Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

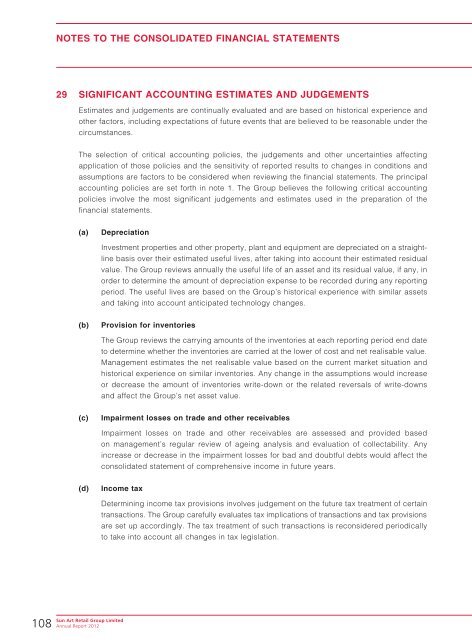

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

29 SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS<br />

Estimates and judgements are continually evaluated and are based on historical experience and<br />

other factors, including expectations of future events that are believed to be reasonable under the<br />

circumstances.<br />

The selection of critical accounting policies, the judgements and other uncertainties affecting<br />

application of those policies and the sensitivity of reported results to changes in conditions and<br />

assumptions are factors to be considered when reviewing the financial statements. The principal<br />

accounting policies are set forth in note 1. The <strong>Group</strong> believes the following critical accounting<br />

policies involve the most significant judgements and estimates used in the preparation of the<br />

financial statements.<br />

(a)<br />

Depreciation<br />

Investment properties and other property, plant and equipment are depreciated on a straightline<br />

basis over their estimated useful lives, after taking into account their estimated residual<br />

value. The <strong>Group</strong> reviews annually the useful life of an asset and its residual value, if any, in<br />

order to determine the amount of depreciation expense to be recorded during any reporting<br />

period. The useful lives are based on the <strong>Group</strong>’s historical experience with similar assets<br />

and taking into account anticipated technology changes.<br />

(b)<br />

Provision for inventories<br />

The <strong>Group</strong> reviews the carrying amounts of the inventories at each reporting period end date<br />

to determine whether the inventories are carried at the lower of cost and net realisable value.<br />

Management estimates the net realisable value based on the current market situation and<br />

historical experience on similar inventories. Any change in the assumptions would increase<br />

or decrease the amount of inventories write-down or the related reversals of write-downs<br />

and affect the <strong>Group</strong>’s net asset value.<br />

(c)<br />

Impairment losses on trade and other receivables<br />

Impairment losses on trade and other receivables are assessed and provided based<br />

on management’s regular review of ageing analysis and evaluation of collectability. Any<br />

increase or decrease in the impairment losses for bad and doubtful debts would affect the<br />

consolidated statement of <strong>com</strong>prehensive in<strong>com</strong>e in future years.<br />

(d)<br />

In<strong>com</strong>e tax<br />

Determining in<strong>com</strong>e tax provisions involves judgement on the future tax treatment of certain<br />

transactions. The <strong>Group</strong> carefully evaluates tax implications of transactions and tax provisions<br />

are set up accordingly. The tax treatment of such transactions is reconsidered periodically<br />

to take into account all changes in tax legislation.<br />

108<br />

<strong>Sun</strong> <strong>Art</strong> <strong>Retail</strong> <strong>Group</strong> <strong>Limited</strong><br />

Annual Report 2012