br />

All of the comparisons are regionally based to ensure benchmarking<br />

is valid, but the conclusions from his Southland analysis can be<br />

applied across <strong>New</strong> <strong>Zealand</strong> farms in general.<br />

The analysis is a current snapshot based on current returns and<br />

expenses, but farmers also need to examine long-term trends and<br />

market volatility.<br />

Schedule venison prices received by farmers in this gross margin<br />

analysis are based on an $8.00 AP grade seasonal average. Average<br />

price/kg received for weaners ranged from $3.80 for 52 kg liveweight<br />

average hinds, to $4.25 for 56kg liveweight average stags.<br />

Although purchased weaner deer finishing returns were very<br />

positive, the profit on selling weaner hinds is relatively poor, at 6.43<br />

cents, reflecting a current disparity between weaner selling prices<br />

in 2008, and the profit returned from finishing those weaners this<br />

season as the venison market firmed strongly.<br />

12<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

news<br />

<strong>Deer</strong> farming profitability:<br />

Breeding and finishing using Elk/Wapiti terminal sires option<br />

“All gone by December”<br />

The productivity strategy has a mantra “more calves, earlier and<br />

heavier”. The gross margin analysis by Graham Butcher includes a<br />

study of a heavy weight, high-performance venison breeding and<br />

finishing system, based on Elk/Wapiti sires selected for high EBVs.<br />

This analysis has been scaled to the model used in the October issue<br />

of <strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>, page 11.<br />

The farming system is based around John and Mary Falconer’s<br />

Clachanburn Elk, located in the Maniototo area of Central Otago. The<br />

high country extensive tussock hill breeding operation combined<br />

with relatively high-cost autumn/winter finishing on developed,<br />

irrigated pastures of high-quality autumn-saved grass, swedes,<br />

silage and a small amount of barley.<br />

Farm performance is high. The 900 head commercial herd is<br />

based on a crossbred hind averaging 140kg, including R2yo hinds.<br />

Conception rate has averaged 93% over the past three years, and<br />

weaning percentage 90-91%.<br />

Weaning is delayed post rut to first week in May. Following joining of<br />

selected high-EBV Elk/Wapiti 3yo stags (45-70% Elk/Wapiti on DNA) in<br />

mid February, hinds and weaners are moved to the irrigated flats and<br />

power pastures and introduced to silage to boost late lactation.<br />

Clachanburn has a heavy emphasis on animal health. Young stock<br />

are drenched, vaccinated for yersiniosis and selenium treated in<br />

March. Vaccine booster, drenching and copper treatment are done<br />

at weaning in May, with selenium dose and parasite pour on drench<br />

done mid winter and pre spring.<br />

Weaners are 70kg at the March animal health treatments and<br />

wean at an average 90kg in the first week of May.<br />

Elk/Wapiti bulls are removed on 25 April and all dry hinds are<br />

culled following scanning.<br />

The programme targets boosted winter weaner growth of 180g/<br />

day, finishing on early spring grass to supply at peak schedule. Peak<br />

weights average 60kg (male and females) over 8 – 9 weeks.<br />

Shipments head out weekly, with 54% sent by end September,<br />

the next 31% in October and the balance gone by the first week in<br />

December.<br />

In this buoyant season, returns have averaged $595 per head at<br />

$9.38/kg, a far cry from 2007’s $386 per head and $6.35/kg.<br />

We have used Clachanburn’s well-documented performance data<br />

in the established model to show how a breeding and finishing<br />

operation based on Elk/Wapiti terminal sires performs on the same<br />

basis: income in cents per kg, per kilogram dry matter consumed.<br />

Farm profile<br />

600 Crossbred hinds (540 ma/60 R2yo) (15-35% Elk/Wapiti)<br />

92% MA hinds weaning %<br />

86% R2 Hinds weaning %<br />

90% Mean weaning %<br />

