Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

10 FIXED ASSETS (CONTINUED)<br />

(i)<br />

All the <strong>Group</strong>’s fixed assets are located in the PRC.<br />

(ii)<br />

Land use rights represent the fees and related expenses in obtaining land use rights for<br />

periods ranging from 40 to 70 years. As at 31 December 2012, the <strong>Group</strong> had not obtained<br />

land use rights certificates for certain land use rights with an aggregate carrying amount of<br />

RMB900 million (2011: RMB226 million). Notwithstanding this, the directors are of the opinion<br />

that the <strong>Group</strong> owned the beneficial title to these land use rights as at 31 December 2012<br />

and 2011.<br />

(iii)<br />

As at 31 December 2012, the <strong>Group</strong> had not obtained property ownership certificates for<br />

certain buildings with an aggregate carrying amount of RMB2,114 million (2011: RMB2,447<br />

million). Notwithstanding this, the directors are of the opinion that the <strong>Group</strong> owned the<br />

beneficial title to these buildings as at 31 December 2012 and 2011.<br />

(iv)<br />

As set out in note 1(h), the <strong>Group</strong> has applied the cost model for its investment properties.<br />

The directors have estimated the fair value of the investment properties as at 31 December<br />

2012 to be RMB5,880 million, using discounted cash flow techniques based on contracted<br />

and expected cash inflows and outflows arising from the investment properties (2011:<br />

RMB4,585 million). The investment properties were not valued by an independent valuer as<br />

at 31 December 2012 and 2011.<br />

(v)<br />

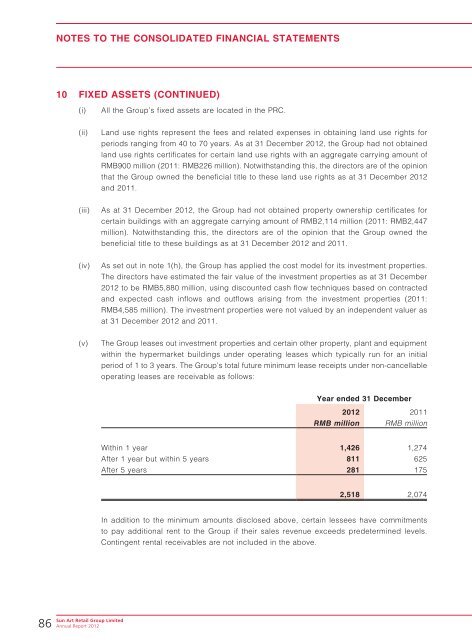

The <strong>Group</strong> leases out investment properties and certain other property, plant and equipment<br />

within the hypermarket buildings under operating leases which typically run for an initial<br />

period of 1 to 3 years. The <strong>Group</strong>’s total future minimum lease receipts under non-cancellable<br />

operating leases are receivable as follows:<br />

Year ended 31 December<br />

2012 2011<br />

RMB million RMB million<br />

Within 1 year 1,426 1,274<br />

After 1 year but within 5 years 811 625<br />

After 5 years 281 175<br />

2,518 2,074<br />

In addition to the minimum amounts disclosed above, certain lessees have <strong>com</strong>mitments<br />

to pay additional rent to the <strong>Group</strong> if their sales revenue exceeds predetermined levels.<br />

Contingent rental receivables are not included in the above.<br />

86<br />

<strong>Sun</strong> <strong>Art</strong> <strong>Retail</strong> <strong>Group</strong> <strong>Limited</strong><br />

Annual Report 2012