Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

Sun Art Retail Group Limited - TodayIR.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

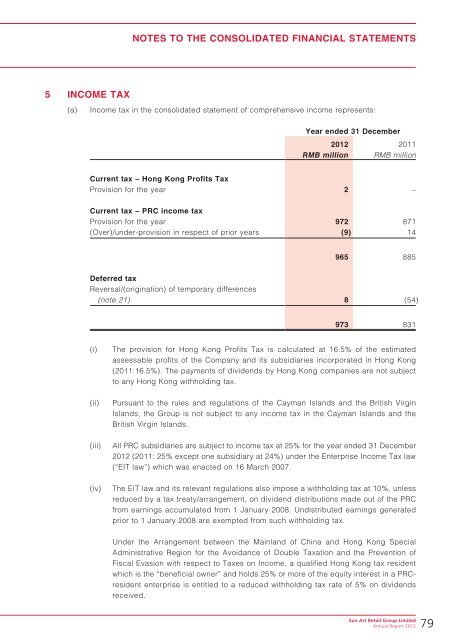

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

5 INCOME TAX<br />

(a)<br />

In<strong>com</strong>e tax in the consolidated statement of <strong>com</strong>prehensive in<strong>com</strong>e represents:<br />

Year ended 31 December<br />

2012 2011<br />

RMB million RMB million<br />

Current tax – Hong Kong Profits Tax<br />

Provision for the year 2 –<br />

Current tax – PRC in<strong>com</strong>e tax<br />

Provision for the year 972 871<br />

(Over)/under-provision in respect of prior years (9) 14<br />

965 885<br />

Deferred tax<br />

Reversal/(origination) of temporary differences<br />

(note 21) 8 (54)<br />

973 831<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

The provision for Hong Kong Profits Tax is calculated at 16.5% of the estimated<br />

assessable profits of the Company and its subsidiaries incorporated in Hong Kong<br />

(2011:16.5%). The payments of dividends by Hong Kong <strong>com</strong>panies are not subject<br />

to any Hong Kong withholding tax.<br />

Pursuant to the rules and regulations of the Cayman Islands and the British Virgin<br />

Islands, the <strong>Group</strong> is not subject to any in<strong>com</strong>e tax in the Cayman Islands and the<br />

British Virgin Islands.<br />

All PRC subsidiaries are subject to in<strong>com</strong>e tax at 25% for the year ended 31 December<br />

2012 (2011: 25% except one subsidiary at 24%) under the Enterprise In<strong>com</strong>e Tax law<br />

(“EIT law”) which was enacted on 16 March 2007.<br />

The EIT law and its relevant regulations also impose a withholding tax at 10%, unless<br />

reduced by a tax treaty/arrangement, on dividend distributions made out of the PRC<br />

from earnings accumulated from 1 January 2008. Undistributed earnings generated<br />

prior to 1 January 2008 are exempted from such withholding tax.<br />

Under the Arrangement between the Mainland of China and Hong Kong Special<br />

Administrative Region for the Avoidance of Double Taxation and the Prevention of<br />

Fiscal Evasion with respect to Taxes on In<strong>com</strong>e, a qualified Hong Kong tax resident<br />

which is the “beneficial owner” and holds 25% or more of the equity interest in a PRCresident<br />

enterprise is entitled to a reduced withholding tax rate of 5% on dividends<br />

received.<br />

<strong>Sun</strong> <strong>Art</strong> <strong>Retail</strong> <strong>Group</strong> <strong>Limited</strong><br />

Annual Report 2012<br />

79