18 3yo High EBV Elk/Wapiti breeding bulls<br />

8% replacement rate in females<br />

1% death loss adults<br />

1% death loss weaners<br />

Income<br />

Numbers Gross income ($)* $/head<br />

Income: Venison<br />

62.5kg @ $9.30/kg average males 263 148,858 566<br />

57.5kg @ $9.30/kg average females 202 105,032 519<br />

Cull hinds @ 77kg average carcass wt @ $9.30 /kg 49 34,276 699<br />

Cull breeding stags @120kg @ $9.30 3 3,286 1,095<br />

*less inspection fees ($9.50 and levy at $0.09)<br />

Income: Velvet<br />

18 Breeding stags 6kg average at $72.00/kg 108kg 7,357 409<br />

Spikers<br />

0kg<br />

Total gross revenue 298,809<br />

*less levy and MAF deduction<br />

Enterprise costs<br />

Number Total cost ($) $/head<br />

Venison and velvet<br />

Transport costs @ $6.50/head 517 3,361 6.50<br />

Sub total 3,361<br />

Direct enterprise on-farm costs<br />

Feeding<br />

Winter feed adults @ $23.57/head 600 14,142 23.57<br />

Winter feed weaners @ 53.56/head 520 27,850 53.56<br />

Winter feed stags @ $48.00 18 864 48.00<br />

Sub total 42,856<br />

Animal health<br />

Animal health adults 600 6,000 10.00<br />

Drench weaners @ $9.00/head 534 4,806 9.00<br />

Copper/ Selenium @ $5.00/head 1,134 5,670 5.00<br />

Pregnancy scanning @ 3.50/head 2,100 3.50<br />

Velvetting adults $17.50 18 315 17.50<br />

Velvetting spikers 0 0<br />

Tb testing @$2.50 600 1,500 2.50<br />

Sub total 20,391<br />

Stock purchases<br />

Breeding stag (good EBVs) replacements @<br />

3 10,500 3,500<br />

$3,500 X 3 per 600 hinds per year<br />

Sub total 10,500<br />

Total direct enterprise costs 77,108<br />

Note: Feeding<br />

This system utilises the cold dry winters ideally suited for deer.<br />

Weaners are offered 2kg DM of swedes for winter (125 days),<br />

utilising 1.3kg daily with 1.1kg DM silage and 0.1kg of barley<br />

consumed daily. Hinds return to the hill following weaning and<br />

return to eat silage and clean up swedes in the latter part. Total<br />

winter costs average $29/head with weaner feed being almost ⅔ of<br />

the costs to achieve the 180g/day average winter growth ($53.56/<br />

head) and hinds at $23.57 share of the specific supplementary feed.<br />

Feed Unit cost Total ($)<br />

10.8ha Swedes (yield 8 tonnes Including regrassing @ $1,667/ha 18,004 4.79c/kg DM<br />

DM/ha)<br />

503 tonnes silage used $25/tonne 12,575 13.2c/kg DM<br />

6.72 tonnes barley $450/tonne fed 3,240 23.27c/kg DM<br />

Conservation fertiliser (silage) $18/tonne DM 9,045<br />

Total winter feeding costs 42,864<br />

Bottom line<br />

We calculated the amount of feed that this level of production<br />

required for lactation and production of venison with 18-25kg<br />

put on over winter and in early spring to reach targeted finishing<br />

weights:<br />

Gross Margin Venison Breeding Finishing $221,701<br />

Calculated kg DM used 1,016,787 21.8 c/kg DM consumed<br />

Rural Solutions’ gross margin analysis takes a detailed, pragmatic<br />

view of enterprises. It includes interest on capital stock and has<br />

calculated conversion costs from sheep and cattle to deer. For<br />

completeness, the gross margin analysis concludes:<br />

Enterprise gross margin $221,701<br />

Less interest on stock capital at 8.5% $54,431<br />

Interest on capital required for conversion of 220ha<br />

$26,180<br />

@ $1400/ha @ 8.5%<br />

Gross margin after interest and conversion costs $141,090<br />

Kg DM consumed<br />

1,016,787 kg DM<br />

Gross margin per kg DM consumed<br />

13.88 cents/kg DM<br />

Gross margin after interest only (established deer farm) $167,270<br />

Kg DM consumed<br />

1,016,787 kg DM<br />

Gross margin per kg DM consumed<br />

16.45 cents/kg DM<br />

Issue No 33 • December 2008 13

news<br />

Icon at 7 years - 9.60 kg SA2<br />

North Island figures back venison profitability claim<br />

Eighty percent more profitable than intensive breeding ewes – that’s how deer finishing stacks up in a simple land use<br />

option analysis prepared by Mark Macintosh, Facilitator for the DINZ Northern Regions Focus Farm Programme.<br />

