COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

COIF Charity Funds - CCLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>COIF</strong> Charities Fixed Interest Fund<br />

Notes to the Accounts<br />

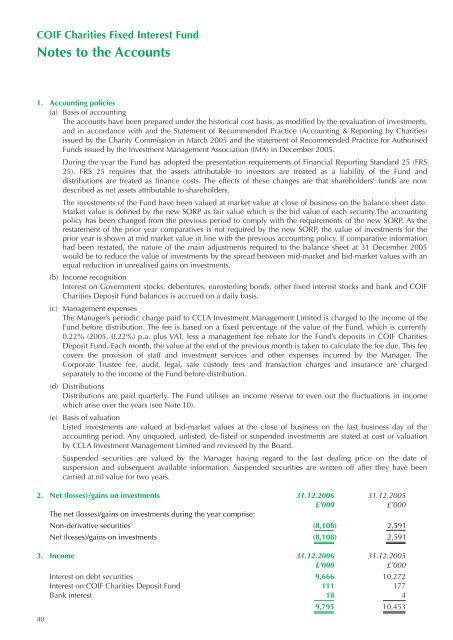

1. Accounting policies<br />

(a) Basis of accounting<br />

The accounts have been prepared under the historical cost basis, as modified by the revaluation of investments,<br />

and in accordance with and the Statement of Recommended Practice (Accounting & Reporting by Charities)<br />

issued by the <strong>Charity</strong> Commission in March 2005 and the statement of Recommended Practice for Authorised<br />

<strong>Funds</strong> issued by the Investment Management Association (IMA) in December 2005.<br />

During the year the Fund has adopted the presentation requirements of Financial Reporting Standard 25 (FRS<br />

25). FRS 25 requires that the assets attributable to investors are treated as a liability of the Fund and<br />

distributions are treated as finance costs. The effects of these changes are that shareholders’ funds are now<br />

described as net assets attributable to shareholders.<br />

The investments of the Fund have been valued at market value at close of business on the balance sheet date.<br />

Market value is defined by the new SORP as fair value which is the bid value of each security.The accounting<br />

policy has been changed from the previous period to comply with the requirements of the new SORP. As the<br />

restatement of the prior year comparatives is not required by the new SORP, the value of investments for the<br />

prior year is shown at mid market value in line with the previous accounting policy. If comparative information<br />

had been restated, the nature of the main adjustments required to the balance sheet at 31 December 2005<br />

would be to reduce the value of investments by the spread between mid-market and bid-market values with an<br />

equal reduction in unrealised gains on investments.<br />

(b) Income recognition<br />

Interest on Government stocks, debentures, eurosterling bonds, other fixed interest stocks and bank and <strong>COIF</strong><br />

Charities Deposit Fund balances is accrued on a daily basis.<br />

(c) Management expenses<br />

The Manager’s periodic charge paid to <strong>CCLA</strong> Investment Management Limited is charged to the income of the<br />

Fund before distribution. The fee is based on a fixed percentage of the value of the Fund, which is currently<br />

0.22% (2005, 0.22%) p.a. plus VAT, less a management fee rebate for the Fund’s deposits in <strong>COIF</strong> Charities<br />

Deposit Fund. Each month, the value at the end of the previous month is taken to calculate the fee due. This fee<br />

covers the provision of staff and investment services and other expenses incurred by the Manager. The<br />

Corporate Trustee fee, audit, legal, safe custody fees and transaction charges and insurance are charged<br />

separately to the income of the Fund before distribution.<br />

(d) Distributions<br />

Distributions are paid quarterly. The Fund utilises an income reserve to even out the fluctuations in income<br />

which arise over the years (see Note 10).<br />

(e) Basis of valuation<br />

Listed investments are valued at bid-market values at the close of business on the last business day of the<br />

accounting period. Any unquoted, unlisted, de-listed or suspended investments are stated at cost or valuation<br />

by <strong>CCLA</strong> Investment Management Limited and reviewed by the Board.<br />

Suspended securities are valued by the Manager having regard to the last dealing price on the date of<br />

suspension and subsequent available information. Suspended securities are written off after they have been<br />

carried at nil value for two years.<br />

2. Net (losses)/gains on investments 31.12.2006 31.12.2005<br />

£’000 £’000<br />

The net (losses)/gains on investments during the year comprise:<br />

Non-derivative securities (8,108) 2,591<br />

Net (losses)/gains on investments (8,108) 2,591<br />

3. Income 31.12.2006 31.12.2005<br />

£’000 £’000<br />

40<br />

Interest on debt securities 9,666 10,272<br />

Interest on <strong>COIF</strong> Charities Deposit Fund 111 177<br />

Bank interest 18 4<br />

9,795 10,453