Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

5 INCOME TAX (CONTINUED)<br />

(a)<br />

In<strong>com</strong>e tax in the consolidated statement of <strong>com</strong>prehensive in<strong>com</strong>e represents: (continued)<br />

(iv)<br />

(continued)<br />

Since the <strong>Group</strong> can control the quantum and timing of distribution of profits of the<br />

<strong>Group</strong>’s PRC subsidiaries, deferred tax liabilities are only provided to the extent that<br />

such profits are expected to be distributed in the foreseeable future.<br />

As at 31 December 2012, deferred tax liabilities of RMB53 million (2011: RMB34<br />

million) have been recognised in respect of the withholding tax payable on the retained<br />

profits of the <strong>Group</strong>’s PRC subsidiaries generated subsequent to 1 January 2008<br />

which the directors expect to distribute outside the PRC in the foreseeable future. The<br />

deferred tax liabilities as at 31 December 2012 were calculated at the withholding tax<br />

rate of 5% (2011: 5%).<br />

On 1 May 2010, CIC received an advance ruling from its tax authority in-charge<br />

confirming that the reduced withholding tax rate of 5% would be applied on its<br />

dividends to RT-Mart Holdings <strong>Limited</strong>. The valid period of the ruling is from 1 May<br />

2010 to 30 April 2013.<br />

On 12 July 2012, Announcement [2012] No. 30 (Announcement 30) dated 29 June<br />

2012 was released by the State Administration of Taxation (SAT). Announcement 30<br />

explicitly states that a <strong>com</strong>pany that is a tax resident of a Double Taxation Agreement<br />

(DTA) partner state and is listed in that jurisdiction (Listed Parent) will automatically<br />

satisfy the beneficial ownership criteria in respect of PRC dividends received.<br />

Furthermore, subsidiaries that are wholly owned by the Listed Parent, directly and/<br />

or indirectly, and are tax residents of the same DTA partner state, may also be<br />

automatically regarded as the beneficial owners of any PRC dividends they receive.<br />

Accordingly, dividends receivable by RT-Mart Holdings <strong>Limited</strong> and ACHK should be<br />

subject to 5% withholding tax rate.<br />

On 15 July 2012, ACI obtained the notification from Shanghai Yangpu National Tax<br />

Bureau confirming it is eligible for the reduced withholding tax rate on dividends of<br />

5% for the year ended 31 December 2012.<br />

(b)<br />

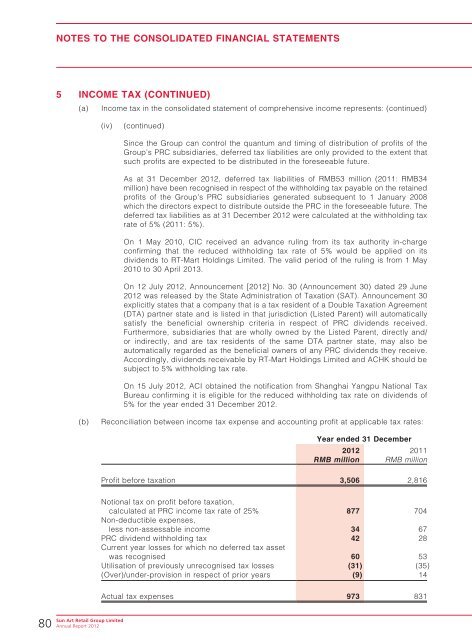

Reconciliation between in<strong>com</strong>e tax expense and accounting profit at applicable tax rates:<br />

Year ended 31 December<br />

2012 2011<br />

RMB million RMB million<br />

Profit before taxation 3,506 2,816<br />

Notional tax on profit before taxation,<br />

calculated at PRC in<strong>com</strong>e tax rate of 25% 877 704<br />

Non-deductible expenses,<br />

less non-assessable in<strong>com</strong>e 34 67<br />

PRC dividend withholding tax 42 28<br />

Current year losses for which no deferred tax asset<br />

was recognised 60 53<br />

Utilisation of previously unrecognised tax losses (31) (35)<br />

(Over)/under-provision in respect of prior years (9) 14<br />

Actual tax expenses 973 831<br />

80<br />

<strong>Sun</strong> <strong>Art</strong> <strong>Retail</strong> <strong>Group</strong> <strong>Limited</strong><br />

Annual Report 2012