Based on return per kilogram of<br />

feed utilised, Mark’s work backs the<br />

findings from Rural Solutions’ more<br />

detailed gross margin cost breakdown<br />

across farming enterprises. Both<br />

reports rate venison among the most<br />

profitable options.<br />

“Land use definitely favours deer<br />

over sheep and beef from an<br />

economic point of view, so venison production offers a costeffective<br />

business option,” says Mark.<br />

Sticking with the industry and building deer numbers<br />

therefore stacks up financially. Mark believes conversion<br />

could also be an option for some sheep and beef farmers<br />

with an interest in deer.<br />

“It’s a different type of farming, so it’s a lifestyle choice<br />

as well as a financial decision. It won’t be for everyone.<br />

However, the profit per kilogram of feed input from deer<br />

is nearly twice that of sheep and beef. The numbers are<br />

compelling.”<br />

Mark presented some land-class comparisons to farmers<br />

attending a recent North Island deer Focus Farm field day in<br />

Te Awamutu. “There was a lot of discussion about improving<br />

returns, and a growing awareness that there is good<br />

Land use Policy Price/head Profit c/kgDM<br />

1. Intensive breeding ewes 140% lambing with 75% from hoggets (includes Lambs at $81.00, $5.00 schedule 14.4<br />

shearing costs)<br />

2. Trading steers, 18 month system Finishing in autumn at 2.5 years of age. 300kg cwt $850/head margin, $4.50 schedule 15.6<br />

3. Bull Beef Finishing at 18 months, 268kg cwt $4.30 schedule 16.5<br />

4. Grazing dairy heifers 50% taken on as weaned calves in December, balance 6.00/week as calves, $8.00/week 16.3<br />

in May<br />

as yearlings<br />

5. <strong>Deer</strong> finishing Weaners purchased in autumn and sold Aug-Jan 55kg cwt at $8/kg schedule 26.0<br />

6. Dairy cows, short-term grazing Taken on for 4-8 weeks June/July $25.00/head per week, over winter 28.0<br />

profitability for deer on hill country in the North Island.”<br />

Based on an analysis using Farmax modelling, deer<br />

finishing came out at 26 cents/kg DM, second only to shortterm<br />

grazing dairy cows at 28 cents/kg DM. This compares<br />

with intensive breeding ewes at 14.4 cents, trading steers in<br />

an 18 month system at 15.6 cents, bull beef at 16.5 cents,<br />

and grazing dairy heifers at 16.3 cents.<br />

Results and their policy assumptions for the various<br />

enterprises are shown in more detail in the table above.<br />

All returns include a cost component for interest on stock at<br />

10% but no other enterprise costs associated with feed, stock<br />

health or animal management as these are assumed constant<br />

on a SU basis across enterprises.<br />

• Contact Northern Regions Focus Farm facilitator Mark<br />

Macintosh: 027 449 1077, mark.mac@agfirst.co.nz<br />

14<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

general news<br />

Landcorp would be hit hard by ETS<br />

If carbon emissions were priced at $25 a tonne, the Emissions Trading Scheme (ETS) as it stands, fully implemented,<br />

would wipe 75 percent off Landcorp’s bottom line, according to the state-owned enterprise’s National Manager –<br />

Services & Strategy, Collier Isaacs.<br />

Speaking to Branch Chairmen at their October meeting, he<br />

said Landcorp would like to see more being done to help<br />

agriculture reduce emissions, rather than simply being taxed<br />

for emitting. “That’s why we’re investing $100,000 in the<br />

Pastoral Greenhouse Gas Research Consortium.”<br />

He said Landcorp would need to plant about 17,000 hectares<br />

in forest to fully offset its emissions. “We have about 7,000<br />

hectares now, but about 5,500 hectares of that is pre-1990,<br />

so it’s no use to us [for ETS purposes]. We’re fortunate we<br />

have some hard country that might be suitable for planting,<br />

but even so, we could probably only capture about half our<br />

equivalent emissions in a carbon sink this way. But we won’t<br />

be planting anything that would be better off under sheep,<br />

cattle or deer.”<br />

The review provided for in the legislation will take<br />

international competitiveness into account which could help<br />

mitigate against some of the impacts of the ETS, Collier said.<br />

“The scheme creates a positive marketing angle, but it may<br />

not help with survival.”<br />

Landcorp had made some strident submissions on the ETS to<br />

the select committee, in line with others in the agricultural<br />

sector.<br />

Collier Isaacs’ association with deer goes back around<br />

25 years, and continues today in his role as independent<br />

Chairman of DEEResearch. He noted that as the owner of<br />

55,000 breeding hinds Landcorp continues to put $100,000<br />

each year into deer research to invest in their productivity as<br />

well as the industry’s.<br />

With such a large herd, Landcorp is well placed to assist<br />

with farm-based research and is willing to share its results.<br />

One such area is Johne’s disease (JD), which continues to<br />

be a significant issue for Landcorp. With movement from the<br />

breeding to finishing properties, the disease is easily moved<br />

into finishing operations. Landcorp has a testing programme<br />

and is working with AgResearch’s Dr Colin Mackintosh on<br />

options for managing JD.<br />

Collier said the Landcorp deer herd, which accounts for<br />

about 6-8 percent of the national herd, covers the full range<br />

when it comes to growth rates and reproductive performance.<br />

“We will definitely benefit from the productivity strategy,<br />

along with the rest of the industry. We’re conscious of<br />

our size in the deer industry and the potential impact we<br />

could have. Many of our management personnel come<br />

from an industry-good background, so we do think about<br />

consequences.” One example of this was resisting the<br />

temptation to accept some very high, potentially short term,<br />

procurement offers for Landcorp’s venison this season.<br />

Landcorp currently derives about 40 percent of its revenue<br />

from dairying and 10 percent from deer, in line with its<br />

strategy. The other 50 percent is divided equally between<br />

sheep and beef – down from 75 percent just 5 years ago. The<br />

diversified livestock portfolio now helped cushion Landcorp<br />

if one sector was suffering.<br />

<strong>Deer</strong> numbers in<br />

Landcorp’s herd<br />

had fallen in the<br />

last two years,<br />

but that reflected<br />

sale of properties<br />

near Taupo, not a<br />

changed attitude<br />

to deer. Drought<br />

conditions and land<br />

development on<br />

the West coast had<br />

also cut Landcorp’s<br />

capacity for deer<br />

recently.<br />

“We’re putting up<br />

more deer fencing<br />

on the Rangitaiki<br />

Station and putting<br />

more deer into the<br />

Te Anau basin, so<br />

the numbers we’ve<br />

lost will be made up<br />

again. We still have<br />

faith in the deer<br />

industry!”<br />

Collier Isaacs: happy to talk turkey<br />

with industry on joint venture for a<br />

Southland focus farm.<br />

Collier said Landcorp farmed a total of about 175,000<br />

effective hectares, and could probably put another 10,000<br />

hectares behind deer fencing without breaking too much<br />

of a sweat, but there was inevitably a balance to be struck<br />

in some land classes between finishing deer or sheep, or<br />

running dairy support. Currently Landcorp was a bit short on<br />

lamb and deer finishing land, Collier said.<br />

“We have been a bit overstocked in some of our deer<br />

developments, and we’d prefer to have fewer animals putting<br />

on more weight.”<br />

Collier didn’t see parallels between the 2001 price peaks and<br />

today’s high schedule. “We are not building a bow-wave of<br />

unsold product this time, nor does the industry have large<br />

numbers of deer overall, so the odds of a major price tumble<br />

are reduced. This not to say current international economic<br />

conditions won’t provide some challenges.”<br />

In response to discussion about the need for a new Focus<br />

Farm in Southland, Collier had encouraging words for the<br />

Branch Chairmen. “If you wanted to pick one of our farms<br />

in the Te Anau basin and turn that into a Focus Farm or<br />

satellite, we wouldn’t have a problem with that.”<br />

He said Landcorp would take a look at any proposal put<br />

forward by the deer industry to contribute, say $25,000 to<br />

such a Focus Farm project. “We could go 50/50 with the<br />

Southland Branch. We have a lot of deer in that region, so<br />

let’s talk.”<br />

That’s one invitation deer farmers will be only too keen to<br />

accept.<br />

Issue No 33 • December 2008 15

general news<br />

Animal Health Board Update:<br />

Steady progress continues<br />

A slower than expected drop-off in infected herd<br />

numbers on the West Coast, and some unexpected<br />

breakdowns in the Waikato have combined to slow<br />

down the decrease in Tb-infected cattle herds across the<br />

country, the Animal Health Board (AHB) reports.<br />

At a presentation to NZDFA Branch Chairmen in October,<br />

AHB Disease Operations Manager, Keith Lewis said the<br />

number of infected cattle herds had dropped by only four, in<br />

the 12 months to June 2008.<br />

The pattern was similar for deer herds, with a steady decline<br />

in infected herds over the past decade, but a relatively modest<br />

drop (18 down to 16 infected herds) in the year to June 2008.<br />

Since then, the last remaining infected herd in the North<br />

Island has been cleared, bringing the national total to 15.<br />

There were 386 Tb reactor deer in the 12 months to June<br />

2008, but the number of confirmed Tb animals was just 23.<br />

Keith said the AHB was currently predicting a total number<br />

of infected herds (cattle and deer) of 118 by June 2009, a<br />

conservative figure that allowed for 14 infected deer herds.<br />

He added that national figures for period prevalence were<br />

still tracking below the 2001 projections, and were in line<br />

with the current national plan.<br />

In discussion with the Branch Chairmen, there was some<br />

concern that the large number of cattle movements caused<br />

by last summer’s drought, and the continuing expansion<br />

of dairying, could be helping spread the disease. It was<br />

confirmed that calves less than one month of age do not<br />

require tagging, as their risk of spreading Tb is extremely<br />

low.<br />

The issue of resistance to depopulation orders, which<br />

sometimes sees emotions boiling over and threats issued,<br />

was also raised during questions and answers. There<br />

was general agreement that all deer farmers need to take<br />

ownership of the Tb strategy, and if there are concerns about<br />

herds not being tested or unauthorised movements, then<br />

farmers should not be afraid to speak up.<br />

The recent case of a South Island dairy farmer fined $25,000<br />

plus a further $25,000 in costs, provoked a lively discussion.<br />

Some felt that the fine under the Biosecurity Act could have<br />

been much higher. Others pointed out that the penalty was<br />

not only financial, with the farmer concerned now having<br />

trouble finding grazing.<br />

Keith Lewis said three other significant prosecutions were<br />

in the pipeline. He said the worst offenders cause problems<br />

for everyone, not just the AHB. Their breaches can end up<br />

involving regional councils and in extreme cases the armed<br />

offenders squad has been called out.<br />

Rotorua Branch Chairman Andy Mitchell repeated his concerns<br />

about possible large-scale movements of vectors following<br />

removal of plantation forests in the central North Island. He<br />

had been shooting large numbers of possums on his Bay of<br />

Plenty farm since deforestation began in the area, and said<br />

there were also reports of very high possum numbers on<br />

Landcorp property where trees had been cleared.<br />

16<br />

Time getting tight for Pest<br />

Management Strategy review<br />

The pressure is on for MAF and the AHB to agree on<br />

a strategy to take out for consultation early next year<br />

as part of the scheduled review for the National Pest<br />

Management Strategy (NPMS) for bovine Tb.<br />

A detailed proposal must be presented to the Biosecurity<br />

Minister David Carter by 30 September 2009.<br />

Animal Health Board (AHB) Disease Operations Manager,<br />

Keith Lewis updated Branch Chairmen on the review<br />

process at their October meeting, noting that a new low-cost<br />

containment option for bovine Tb requested by MAF was<br />

unlikely to work.<br />

He said the AHB’s review had identified two preferred<br />

options to date: containment or eradication. Once the preconsultation<br />

work is complete – preferably by the end of this<br />

year – one of these will be taken out for consultation with<br />

farmers and the public.<br />

Containment is essentially a continuation along the present<br />

path, maintaining pressure on vectors and reducing vector<br />

risk areas until the 0.2% period prevalence goals is reached.<br />

Then the disease and infected wildlife would need to be kept<br />

pegged back below that threshold. The main disadvantage of<br />

this approach is the ongoing maintenance cost of disease and<br />

vector control, which AHB estimates is about $55 million per<br />

annum.<br />

The more ambitious eradication option seeks to keep up<br />

the current methods to eventually eradicate the disease<br />

entirely from both wildlife and livestock. (See Figure 1.) AHB<br />

believes this is achievable, with the South Island West Coast<br />

the last area to be cleared. Biological freedom from Tb in<br />

<strong>New</strong> <strong>Zealand</strong> is estimated by AHB to take 25 years from now.<br />

While initially more expensive than the containment option,<br />

eradication would eventually see testing and vector control<br />

cease. It is not expected that possums would be eradicated<br />

per se.<br />

A third option, “ad hoc control”, would involve no formal<br />

NPMS and is not being seriously considered. Neither is the<br />

“do nothing” option. Both are considered to lead to higher<br />

costs and deteriorating Tb status over the long term.<br />

Federated Farmers and Meat and Wool <strong>New</strong> <strong>Zealand</strong> have<br />

declared support for the eradication option, while DairyNZ<br />

and MAF are yet to decide which they will support. DINZ<br />

and NZDFA are also broadly in support of the eradication<br />

option, but also agree with MAF and DairyNZ’s approach,<br />

which calls for a robust analysis of the technical data,<br />

assumptions and cost-benefit analysis. In addition to vector<br />

control, the strategy will consider all the policies that support<br />

the overall aim, such as the testing regime and movement<br />

control.<br />

Keith said progress on the strategy review to date has been<br />

slower than expected.<br />

MAF and DairyNZ have convened a working group which<br />

involves AHB members and independent disease control and<br />

economic advice, he reported.<br />

“AHB’s strategy options have withstood detailed technical<br />

scrutiny and there may be some cost savings available within<br />

<strong>Deer</strong> <strong>Industry</strong> <strong><strong>New</strong>s</strong>

general news<br />

Figure 1: Comparative projected costs for<br />

containment and eradication options.<br />

the eradication and containment strategies.<br />

The group has also requested an additional<br />

lower cost ‘minimal containment’ model.”<br />

Looking at a reduced spend on vector<br />

control for this model, at $30 million/<br />

year, AHB had concluded that the number<br />

of infected herds would probably rise and<br />

eventually stabilise at around 1300 in 15-20<br />

years’ time.<br />

“Realistically the choices for a preferred<br />

strategy option come down to the<br />

eradication and containment strategies as<br />

presented in November 2007,” Keith said.<br />

Retiring AHB Members’ Committee Chairman, Errol Croad<br />

commented that it was essential that the different funding<br />

providers from the dairy, beef and deer sectors agreed on<br />

the strategy and funding formula. “If they are agreed, then<br />

the Government will back it. But if there is any opportunity<br />

for the Government to pull the money from this programme,<br />

they will do so,” he warned. “I have stressed in my [AHB<br />

Members’] committee, that we do not go out for public<br />

consultation unless we agreed on the formula – otherwise<br />

we’ll end up with the same debacle we had seven years<br />

ago.”<br />

The current funding formula sees vector control costs split<br />

between regional councils (10 percent), the Government (50<br />

percent) and the beef, dairy and deer sectors (40 percent).<br />